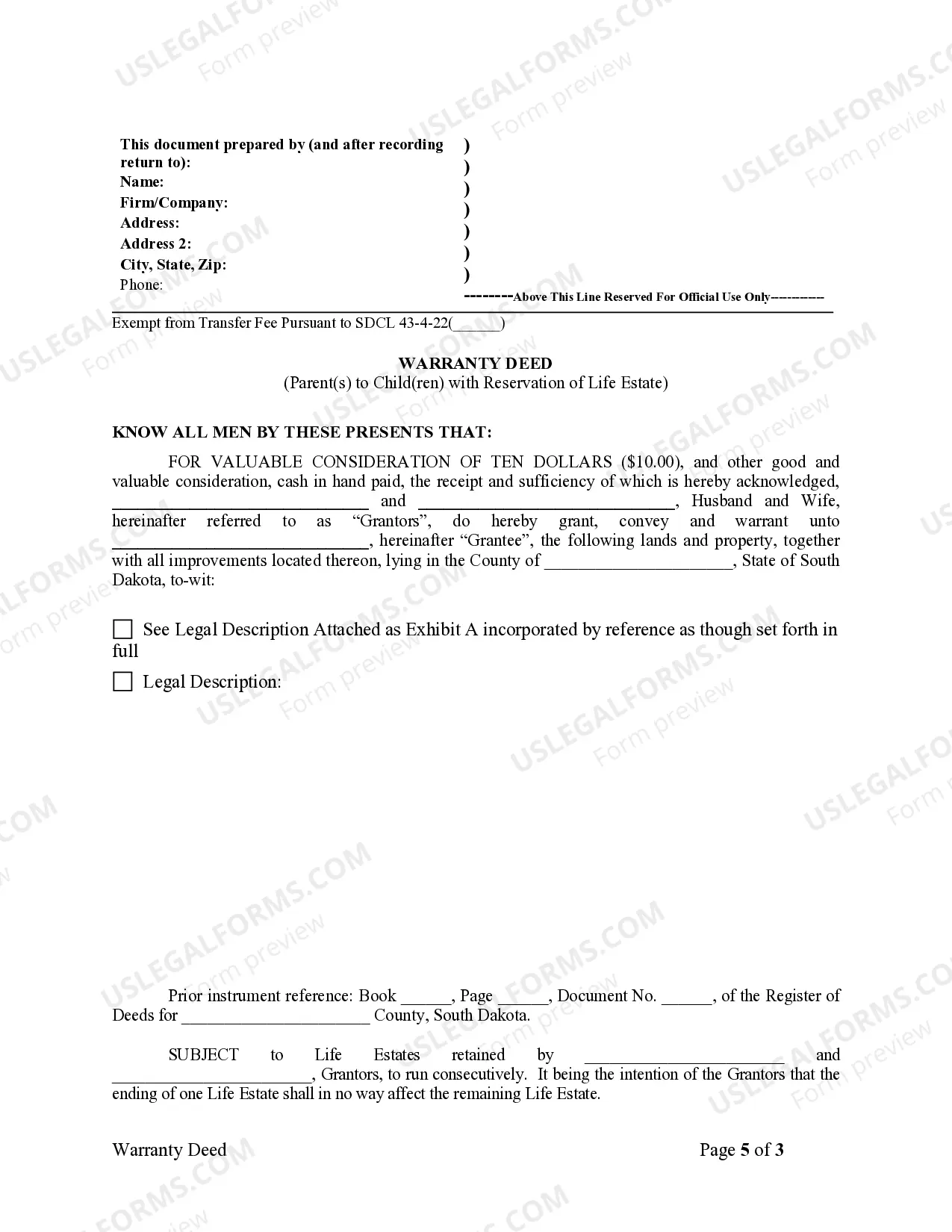

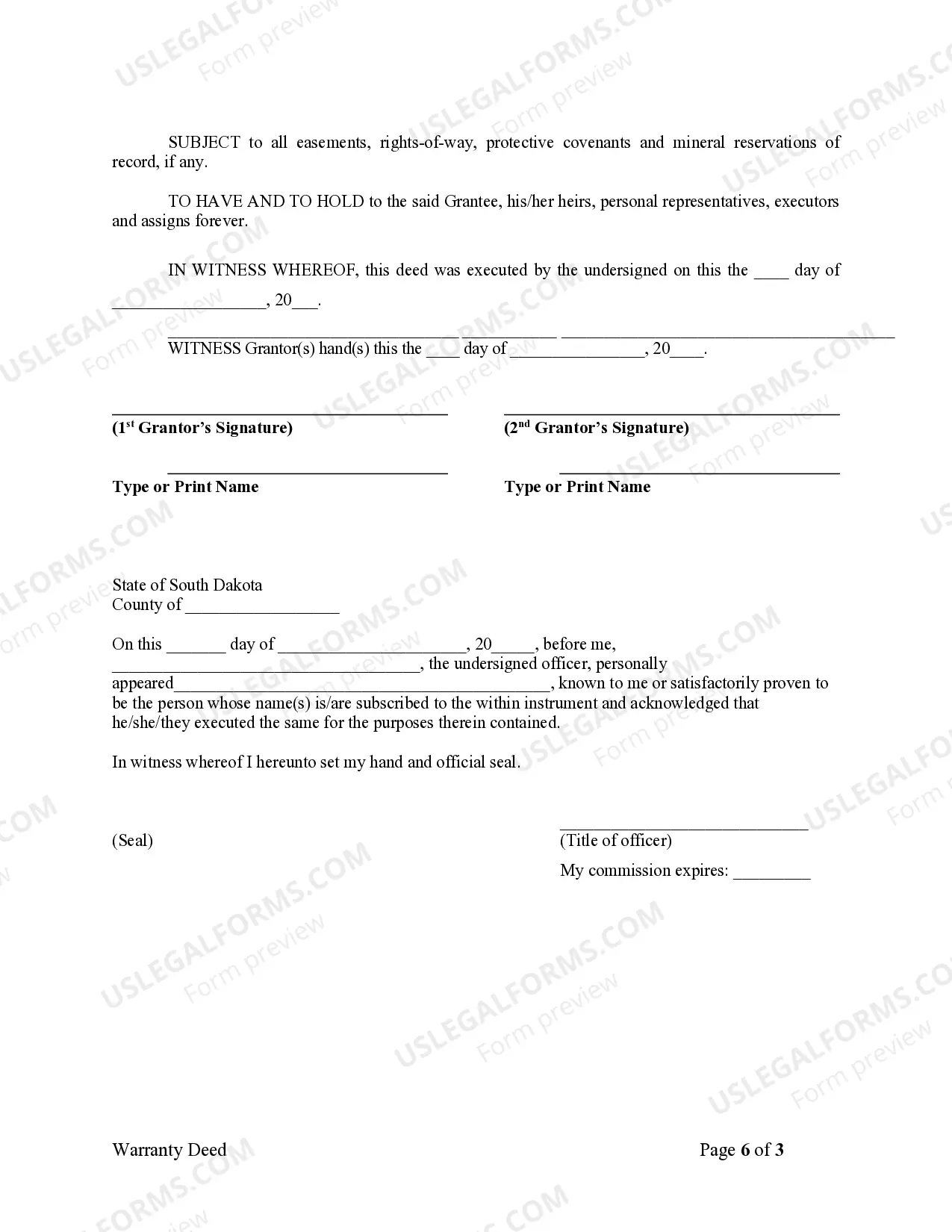

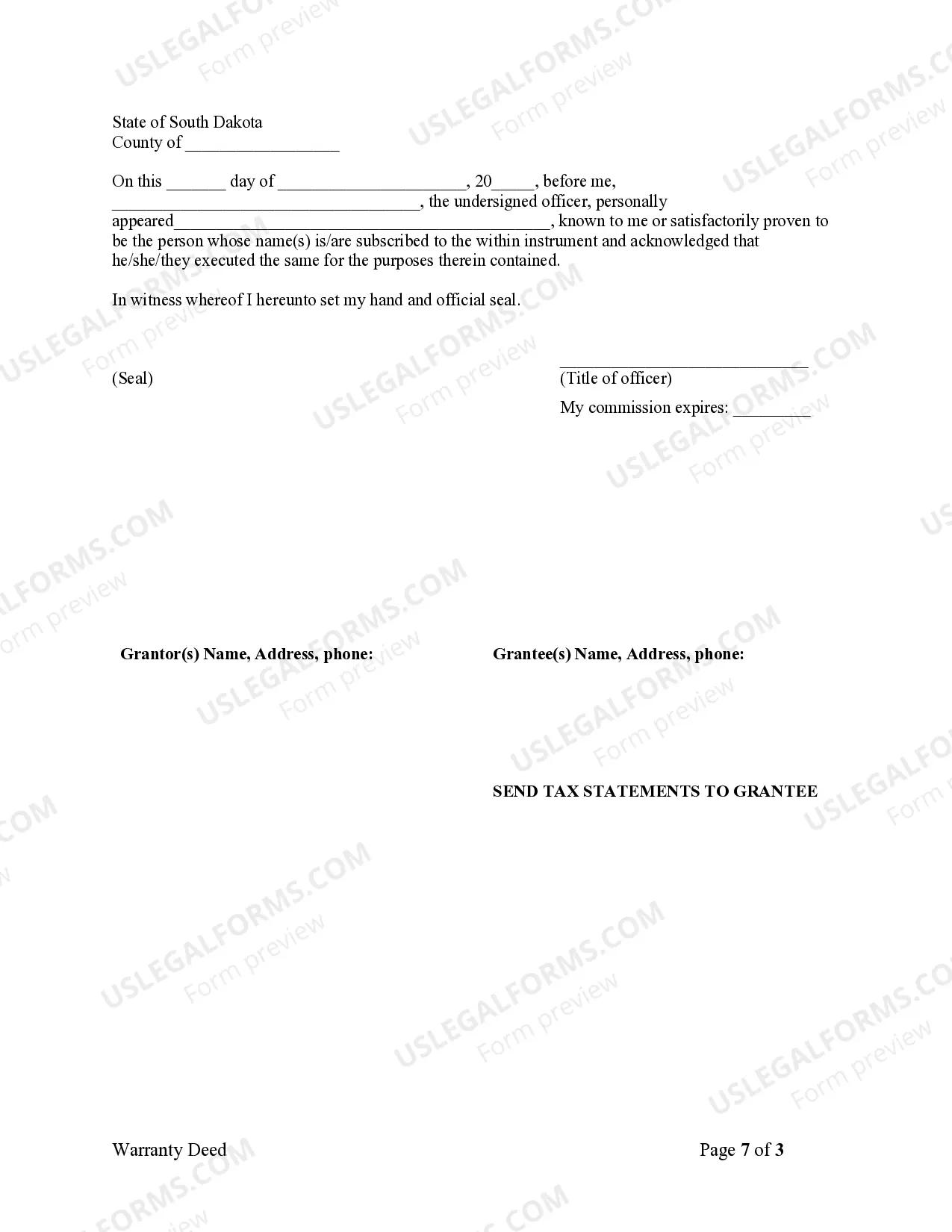

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Title: Understanding Life Estate Deed without a Will in South Dakota Introduction: In South Dakota, when an individual passes away without leaving a will, their real estate assets are distributed according to state laws. One common method of transferring property in such cases is through a life estate deed. This detailed description will explore the concept of a life estate deed without a will in South Dakota, its purpose, and any potential variations. Key Points: 1. Life Estate Deed Without a Will: A life estate deed without a will refers to the transfer of property ownership when an individual dies intestate (without a valid will) in South Dakota. This legal document outlines the rights and limitations of the property's ownership and usage by the designated parties. 2. Purpose of a Life Estate Deed: The primary purpose of a life estate deed is to ensure the smooth transfer of property ownership from the deceased individual (the granter) to the beneficiary (grantee) without the need for probate. This legal instrument aims to simplify the transfer process and protect the interests of both parties involved. 3. Rights and Limitations: In a life estate deed without a will, the granter transfers ownership of the property to the grantee for the duration of their lifetime. The grantee, referred to as the life tenant, holds rights to occupy, use, and profit from the property during their lifetime. However, they cannot sell, mortgage, or transfer the property in any way without the consent of the remainder man, who is the ultimate beneficiary of the property. 4. Potential Types of Life Estate Deeds Without a Will: While a basic life estate deed without a will suffices in most situations, there are a few variations that may apply depending on individual circumstances: a) Life Estate Deed with Remainder man: This type of life estate deed designates a specific individual or entity as the remainder man, who will ultimately become the full owner upon the life tenant's passing. b) Life Estate Deed with Multiple Remainder men: In some cases, the granter may choose to name multiple remainder men who will inherit the property equally or in designated proportions upon the life tenant's death. c) Contingent Remainder man: A contingent remainder man is appointed in situations where the primary remainder man is unable or unwilling to assume ownership of the property. This protects the granter's intentions by ensuring the property passes to an alternate designated individual or entity. Conclusion: Life estate deeds without a will play a significant role in the transfer of property ownership when individuals pass away intestate in South Dakota. By outlining the respective rights and limitations of the life tenant and remainder man, this legal instrument allows for a streamlined transfer process while safeguarding the interests of both parties involved. It is essential to consult with a qualified attorney to ensure compliance with state laws and to determine the most appropriate type of life estate deed for individual circumstances.