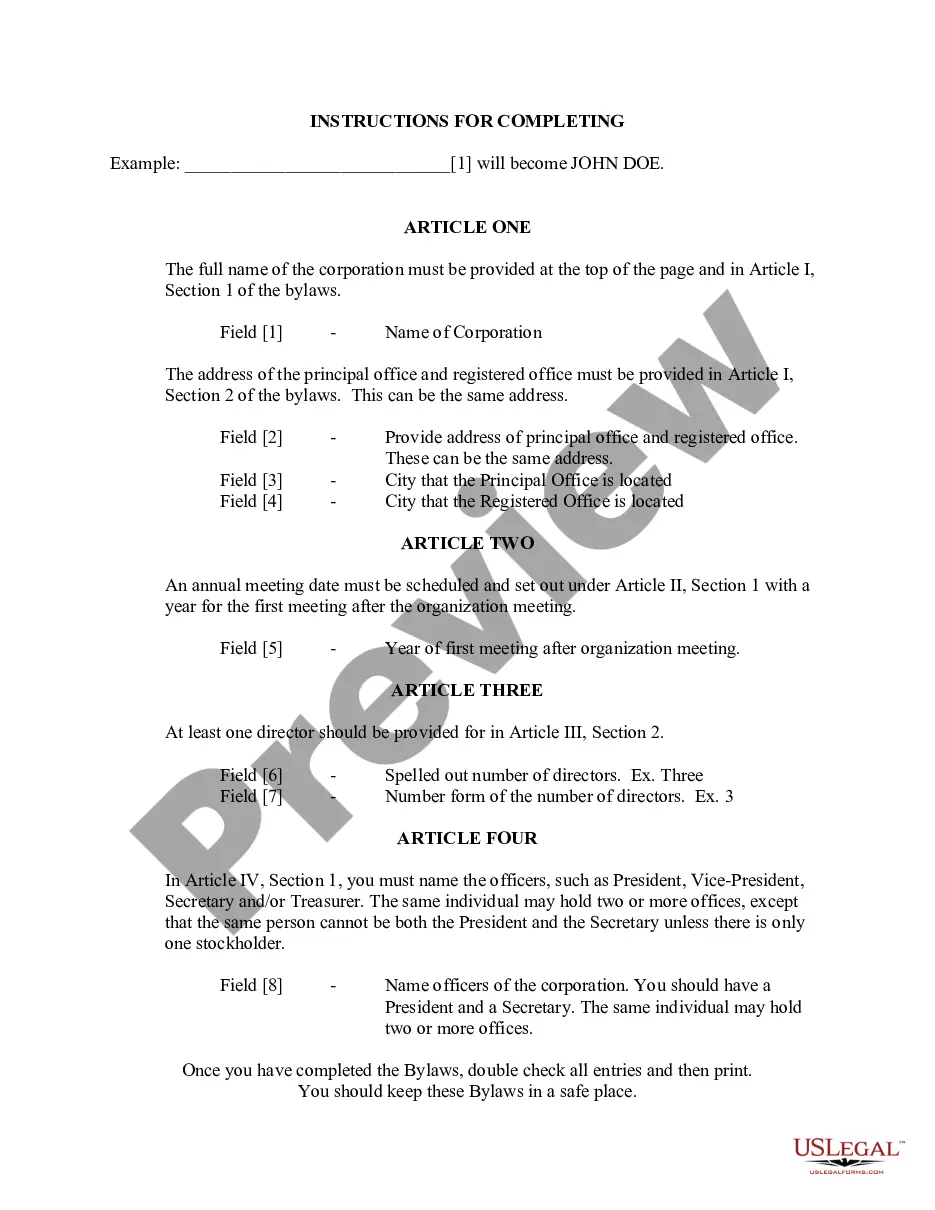

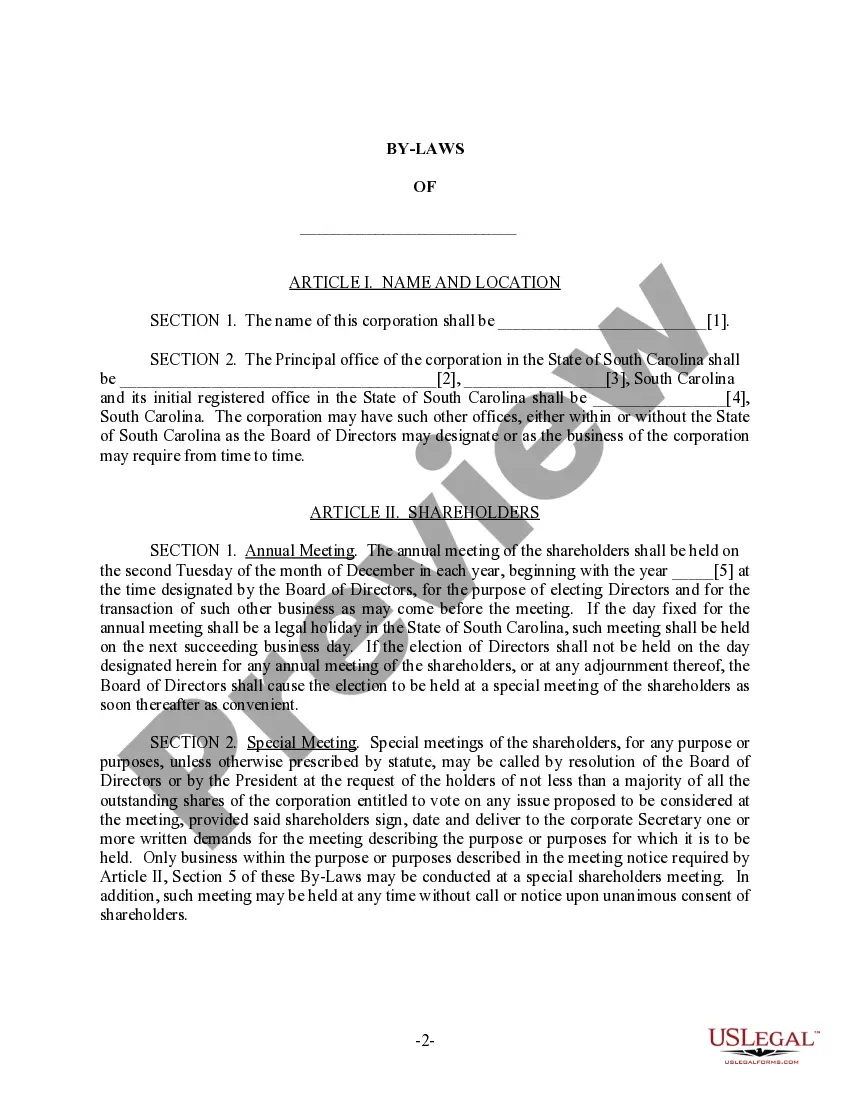

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

South Carolina Corporation Withholding Registration Explanation and Types In South Carolina, corporation withholding registration is a requirement for businesses that need to withhold and remit certain taxes on behalf of their employees or vendors. This process ensures compliance with the state's tax laws and helps the government collect necessary revenue for public services. The South Carolina Department of Revenue (SCOR) oversees the corporation withholding registration process, ensuring businesses follow the necessary regulations. When a corporation registers, it indicates its commitment to adhere to withholding tax obligations. There are different types of South Carolina corporation withholding registration based on the specific activities and payments made by the business entity. Some key types include: 1. Employee Withholding: Businesses employing individuals must register for employee withholding. This type of registration enables the corporation to withhold income taxes from their employees' wages and submit these withholding to the SCOR periodically. 2. Vendor Withholding: Certain businesses may need to register for vendor withholding. This type of registration allows the corporation to withhold state income taxes from payments made to nonresident contractors or vendors doing business in South Carolina. These withholding are also submitted to the SCOR on a regular basis. 3. Nonresident Member Withholding: If a South Carolina corporation has nonresident members, it must obtain registration for nonresident member withholding. This type of registration helps the corporation withhold and remit taxes on behalf of its nonresident members, ensuring compliance with state tax laws. 4. Composite Filing: In certain cases, if a corporation has nonresident shareholders or partners, it may have the option to register for composite filing. This type of registration enables the corporation to withhold and remit state income taxes on behalf of its nonresident shareholders or partners, simplifying the tax filing process for these individuals. While these are some main types of South Carolina corporation withholding registration, it's important to note that each business's specific needs may vary. It is essential for businesses to consult with the SCOR or a qualified tax professional to determine the appropriate type of registration based on their unique circumstances. By registering for the appropriate type of South Carolina corporation withholding, businesses demonstrate their commitment to fulfilling their tax obligations and contribute to the state's revenue collection efforts. This registration not only ensures compliance but also helps maintain the integrity of the state's tax system, fostering a fair and equitable business environment.South Carolina Corporation Withholding Registration Explanation and Types In South Carolina, corporation withholding registration is a requirement for businesses that need to withhold and remit certain taxes on behalf of their employees or vendors. This process ensures compliance with the state's tax laws and helps the government collect necessary revenue for public services. The South Carolina Department of Revenue (SCOR) oversees the corporation withholding registration process, ensuring businesses follow the necessary regulations. When a corporation registers, it indicates its commitment to adhere to withholding tax obligations. There are different types of South Carolina corporation withholding registration based on the specific activities and payments made by the business entity. Some key types include: 1. Employee Withholding: Businesses employing individuals must register for employee withholding. This type of registration enables the corporation to withhold income taxes from their employees' wages and submit these withholding to the SCOR periodically. 2. Vendor Withholding: Certain businesses may need to register for vendor withholding. This type of registration allows the corporation to withhold state income taxes from payments made to nonresident contractors or vendors doing business in South Carolina. These withholding are also submitted to the SCOR on a regular basis. 3. Nonresident Member Withholding: If a South Carolina corporation has nonresident members, it must obtain registration for nonresident member withholding. This type of registration helps the corporation withhold and remit taxes on behalf of its nonresident members, ensuring compliance with state tax laws. 4. Composite Filing: In certain cases, if a corporation has nonresident shareholders or partners, it may have the option to register for composite filing. This type of registration enables the corporation to withhold and remit state income taxes on behalf of its nonresident shareholders or partners, simplifying the tax filing process for these individuals. While these are some main types of South Carolina corporation withholding registration, it's important to note that each business's specific needs may vary. It is essential for businesses to consult with the SCOR or a qualified tax professional to determine the appropriate type of registration based on their unique circumstances. By registering for the appropriate type of South Carolina corporation withholding, businesses demonstrate their commitment to fulfilling their tax obligations and contribute to the state's revenue collection efforts. This registration not only ensures compliance but also helps maintain the integrity of the state's tax system, fostering a fair and equitable business environment.