South Carolina Form Sc For Employees

State:

South Carolina

Control #:

SC-P025

Format:

Word;

Rich Text

Instant download

Description Laws Title Donor

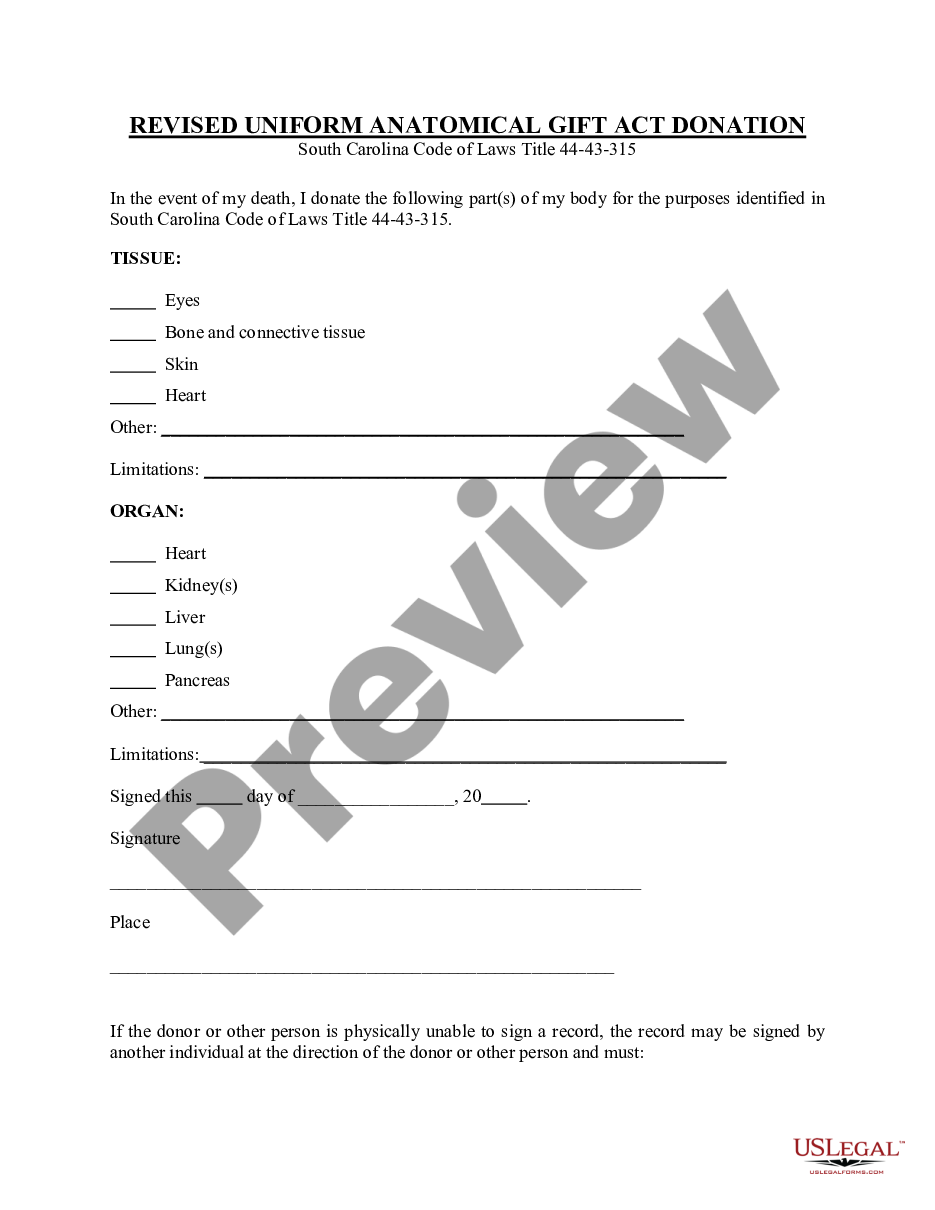

This Revised Uniform Anatomical Gift Act Donation form pursuant to state statutes designates the specific body parts and organs an individual wishes to donate at the time of death.

Any person of sound mind and who is eighteen years of age or more may give all or any part of his body for any purpose by will or by document other than a will.

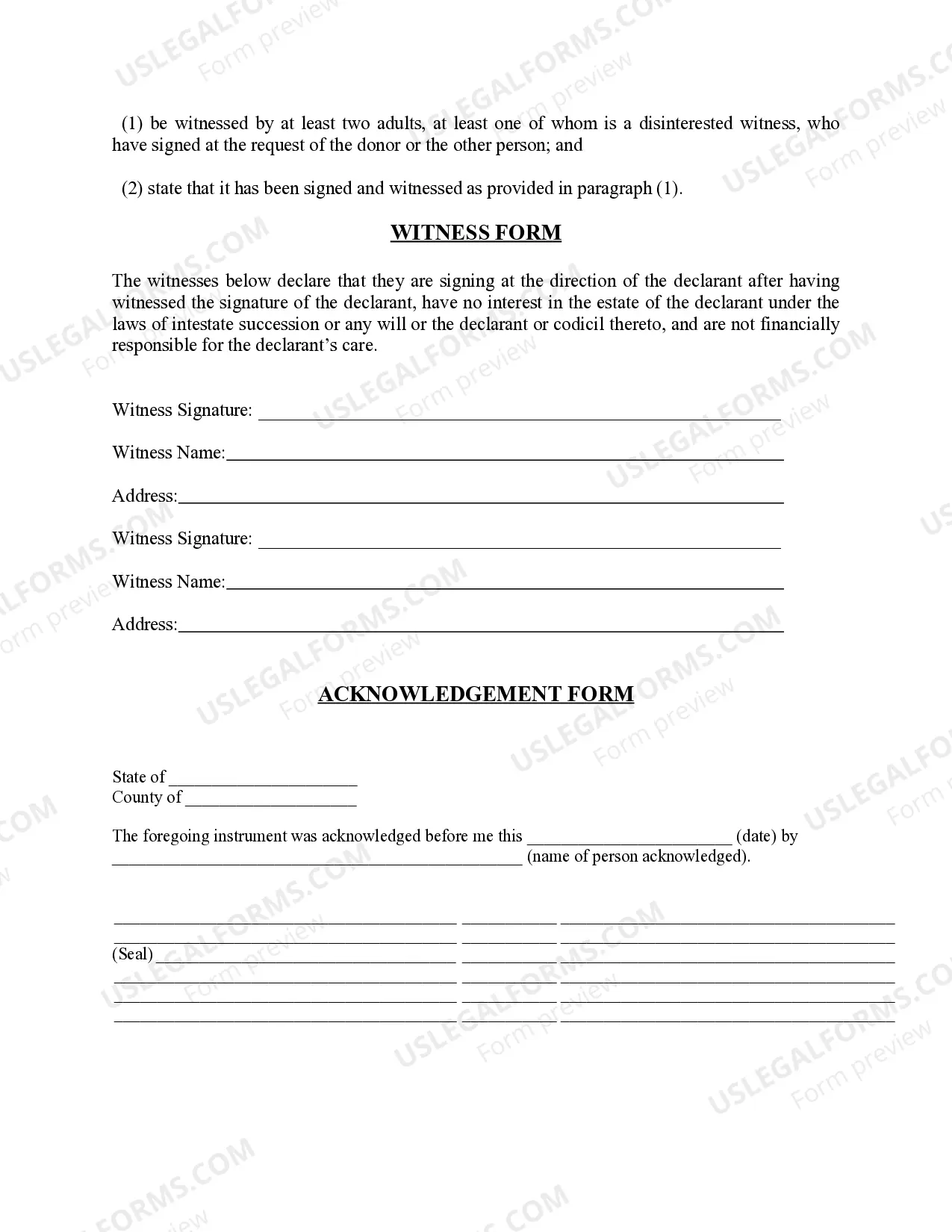

Free preview Witness Other Laws