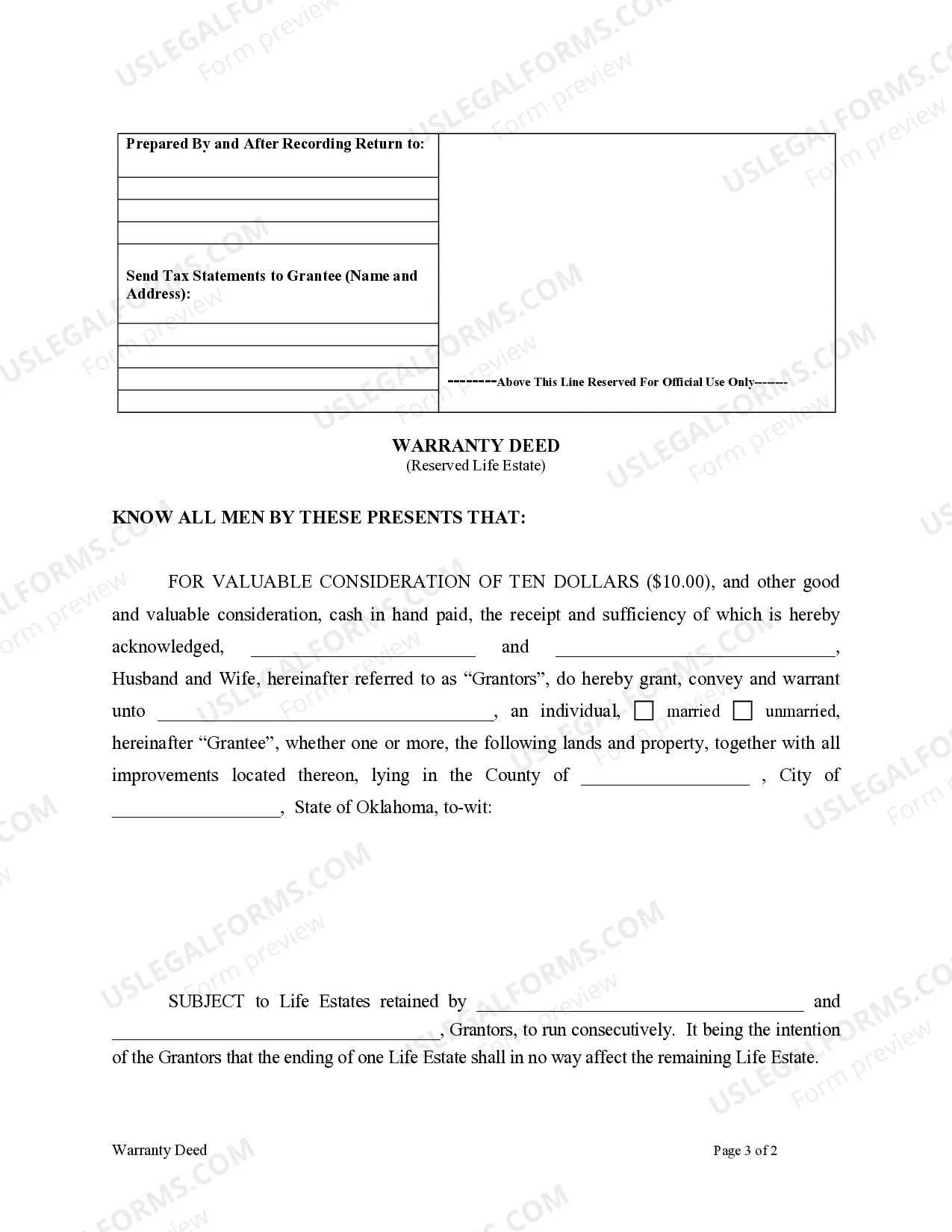

The Deed Reserving Life Estate form in Minnesota refers to a legal instrument used to transfer real estate ownership while allowing the current owner (granter) to retain a life estate on the property. This means that the granter can continue to live on or use the property until their death, at which point ownership automatically transfers to another individual or entity named in the deed (grantee). The Deed Reserving Life Estate form establishes two distinct interests in the property: the life estate and the remainder interest. The life estate grants exclusive use and possession of the property to the granter for the duration of their life. The remainder interest ensures that upon the granter's death, the property automatically passes to the grantee without the need for probate or court intervention. It is important to note that a life estate cannot be sold, mortgaged, or transferred to anyone other than the original grantee named in the deed. Additionally, the granter retains certain responsibilities such as paying property taxes and maintaining the property until their passing. While the Deed Reserving Life Estate form is generally the same throughout the state of Minnesota, it is possible that different counties or local jurisdictions may have their own unique variations or requirements. Therefore, it is advisable to consult with a qualified attorney or legal professional to ensure compliance with local regulations. Keywords: Deed Reserving Life Estate form, Minnesota, life estate, remainder interest, property ownership, granter, grantee, real estate, legal instrument, probate, property taxes, possession, exclusive use, local regulations.

Deed Reserving Life Estate Form Minnesota

Description

How to fill out Deed Reserving Life Estate Form Minnesota?

It’s no secret that you can’t become a law professional immediately, nor can you grasp how to quickly draft Deed Reserving Life Estate Form Minnesota without the need of a specialized set of skills. Creating legal forms is a time-consuming venture requiring a specific training and skills. So why not leave the creation of the Deed Reserving Life Estate Form Minnesota to the professionals?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court documents to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the form you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Deed Reserving Life Estate Form Minnesota is what you’re searching for.

- Start your search again if you need any other form.

- Set up a free account and choose a subscription plan to buy the template.

- Pick Buy now. As soon as the payment is complete, you can get the Deed Reserving Life Estate Form Minnesota, fill it out, print it, and send or send it by post to the designated individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

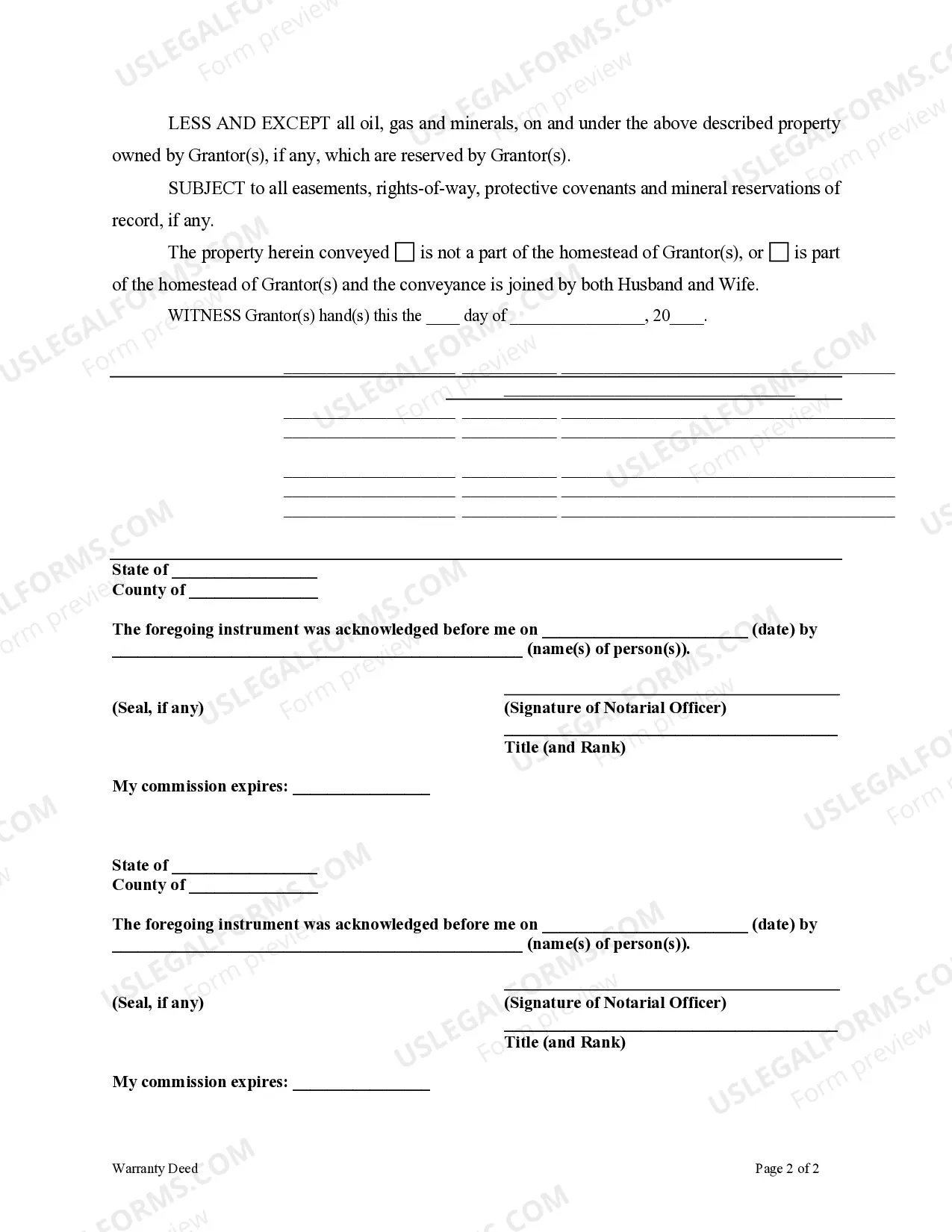

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

Minnesota's deed tax is calculated based on the consideration for the transfer. The rate for most transfers is 0.33 percent of the purchase price. Minnesota law authorizes Hennepin and Ramsey Counties to charge an additional . 01 percent of consideration.

A life estate will provide the surviving spouse with: the right to live in the homestead until his or her death, and. a certain percentage of the sale proceeds upon any sale prior to the death of the surviving spouse ? which percentage will decline over time.

A life estate is a form of legal ownership that is usually created through a deed, will, or by operation of law. is an interest in real property that entitles the life estate owner (sometimes referred to as the life tenant) to the right to occupy, possess or otherwise use the property for the lifetime of one or more ...