South Carolina Trust Fort Jackson

State:

South Carolina

Control #:

SC-015-78

Format:

Word;

Rich Text

Instant download

Description

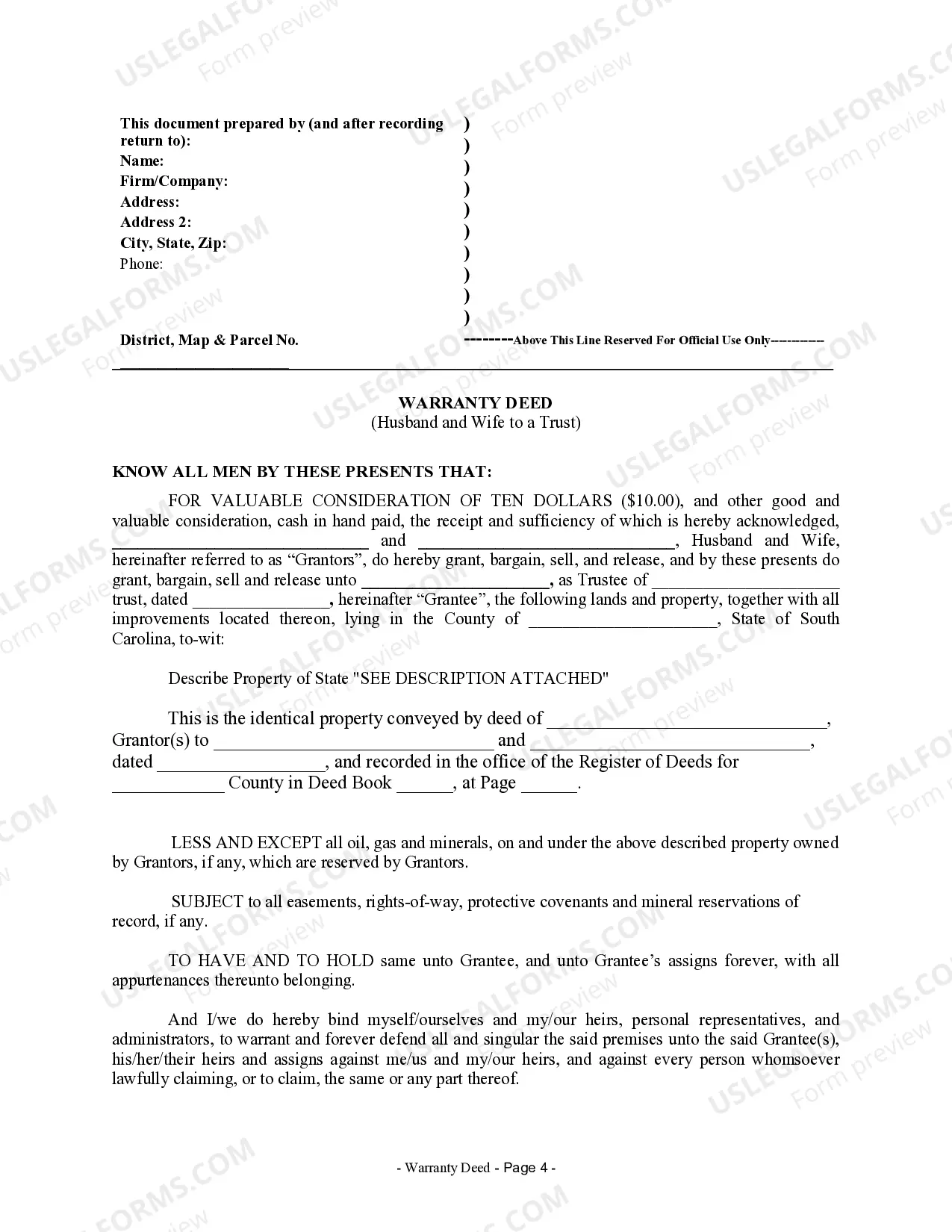

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Free preview