Closing Costs With Rocket Mortgage

Description

How to fill out Closing Costs With Rocket Mortgage?

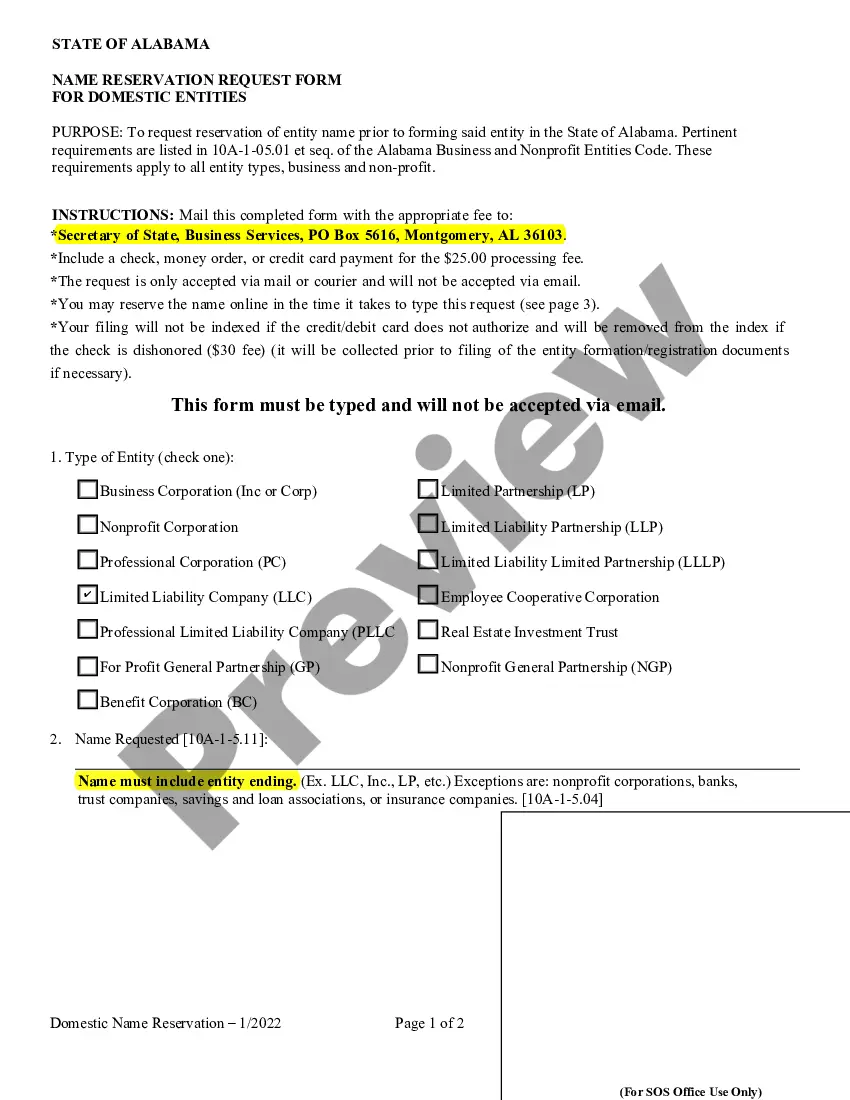

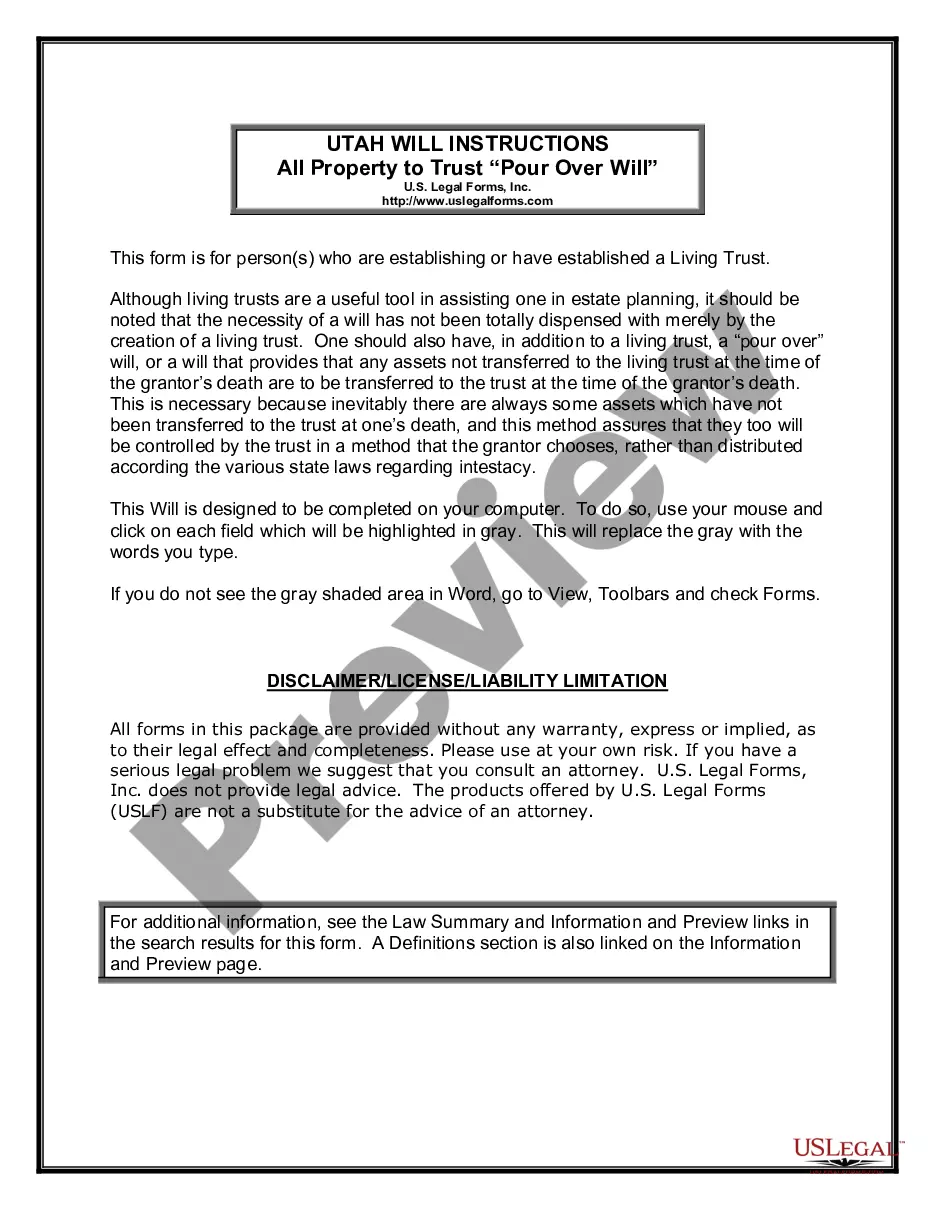

Legal managing might be mind-boggling, even for knowledgeable specialists. When you are looking for a Closing Costs With Rocket Mortgage and don’t get the a chance to commit searching for the appropriate and up-to-date version, the procedures might be stressful. A strong online form catalogue can be a gamechanger for anybody who wants to handle these situations successfully. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you are able to:

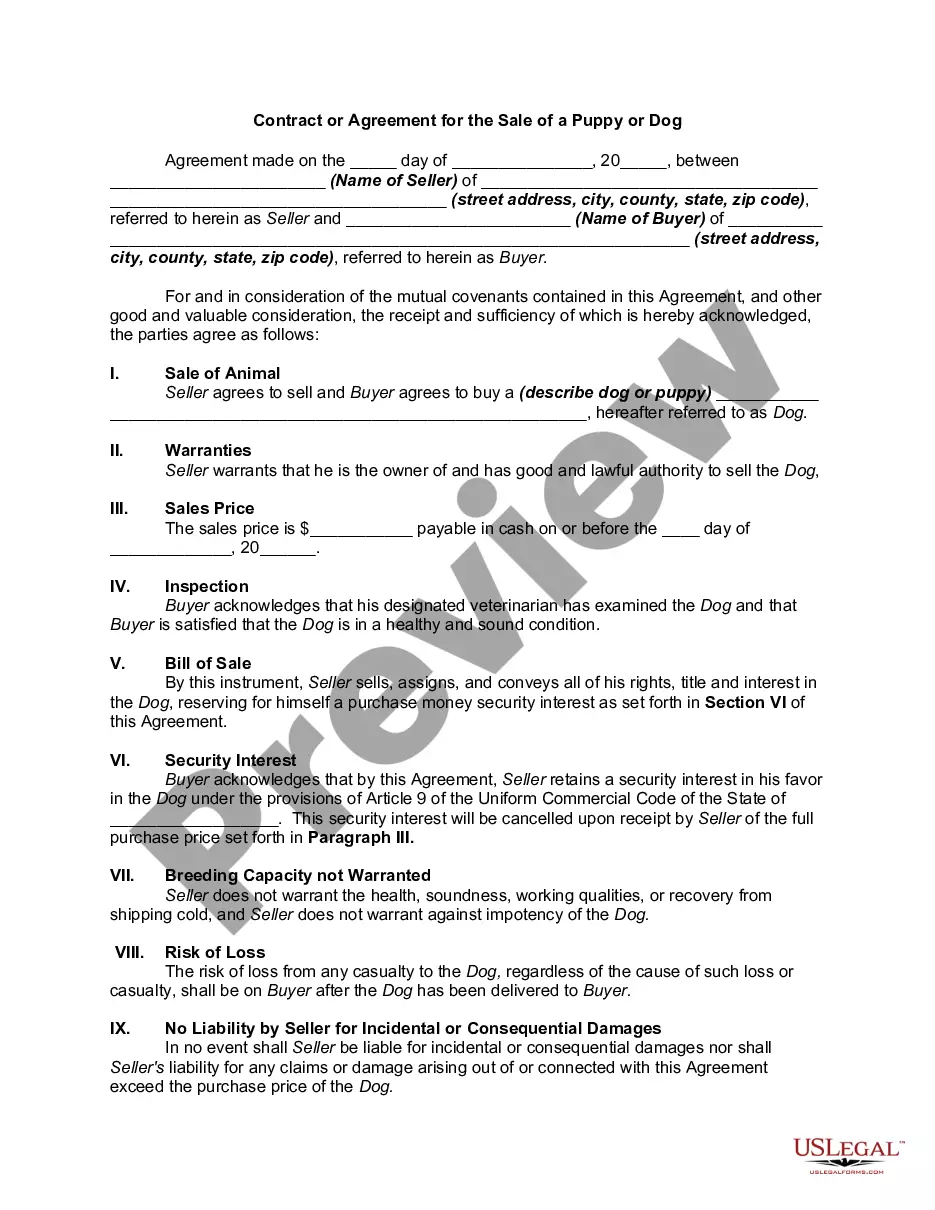

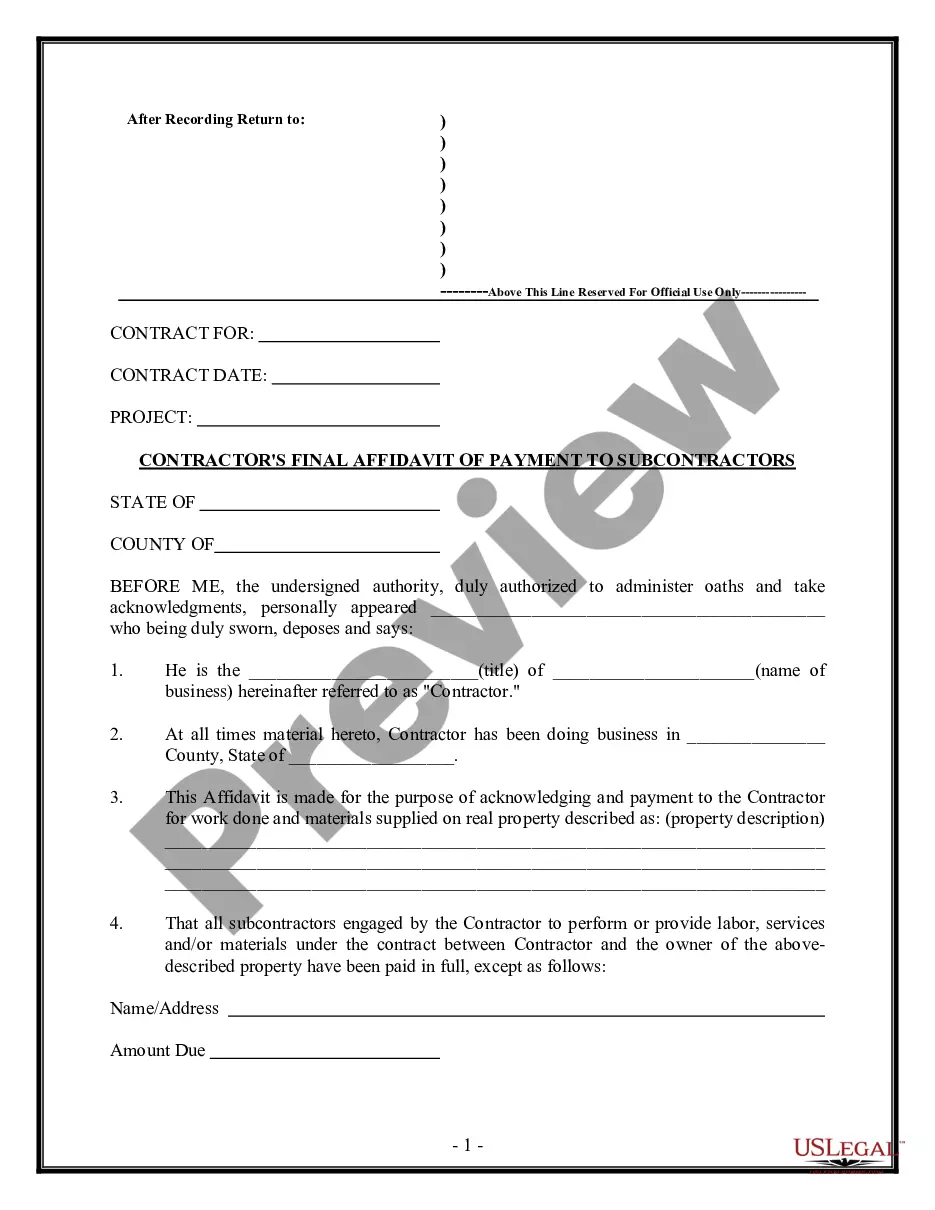

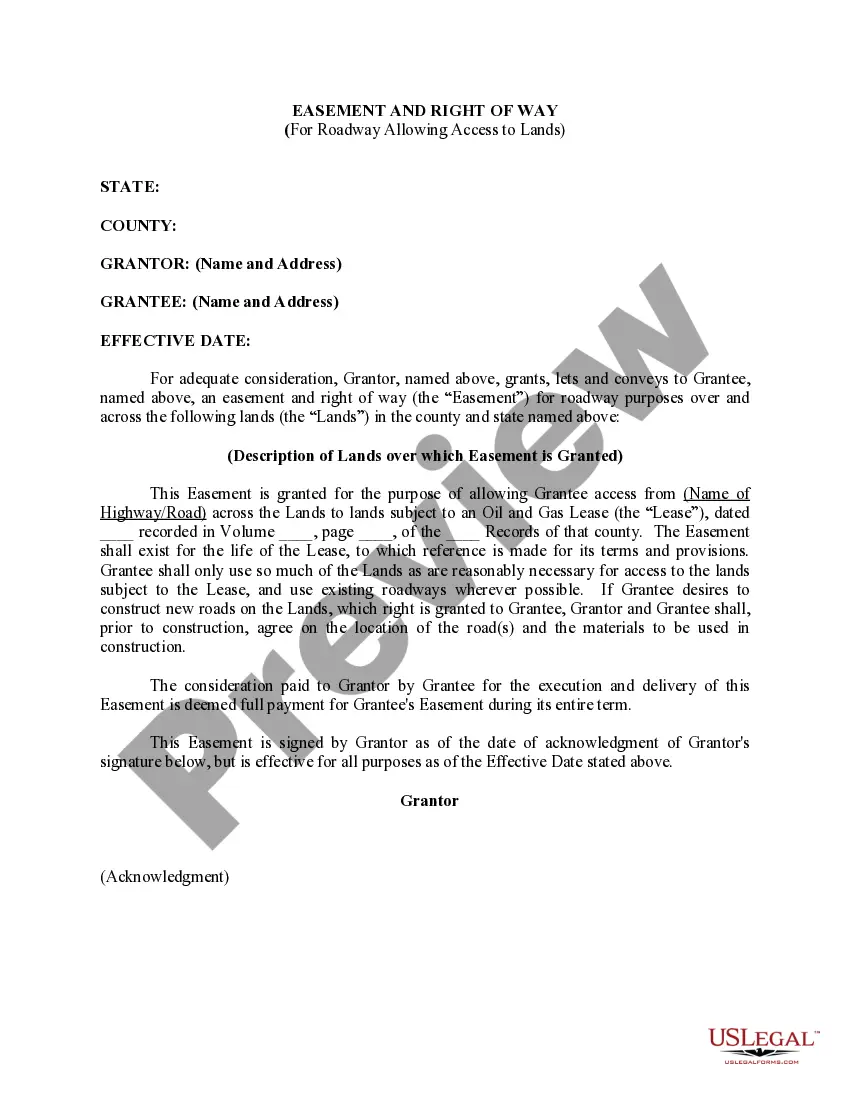

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you may have, from personal to business papers, all-in-one location.

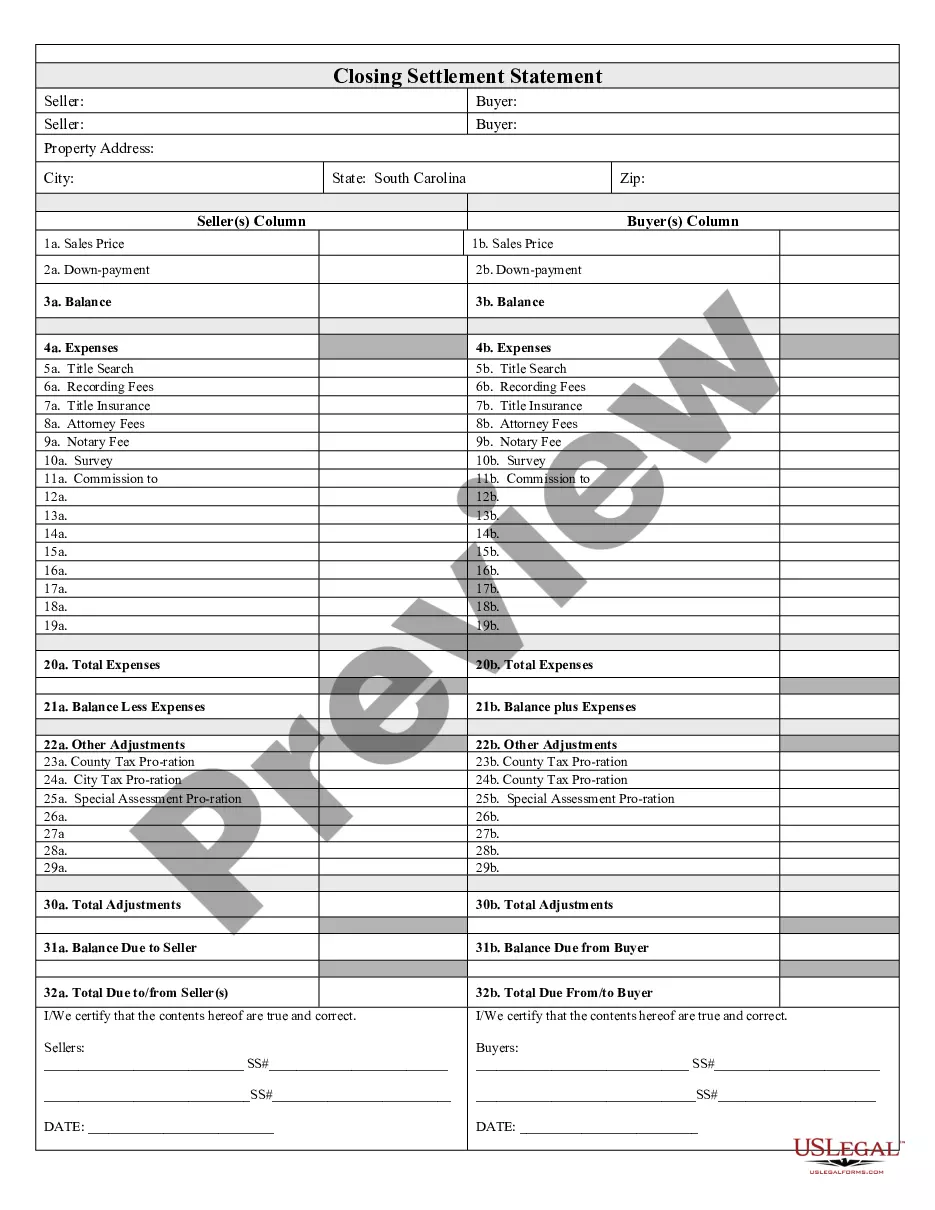

- Use advanced tools to accomplish and handle your Closing Costs With Rocket Mortgage

- Access a useful resource base of articles, instructions and handbooks and resources related to your situation and needs

Help save time and effort searching for the papers you need, and utilize US Legal Forms’ advanced search and Preview feature to find Closing Costs With Rocket Mortgage and acquire it. If you have a membership, log in in your US Legal Forms account, search for the form, and acquire it. Review your My Forms tab to view the papers you previously downloaded and also to handle your folders as you can see fit.

If it is the first time with US Legal Forms, register a free account and obtain unrestricted access to all benefits of the library. Here are the steps to consider after accessing the form you want:

- Confirm it is the right form by previewing it and reading its information.

- Be sure that the sample is approved in your state or county.

- Pick Buy Now once you are ready.

- Choose a subscription plan.

- Find the formatting you want, and Download, complete, eSign, print and send out your document.

Take advantage of the US Legal Forms online catalogue, supported with 25 years of expertise and trustworthiness. Enhance your everyday document management in a smooth and user-friendly process right now.

Form popularity

FAQ

You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

Closing costs are typically 3% ? 6% of the loan amount. This means that if you take out a mortgage worth $200,000, you can expect to add closing costs of about $6,000 ? $12,000 to your total cost. Closing costs don't include your down payment, but you may be able to negotiate them.

On average, it takes about 30 ? 45 days to close on a home, from filling out your mortgage loan application to showing up at the closing table. Closing day, the day you sign your final paperwork, lasts about 1 to 2 hours as long as everything goes as planned.

Average closing costs for the buyer run between about 2% and 6% of the loan amount. That means, on a $300,000 home loan, you would pay from $6,000 to $18,000 in closing costs in addition to the down payment. The most cost-effective way to cover the costs is to pay them out-of-pocket as a one-time expense.

Timing Requirements ? The ?3/7/3 Rule? The initial Truth in Lending Statement must be delivered to the consumer within 3 business days of the receipt of the loan application by the lender. The TILA statement is presumed to be delivered to the consumer 3 business days after it is mailed.