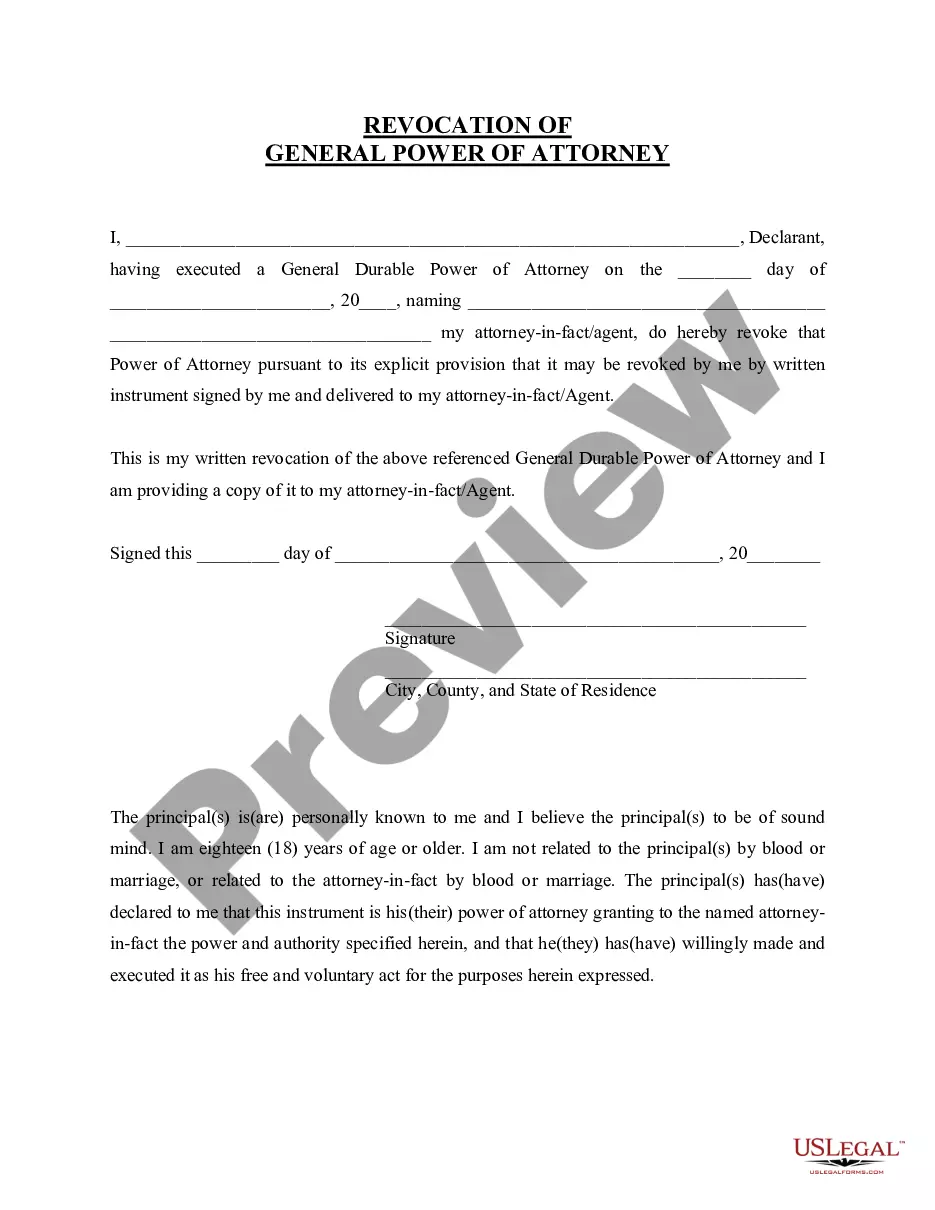

Durable Power Of Attorney Oregon Form

Description

How to fill out Durable Power Of Attorney Oregon Form?

How to obtain professional legal documents that comply with your state regulations and prepare the Durable Power Of Attorney Oregon Form without seeking an attorney's assistance.

Numerous online services offer templates to address various legal scenarios and requirements. However, it may require time to determine which of the available samples meet both your specific needs and legal standards.

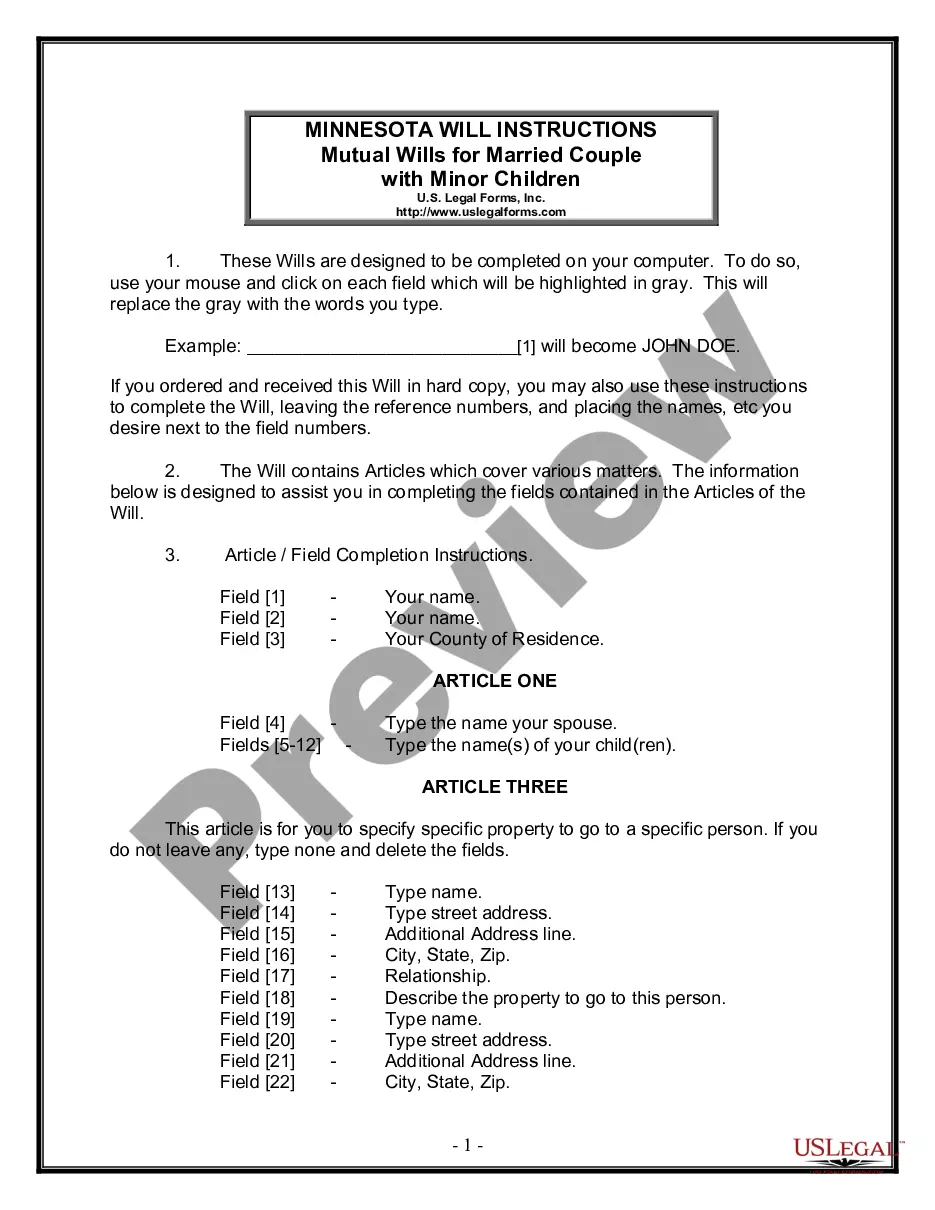

US Legal Forms is a trusted service that assists you in locating formal documents created in accordance with the most recent updates in state law and helps you save costs on legal support.

If you do not have an account with US Legal Forms, follow the instructions below: Review the opened webpage and verify if the form meets your requirements. Utilize the form description and preview options if available. If necessary, search for another template in the header by providing your state. Click the Buy Now button when you find the suitable document. Choose the most appropriate pricing plan, then sign in or register for an account. Select the payment method (by credit card or through PayPal). Choose the file format for your Durable Power Of Attorney Oregon Form and click Download. The documents obtained will remain yours: you can always access them in the My documents tab of your profile. Subscribe to our platform and create legal documents on your own like a seasoned legal expert!

- US Legal Forms is more than just a typical online library.

- It is a compilation of over 85,000 verified templates for a wide range of business and personal circumstances.

- All documents are organized by field and state to expedite and simplify your search process.

- Additionally, it incorporates powerful tools for PDF editing and electronic signatures, enabling users with a Premium subscription to quickly complete their forms online.

- It requires minimal effort and time to acquire the necessary documents.

- If you already have an account, Log In/">Log In and confirm that your subscription is up-to-date.

- Download the Durable Power Of Attorney Oregon Form by using the corresponding button located next to the file name.

Form popularity

FAQ

One must mention the following details on the Power of Attorney format PDF:The name of the principal.The name of the agent.Signature.Details and legal authorities provided to the agent.Other details depending on the Power of Attorney format for authorized signatories.

Sign your power of attorney document Unlike many states, Oregon does not require you to use witnesses or use a notary public. However, you should sign and date your power of attorney and ask a notary public to notarize it.

Oregon does not require witnesses to the power of attorney, but significant discussion among legislators has taken place about adding a witness requirement.

The Oregon tax power of attorney form is provided by the Oregon Department of Revenue and is used to appoint a tax representative.

If your agent will engage in real estate transactions, the Power of Attorney must be signed before a notary public and recorded or filed with the county.