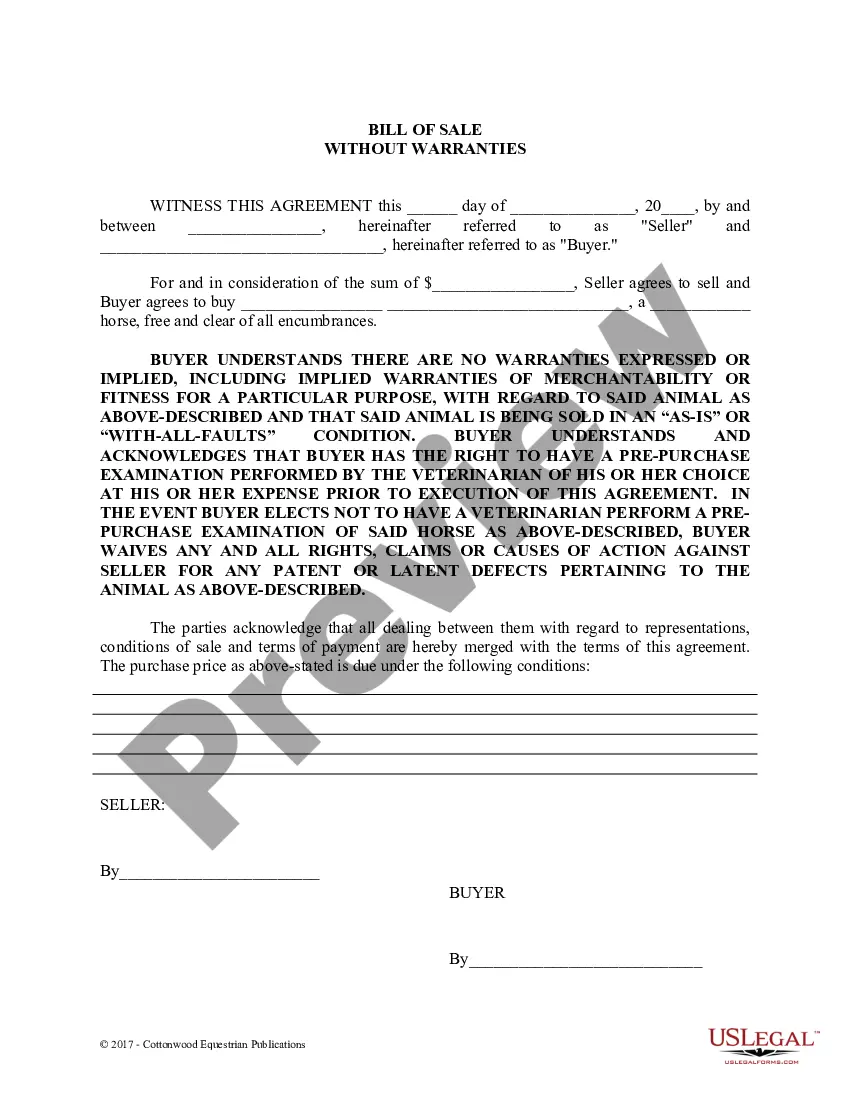

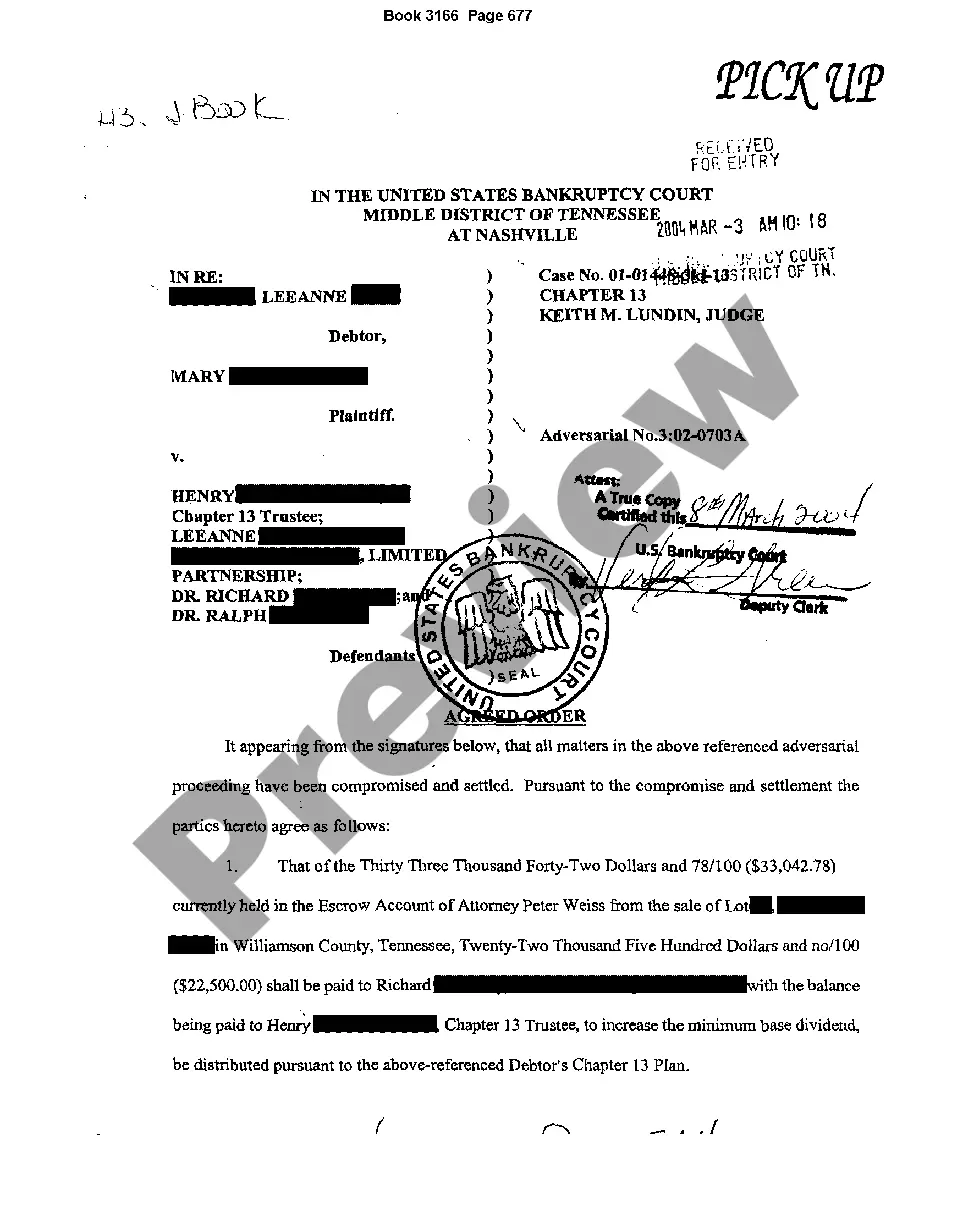

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Ohio Promissory Note With Collateral Sample

Description mortgage note example

How to fill out Ohio Promissory Note With Collateral Sample?

There's no longer a necessity to squander time looking for legal documents to fulfill your regional state obligations. US Legal Forms has gathered all of them in a single location and made them reachable.

Our site provides over 85,000 templates for any business and individual legal situations categorized by state and area of application. All forms are expertly drafted and verified for accuracy, so you can have confidence in obtaining an up-to-date Ohio Promissory Note With Collateral Sample.

If you are acquainted with our platform and already possess an account, you must verify that your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all obtained documents at any time needed by accessing the My documents tab in your profile.

Print your form to fill it out manually or upload the sample if you prefer using an online editor. Preparing legal documentation under federal and state laws and regulations is quick and straightforward with our library. Try out US Legal Forms now to keep your paperwork organized!

- If you've never utilized our platform before, the procedure will require additional steps to complete.

- Here's how new users can acquire the Ohio Promissory Note With Collateral Sample from our catalog.

- Examine the page content thoroughly to confirm it includes the sample you seek.

- To do this, use the form description and preview options, if available.

- Utilize the Search field above to find another sample if the current one doesn't suit you.

- Click Buy Now adjacent to the template name when you identify the right one.

- Select the most suitable subscription plan and register for an account or Log In.

- Make a payment for your subscription with a credit card or through PayPal to proceed.

- Choose the file format for your Ohio Promissory Note With Collateral Sample and download it to your device.

small estate affidavit ohio Form popularity

example promissory note Other Form Names

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

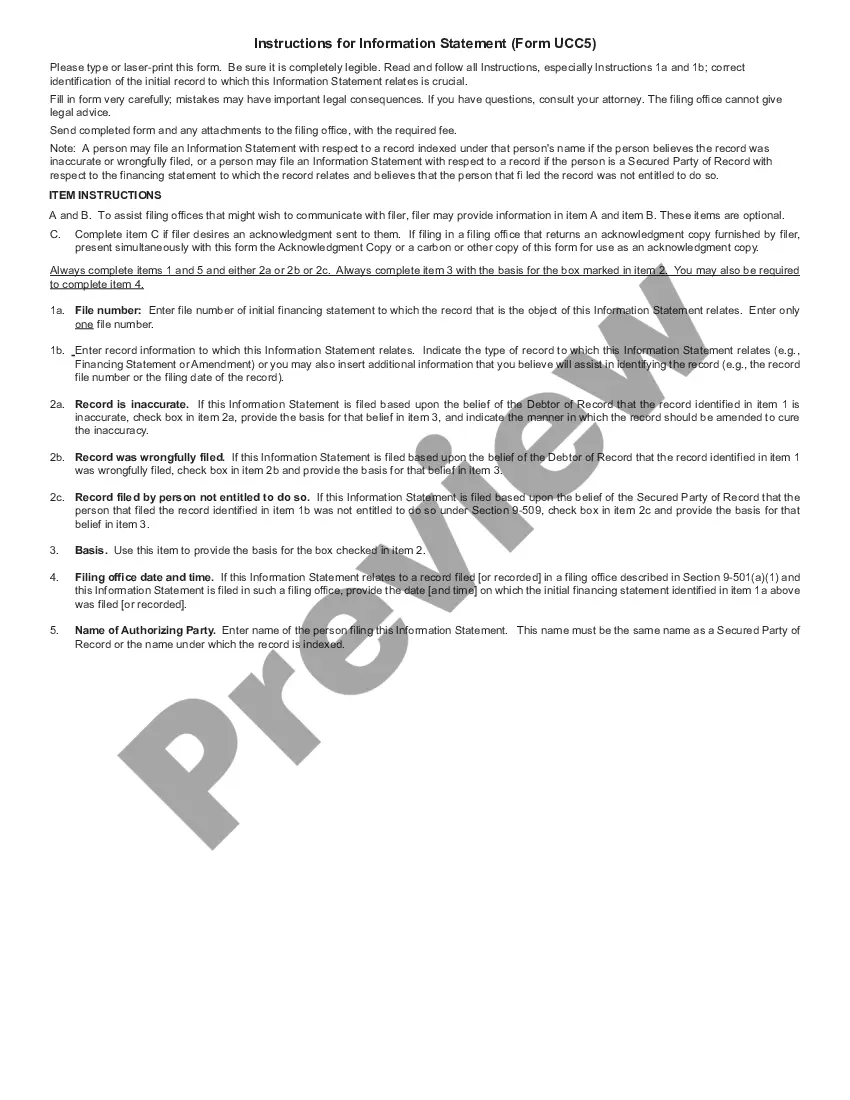

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

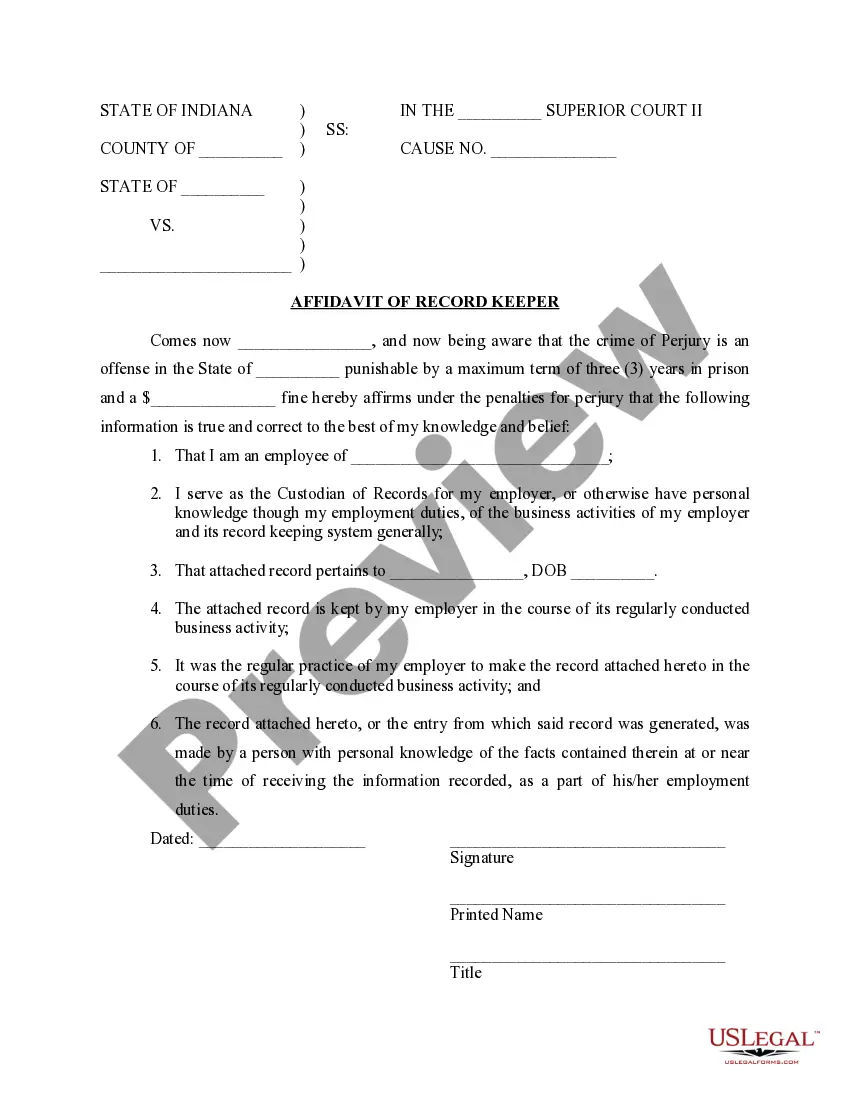

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

There is no legal requirement for promissory notes to be witnessed or notarized in Ohio. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.