The South Carolina Deed of Trust is a legal document used in real estate transactions in the state of South Carolina. It serves as a security instrument that is commonly used in mortgage loans, providing protection for lenders in case the borrower defaults on their loan payments. This description will cover the basics of the South Carolina Deed of Trust and highlight different types associated with it. A South Carolina Deed of Trust is a three-party agreement involving the borrower (trust or), the lender (beneficiary), and a neutral third party known as the trustee. The deed of trust is executed by the borrower at the time of closing and is recorded in the county where the property is located. It outlines the terms and conditions of the mortgage loan, including the amount borrowed, interest rate, repayment terms, and other relevant details. The South Carolina Deed of Trust contains specific keywords related to its components, such as "borrower," "lender," "trustee," "mortgage loan," "principal," "interest rate," "repayment schedule," "default," and "foreclosure." These keywords are pertinent to understanding the document and its implications fully. Types of South Carolina Deed of Trust include: 1. Traditional Deed of Trust: This is the most common type. It establishes a lien on the property, allowing the lender to foreclose if the borrower defaults on the loan payments. In case of default, the lender can initiate foreclosure proceedings, sell the property, and recover the loan amount. 2. Deed in Lieu of Foreclosure: This type of deed allows a borrower facing foreclosure to transfer ownership of the property to the lender voluntarily. It serves as an alternative to foreclosure, protecting the borrower from a public auction while allowing the lender to avoid the lengthy foreclosure process. 3. Deed of Re conveyance: This document is issued after the borrower successfully pays off the mortgage loan. It is recorded to release the lender's lien on the property, indicating that the debt has been fully satisfied. 4. Deed of Trust with Assignment of Rents: This special type of deed gives the lender the right to collect rents and income generated from the property in case of default. It provides additional security for the lender, ensuring the possibility of recovering loan payments from rental income. Understanding the South Carolina Deed of Trust is crucial for both borrowers and lenders involved in real estate transactions in South Carolina. It is advisable to consult with a legal professional or a real estate attorney to ensure a clear comprehension of the document's terms and implications and to fulfill all legal obligations associated with it. Being aware of the different types of Deeds of Trust in South Carolina will further assist in navigating specific circumstances and requirements.

South Carolina Deed Of Trust

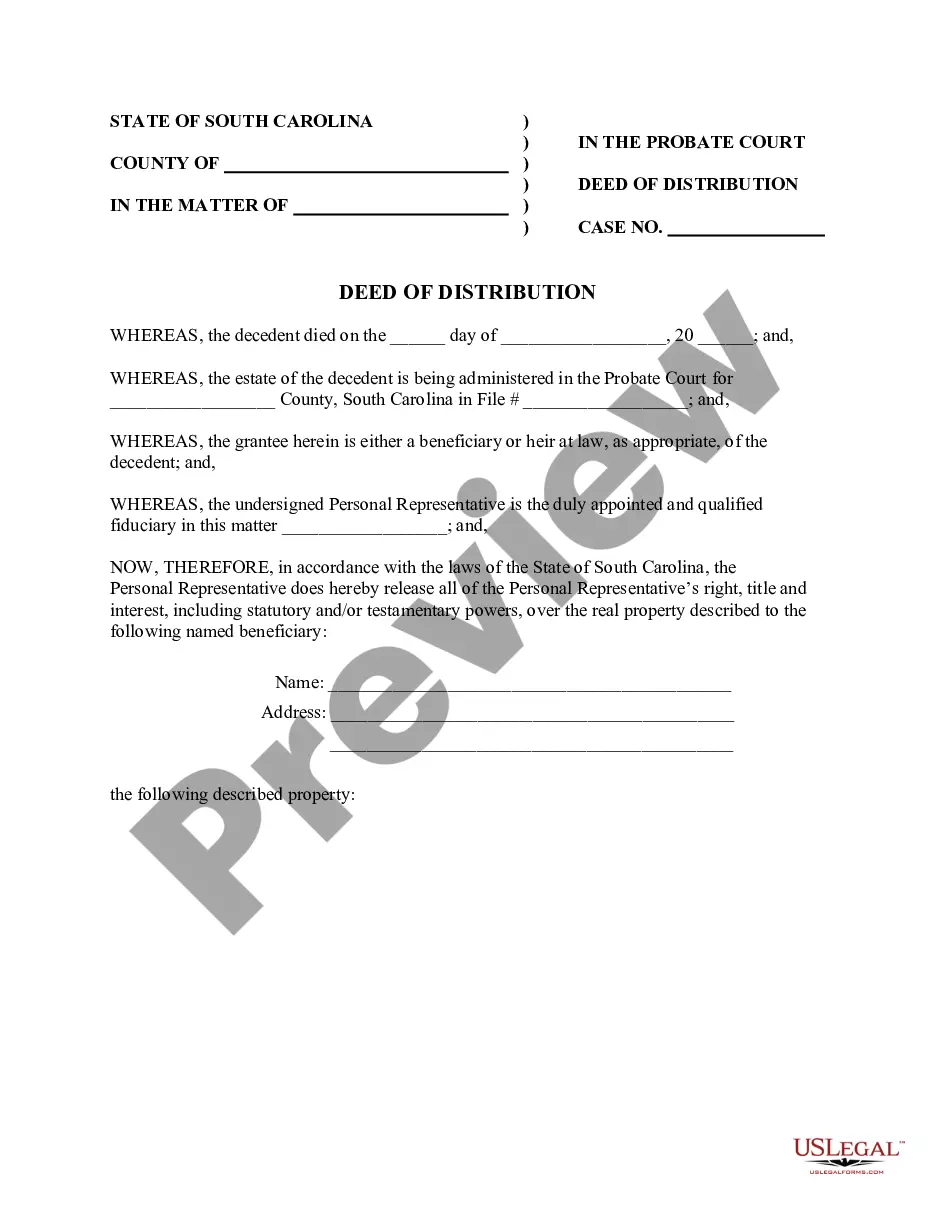

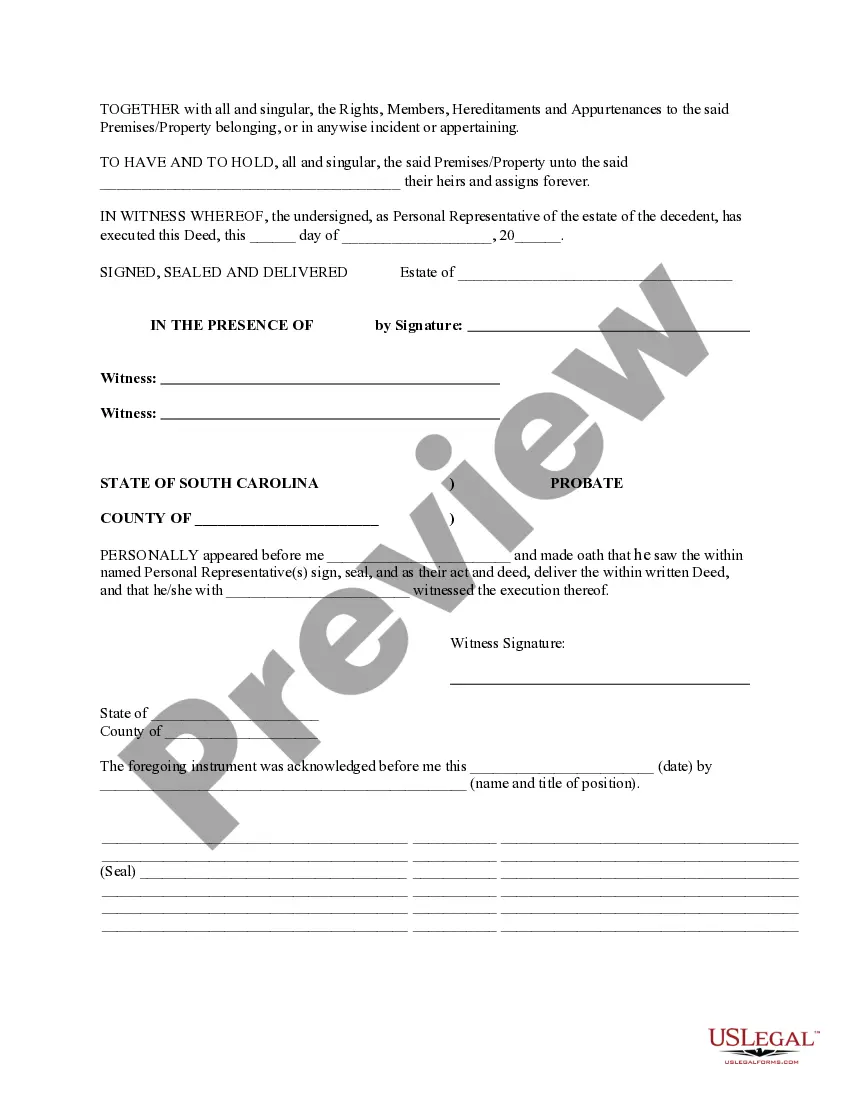

Description Deed Of Distribution Form

How to fill out What Is A Deed Of Distribution In Sc?

Using legal templates that meet the federal and local regulations is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the right South Carolina Deed Of Trust sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any business and personal situation. They are simple to browse with all files grouped by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when acquiring a South Carolina Deed Of Trust from our website.

Obtaining a South Carolina Deed Of Trust is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, adhere to the instructions below:

- Analyze the template using the Preview option or via the text outline to ensure it meets your requirements.

- Look for another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your South Carolina Deed Of Trust and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!