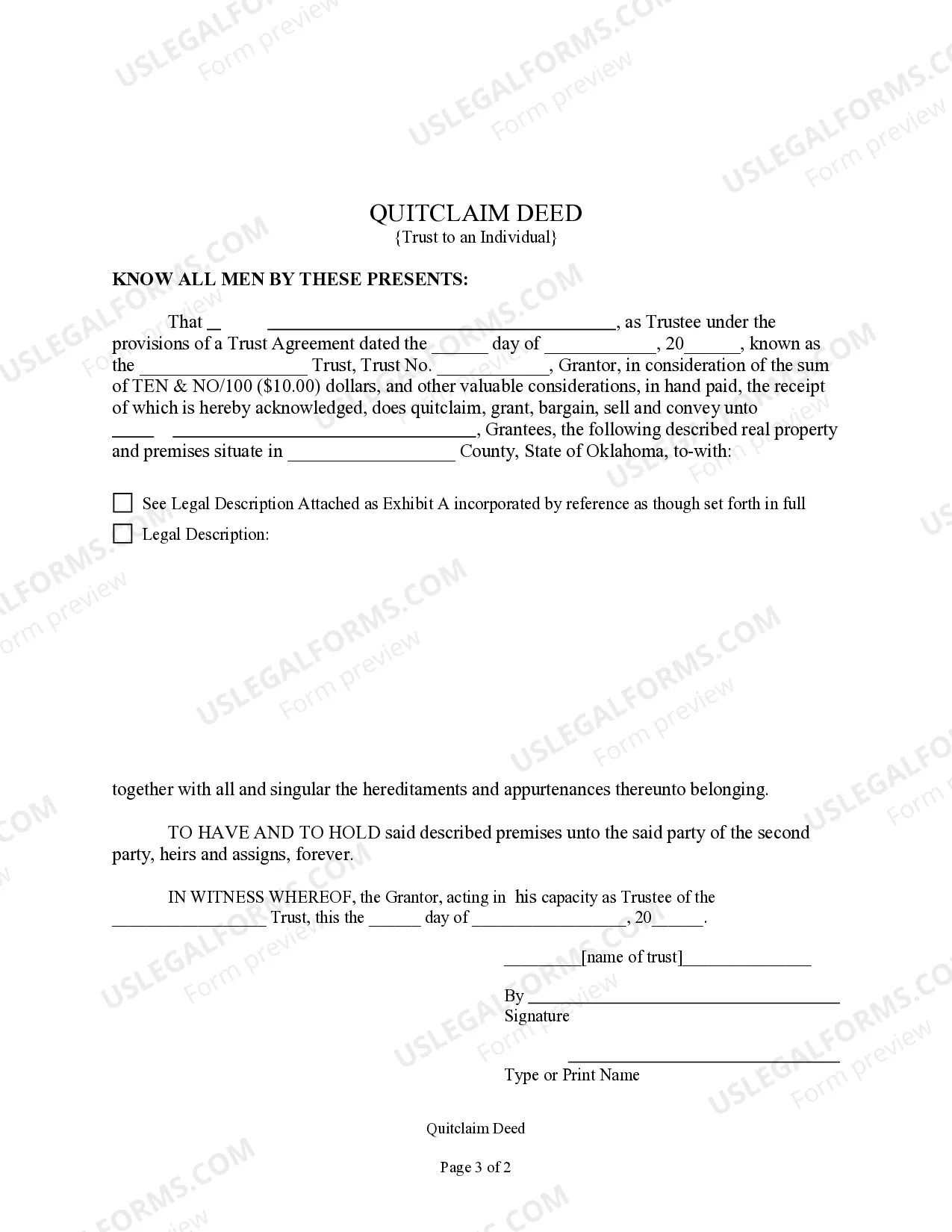

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Trust Deeds For Real Estate

Description

Form popularity

FAQ

Filling out a trust certification involves gathering specific information such as the trust's name, the date it was established, and the identities of the trustees. It's essential to include details about the assets held in trust and ensure accurate representation of the terms. Using US Legal Forms can streamline this process by providing templates and guidance to ensure your trust certification is completed correctly.

The primary difference lies in their roles; a trust is an arrangement for managing assets, while a trust deed serves as the legal document that establishes that trust. Trust deeds for real estate specifically set out the terms and conditions for property transactions and management. Knowing this distinction can help you navigate legal matters more confidently.

A trust deed UK template is a formal document designed to guide individuals in creating trust deeds for real estate transactions. It provides a structured outline that ensures all legal requirements are met while offering flexibility for specific details. Using a reliable platform like US Legal Forms can simplify this process by providing vetted templates that cater to your needs.

Beneficiaries of a trust deed typically include individuals or entities that receive the benefits from the trust. In the context of trust deeds for real estate, these beneficiaries often include the lenders who hold the deed, as well as the property owners who initiate the trust. Understanding the roles of beneficiaries can help in effectively managing the terms of the trust deed, ensuring all parties are aware of their rights.

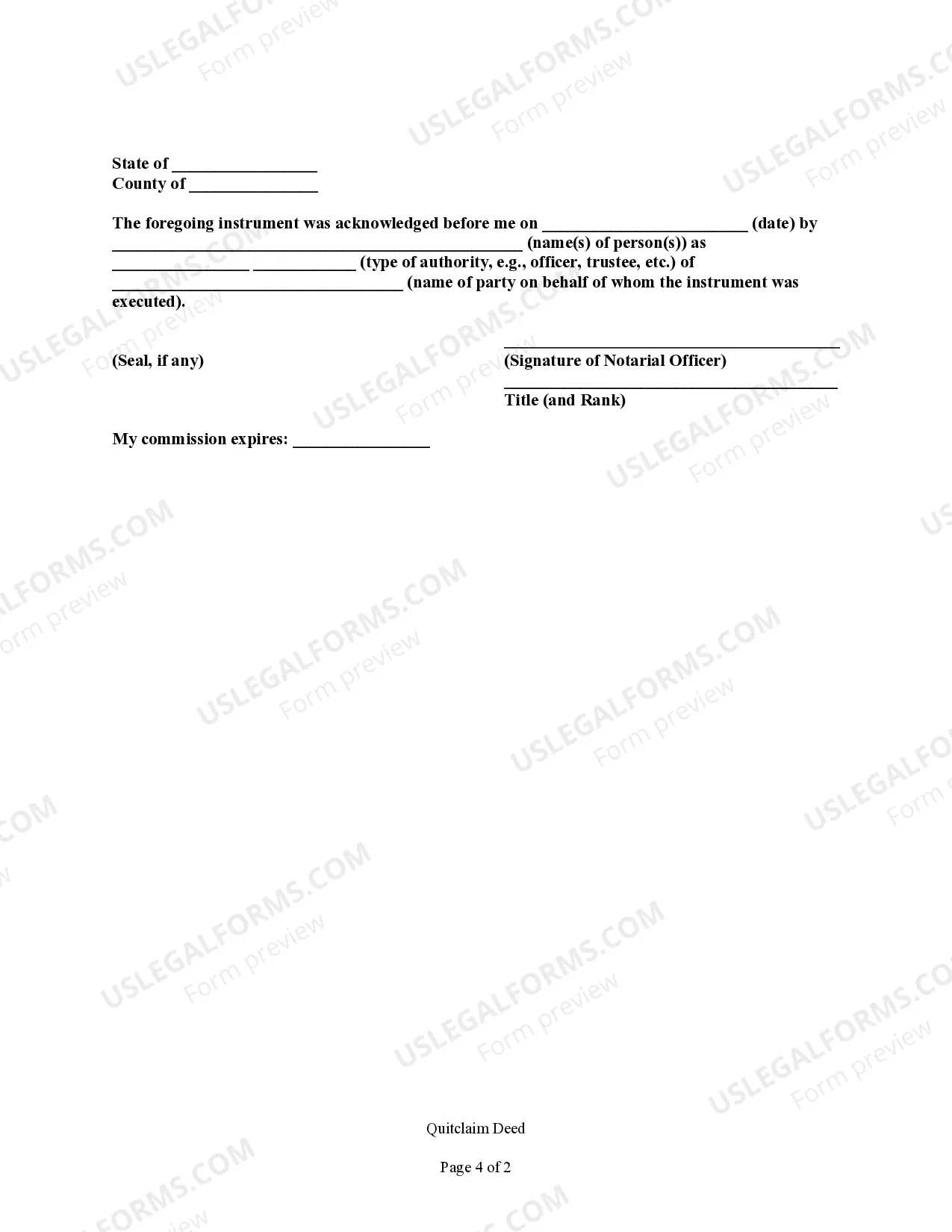

Yes, filing a deed of trust is typically required to make it legally binding. Trust deeds for real estate must be recorded with the county to ensure that all parties are protected. This process allows creditors to secure loans with the real estate as collateral. By using services like US Legal Forms, you can easily navigate the filing process and ensure your documentation is handled properly.

The requirements for a trust deed generally include the identification of the trustee, the beneficiaries, and the property in question. Additionally, it should be signed, notarized, and recorded according to state regulations. Compliance with these requirements ensures that your trust deeds for real estate are enforceable and protect the interests of all parties involved.

A trust deed usually includes essential information like the names and addresses of the parties involved, a description of the property, and the terms of the trust. It also outlines the rights and obligations of the trustee and the beneficiaries. By clearly stating the intentions and responsibilities, a well-crafted trust deed ensures smooth management of real estate matters.

To acquire a trust deed, start by drafting the necessary documentation that outlines the terms and conditions of the trust. You can seek assistance from legal professionals or use platforms like US Legal Forms, which provide templates for creating trust deeds for real estate. Once you complete the documents, make sure to have them notarized and recorded in your local county office.

A deed of trust can be deemed invalid in California for several reasons. If the deed was not properly signed or notarized, it may not hold up in court. Additionally, if the property was not clearly identified, or if there was a failure to meet statutory requirements, the deed may be challenged. Always consult legal experts to ensure your trust deeds for real estate comply with state laws.

To create a trust, you need at least one trustee and one beneficiary. The trustee manages the assets, while the beneficiary receives the benefits. In many cases, a person can serve as both the trustee and the beneficiary. Therefore, it is possible to establish a trust with just one person.