Deed Parents Child Estate For Sale By Owner

Description

How to fill out Deed Parents Child Estate For Sale By Owner?

When you need to file Deed Parents Child Estate For Sale By Owner that adheres to your local state's laws and regulations, there can be several alternatives to select from.

There's no need to examine each form to ensure it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a trustworthy resource that can assist you in obtaining a reusable and current template on any subject.

- US Legal Forms is the most extensive online collection with a repository of over 85k ready-to-use documents for business and personal legal situations.

- All templates are confirmed to conform to each state's regulations.

- Therefore, when downloading Deed Parents Child Estate For Sale By Owner from our site, you can be confident that you possess a valid and current document.

- Acquiring the necessary sample from our platform is exceptionally simple.

- If you already have an account, just Log In to the system, ensure your subscription is valid, and save the chosen file.

- In the future, you can access the My documents tab in your profile to retrieve the Deed Parents Child Estate For Sale By Owner whenever necessary.

- If it’s your first experience with our website, please follow the guidelines below.

- Review the suggested page and verify it against your needs.

Form popularity

FAQ

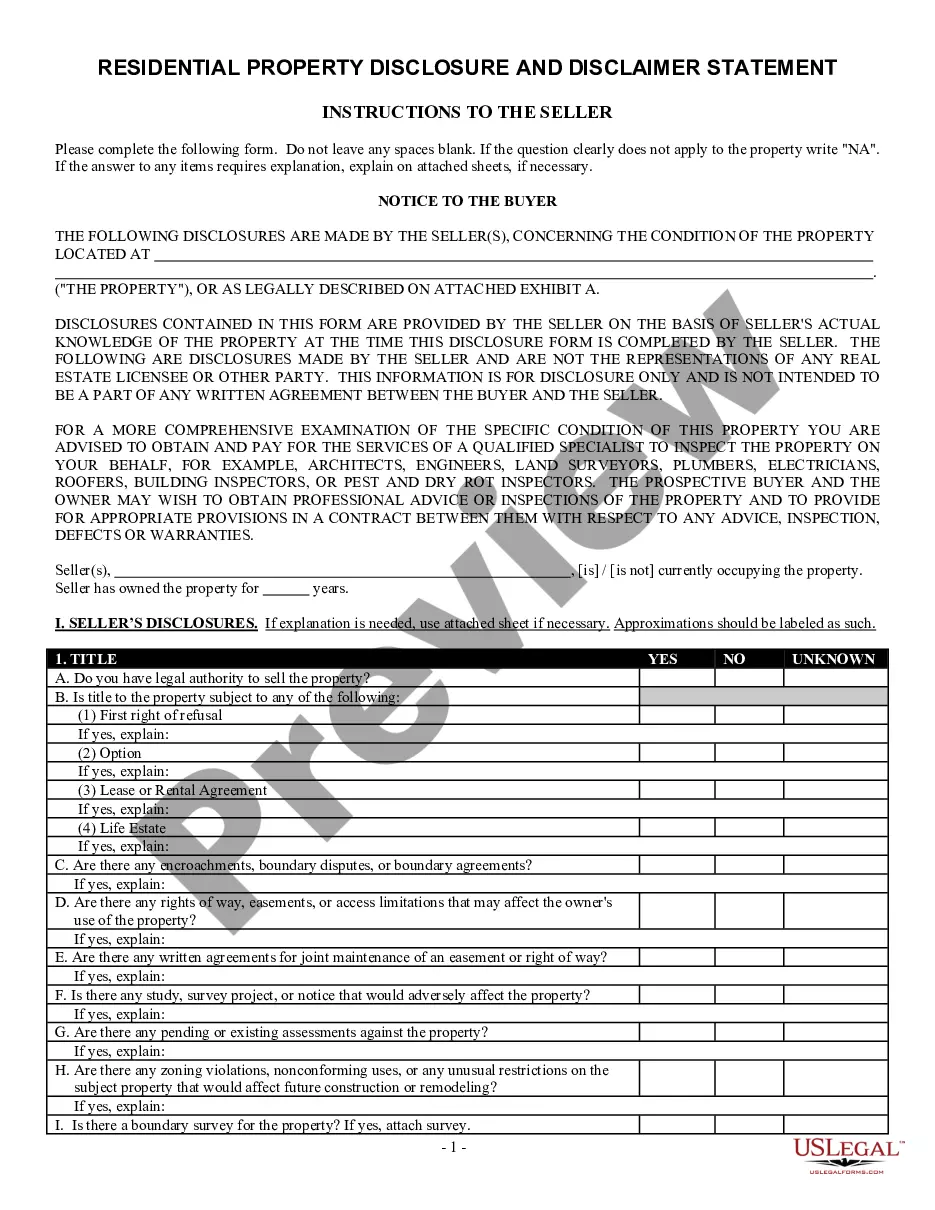

The best deed to transfer property often depends on your specific situation; however, a quitclaim deed is frequently used for ease and speed. This type of deed releases any claim the grantor has on the property without guaranteeing any title rights. For parents transferring their estate to a child, a quitclaim deed can be an efficient way to facilitate the transfer, especially if the plan includes selling the estate by owner.

The best way to transfer a property to a family member is to execute a deed that clearly states the transfer of ownership. This ensures that the transfer is legally recognized and protects both parties' interests. If you are considering selling the property by owner, using a well-drafted deed can simplify the process and avoid potential disputes.

To transfer a land title from a deceased parent in the Philippines, you typically need to secure a copy of the death certificate and the parent’s title. Next, you must navigate the requirements for estate settlement, which may include obtaining a tax clearance certificate. Utilizing a deed can streamline this process for the child, especially if they aim to sell the estate by owner.

The most common method of transferring real property is through a deed. This legal document clearly outlines who the current owner of the property is and who the new owner will be. For parents wishing to transfer their estate to their child, using a deed is a critical step in the process, especially when managing property for sale by owner.

The best way to pass property to a child is often through a deed parents child estate for sale by owner. This method allows you to transfer ownership directly while avoiding lengthy probate processes. Additionally, you can use a warranty deed or a quitclaim deed to ensure the transfer is clear and legal. Utilizing platforms like US Legal Forms can simplify this process, providing templates and guidance tailored to your needs.

The best way to leave property to children after death is by establishing a comprehensive estate plan that includes a will or trust. This planning helps ensure that your property is distributed according to your wishes while minimizing legal hurdles. In the context of a deed parents child estate for sale by owner, such planning provides peace of mind and clarity for your heirs.

Yes, a parent can gift a house to a child in Pennsylvania using a gift deed. This deed allows for the transfer of ownership without the need for financial compensation, facilitating a direct transfer. To streamline this process in a deed parents child estate for sale by owner situation, consider utilizing legal resources to ensure clarity.

In Texas, the process to transfer ownership from a parent to a child generally involves executing a gift deed or a warranty deed. The deed must be filed in the county where the property is located, ensuring public records reflect the new owner. Taking care of this effectively can be especially beneficial in a deed parents child estate for sale by owner context.

In the Philippines, transferring ownership from a deceased parent to a child typically requires securing a document called a 'decree of extra-judicial settlement.' This document outlines the division of the estate among heirs and facilitates the transfer. It's crucial to engage legal assistance to handle the complexities involved, particularly in a deed parents child estate for sale by owner situation.

You can transfer a property title to a family member in Pennsylvania by preparing and recording a deed that specifies the new owner. It’s essential to ensure that all relevant details, such as names and property descriptions, are accurate. Engaging a service related to a deed parents child estate for sale by owner can ease this process.