Real Estate Closings Alabama Withholding

Category:

State:

South Carolina

Control #:

SC-CLOSE4

Format:

Word;

Rich Text

Instant download

Description

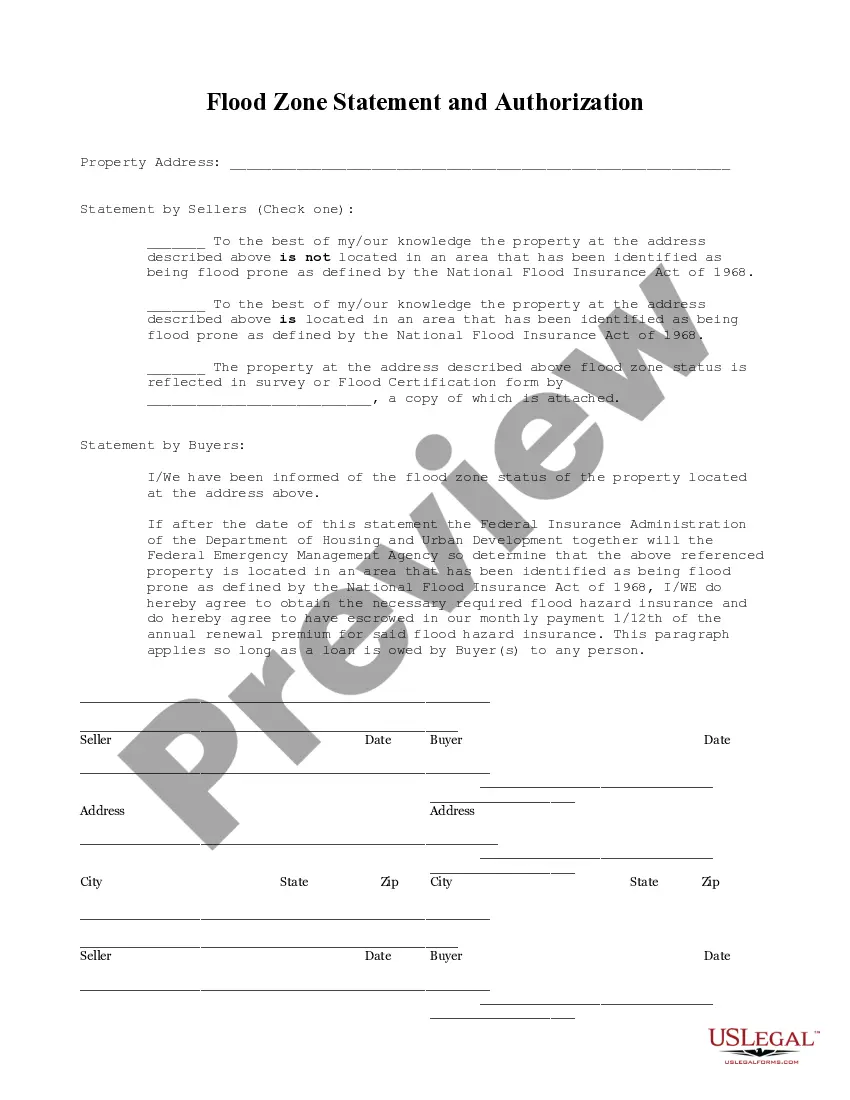

This Flood Zone Statement and Authorization form is for seller(s) to sign, stating the flood zone status of the property and for the buyers to acknowledge the same and state that should the property ever be determined to be in a flood zone, that they will obtain flood insurance.