Oregon Law For Trustee

Category:

State:

Oregon

Control #:

OR-SDEED-8-3

Format:

Word;

Rich Text

Instant download

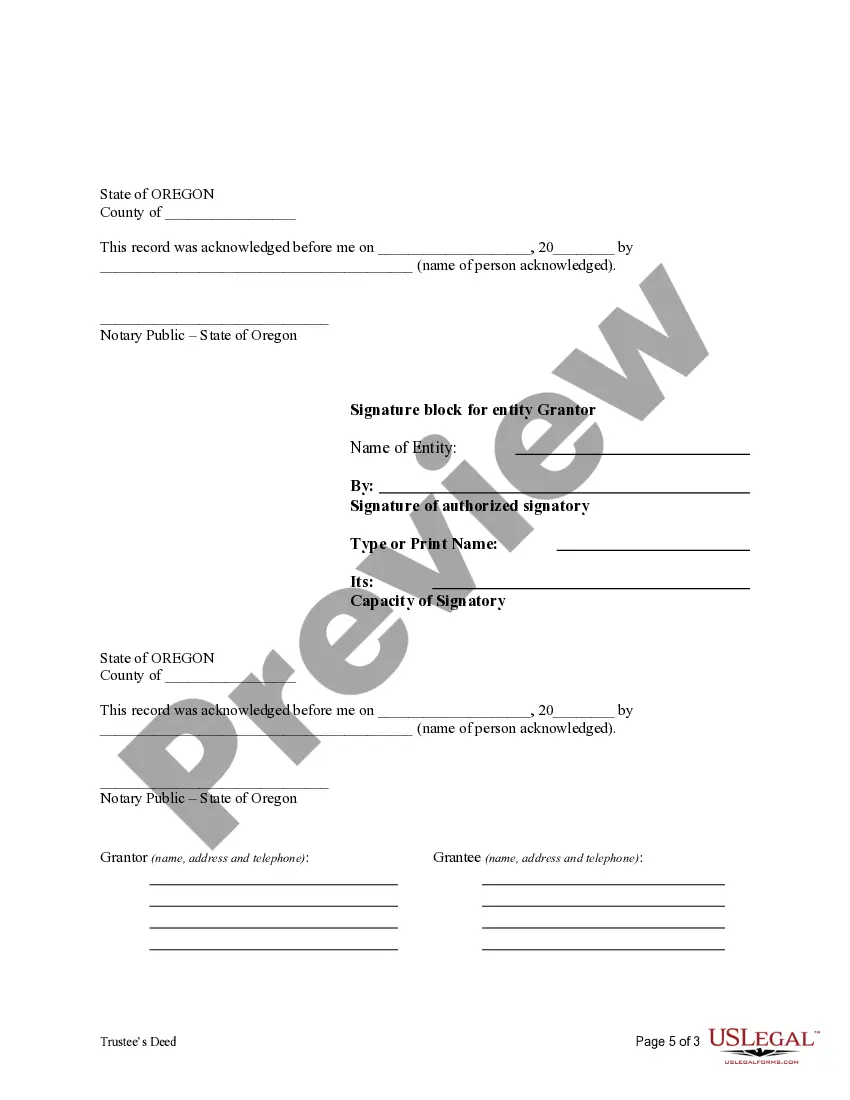

Description Fiduciary Deed Oregon

This form is a Fiduciary Deed where the grantor is a trustee and the grantee is a trustee.

Free preview Oregon Deed Form