Life Estate With Remainder

Description

How to fill out Oregon Life Estate Deed From An Individual To An Individual.?

Whether for commercial reasons or for individual matters, everyone must confront legal issues eventually in their lifetime.

Completing legal paperwork requires meticulous attention, starting with selecting the correct form template.

With a comprehensive US Legal Forms catalog available, you do not need to waste time searching for the suitable template online. Utilize the library’s straightforward navigation to find the correct form for any situation.

- Locate the template you require by utilizing the search bar or catalog browsing.

- Review the form’s summary to confirm it aligns with your circumstances, state, and county.

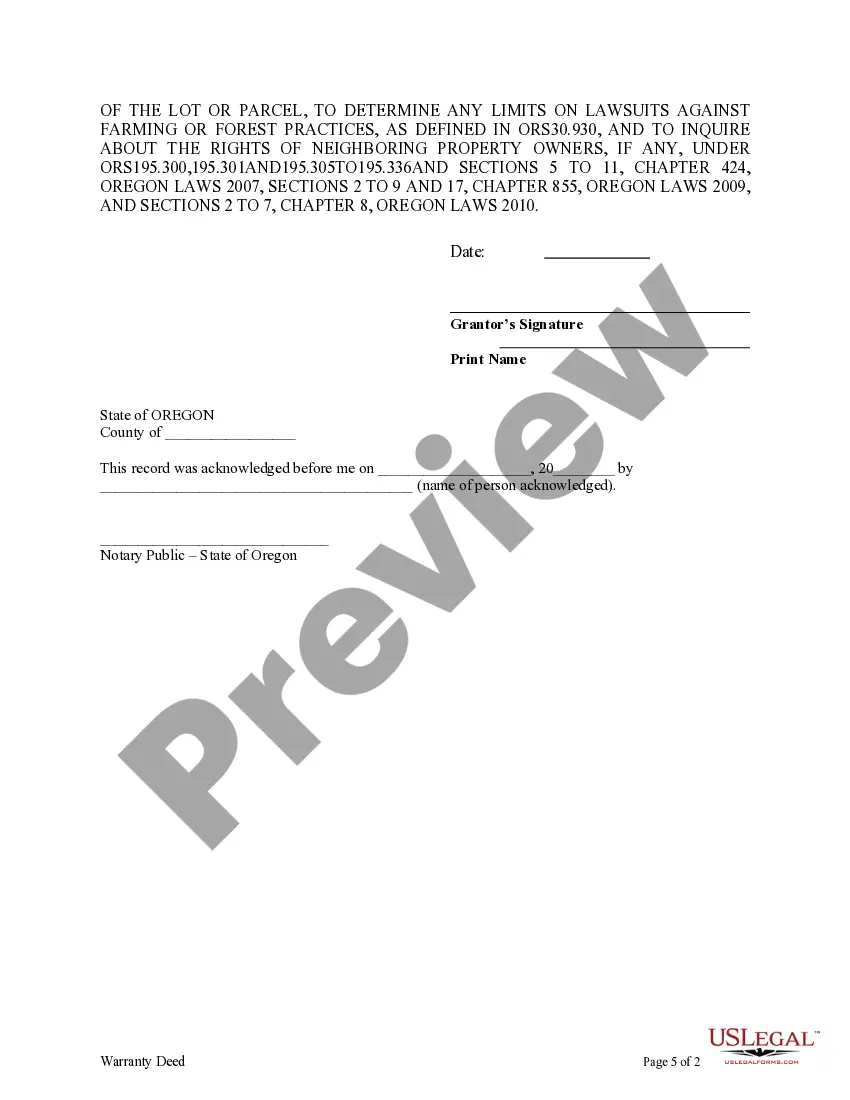

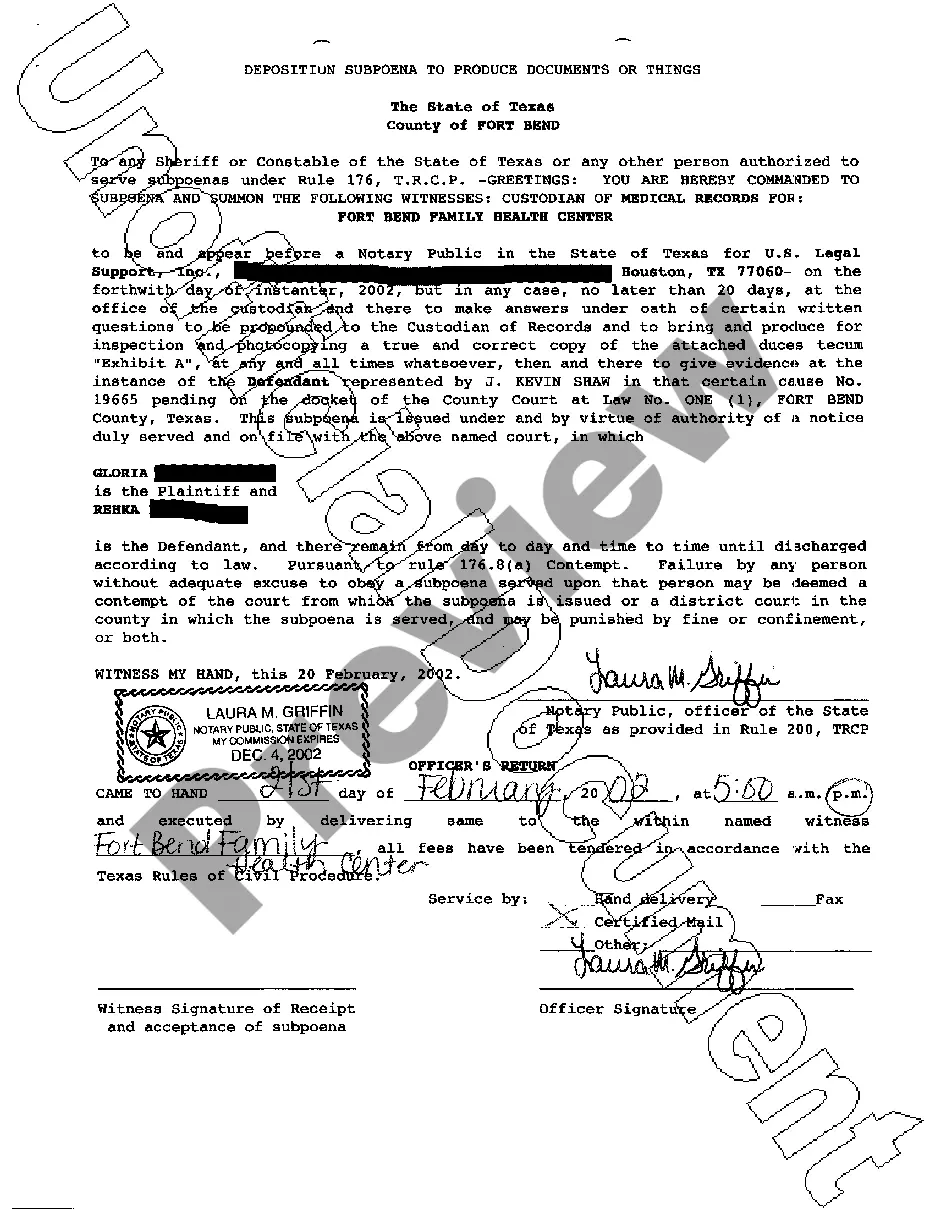

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search function to find the Life Estate With Remainder example you need.

- Obtain the document once it fulfills your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you desire and download the Life Estate With Remainder.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

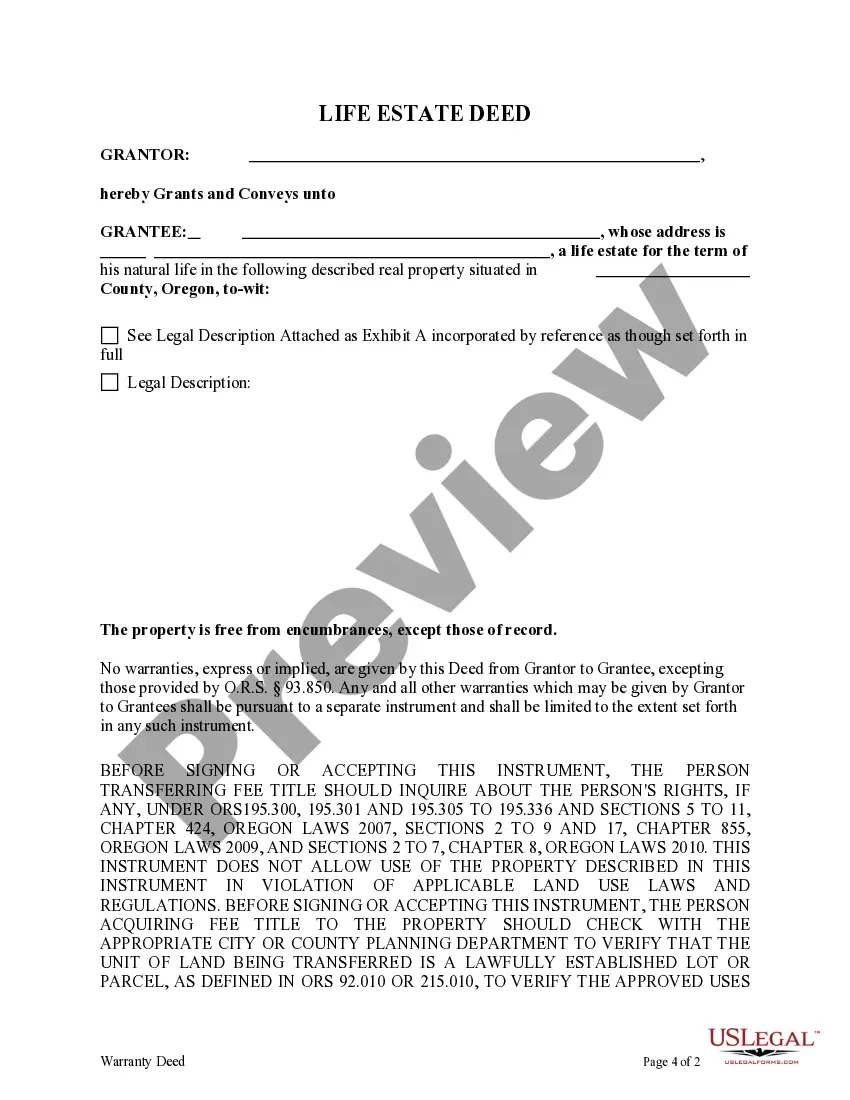

A remainderman owns the property after the original owner passes away or relinquishes rights. In a life estate with remainder, the remainderman gains full ownership only once the life tenant's interest ends. This arrangement ensures that the property's use and enjoyment are separated, allowing the life tenant to live in the property for a specified period. If you want to establish clear property rights, consider using US Legal Forms to create an effective life estate with remainder document.

Life estate with remainder refers to a legal arrangement in which one person holds the right to use a property during their lifetime, and another person, the remainderman, automatically receives the property after their death. This setup simplifies the transition of ownership and can help avoid the lengthy probate process. It also provides a sense of security for both the life tenant and the remainderman. If you're looking for documents or guidance to establish a life estate with remainder, UsLegalForms offers reliable resources to assist you.

A life estate with a remainder is a type of property ownership where one individual, known as the life tenant, has the right to use the property for their lifetime. After the life tenant passes away, ownership of the property passes to another individual, called the remainderman. This arrangement allows for easy transfer of property upon the life tenant's death, ensuring that the remainderman receives the property without going through probate. If you're considering this arrangement, understanding its benefits can help you make informed decisions.

Yes, a remainderman can be removed from a life estate, but the process may involve legal steps. The current life tenant and the remainderman need to agree on this change. You may wish to consult an attorney to ensure that you handle this correctly. Understanding the implications of altering a life estate with remainder can help protect your interests.

The step-up basis for a remainder interest means that when the life tenant passes away, the remainderman's tax basis is reset to the current market value of the property. This adjustment can significantly reduce capital gains tax if the property is sold later. Knowing about the step-up basis in the context of a life estate with remainder can be beneficial for effective estate planning, helping to minimize tax burdens for your heirs.

The tax basis for the remainderman is typically the fair market value of the property at the time the life estate ends. This means that when the life tenant passes away, the remainderman's tax basis is adjusted to reflect the property's value at that moment. By understanding this aspect of a life estate with remainder, you can better prepare for any future tax implications associated with the property.

To calculate the value of a life estate, you typically consider the age and life expectancy of the life tenant and the fair market value of the property. You can use actuarial tables to estimate life expectancy and apply a specific formula to determine the present value of the life estate. This assessment is crucial for estate planning because it helps both the life tenant and the remainderman understand the value division of the property.

The remainder of an estate refers to the interest in property that becomes available after the life estate ends. In the context of a life estate with remainder, this means that the remainderman will receive full ownership of the property only after the life tenant's right to use the property ceases. This structured approach to property ownership helps in estate planning and ensures that your wishes are respected.

A life estate in remainder is a property interest that allows an individual to use the property during their lifetime, after which the property passes to another person, known as the remainderman. This arrangement provides the life tenant with usage rights, while the remainderman receives the property once the life tenant passes away. Essentially, it's a way to ensure that the property transitions smoothly to the next owner.

The remainderman cannot sell the property while the life estate is active, as the life tenant holds rights to the property during their lifetime. However, once the life tenant passes and the life estate terminates, the remainderman gains full ownership and can sell the property. It's important to plan ahead to ensure a smooth transition of ownership.