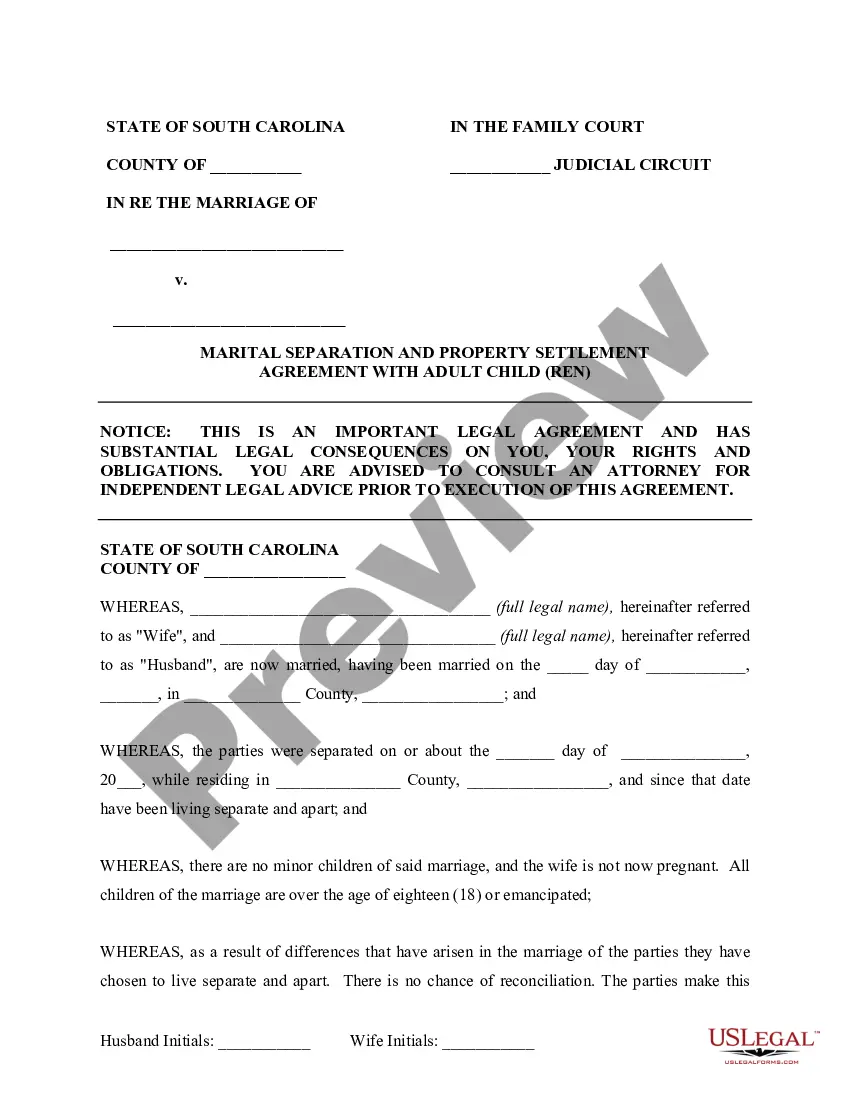

Separation Agreement South Carolina Withholding

Description

How to fill out Separation Agreement South Carolina Withholding?

Traversing through the red tape of traditional documents and forms can be difficult, particularly if one is not accustomed to doing so professionally.

Even selecting the appropriate template for the Separation Agreement South Carolina Withholding will be laborious, as it must be accurate and precise to the final figure.

However, you will need to spend significantly less time locating a suitable template from a source you trust.

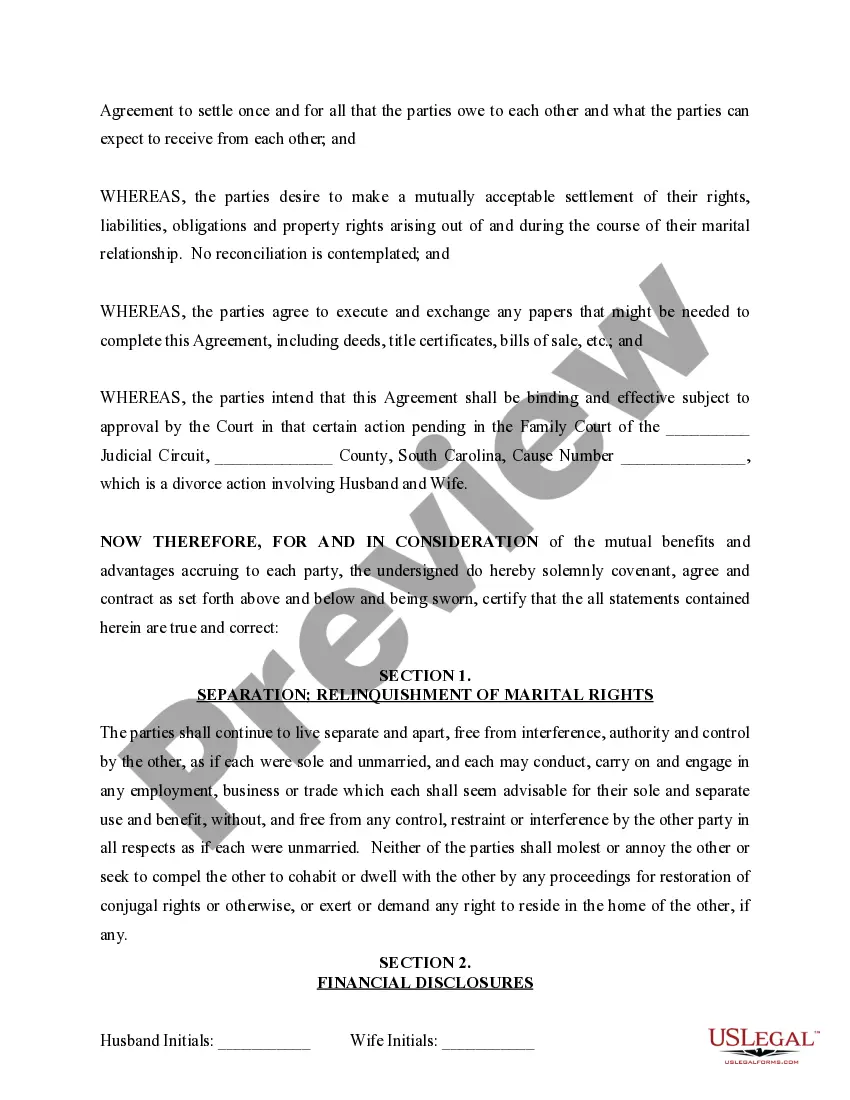

Obtain the correct form in a few straightforward steps: Enter the title of the document in the search bar, find the right Separation Agreement South Carolina Withholding from the results list, examine the description of the sample or open its preview. When the template meets your needs, click Buy Now. Then, choose your subscription plan, use your email and create a security password to register an account at US Legal Forms. Select a credit card or PayPal payment method, and save the template document on your device in your preferred format. US Legal Forms can save you time and effort determining if the form you found online fits your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the task of finding the correct forms online.

- US Legal Forms is a singular resource where you can access the latest document samples, verify their use, and download these samples for completion.

- This is a repository with over 85K forms applicable in various fields.

- Searching for a Separation Agreement South Carolina Withholding, you need not doubt its validity as all forms are authenticated.

- Having an account at US Legal Forms will ensure you have all the essential samples at your fingertips.

- Store them in your history or add them to your My documents catalog.

- You can retrieve your saved forms from any device by clicking Log In on the library website.

- If you haven’t established an account yet, you can always search for the template you require.

Form popularity

FAQ

Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

MyDORWAY: Pay your withholding tax bill online. Electronic Funds Transfer (EFT): Visit GovOne to make SCDOR tax payments online OR call 1-800-834-7733 to make tax payments with operator assistance or over the Interactive Voice Response system.

How Many Allowances Should I Claim if I'm Single? If you are single and have one job, you can claim 1 allowance. There's also the option of requesting 2 allowances if you are single and have one job. That allows you to get close to your break-even amount.