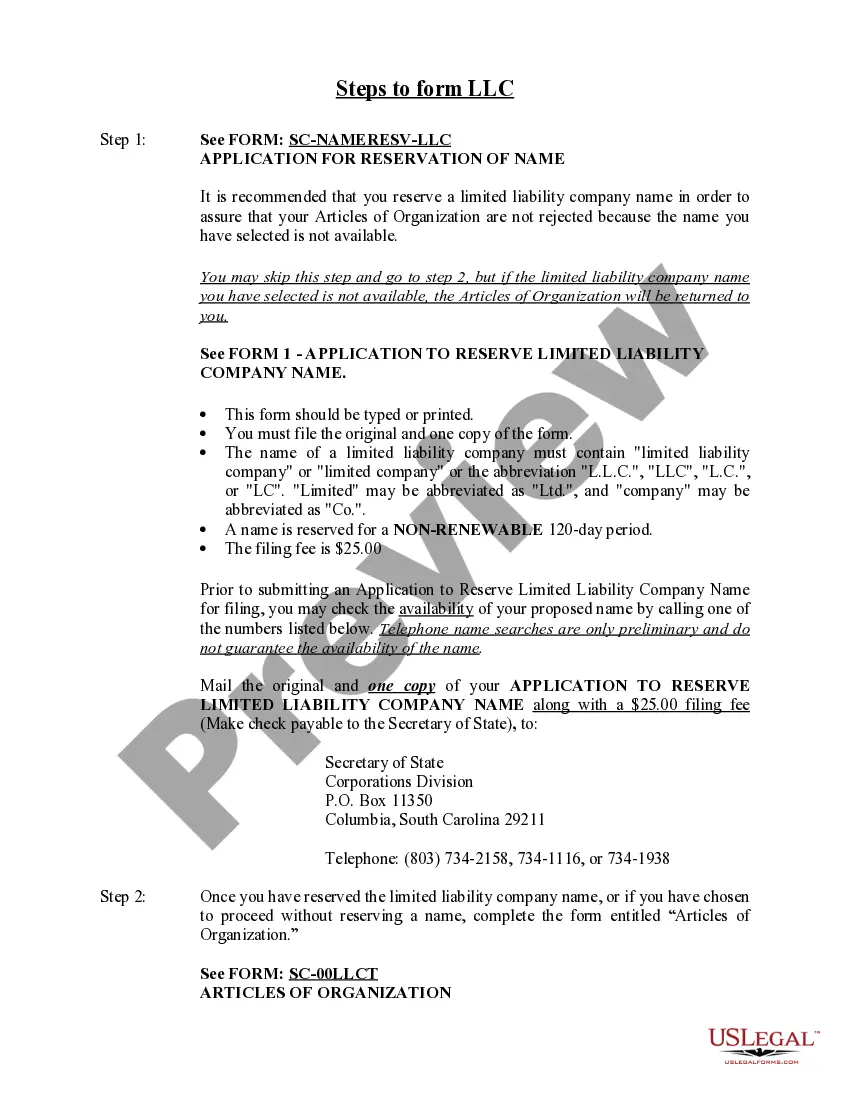

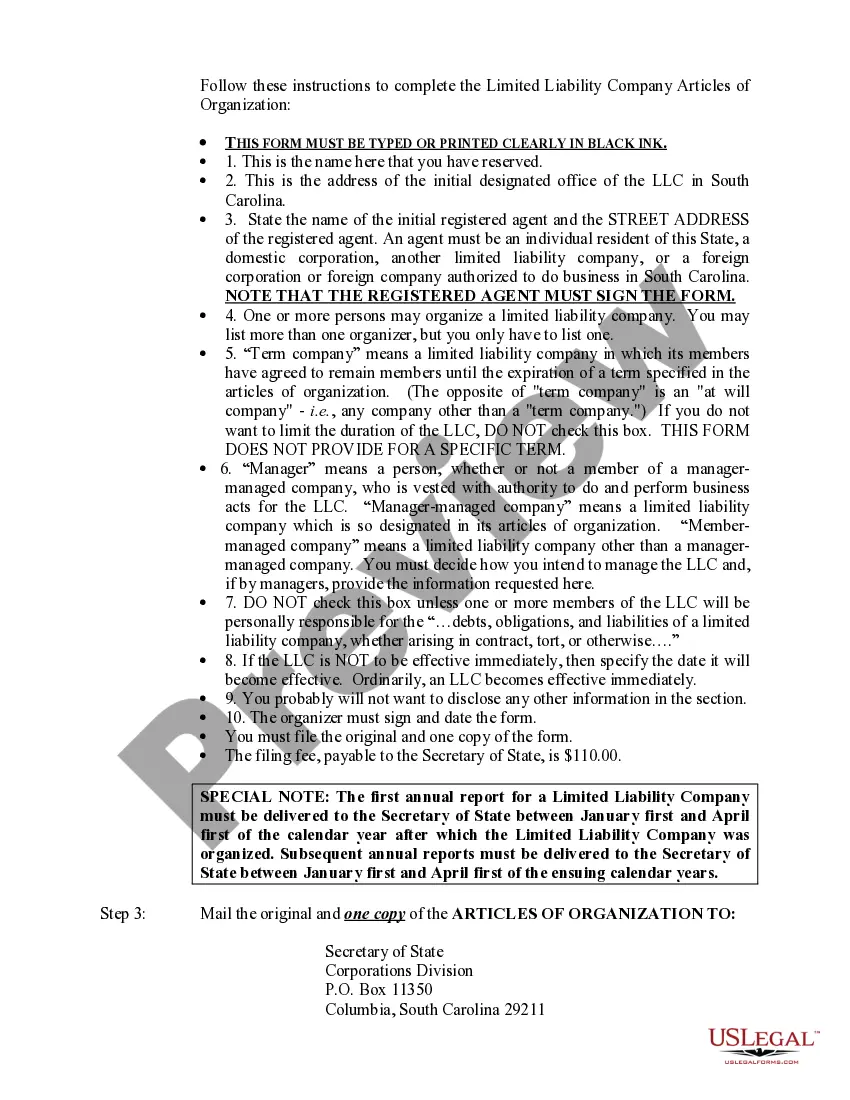

This Limited Liability Company LLC Formation Package includes Step by Step Instructions, Articles of Formation, Operating Agreement, Resolutions and other forms for formation of a Limited Liability Company in the State of South Carolina.

Limited liability companies (LCS) registered in South Carolina are subject to certain withholding requirements. These requirements vary based on the specific type of LLC and the transactions it engages in. 1. South Carolina Employee Withholding Taxes: LCS operating with employees are required to withhold state income taxes from their employees' wages. The LLC must obtain withholding tax forms from the South Carolina Department of Revenue (SCOR) and submit regular withholding tax returns, making the necessary payments on behalf of the employees. 2. South Carolina Sales and Use Tax Withholding: Some LCS may be required to withhold sales and use tax when purchasing certain goods or services. This withholding is applicable if the supplier is not registered for South Carolina sales and use tax purposes. The LLC must understand and comply with the sales and use tax requirements to accurately withhold and remit the tax to the SCOR. 3. Nonresident Member Withholding: If an LLC has nonresident members, it may be required to withhold state income taxes on behalf of these members for their share of income generated from South Carolina sources. This withholding applies to both individuals and non-corporate entities. Nonresident member withholding requirements aim to ensure that out-of-state members appropriately contribute to the state's tax revenue. 4. South Carolina Estimated Income Tax: LCS that anticipate owing more than $1,000 in South Carolina income tax for the year are required to make estimated tax payments throughout the year. These payments are based on the LLC's expected annual tax liability and ensure that the LLC remains in compliance with state tax laws. It is important for LCS operating in South Carolina to familiarize themselves with these withholding requirements to avoid potential penalties or legal issues. Noncompliance with these requirements may result in additional tax liabilities, interest, and penalties imposed by the SCOR. Consulting with a qualified tax professional or seeking guidance from the SCOR can help ensure proper compliance with all South Carolina withholding requirements for Limited Liability Companies.Limited liability companies (LCS) registered in South Carolina are subject to certain withholding requirements. These requirements vary based on the specific type of LLC and the transactions it engages in. 1. South Carolina Employee Withholding Taxes: LCS operating with employees are required to withhold state income taxes from their employees' wages. The LLC must obtain withholding tax forms from the South Carolina Department of Revenue (SCOR) and submit regular withholding tax returns, making the necessary payments on behalf of the employees. 2. South Carolina Sales and Use Tax Withholding: Some LCS may be required to withhold sales and use tax when purchasing certain goods or services. This withholding is applicable if the supplier is not registered for South Carolina sales and use tax purposes. The LLC must understand and comply with the sales and use tax requirements to accurately withhold and remit the tax to the SCOR. 3. Nonresident Member Withholding: If an LLC has nonresident members, it may be required to withhold state income taxes on behalf of these members for their share of income generated from South Carolina sources. This withholding applies to both individuals and non-corporate entities. Nonresident member withholding requirements aim to ensure that out-of-state members appropriately contribute to the state's tax revenue. 4. South Carolina Estimated Income Tax: LCS that anticipate owing more than $1,000 in South Carolina income tax for the year are required to make estimated tax payments throughout the year. These payments are based on the LLC's expected annual tax liability and ensure that the LLC remains in compliance with state tax laws. It is important for LCS operating in South Carolina to familiarize themselves with these withholding requirements to avoid potential penalties or legal issues. Noncompliance with these requirements may result in additional tax liabilities, interest, and penalties imposed by the SCOR. Consulting with a qualified tax professional or seeking guidance from the SCOR can help ensure proper compliance with all South Carolina withholding requirements for Limited Liability Companies.