Oklahoma Limited Partnership For Real Estate Investments

Category:

State:

Oklahoma

Control #:

OK-SDEED-7

Format:

Word;

Rich Text

Instant download

Description Ok Grantor Print

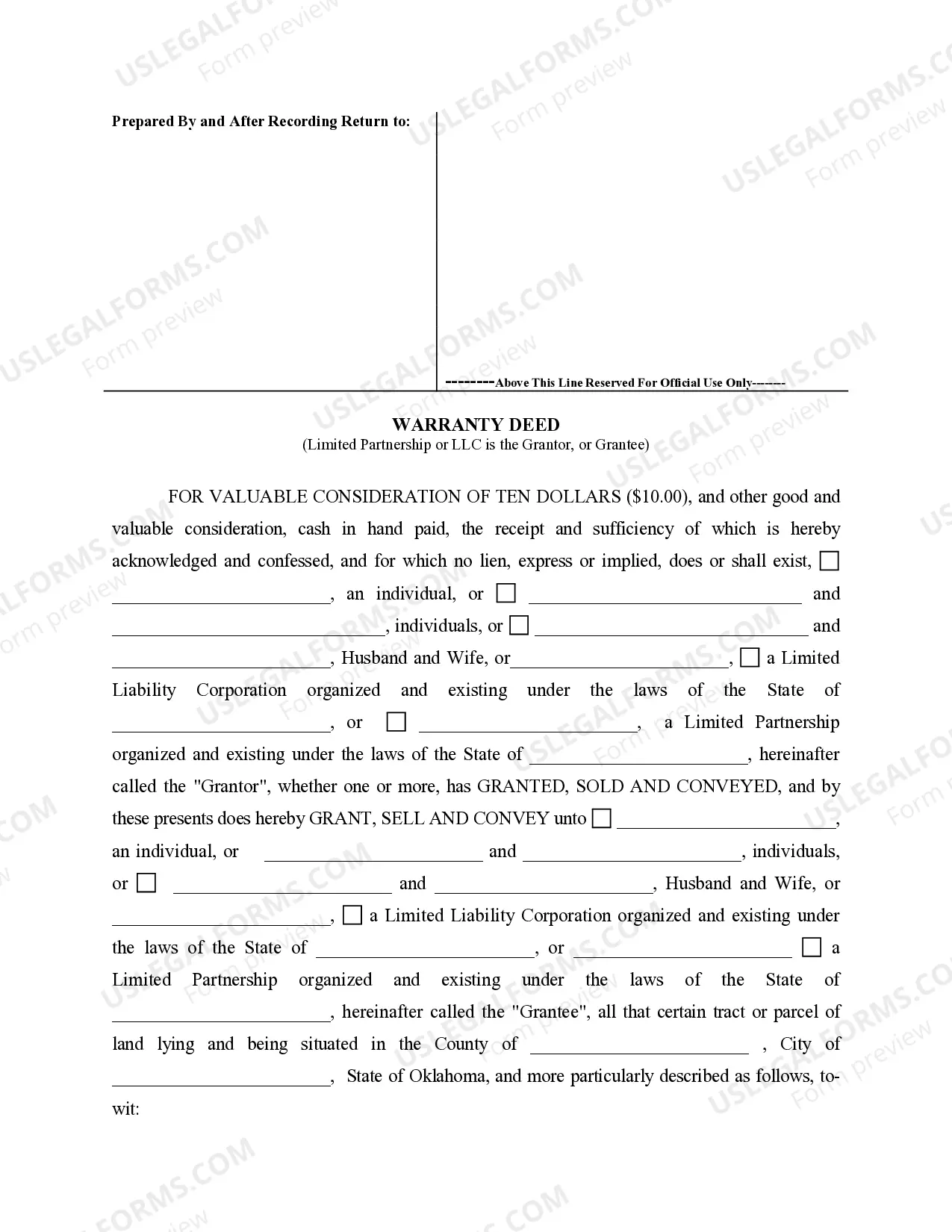

This form is a Warranty Deed where the grantor and/or grantee could be a limited partnership or LLC.

Free preview Llc Grantee Printable