Entry Of Appearance And Waiver Form Oklahoma Withholding Tax

State:

Oklahoma

Control #:

OK-806D

Format:

Word;

Rich Text

Instant download

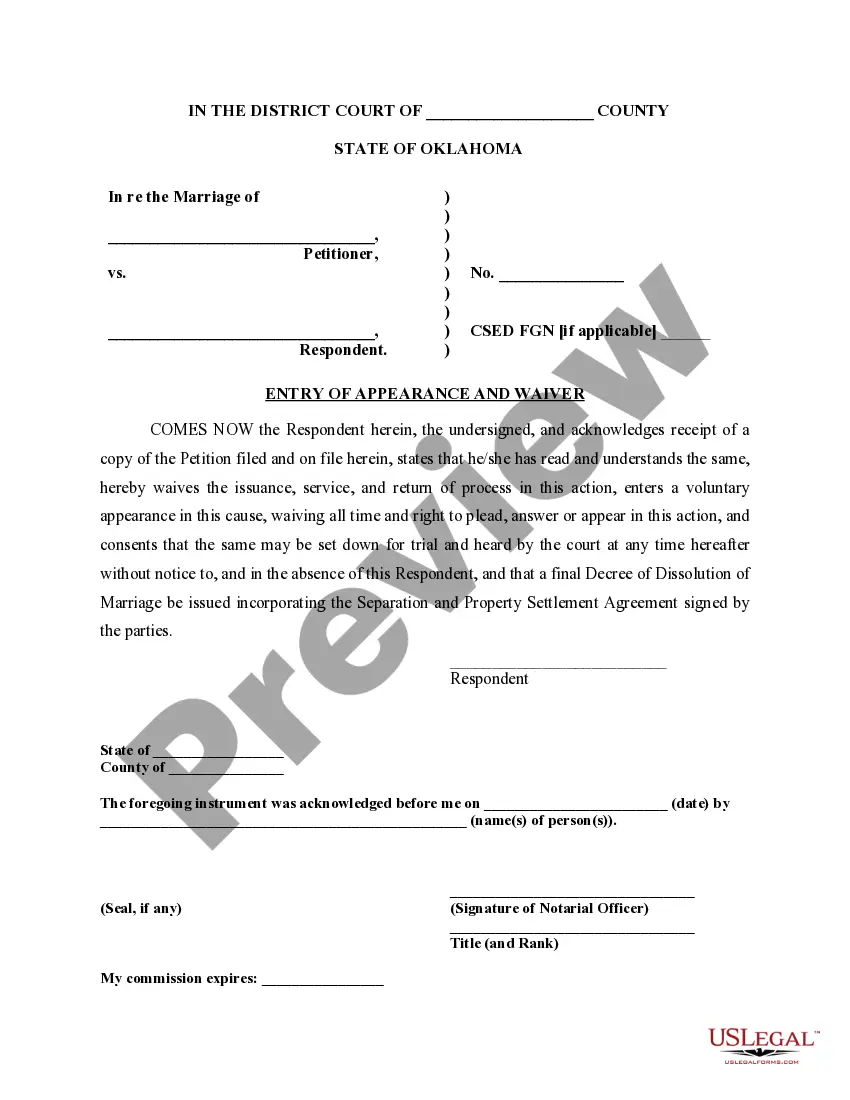

Description Waiver Of Appearance Divorce Form Oklahoma

Entry of Appearance and Waiver: This form must be signed by your spouse in front of a Notary Public. It indicates that your spouse waives all formalities in the case and agrees to the divorce according to the terms of the Separation and Property Settlement Agreement. This form is available in both Word and fillable PDF formats.