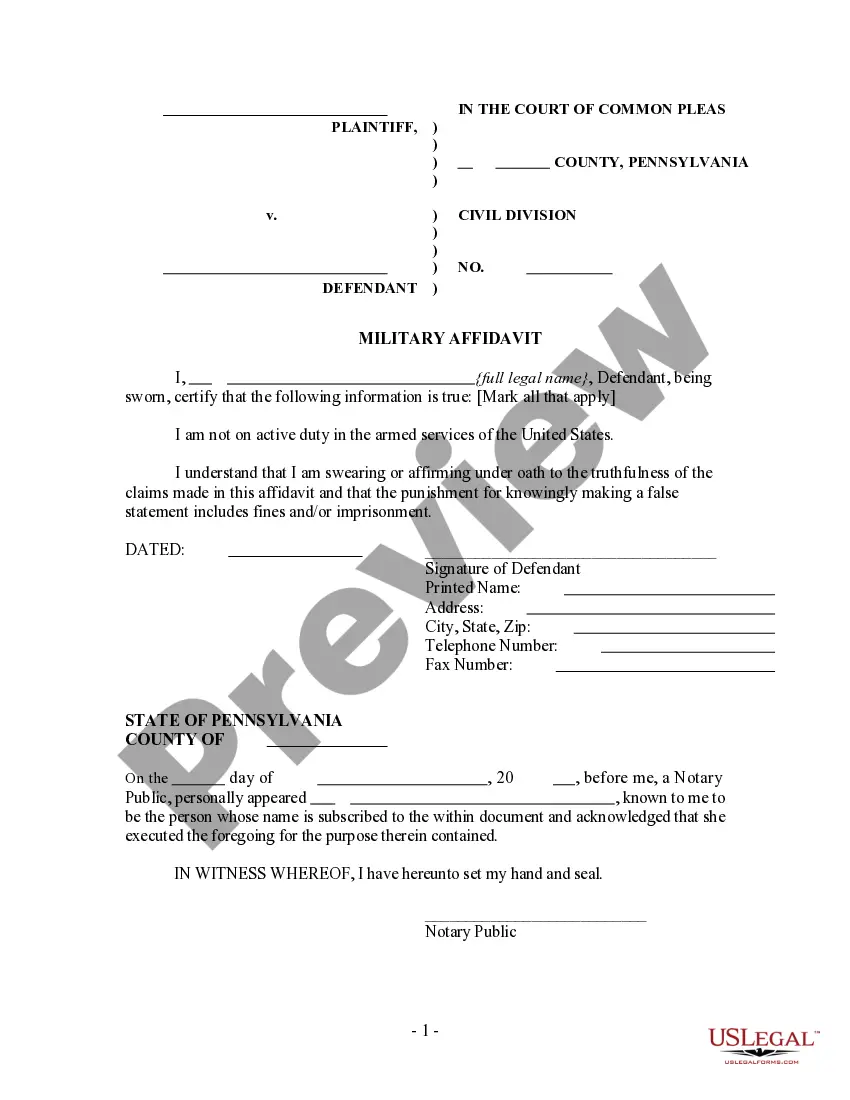

Non Resident Military Affidavit For Exemption Of Excise Tax

Description

How to fill out Non Resident Military Affidavit For Exemption Of Excise Tax?

Individuals typically link legal documentation with something intricate that only an expert can handle.

In a sense, this is accurate, as creating a Non Resident Military Affidavit For Exemption Of Excise Tax necessitates comprehensive expertise in subject matters, including state and local statutes.

However, with US Legal Forms, the situation has become more streamlined: pre-prepared legal documents for any personal and business event that adhere to state laws are gathered in a single online directory and are now accessible to all.

Establish an account or sign in to continue to the payment page. Make payment for your subscription using PayPal or your credit card. Choose the format for your file and click Download. Print your document or import it into an online editor for faster completion. All templates in our collection are reusable: once purchased, they remain stored in your profile. You can access them anytime needed through the My documents section. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and area of application, making it easy to locate the Non Resident Military Affidavit For Exemption Of Excise Tax or any other specific template in just a few minutes.

- Existing users with an active membership need to sign in to their account and click Download to access the form.

- New users must first establish an account and subscribe before they can download any legal documents.

- Here is a step-by-step guide on how to obtain the Non Resident Military Affidavit For Exemption Of Excise Tax.

- Review the content of the page diligently to ensure it satisfies your requirements.

- Examine the form description or view it through the Preview function.

- If the previous document doesn't fit your needs, find another example using the Search bar at the top.

- Press Buy Now when you identify the appropriate Non Resident Military Affidavit For Exemption Of Excise Tax.

- Select the subscription plan that aligns with your preferences and financial capacity.

Form popularity

FAQ

An exemption from the payment of sales tax may apply when a member of the United States military, who is a permanent Florida resident, stationed outside Florida, purchases a motor vehicle or vessel outside of Florida and titles and registers the motor vehicle or vessel in Florida.

Motor Vehicle Sales and Use Tax Motor vehicles are exempt from tax if they are modified to be used by someone with orthopedic disabilities to help them drive or ride in the vehicle. The modified vehicle must be used at least 80 percent of the time to transport, or be driven by, a person with an orthopedic disability.

The non-resident affidavit exempts servicemembers from paying Colorado ownership tax. Only an active-duty servicemember or a lawful agent with a power of attorney and a copy of orders indicating a Colorado duty station may execute the non-resident affidavit.

If you're in the military and stationed in Oklahoma or are an OK resident, you can receive a reduced registration rate of $26. To get the reduced rate, you must complete and submit the U.S. Armed Forces Affidavit (Form 779) along with your other required Registration Documents.

Colorado Income Tax on Military Pay: Military pay received by a Colorado Resident Service member is subject to Colorado income tax. Pay received by active duty Service members for service in a combat zone, that is exempt from federal taxes is also exempt from Colorado income taxes.