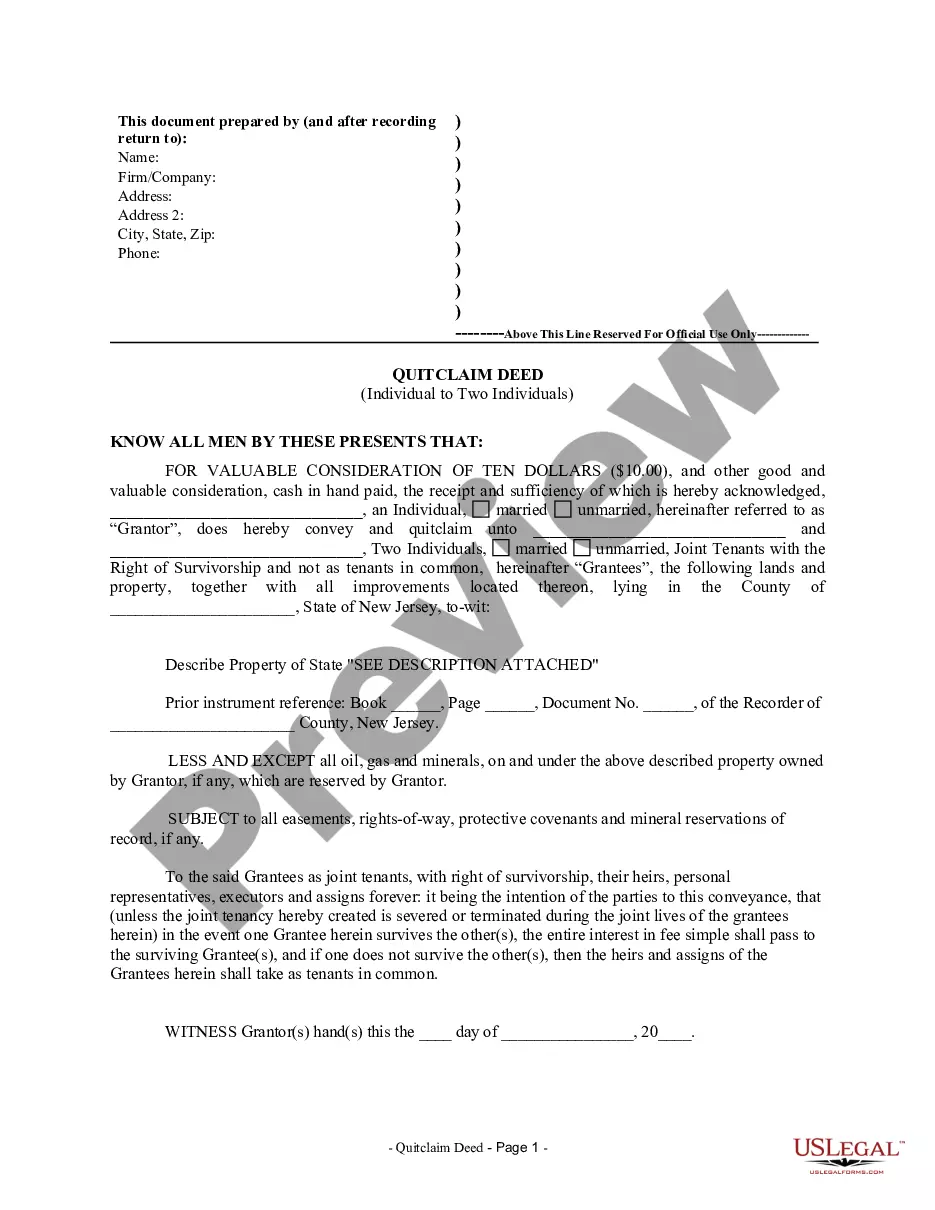

This form is a Life Estate Deed where the Grantor is an individual and the Grantee is an Individual. Grantor conveys and warrants the described life estate to the Grantee. This deed complies with all state statutory laws.

A life estate with an existing mortgage is a legal arrangement that allows an individual, known as the life tenant, to possess and use a property for the duration of their lifetime while there is an existing mortgage on the property. This type of real estate arrangement comes with specific rights and responsibilities for both the life tenant and the remainder man, who is the individual or entity named to inherit the property after the life tenant's passing. In a life estate with an existing mortgage, the life tenant has the right to use and enjoy the property throughout their lifetime. They can live in the property, lease it, collect rent, and make any necessary improvements as long as it complies with the terms of the mortgage agreement. The life tenant is also responsible for paying property taxes, insurance, and maintaining the property in good condition. The existence of an underlying mortgage means that the life tenant must also fulfill the mortgage obligations, such as making monthly mortgage payments to the lender. However, the life tenant is not personally liable for the repayment of the mortgage debt upon their death. Instead, the responsibility for paying off the mortgage falls on the remainder man or their estate. There are a few different types of life estate with an existing mortgage: 1. Life Estate Plus Mortgage: In this type of arrangement, the life tenant holds a life estate interest in the property while also assuming responsibility for an existing mortgage. The remainder interest belongs to the designated individual or entity. 2. Life Estate with Mortgage Assumption: Here, the life tenant assumes the mortgage from the original owner, either partially or fully, and carries on with the responsibility of mortgage payments. The remainder man still retains their interest in the property and ultimately assumes full ownership after the life tenant's passing. 3. Life Estate Encumbered by Mortgage: In this scenario, the life tenant is granted a life estate in the property, but the lender keeps the right to foreclose if mortgage payments are not made. The remainder man's interest could be at risk if the life tenant fails to meet the mortgage obligations. When considering a life estate with an existing mortgage, it is crucial for all parties involved to clearly outline their rights, responsibilities, and potential limitations in a legally binding agreement. Consulting with legal professionals and mortgage experts is recommended to ensure that all aspects of the arrangement are properly understood and protected.