A Right to Cure Letter, also known as a Notice of Intent to Foreclose, is an important legal document that provides homeowners in South Carolina with an opportunity to rectify defaulted loan payments before facing foreclosure. This letter is usually sent by the lender or mortgage service and serves as a preliminary warning to the borrower, giving them a chance to cure their loan default. In South Carolina, there are two main types of Right to Cure Letters related to loans: Right to Cure for Mortgage Loans and Right to Cure for Home Equity Loans. 1. Right to Cure for Mortgage Loans: This type of Right to Cure Letter is applicable to borrowers who have defaulted on their mortgage payments. When the borrower falls behind on payments, the lender or mortgage service will send a Notice of Intent to Foreclose, which outlines the specific amount due, the actions required to cure the default, and the timeframe within which these actions must be taken. The borrower is typically given 20 days to cure the default by making the overdue payment or reaching a suitable agreement with the lender. 2. Right to Cure for Home Equity Loans: In South Carolina, homeowners who have taken out home equity loans also have specific rights and responsibilities when it comes to curing defaults. If a borrower fails to make timely payments on their home equity loan, the lender will send a Notice of Intent to Foreclose, similar to the one sent for mortgage loans. This letter will specify the amount that needs to be paid and the timeframe for curing the default. The borrower usually has 30 days to resolve the default by making the appropriate payment or reaching an agreement with the lender. It is crucial for borrowers in South Carolina to take the Right to Cure Letter seriously and respond promptly. Failure to cure the default within the specified timeframe may lead to the initiation of foreclosure proceedings by the lender. Foreclosure can have severe financial and legal consequences, including the loss of the property and damage to the borrower's creditworthiness. To protect their rights and explore available options, borrowers receiving a Right to Cure Letter should consider seeking legal advice from a qualified attorney specializing in real estate or mortgage law. Responding promptly and proactively to a Right to Cure Letter can help borrowers in South Carolina avoid foreclosure and potentially develop a repayment plan that suits their financial circumstances.

Right To Cure Letter South Carolina With A Loan

Category:

State:

South Carolina

Control #:

SC-02325

Format:

Word;

Rich Text

Instant download

Description What Is A Right To Cure Letter

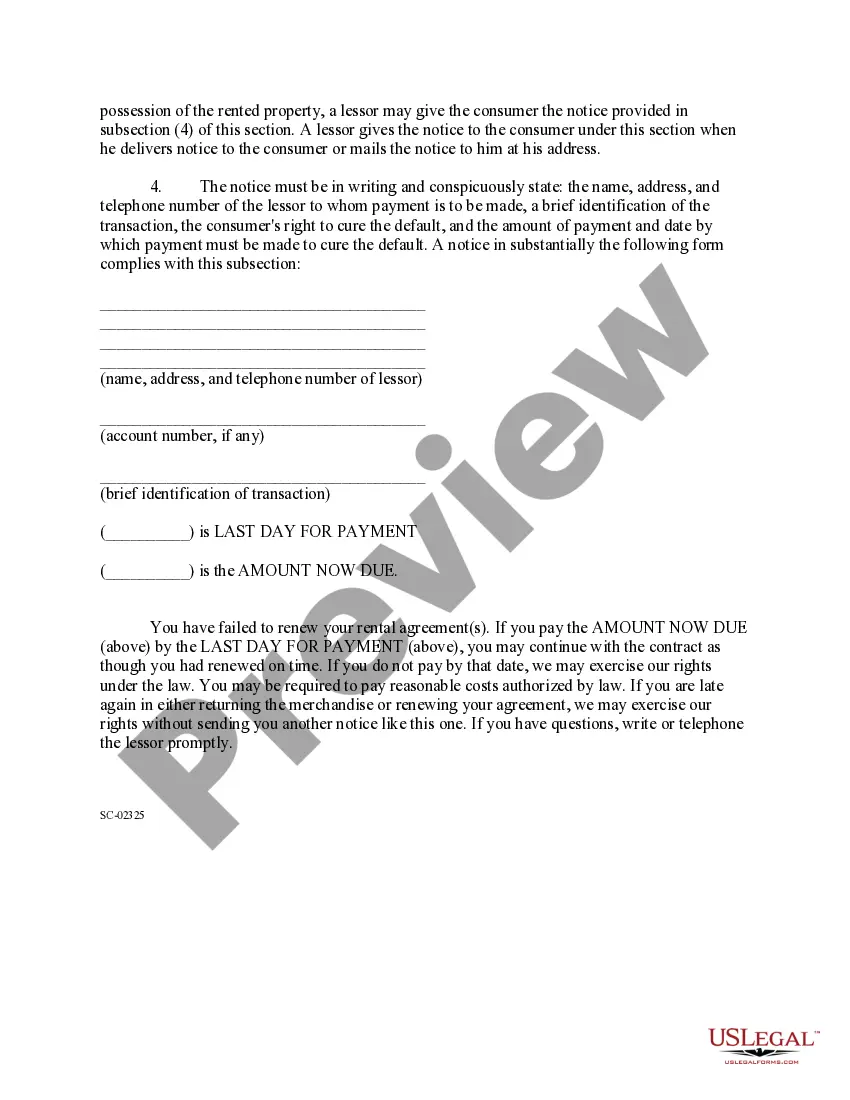

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Consumer's Right to Cure Default, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now. USLF control number SC-02325

A Right to Cure Letter, also known as a Notice of Intent to Foreclose, is an important legal document that provides homeowners in South Carolina with an opportunity to rectify defaulted loan payments before facing foreclosure. This letter is usually sent by the lender or mortgage service and serves as a preliminary warning to the borrower, giving them a chance to cure their loan default. In South Carolina, there are two main types of Right to Cure Letters related to loans: Right to Cure for Mortgage Loans and Right to Cure for Home Equity Loans. 1. Right to Cure for Mortgage Loans: This type of Right to Cure Letter is applicable to borrowers who have defaulted on their mortgage payments. When the borrower falls behind on payments, the lender or mortgage service will send a Notice of Intent to Foreclose, which outlines the specific amount due, the actions required to cure the default, and the timeframe within which these actions must be taken. The borrower is typically given 20 days to cure the default by making the overdue payment or reaching a suitable agreement with the lender. 2. Right to Cure for Home Equity Loans: In South Carolina, homeowners who have taken out home equity loans also have specific rights and responsibilities when it comes to curing defaults. If a borrower fails to make timely payments on their home equity loan, the lender will send a Notice of Intent to Foreclose, similar to the one sent for mortgage loans. This letter will specify the amount that needs to be paid and the timeframe for curing the default. The borrower usually has 30 days to resolve the default by making the appropriate payment or reaching an agreement with the lender. It is crucial for borrowers in South Carolina to take the Right to Cure Letter seriously and respond promptly. Failure to cure the default within the specified timeframe may lead to the initiation of foreclosure proceedings by the lender. Foreclosure can have severe financial and legal consequences, including the loss of the property and damage to the borrower's creditworthiness. To protect their rights and explore available options, borrowers receiving a Right to Cure Letter should consider seeking legal advice from a qualified attorney specializing in real estate or mortgage law. Responding promptly and proactively to a Right to Cure Letter can help borrowers in South Carolina avoid foreclosure and potentially develop a repayment plan that suits their financial circumstances.

Free preview Right To Cure Letter Sample

How to fill out Repossession Notice Letter?

The Right To Cure Letter South Carolina With A Loan you see on this page is a reusable formal template drafted by professional lawyers in accordance with federal and regional regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Right To Cure Letter South Carolina With A Loan will take you just a few simple steps:

- Search for the document you need and check it. Look through the file you searched and preview it or review the form description to ensure it satisfies your requirements. If it does not, use the search bar to find the correct one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Pick the format you want for your Right To Cure Letter South Carolina With A Loan (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork again. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.