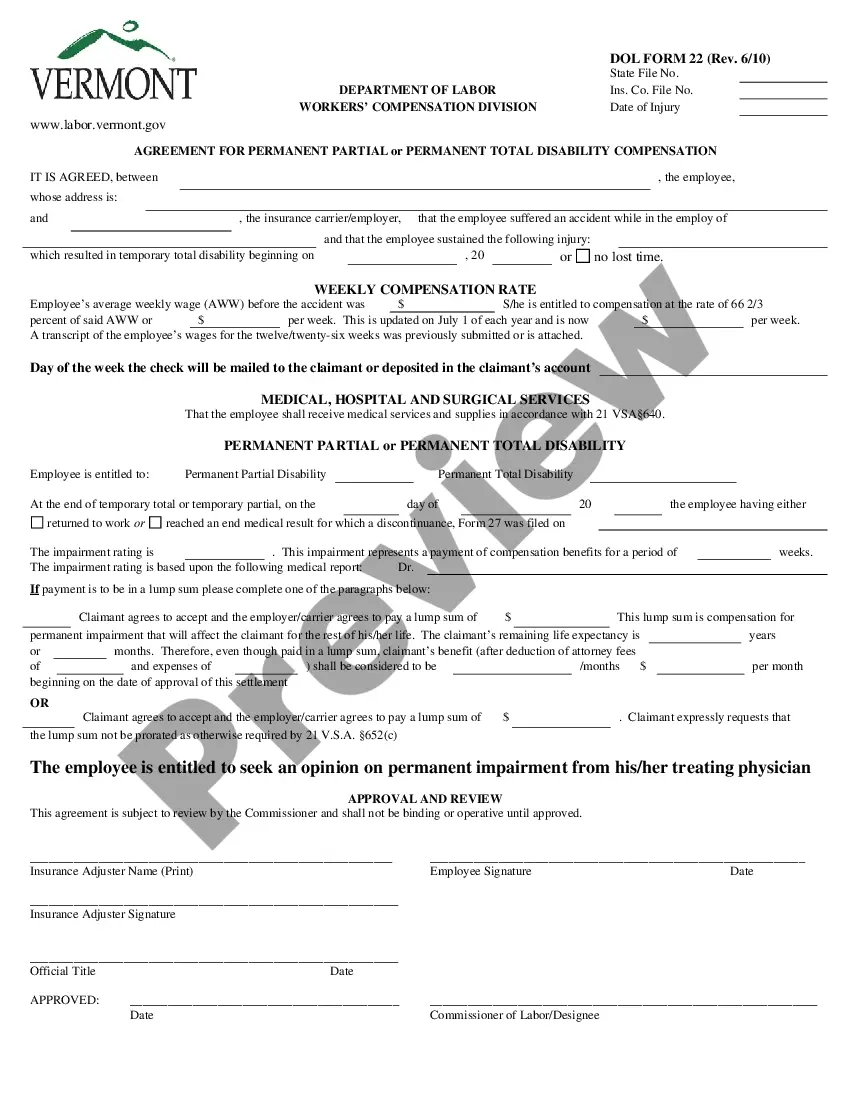

This is one of the official workers' compensation forms for the state of Ohio.

Ohio Work Employer For The Same

Description

Form popularity

FAQ

Ohio is well known for being the birthplace of several U.S. presidents, earning it the nickname 'Mother of Presidents.' This historical significance adds to the state's rich culture and heritage. As an Ohio work employer, embracing the state’s history can enhance branding and community engagement efforts. By connecting with local pride, businesses can create stronger customer relations and foster a loyal following.

Several factors can disqualify an individual from receiving Ohio unemployment benefits. These include voluntarily quitting a job without good cause, being dismissed for misconduct, or not being able and available to work. For Ohio work employers, understanding these disqualifications is crucial when managing employee transitions to ensure compliance and navigate the unemployment insurance landscape effectively. Awareness of these criteria can help in preventing misunderstandings and disputes.

To register as an employer for Ohio unemployment, you need to visit the Ohio Department of Job and Family Services website. The registration process involves providing your business information, including your Federal Employer Identification Number. By registering, Ohio work employers become eligible for various unemployment insurance programs that may assist during times of economic hardship. If you encounter challenges, consider using platforms like USLegalForms to streamline the process and ensure compliance.

Amish country in Ohio is primarily located in Holmes County and surrounding areas, known for their unique culture and lifestyle. Visitors can experience beautiful landscapes, traditional craftsmanship, and delicious homemade foods in this region. As an Ohio work employer, understanding local cultures like the Amish can enhance community relations and help tailor business practices to align with local values. Engaging with this community can foster goodwill and positive business interactions.

Shared work refers to a flexible arrangement where employers redistribute hours among their employees rather than laying them off. This means that instead of losing jobs, workers can share the available hours to maintain their employment status. For Ohio work employers, this option provides an effective solution to managing labor costs during tough times while keeping skilled workers engaged. Programs like these are vital for sustaining businesses and supporting employees.

SharedWork in Ohio is a program that allows employers to reduce work hours for their employees while enabling them to receive partial unemployment benefits. This initiative helps Ohio work employers retain their workforce during economic downturns, ensuring that employees can maintain their jobs rather than face layoffs. By using this program, employers can save on payroll costs while employees can manage their financial needs. It's a win-win for both parties.

Any Ohio resident who earns income must file an Ohio income tax return. This includes workers, self-employed individuals, and businesses with income derived from sources within the state. For Ohio work employers, ensuring that employees understand their filing obligations can foster compliance and financial awareness. Uslegalforms can assist with resources and tools that make navigating these requirements easier for both employers and employees.

Ohio municipal net profit tax must be filed by individuals and businesses operating within specific Ohio municipalities. This tax is applicable to entities generating profits in those jurisdictions and requires careful tracking of income. Identifying the right filing requirements can be complex, but understanding these obligations is crucial for Ohio work employers to remain compliant and avoid penalties. A platform like uslegalforms can help simplify this process with up-to-date resources.

The Ohio Administrative Code provides the specific rules and regulations that govern various state programs and agencies. This code outlines the procedures and laws that Ohio work employers must follow to operate legally within the state. By adhering to the guidelines established in the Ohio Administrative Code, employers can ensure they meet legal expectations and foster a positive working environment. Familiarity with these provisions can significantly benefit Ohio work employers navigating state compliance.

Yes, Ohio requires certain businesses to file an annual report. This report provides the state with updated information about the company, including its current structure and contact details. Filing the annual report is essential for Ohio work employers to ensure they remain compliant with state regulations and avoid any unnecessary fines. By keeping this report current, businesses can focus on their growth and responsibilities without interruption.