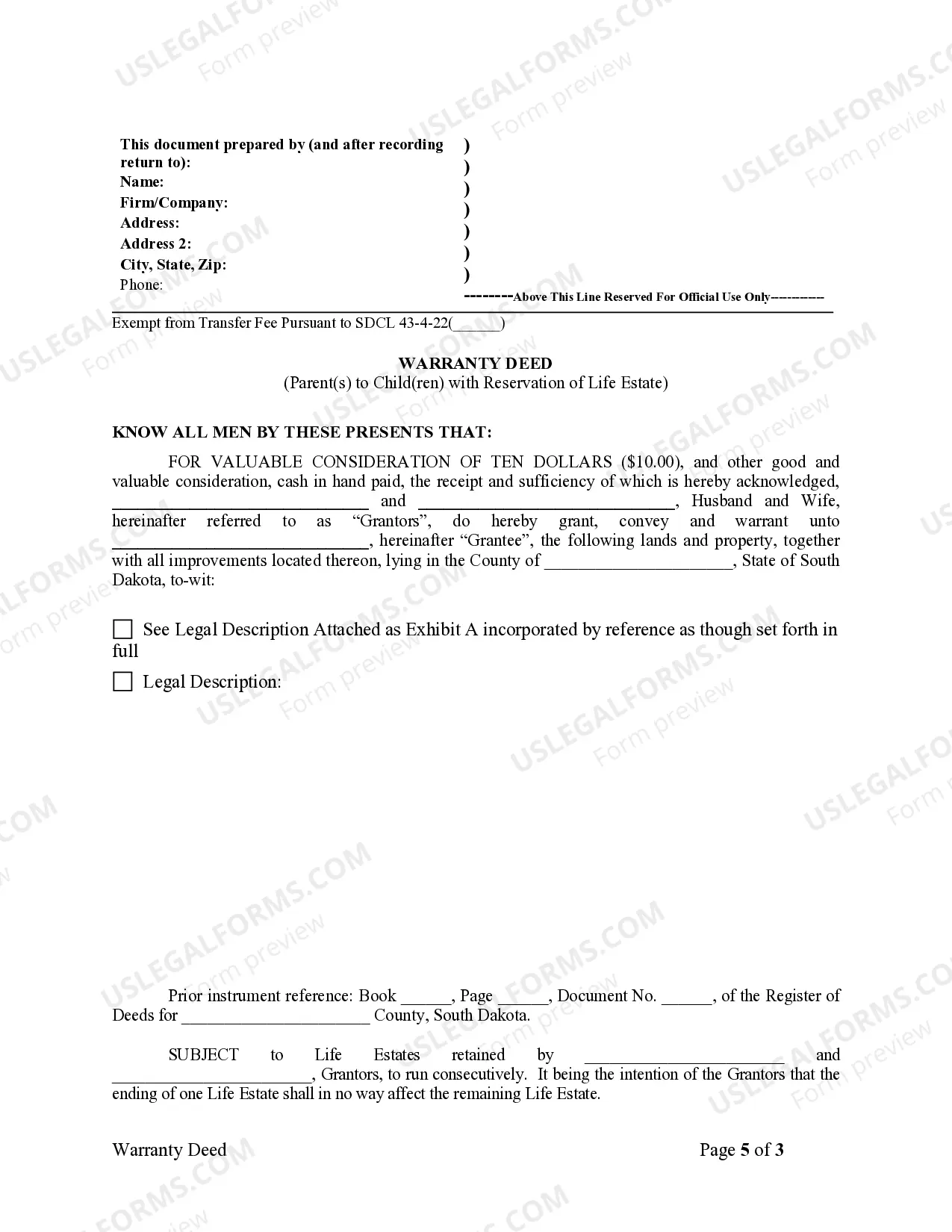

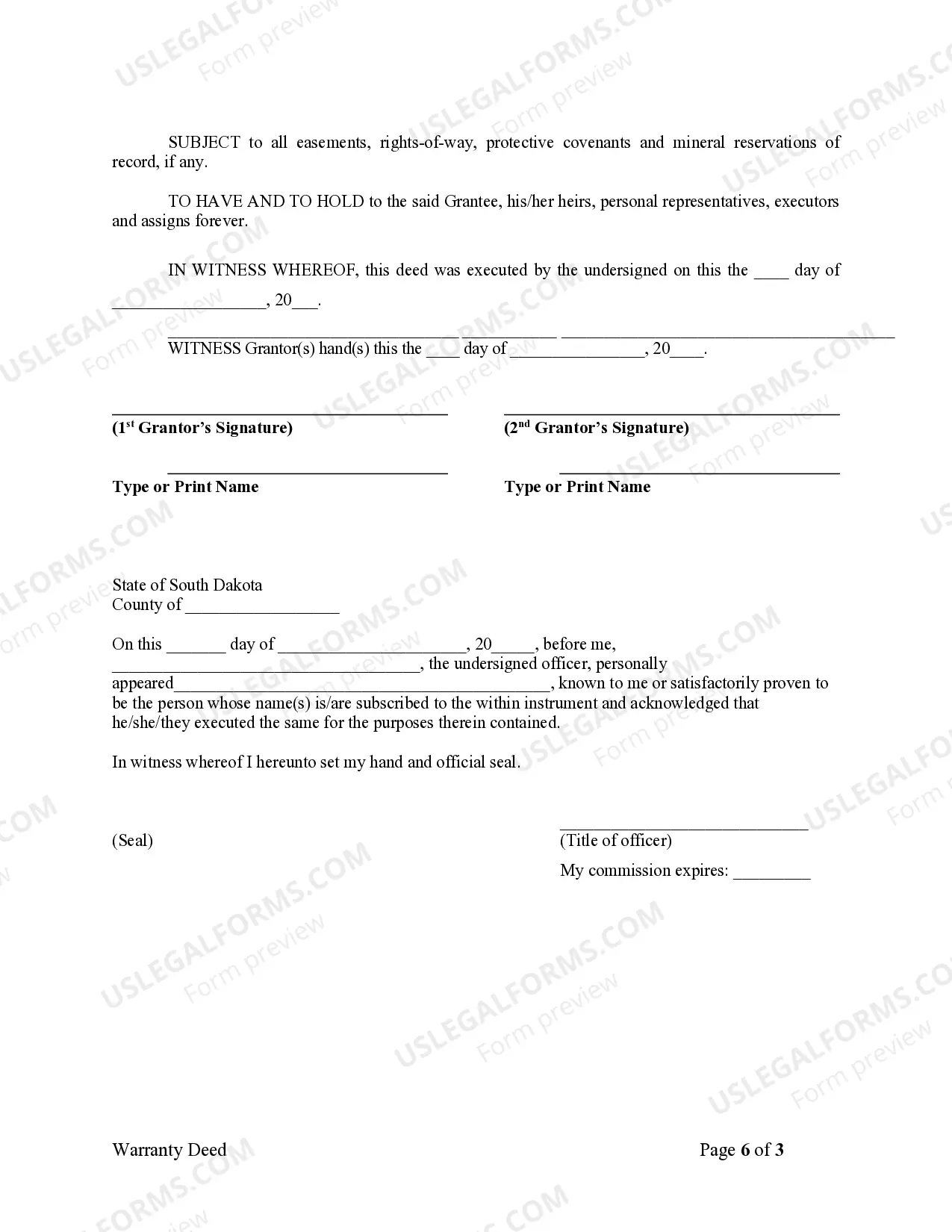

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

South Dakota Life Estate For Medicaid

Description

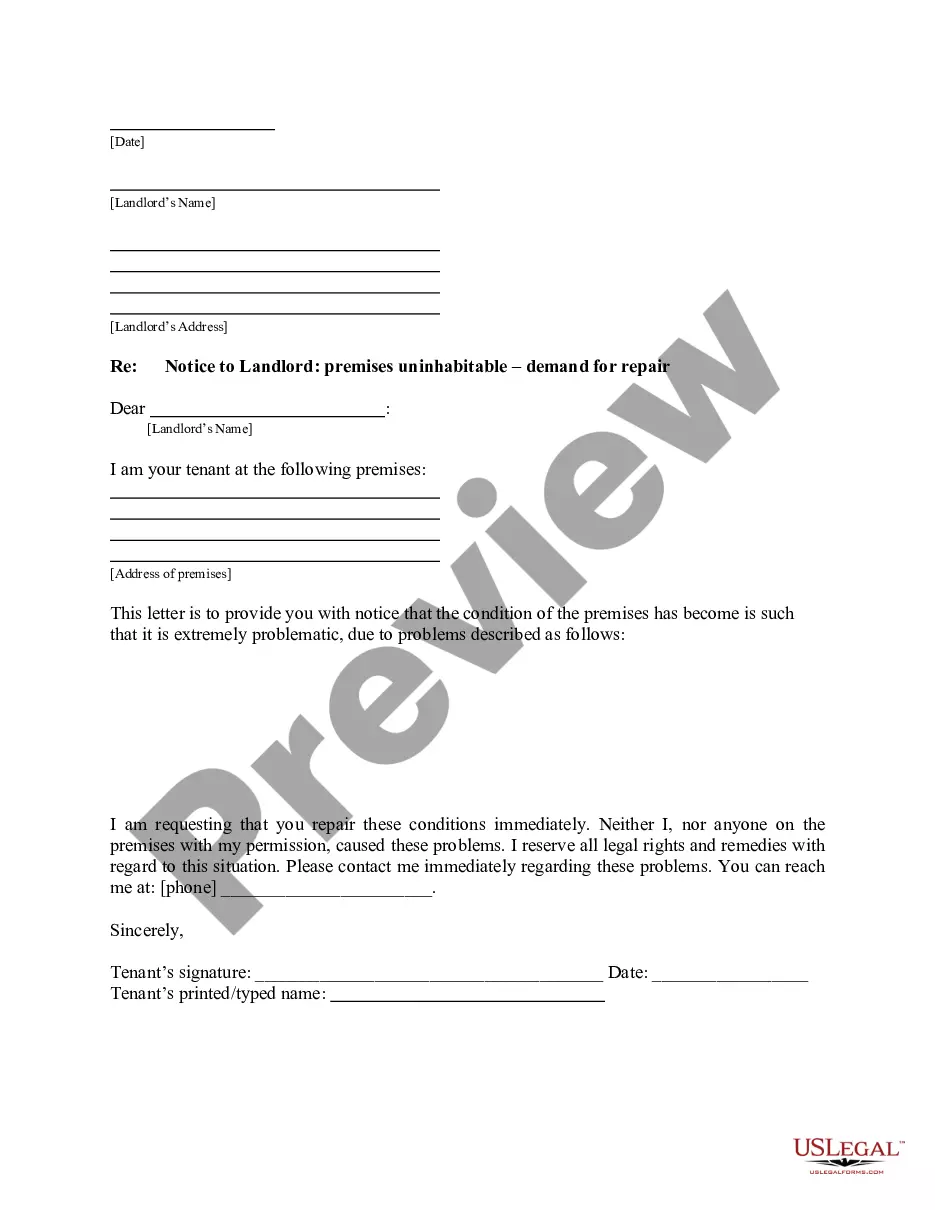

How to fill out South Dakota Life Estate For Medicaid?

Red tape requires exactness and correctness.

Unless you are accustomed to completing forms like South Dakota Life Estate For Medicaid on a daily basis, it may lead to some misunderstanding.

Selecting the appropriate template from the outset will guarantee that your document submission proceeds smoothly and avoid any hassles of resubmitting a document or performing the same task from the beginning.

Acquiring the correct and current samples for your documentation takes only a few minutes with an account at US Legal Forms. Eliminate bureaucratic concerns and simplify your document management.

- Retrieve the sample using the search field.

- Ensure the South Dakota Life Estate For Medicaid you’ve found is applicable to your state or district.

- Review the preview or examine the description that includes details on the template’s usage.

- When the outcome meets your criteria, click the Buy Now button.

- Choose the suitable option among the available subscription packages.

- Log in to your account or create a new one.

- Finalize the purchase using a credit card or PayPal account.

- Download the form in the file format that suits your needs.

Form popularity

FAQ

Avoiding the Medicaid five-year look back period effectively involves strategic planning. Utilizing options such as irrevocable trusts and a South Dakota life estate for Medicaid can help you preserve assets while maintaining eligibility. By seeking advice from legal experts, you can structure your assets wisely and mitigate issues that arise during the look-back review.

Medicaid typically cannot take a life estate because it allows individuals to retain certain rights to their property. However, it’s essential to ensure that this estate is correctly structured to avoid complications. Consulting with professionals about a South Dakota life estate for Medicaid can clarify how to navigate these rules effectively.

The look back period in South Dakota is five years. During this time, the state reviews any asset transfers to ensure individuals are not attempting to qualify for Medicaid by giving away assets. Notably, employing a South Dakota life estate for Medicaid strategies can potentially safeguard certain transfers and help you comply with state regulations.

Medicaid probate refers to the legal process that occurs after someone passes away when their assets are managed and distributed according to their will or state law. In South Dakota, Medicaid can seek reimbursement from the deceased's estate for services provided. Planning with mechanisms like a South Dakota life estate for Medicaid can help minimize complications during probate and protect your legacy.

South Dakota Medicaid regulations outline several exempt assets that can help you qualify for benefits. These include your home, one vehicle, and essential household items. Utilizing strategies such as a South Dakota life estate for Medicaid can help you preserve these assets while accessing necessary medical care without financial strain.

Medicaid estate recovery in South Dakota generally seeks to recoup costs from certain assets after a recipient passes. However, exempt assets include your primary residence, personal belongings, and certain burial funds. To protect your estate further, a South Dakota life estate for Medicaid planning can ensure assets remain within the family while facilitating eligibility.

Generally, a vehicle is considered a countable asset for Medicaid eligibility. However, South Dakota allows certain exemptions which may apply, particularly if the car is necessary for transportation. If your car's value falls within allowable limits, it may not affect your eligibility. Strategies involving a South Dakota life estate for Medicaid can offer additional protection.

In South Dakota, some resources are exempt from Medicaid, meaning they do not count against the eligibility limit. These include your primary home, personal belongings, and certain life insurance policies. Importantly, a South Dakota life estate for Medicaid allows individuals to retain rights to their property while still qualifying for benefits. Planning appropriately can protect vital assets.

A life estate can provide some protection from Medicaid recovery, depending on how it is structured. In South Dakota, if you retain rights to the property, it may not be counted against your Medicaid eligibility. However, careful planning is necessary to ensure protection, as specific rules apply. Utilizing services like USLegalForms can help you create a strategy that maximizes the benefits of your life estate while protecting it from Medicaid concerns.

Medicaid can recover costs from an estate after the death of the recipient. In South Dakota, this recovery may include the value of a life estate, depending on how the estate is structured and other assets. It's vital to plan accordingly so that your heirs can retain as much of the estate as possible. Consulting a professional can help you navigate these complexities.