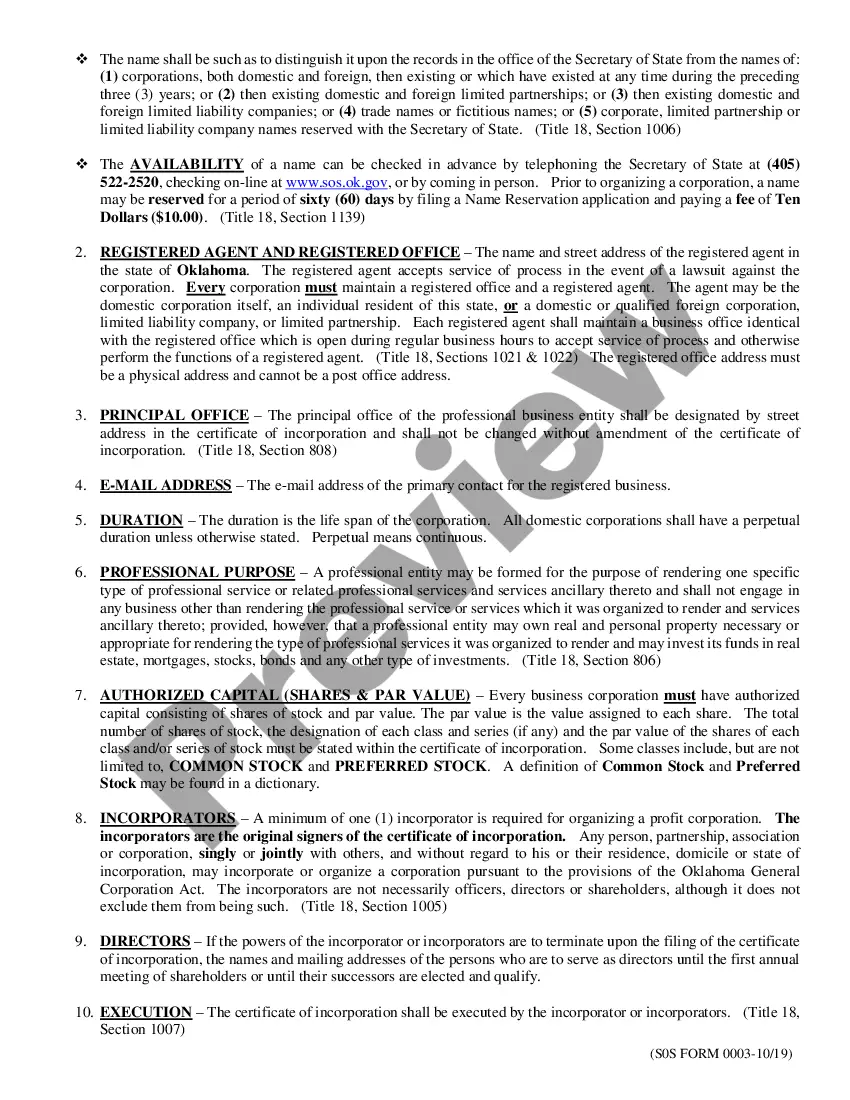

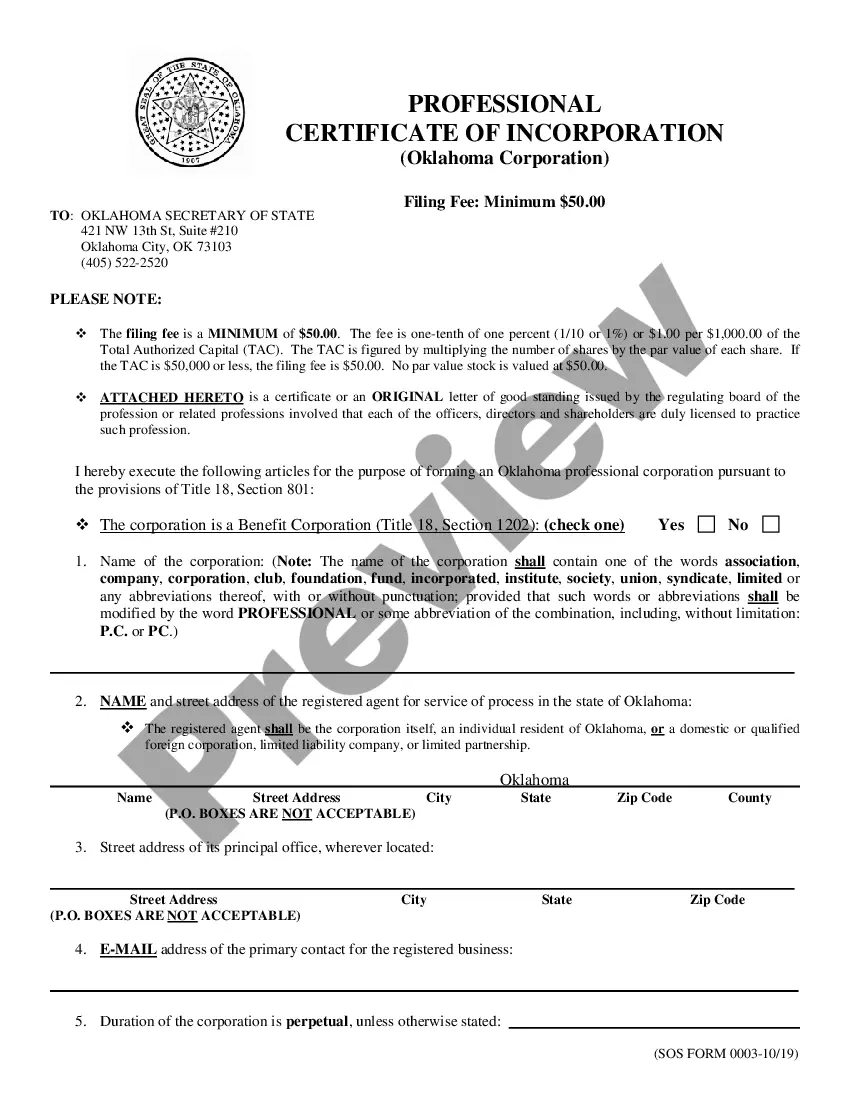

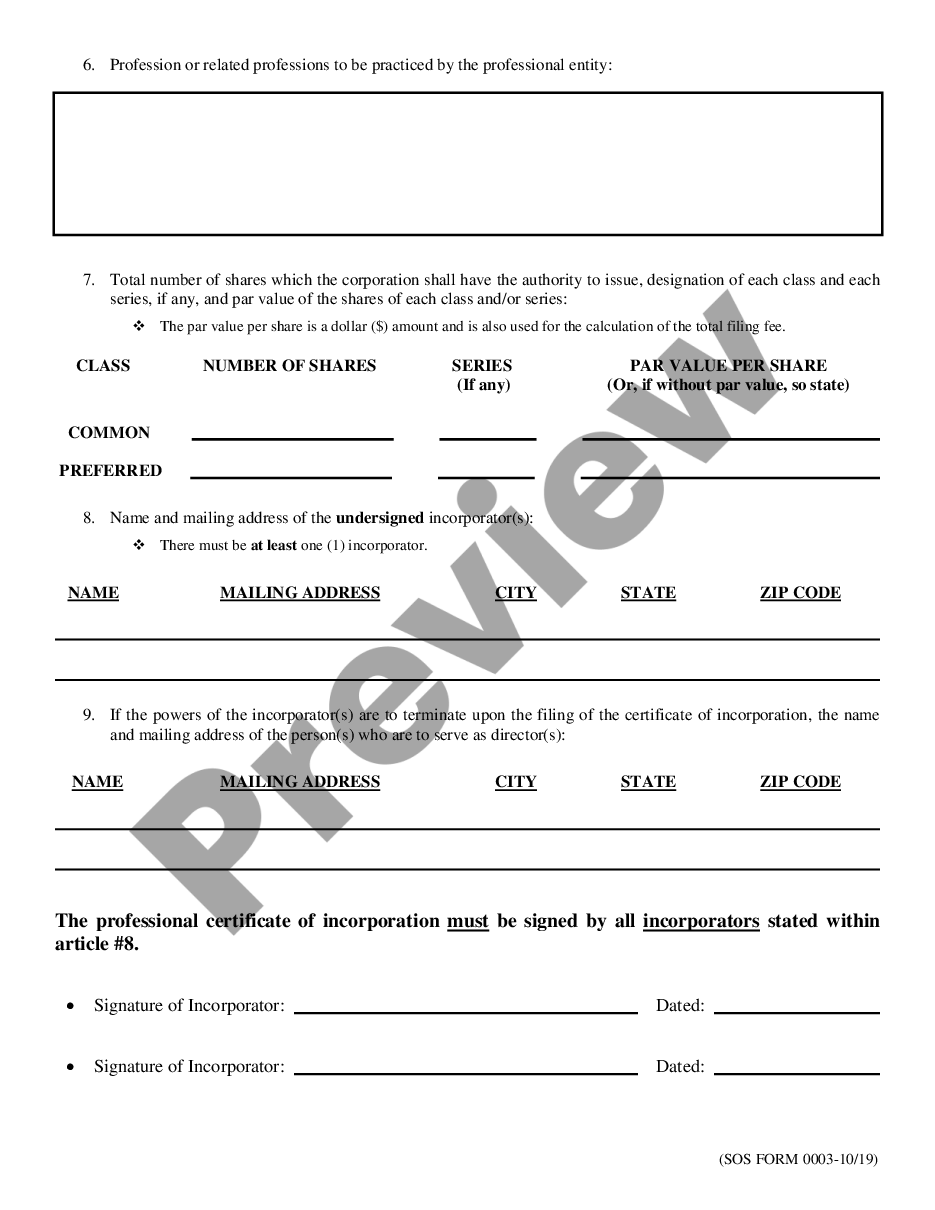

Certificate of Incorporation for a Oklahoma Professional Corporation.

Articles Of Incorporation Oklahoma Withholding

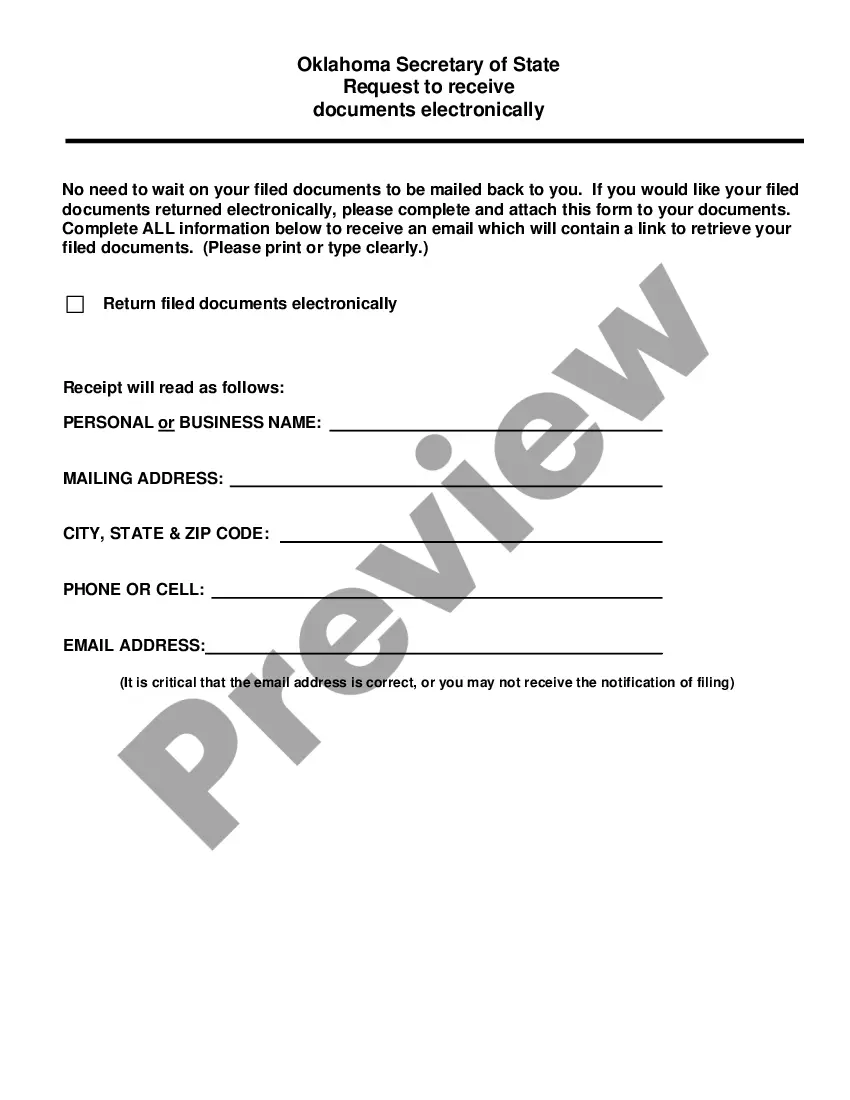

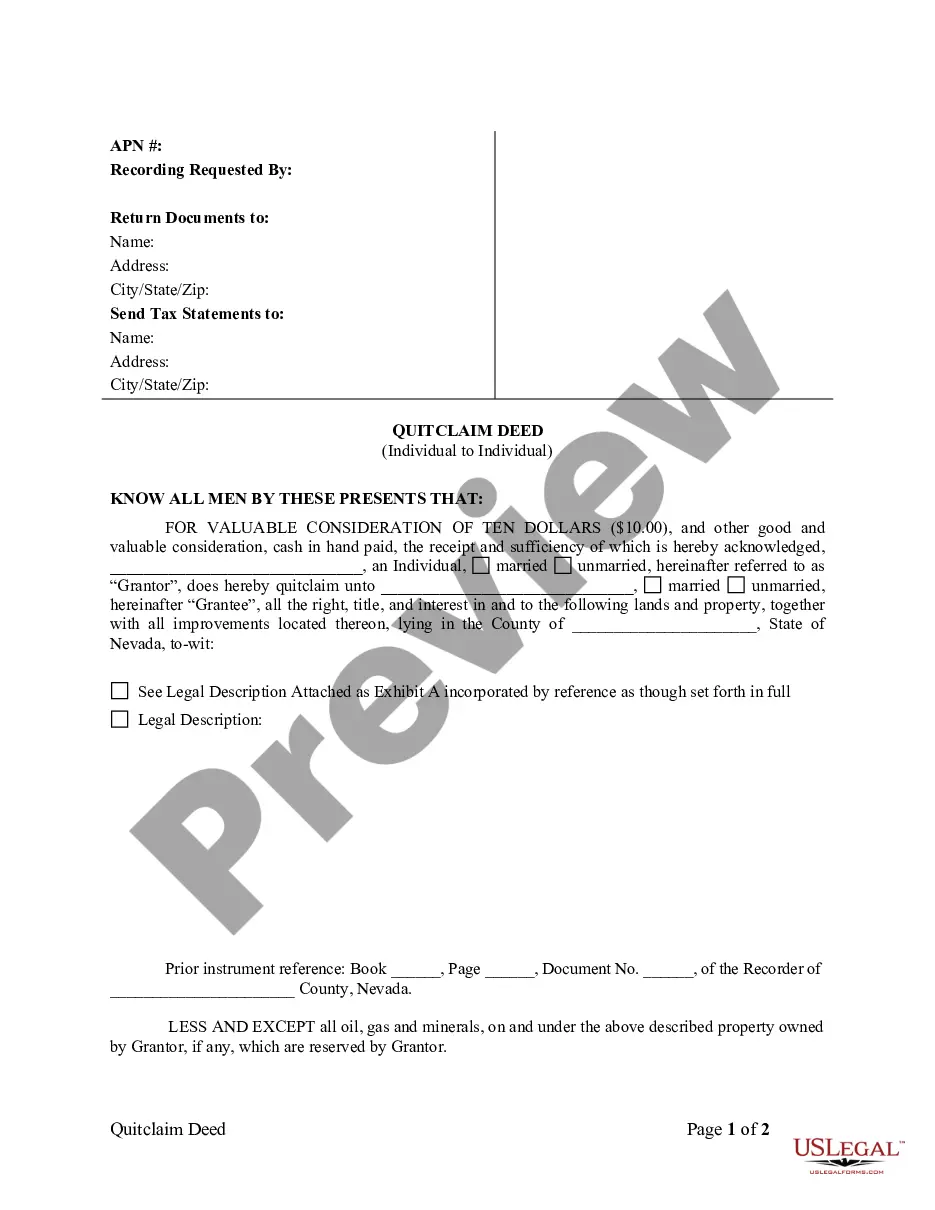

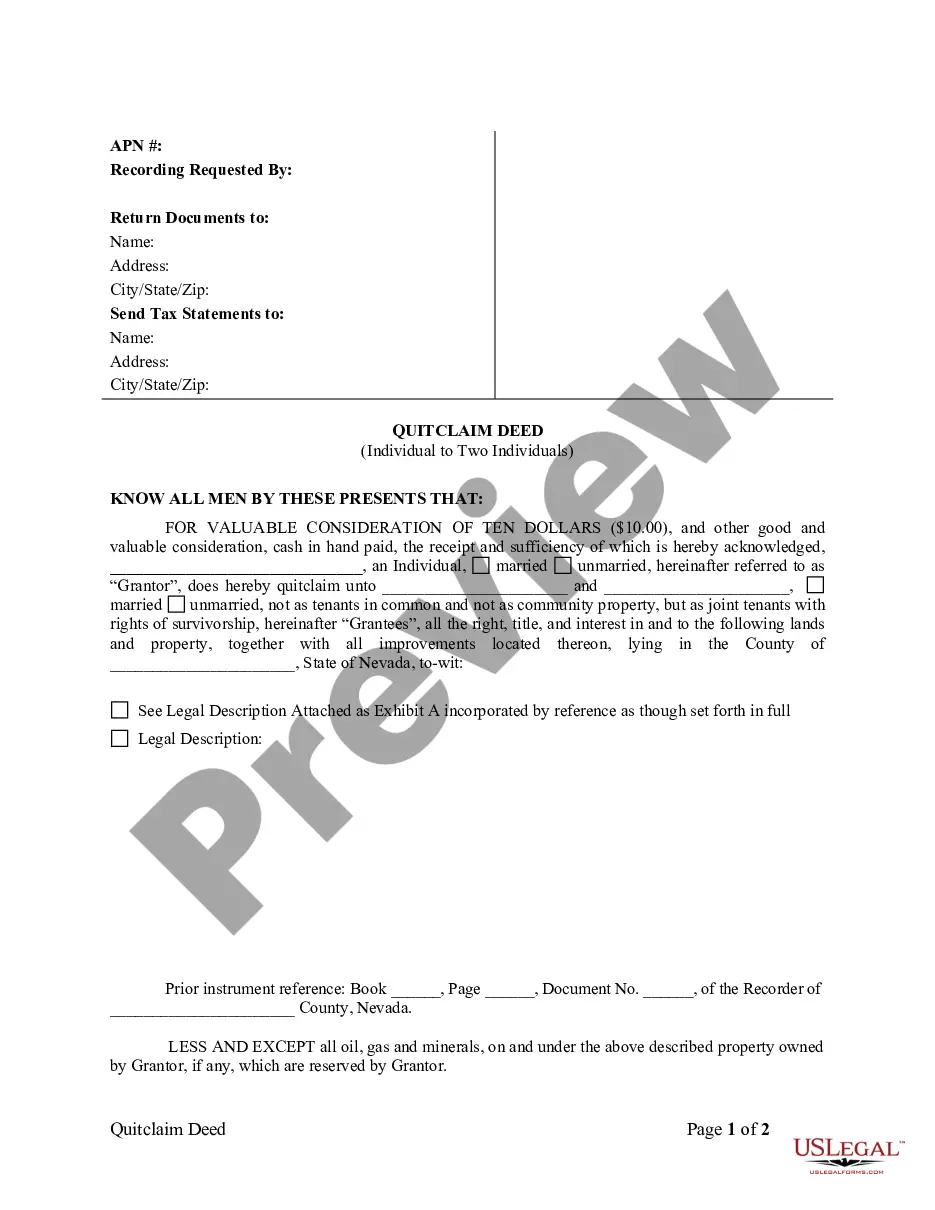

Instant download

Description Incorporation Letter

Free preview Certificate Of Incorporation Oklahoma