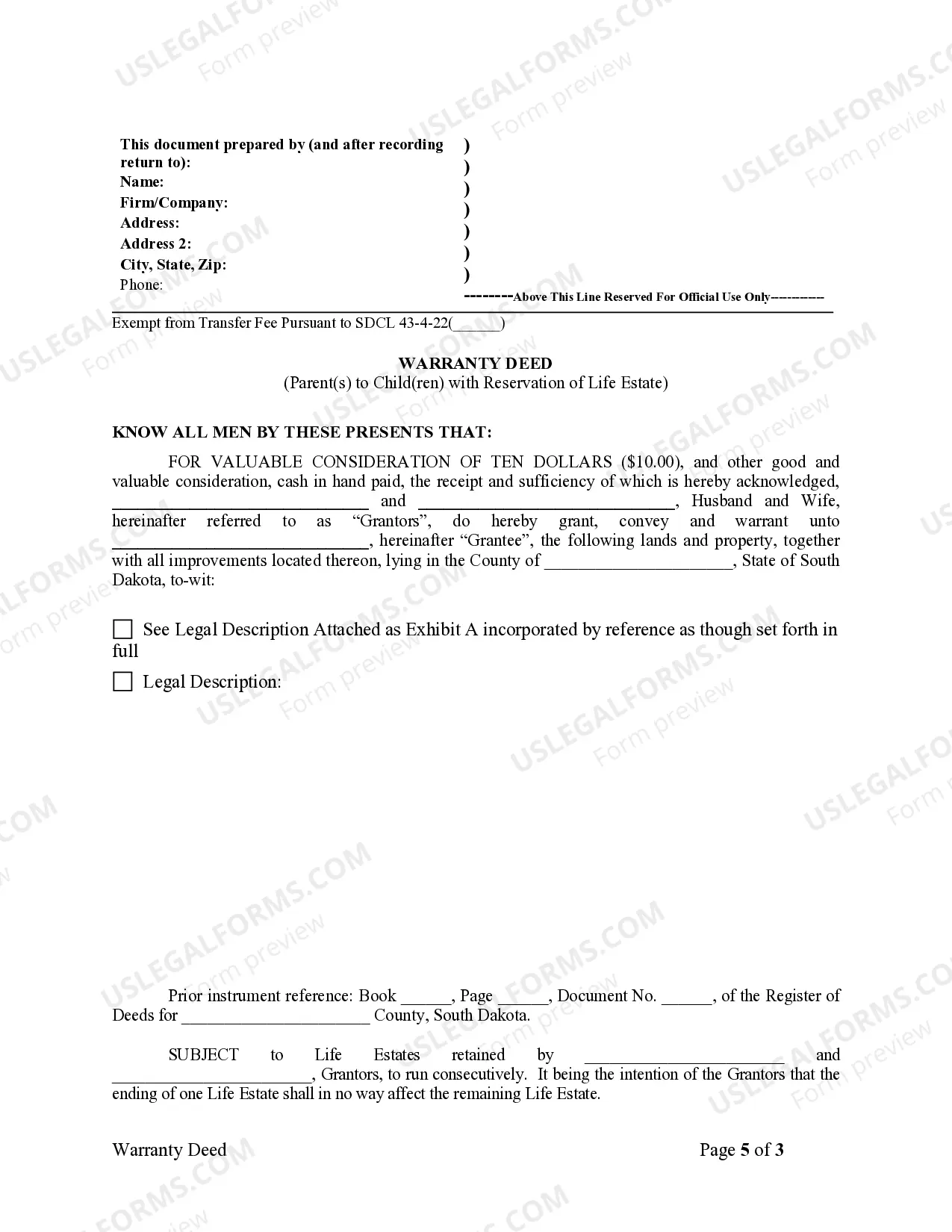

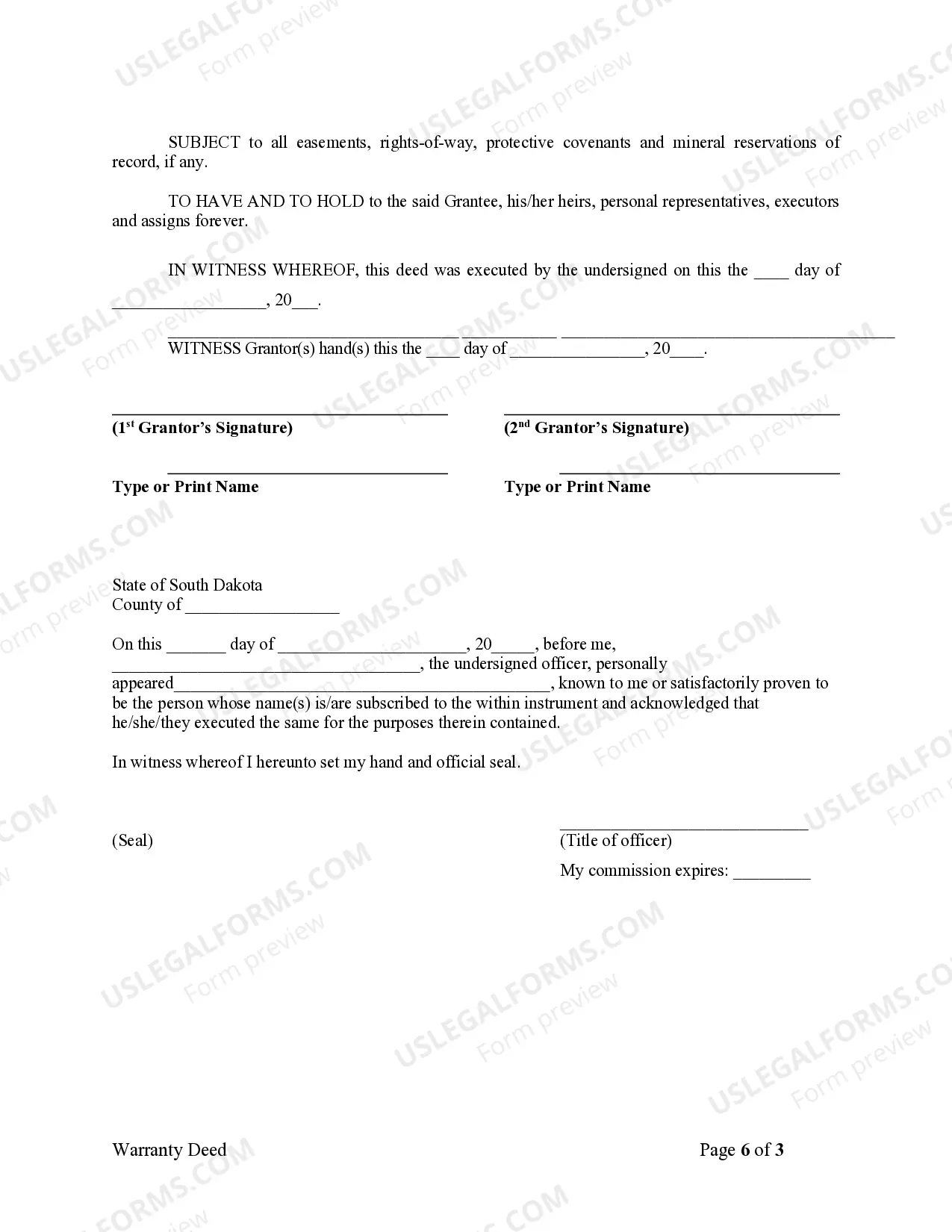

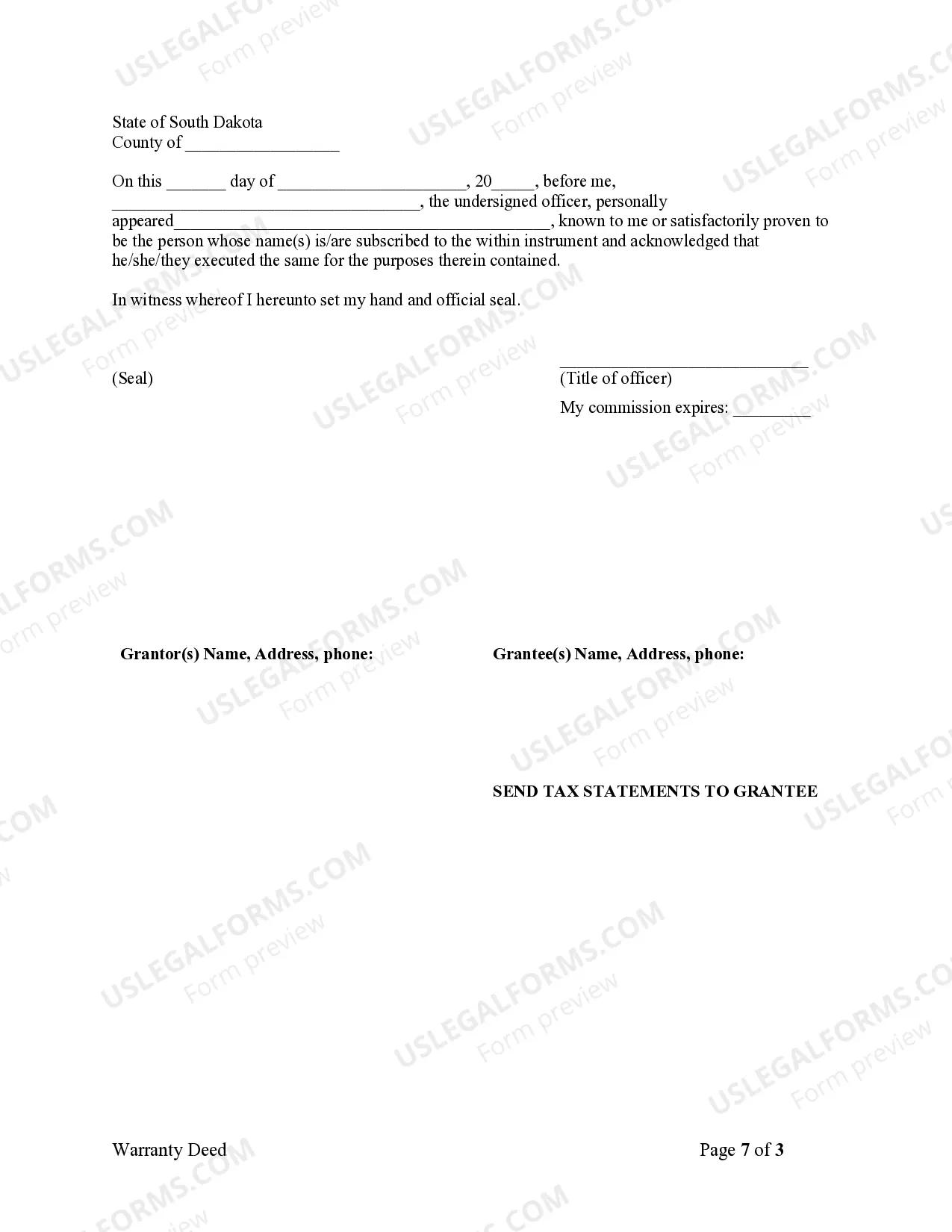

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

South Dakota Life Estate Form

Description life estate deed south dakota

How to fill out South Dakota Life Estate Form?

Individuals often link legal documentation with complexity that is only manageable by an expert.

In a sense, this is accurate, as formulating the South Dakota Life Estate Form demands considerable knowledge in relevant areas, encompassing state and county laws.

However, with US Legal Forms, the process has been simplified: pre-designed legal templates for various life and business scenarios tailored to state legislation are gathered in one online repository and are now accessible to everyone.

All templates in our catalog are reusable: once purchased, they remain in your account. You can access them whenever necessary through the My documents tab. Discover all the benefits of utilizing the US Legal Forms service. Subscribe today!

- Examine the page content thoroughly to ensure it meets your requirements.

- Review the form description or view it through the Preview option.

- Find another example using the Search bar in the header if the previous one does not fit your needs.

- Click Buy Now when you identify the appropriate South Dakota Life Estate Form.

- Select the pricing plan that matches your requirements and financial capacity.

- Create an account or Log In to continue to the payment section.

- Complete your subscription payment via PayPal or with your credit card.

- Select the format for your document and click Download.

- Print your file or upload it to an online editor for quicker completion.

Form popularity

FAQ

The main negatives of a life estate include limited control over the property and potential tax implications for the remainder beneficiaries. Changes in laws or personal circumstances could also create complications. To navigate these challenges effectively, employing a South Dakota life estate form can provide clarity and guidance.

In a life estate, the life tenant has the right to use and occupy the property for their lifetime. However, they must maintain the property and cannot significantly change it without permission from the remainder beneficiaries. A South Dakota life estate form clearly outlines these responsibilities, ensuring all parties understand their roles.

People create life estates primarily for estate planning purposes. This setup allows them to retain rights to live in the property while transferring ownership to heirs, avoiding probate. Utilizing a South Dakota life estate form can help streamline this process, making it easier to achieve your estate planning goals.

Selling a home with a life estate deed can be complicated. While the person holding the life estate can live there, they typically cannot sell the property without the consent of the remainder beneficiaries. To navigate these waters, refer to a South Dakota life estate form, which clarifies rights and procedures.

One disadvantage of a life estate deed is that it restricts your ability to make changes to the property without consent from the remainder beneficiaries. Additionally, the value of the property could affect your eligibility for certain financial assistance programs. Considering these factors, it's wise to use a South Dakota life estate form, which guides you through these complexities.

To create a life estate, you typically need clear language indicating your intention. You must state your desire to transfer the property to another party for their lifetime, while retaining certain rights for yourself. Using a South Dakota life estate form can simplify this process and ensure compliance with state laws.

The various forms of life estates include transfer-on-death deeds and traditional life estates. Transfer-on-death deeds allow property owners to pass their assets directly to beneficiaries upon death. In contrast, traditional life estates grant usage rights during the owner's lifetime. To ensure proper documentation, consider a South Dakota life estate form tailored to your specific needs.

A qualified life estate is a specific arrangement that allows individuals to enjoy certain tax benefits and protections. This type of estate ensures that the owner can maintain the property during their lifetime, with stipulations on the transfer of ownership afterward. Understanding qualified life estates is vital when planning your estate. For clarity, South Dakota life estate forms can simplify this process.

Another name for a life estate is a 'life interest.' This term highlights the right of an individual to use a property for their lifetime, but not beyond. Understanding the terminology can clarify your options when dealing with property transfers. Utilizing a South Dakota life estate form can help you set this up effectively.

If you are considering alternatives to a life estate, options abound. Trusts, jointly owning property, and retaining full ownership are common choices. Each of these alternatives has unique benefits and implications, so understanding them is crucial. Using a South Dakota life estate form might still be your best choice depending on your specific circumstances.