Oklahoma Limited Partnership Withers

Description

Form popularity

FAQ

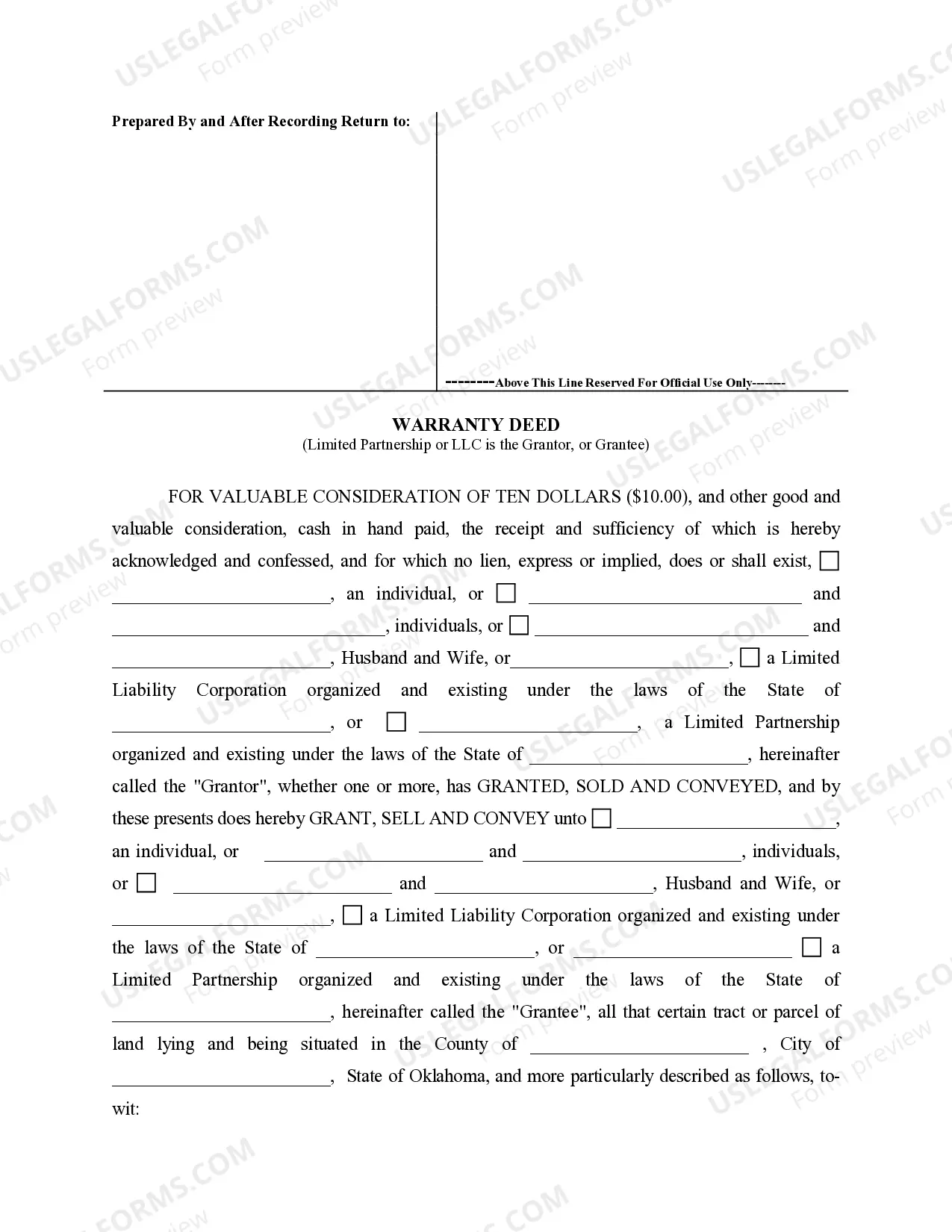

Creating a limited partnership (LP) involves filing a certificate of limited partnership with the Oklahoma Secretary of State. Ensure you choose a unique name for your LP that complies with state rules. After filing, draft a limited partnership agreement to outline roles and responsibilities. To simplify the process, consider using USLegalForms, which provides resources tailored for establishing an Oklahoma limited partnership withers.

To write a limited partnership agreement, you start by defining the roles of general and limited partners, outlining their responsibilities and contributions. Next, include the partnership’s purpose, profit distribution, and procedures for adding or removing partners. It's also crucial to address dispute resolution and dissolution processes. For assistance, you can use USLegalForms to access templates that help you create an Oklahoma limited partnership withers efficiently.

The timeline for getting your LLC in Oklahoma can vary. Typically, if you file online, you can receive approval within a few business days. By ensuring your submission is complete, you help streamline the process and prevent any delays in your Oklahoma limited partnership withers.

To qualify as a limited partner in Oklahoma, you must provide capital to the partnership but not be involved in day-to-day operations. Your role is primarily financial, allowing you to enjoy limited liability protection. Understanding how your Oklahoma limited partnership withers can ensure you remain compliant and fully benefit from your investment.

To dissolve a partnership in Oklahoma, you must obtain the agreement of all partners. Next, you should file a Certificate of Cancellation with the Secretary of State. Make sure to settle any outstanding debts and obligations, as this will ensure that your Oklahoma limited partnership withers effectively without legal complications.

Yes, in Oklahoma, you are required to file an Annual Certificate each year to maintain your LLC status. This process helps ensure that your Oklahoma limited partnership withers are in good standing with the state. Additionally, it’s a good idea to keep your business information up to date during this renewal.

To establish your LLC in Oklahoma, you need to file Articles of Organization with the Secretary of State. You can complete this process online or via mail. After filing, you’ll receive confirmation, and your Oklahoma limited partnership withers under legal scrutiny, allowing you to operate your business confidently.

Any partnership engaging in business activities and generating income in Oklahoma is required to file a partnership tax return. This includes limited partnerships and limited liability partnerships. Understanding the requirements for an Oklahoma limited partnership withers is crucial for ensuring compliance with tax laws. Consulting resources like uslegalforms can provide clarity on your filing obligations.

To form a limited partnership in Oklahoma, you need to file a Certificate of Limited Partnership with the Secretary of State. This certificate should include the names of the general and limited partners, as well as the partnership’s business address. Knowing how an Oklahoma limited partnership withers can impact your business is essential for compliance and protection from liabilities. You can also leverage uslegalforms to streamline the formation process.

All individuals and entities earning income in Oklahoma are typically required to file a state tax return. This includes residents, non-residents, and businesses like Oklahoma limited partnerships withers that have taxable income within the state. Meeting tax filing obligations is essential to avoid penalties and remain compliant. Platforms such as uslegalforms can assist you in understanding your specific filing requirements.