South Carolina Quit Claim With Mortgage

Description

Form popularity

FAQ

A quitclaim deed works by allowing one party to transfer their ownership interest in a property to another party without guaranteeing that the title is clear. In South Carolina, this means that if you execute a quitclaim deed, the grantee receives whatever interest the grantor has, which may include mortgage liabilities. Consequently, it is vital for both parties to understand how the South Carolina quit claim with mortgage implications may affect them. By using reliable resources like uslegalforms, you can ensure clarity and accuracy in your conveyance.

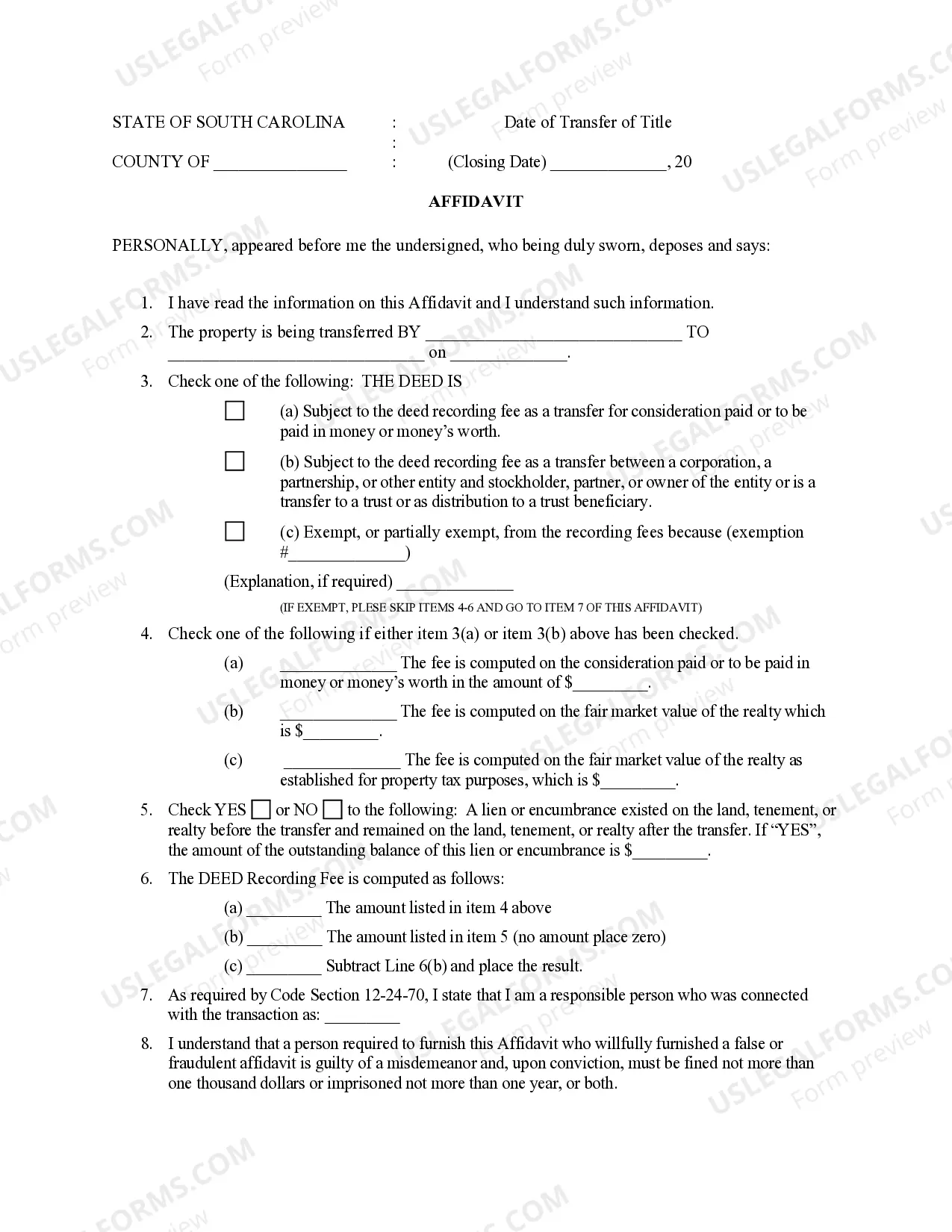

Filling out a quitclaim deed in South Carolina involves several straightforward steps. First, accurately complete the form with the grantor's and grantee's names, property description, and any details about the existing mortgage. Ensure that you sign the document in the presence of a notary public and record it at the local county register of deeds. For assistance with the process, consider using a platform like uslegalforms, which offers detailed templates and guidance for South Carolina quit claim with mortgage transactions.

The most common use of a quitclaim deed is to transfer property ownership without warranties. This is typically used among family members, such as in estate planning or during property division in a divorce. However, if you have a mortgage, you need to address how the quitclaim deed affects the mortgage obligations. Understanding how a South Carolina quit claim with mortgage works can help you make informed decisions.

A quitclaim deed in South Carolina remains effective indefinitely, as long as it has been properly executed and recorded. This means that ownership can be transferred until a new deed is filed or legal action alters the ownership. It's important to ensure that your quitclaim deed includes any mortgage-related details to avoid complications later. Always consider consulting a legal expert to confirm your deed's validity regarding South Carolina quit claim with mortgage.

To obtain a quitclaim deed in South Carolina, you typically need to prepare a written document that outlines the transfer of property. It's advisable to include relevant details, such as the property description and the names of the parties involved. For an efficient process, consider using US Legal Forms, which can guide you through preparing your South Carolina quit claim with mortgage clearly and correctly.

The primary beneficiaries of a quitclaim deed are individuals looking to quickly transfer property rights without intensive legal procedures. This method is particularly useful in family situations, such as divorce or inheritance, where a quick transfer is desirable. Additionally, those engaged in a South Carolina quit claim with mortgage can find this option beneficial for simplifying complex ownership situations while addressing their mortgage responsibilities.

Transferring a deed to a family member in South Carolina can be achieved through a quit claim deed. This process involves drafting the deed with the necessary information, notarizing it, and filing it with the local register of deeds. When transferring a property with existing mortgages, like in a South Carolina quit claim with mortgage, make sure both parties understand the financial implications of the transfer.

Many mortgage companies will recognize a quit claim deed, but acceptance can vary based on the lender's policies. Generally, a quit claim deed removes one party's interest and can impact mortgage responsibilities. If you are dealing with a South Carolina quit claim with mortgage, it is important to confirm with the mortgage company to understand the implications of the deed transfer on the mortgage.

To file a quit claim deed in South Carolina, you must first complete the deed with accurate information about the property and parties involved. After notarizing the document, you will submit it to the county register of deeds office where the property is located. For those handling a South Carolina quit claim with mortgage, it’s vital to ensure that the mortgage provider is notified about the transfer to avoid any future complications.

In South Carolina, a quit claim deed requires essential information such as the names of the grantor and grantee, a legal description of the property, and the date of execution. The document must be signed by the grantor in front of a notary public, ensuring its validity. When dealing with a South Carolina quit claim with mortgage, it is crucial to include any mortgage information to clarify the financial obligations tied to the property.