Pennsylvania Trust Forms

Category:

State:

Pennsylvania

Control #:

PA-E0178A

Format:

Word;

Rich Text

Instant download

Description Amendment Living Trust

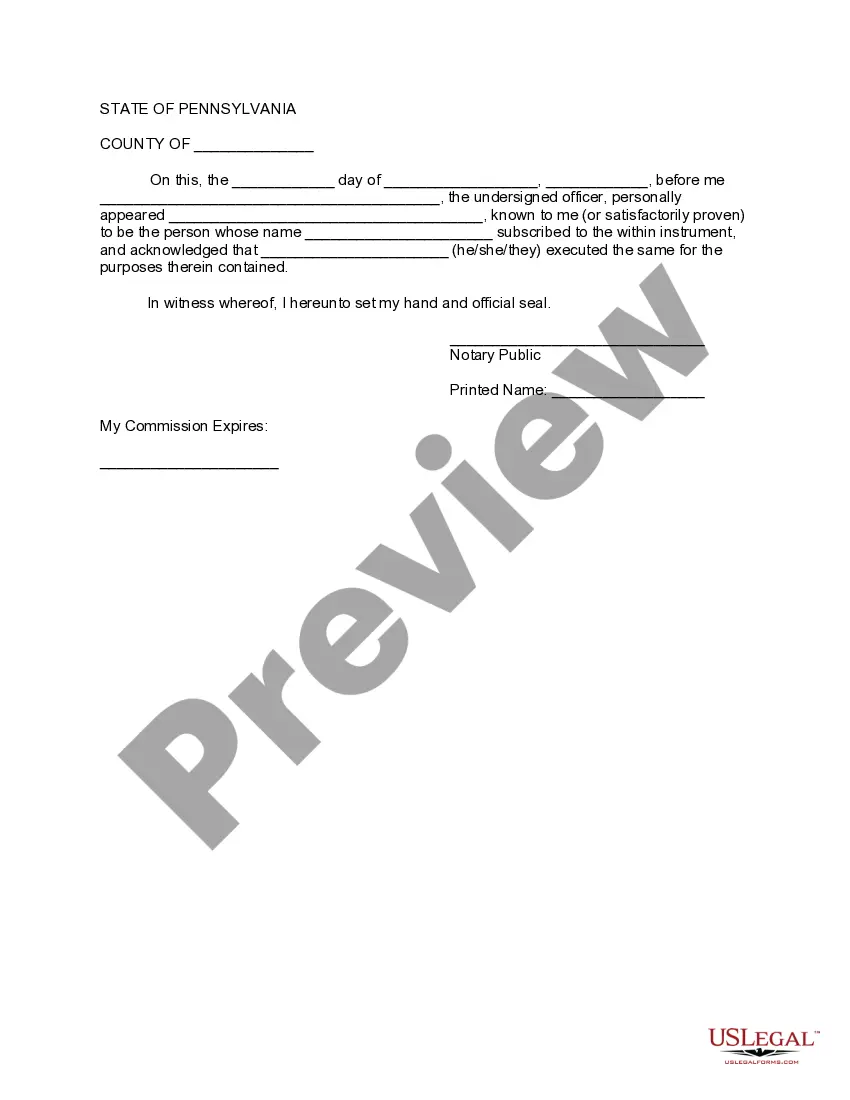

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Free preview Pa Trust