Rhode Island Citation Petition To Foreclose Tax Lien Foreclosure

Description

Form popularity

FAQ

Foreclosure begins with the lender notifying the borrower of default, typically following missed payments. The lender then may file a lawsuit to obtain a judgment that allows them to sell the property to recover the owed amount. Understanding the Rhode island citation petition to foreclose tax lien foreclosure is essential for homeowners facing tax lien issues, as it outlines the legal process and options available. Seeking professional guidance can simplify this complex process.

The most common method of foreclosure is a judicial foreclosure, where the lender files a lawsuit to gain the right to sell the property. This process is typically initiated when a homeowner defaults on their mortgage payments. It's crucial for property owners to understand their rights, especially in the context of the Rhode island citation petition to foreclose tax lien foreclosure, as timely action can mitigate losses. Being proactive helps in managing the situation more effectively.

The property owner often suffers the most in a foreclosure situation, facing financial loss and potential homelessness. Families often experience emotional and economic distress, impacting their long-term stability. Additionally, communities can feel the effects of increased abandoned properties and reduced neighborhood values. Understanding the implications of the Rhode island citation petition to foreclose tax lien foreclosure can aid in making informed decisions.

New Jersey is known for having one of the longest foreclosure processes in the United States. Foreclosure can take over two years to complete due to strict legal requirements and steps involved. This lengthy process emphasizes the importance of understanding the Rhode island citation petition to foreclose tax lien foreclosure. If you find yourself in a similar situation, being informed can help you prepare and respond appropriately.

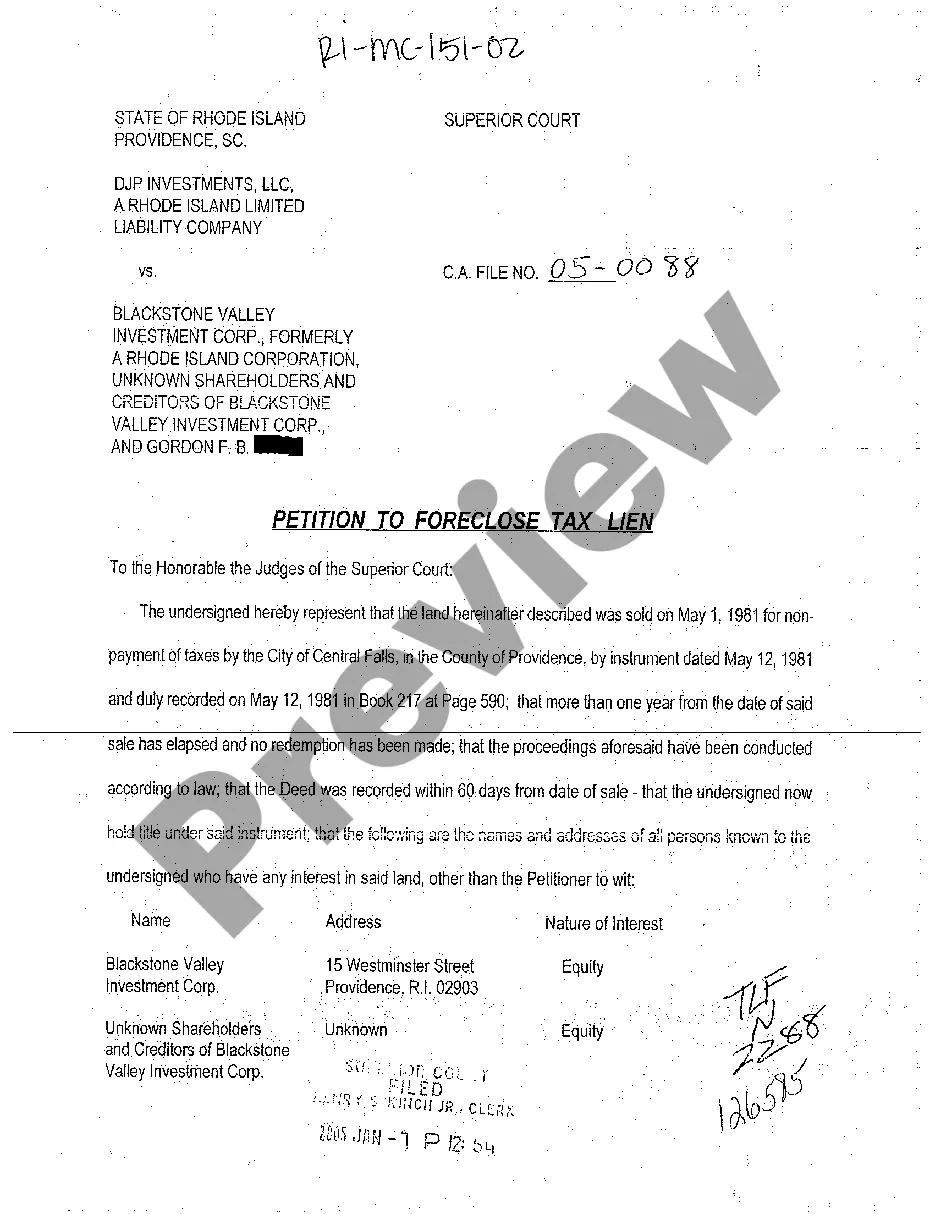

A tax sale in Rhode Island occurs when a municipality sells a property to recover unpaid property taxes. This sale allows the city to collect overdue taxes while offering buyers the opportunity to claim a tax lien on the property. If you are involved in such proceedings, understanding the implications is essential, especially if you are dealing with a Rhode island citation petition to foreclose tax lien foreclosure.

In Rhode Island, property tax is assessed on real estate and based on the fair market value of the property. Local assessors determine the value, and the tax rate is set by local municipalities. Your property tax bill is an important part of funding essential services like schools and public safety. Understanding the process, especially in the context of a Rhode island citation petition to foreclose tax lien foreclosure, can help you manage your financial responsibilities.

In Rhode Island, property owners can qualify for tax relief programs, including exemptions, typically available to seniors aged 65 and older. This age requirement allows seniors to reduce or stop paying certain property taxes. It’s beneficial to explore how the Rhode island citation petition to foreclose tax lien foreclosure may affect your tax obligations as you approach this age.

The foreclosure process in Rhode Island initiates when a property owner fails to repay a tax lien. The process typically starts with a notice and culminates in a court hearing. During this time, the property owner has opportunities to redeem the property. Understanding the Rhode island citation petition to foreclose tax lien foreclosure is vital for anyone facing this serious situation.

The time it takes to settle an estate in Rhode Island can vary widely, typically ranging from several months to a few years. Factors that influence this timeline include the complexity of the estate and any disputes among heirs. Working with a qualified attorney can streamline the process and ensure compliance with Rhode Island laws, including those related to tax lien foreclosures.

In Rhode Island, a tax sale occurs when a municipality sells a property due to unpaid property taxes. The sale aims to recover the owed taxes and lien holder interests. Buyers at the auction receive a tax lien certificate, granting them the right to foreclose if taxes remain unpaid. It’s crucial to understand the implications of the Rhode island citation petition to foreclose tax lien foreclosure if you find yourself in this situation.