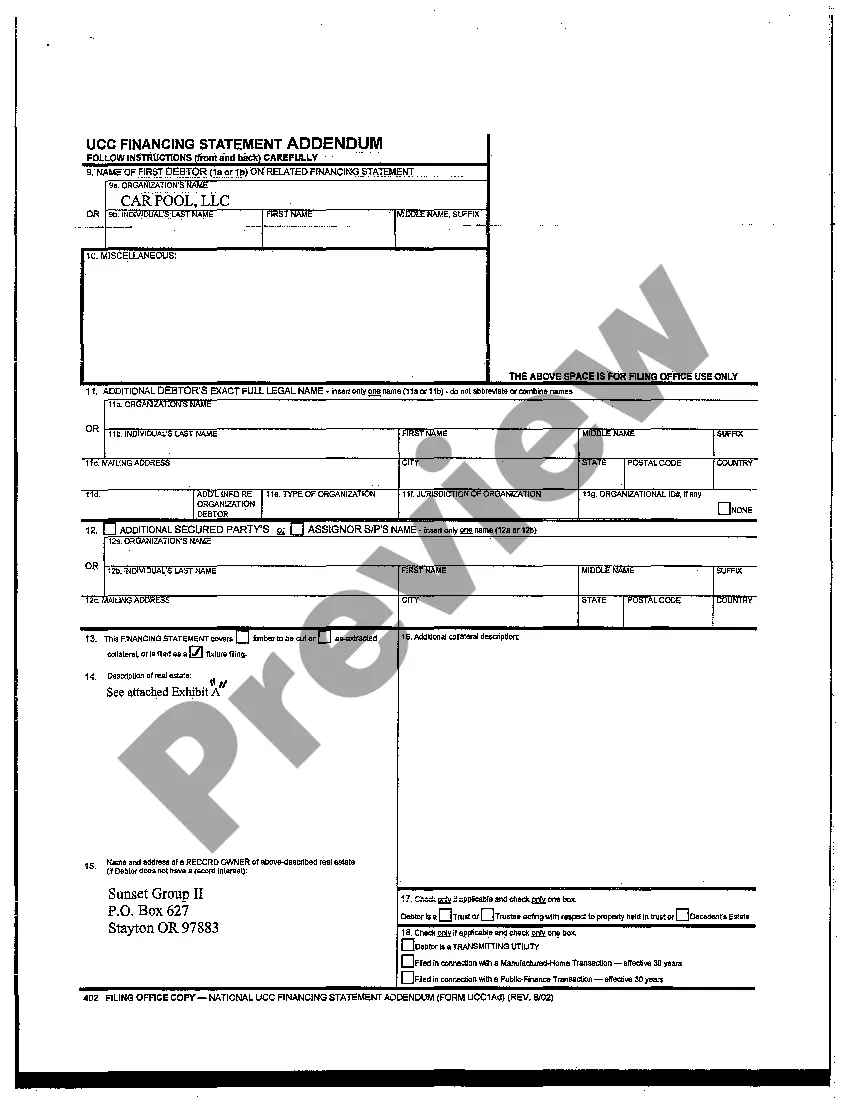

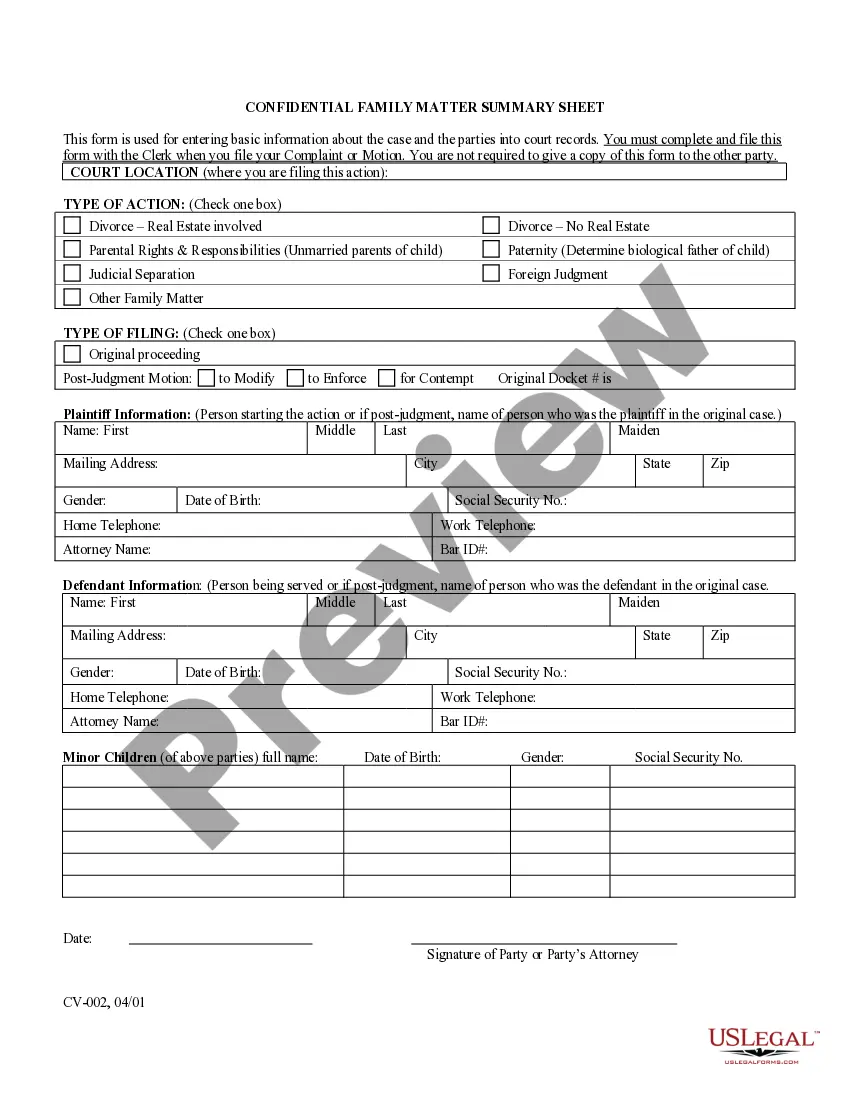

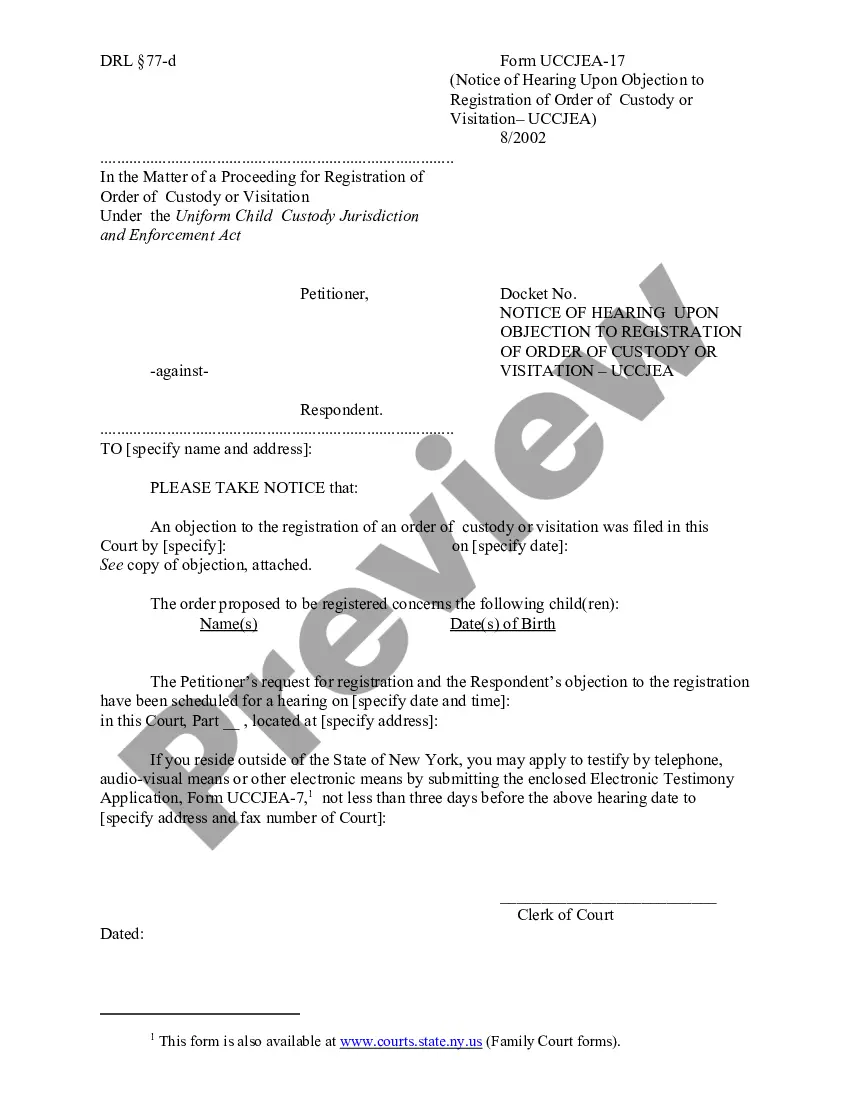

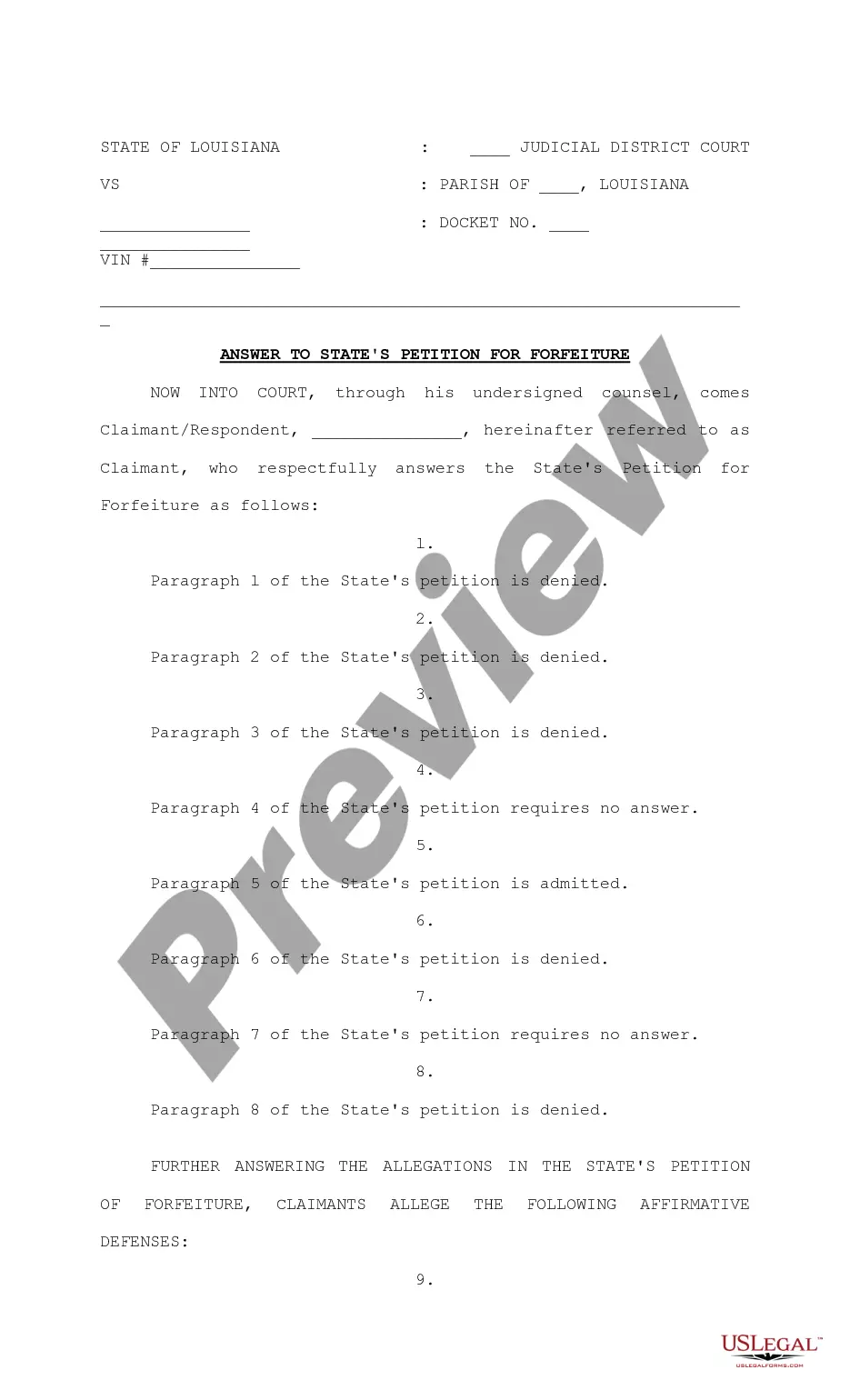

UCC (Uniform Commercial Code) Search in Oregon allows individuals and businesses to examine public records related to financial transactions and security interests. Conducting a UCC search is crucial for understanding the financial standing and potential risks associated with a person or business before entering into commercial agreements or transactions. In Oregon, there are two primary types of UCC searches: 1. UCC Debtor Search: This search helps identify the liens and security interests placed on the assets of an individual or business. By conducting a UCC debtor search, interested parties can determine if there are any existing claims on specific assets, such as real estate, vehicles, or business equipment. This information helps potential buyers or lenders make well-informed decisions and minimizes the risk of encountering undisclosed encumbrances. Relevant keywords: UCC debtor search Oregon, UCC lien search, UCC financing statement search, UCC search for individuals, UCC search for businesses. 2. UCC Financing Statement Search: This search allows individuals or businesses to file and retrieve financing statements with the Oregon Secretary of State concerning security interests on personal property. A financing statement provides public notice to potential creditors regarding a specific transaction or loan. By conducting a UCC financing statement search, interested parties can assess if someone has claimed a security interest in personal property, indicating a potential lien or collateral arrangement. Relevant keywords: UCC financing statement Oregon, UCC filing search, UCC secured party search, UCC lien search Oregon, UCC collateral search. It is important to note that UCC searches in Oregon are typically conducted through the Oregon Secretary of State website or with the assistance of approved commercial databases. These searches involve providing relevant information such as debtor names, business names, or filing numbers to retrieve accurate and up-to-date reports. Conducting UCC searches in Oregon plays a vital role in ensuring transparency and reducing potential risks when engaging in financial transactions or agreements. By utilizing these searches, individuals and businesses can gain a comprehensive understanding of existing liens, security interests, and potential encumbrances related to specific individuals or businesses, enabling more informed decision-making.

Ucc Search In Oregon

Description oregon ucc lien search

How to fill out Ucc Search In Oregon?

Getting a go-to place to take the most current and relevant legal templates is half the struggle of working with bureaucracy. Finding the right legal documents needs precision and attention to detail, which is the reason it is important to take samples of Ucc Search In Oregon only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the information regarding the document’s use and relevance for the situation and in your state or region.

Take the following steps to finish your Ucc Search In Oregon:

- Make use of the catalog navigation or search field to locate your template.

- View the form’s description to ascertain if it matches the requirements of your state and area.

- View the form preview, if available, to make sure the template is definitely the one you are interested in.

- Return to the search and look for the appropriate template if the Ucc Search In Oregon does not suit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Select the pricing plan that fits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by picking a transaction method (credit card or PayPal).

- Select the document format for downloading Ucc Search In Oregon.

- When you have the form on your device, you can alter it using the editor or print it and complete it manually.

Eliminate the inconvenience that accompanies your legal documentation. Check out the extensive US Legal Forms library to find legal templates, examine their relevance to your situation, and download them on the spot.

oregon sos ucc search Form popularity

oregon secretary of state ucc search Other Form Names

FAQ

Luckily, this process is simple, and all you have to do is request your lender file a UCC-3 termination statement with your last loan payment. This will remove the UCC-1 lien and free you up for other loans.

"Assignment" is an amendment that assigns all or part of a secured party's power to authorize an amendment to a financing statement. "Information Statement" means a UCC record that indicates that a financing statement is inaccurate or wrongfully filed.

Fill in the debtor's name and mailing address. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement.

There are two basic ways to perform a search with the Oregon UCC office. You can conduct an uncertified search yourself through our site or request our office to perform a certified search for you for a fee.

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.