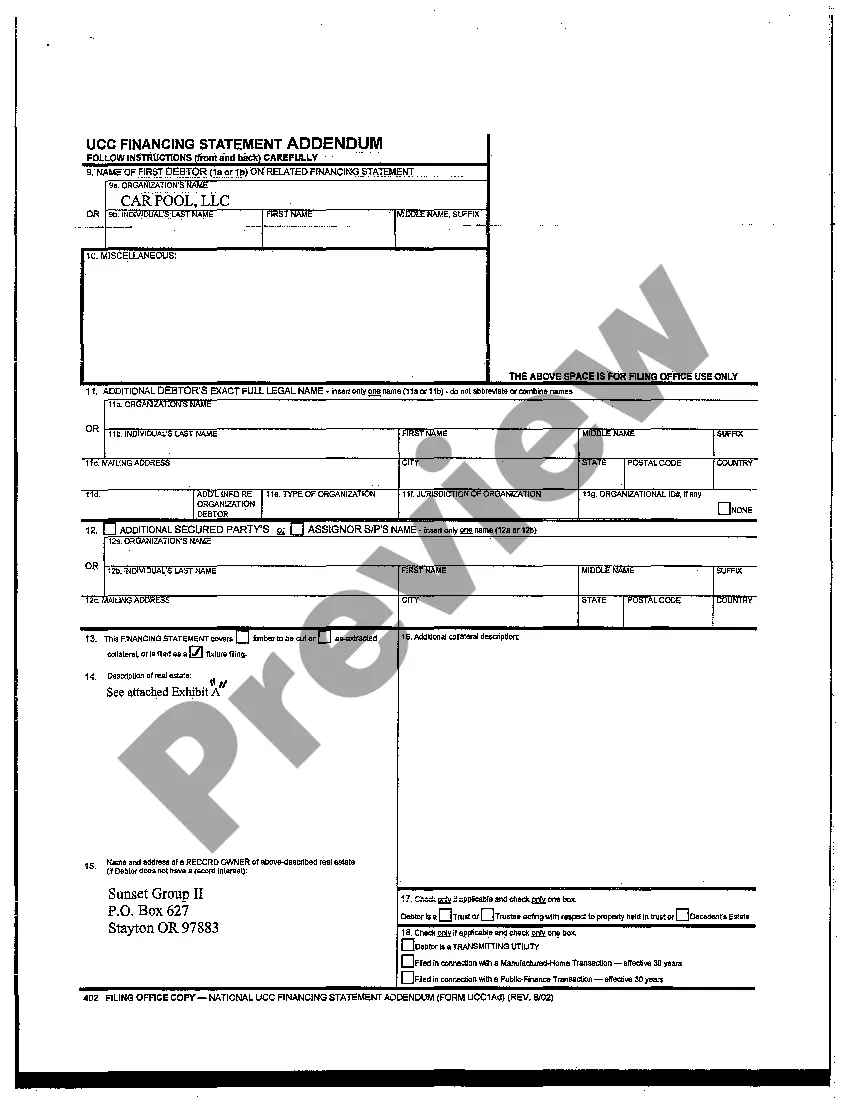

Oregon UCC Filing with Delaware Secretary of State: A Comprehensive Guide Understanding the Oregon UCC Filing process with the Delaware Secretary of State is essential for businesses aiming to ensure their interests in secured transactions are protected. UCC, which stands for Uniform Commercial Code, governs commercial transactions and provides a standardized set of rules across the United States. Let's delve into the details of Oregon UCC Filing and its various types. 1. Oregon UCC Filing Overview: Oregon UCC Filing refers to the process of submitting relevant documents and information to the Delaware Secretary of State to establish and maintain a business's security interest in a debtor's assets. It safeguards interests in various transactions, such as loans, leases, and sales of goods. 2. Types of Oregon UCC Filing with Delaware Secretary of State: a. UCC-1 Financing Statement: This is the most common type of filing and is used to establish a creditor's security interest in a debtor's personal property. It includes detailed information about the debtor, the creditor, and the collateral involved. Filing a UCC-1 Financing Statement creates a public record, providing notice to other potential creditors. b. UCC-3 Continuation Statement: This filing is essential to extend the validity of a UCC-1 Financing Statement after its initial expiration. By filing a UCC-3 Continuation Statement, businesses can ensure their security interest remains in effect and does not lapse. c. UCC-5 Information Statement: The UCC-5 Information Statement is used to amend or correct information contained in a previously filed UCC document. This filing allows businesses to update any errors or changes related to debtor information, collateral description, or creditor's address. d. UCC-11 Information Request: The UCC-11 Information Request is utilized to obtain information about existing UCC filings and to perform comprehensive searches to identify potential liens or security interests associated with a debtor's assets. This filing is commonly adopted during due diligence processes. 3. Key Considerations for Oregon UCC Filing: To ensure a successful Oregon UCC Filing with the Delaware Secretary of State, businesses must pay attention to the following details: a. Accuracy and Completeness: All information provided during the filing process must be accurate and complete to avoid potential disputes or challenges. b. Timely Filing: Businesses should adhere to all relevant deadlines and ensure filings are submitted within the required timeframes to maintain the validity of their security interests. c. Search and Monitoring: Regularly conducting UCC searches is crucial to identify any competing claims or liens on assets of interest. Ongoing monitoring helps safeguard against unauthorized terminations or unauthorized modifications. d. Renewal and Amendments: Keeping track of expiration dates and promptly filing continuation statements or information amendments will help maintain the effectiveness of the UCC filings. In conclusion, businesses seeking to protect their security interests in Oregon should understand and adhere to the UCC filing requirements with the Delaware Secretary of State. By filing the appropriate documents, such as UCC-1 Financing Statements, UCC-3 Continuation Statements, UCC-5 Information Statements, and utilizing UCC-11 Information Requests, businesses can establish and uphold their secured transactions in accordance with UCC guidelines. Proactive management of filings, accuracy, and ongoing monitoring are vital components to ensure the desired level of protection.

Oregon Ucc Filing With Delaware Secretary Of State

Description delaware secretary of state ucc filing

How to fill out Oregon Ucc Filing With Delaware Secretary Of State?

The Oregon Ucc Filing With Delaware Secretary Of State you see on this page is a reusable formal template drafted by professional lawyers in accordance with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided individuals, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Oregon Ucc Filing With Delaware Secretary Of State will take you only a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or check the form description to verify it fits your needs. If it does not, use the search bar to get the correct one. Click Buy Now once you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Pick the format you want for your Oregon Ucc Filing With Delaware Secretary Of State (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a eSignature.

- Download your paperwork again. Use the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

ucc certificate sample pdf Form popularity

FAQ

Generally, you are not giving up any rights by signing a Power of Attorney. The contract can usually be revoked. There is no ?Durable Power of Attorney? in Louisiana, as, unless otherwise stated, all contracts of Mandate survive incapacity. They become invalid upon death.

When you represent yourself, you are referred to as a "self-represented litigant" or "pro-se litigant." Even if you don't have a lawyer, judges and court employees are not allowed to provide you with legal advice and may not be able to speak with you at all about your case outside of the courtroom.

So, you can't just tell someone else that you want them to act as your agent over your person or over your property. All of the documents must be notarized. That means it must be signed in front of a notary public and two witnesses. Even copies of the power of attorney must be certified through the original document.

If a loved one cannot direct their own healthcare, someone else may need to make the big health care decisions in their place. Louisiana law allows those decisions to be made under what is known as a ?durable power of attorney.? Here is a brief overview of attorney laws in Louisiana.

Fee Schedule Filing a Civil Action or Notice of Removal$402.00Power of Attorney$49.00Admission of attorney to practice$188.00Admission to practice pro hac vice, per attorney$100.00Duplicate certificate of admission$20.0019 more rows

Does Louisiana require corporate bylaws? No. ing to Louisiana Revised Statute § -206, corporations MAY adopt corporate bylaws, so bylaws are not legally required for Louisiana corporations.

We recommend that you consult a Louisiana estate planning attorney before trusting that your documents are valid and complete. Additionally, just like any other legal document - your POA document should be written to meet your specific needs and circumstances.