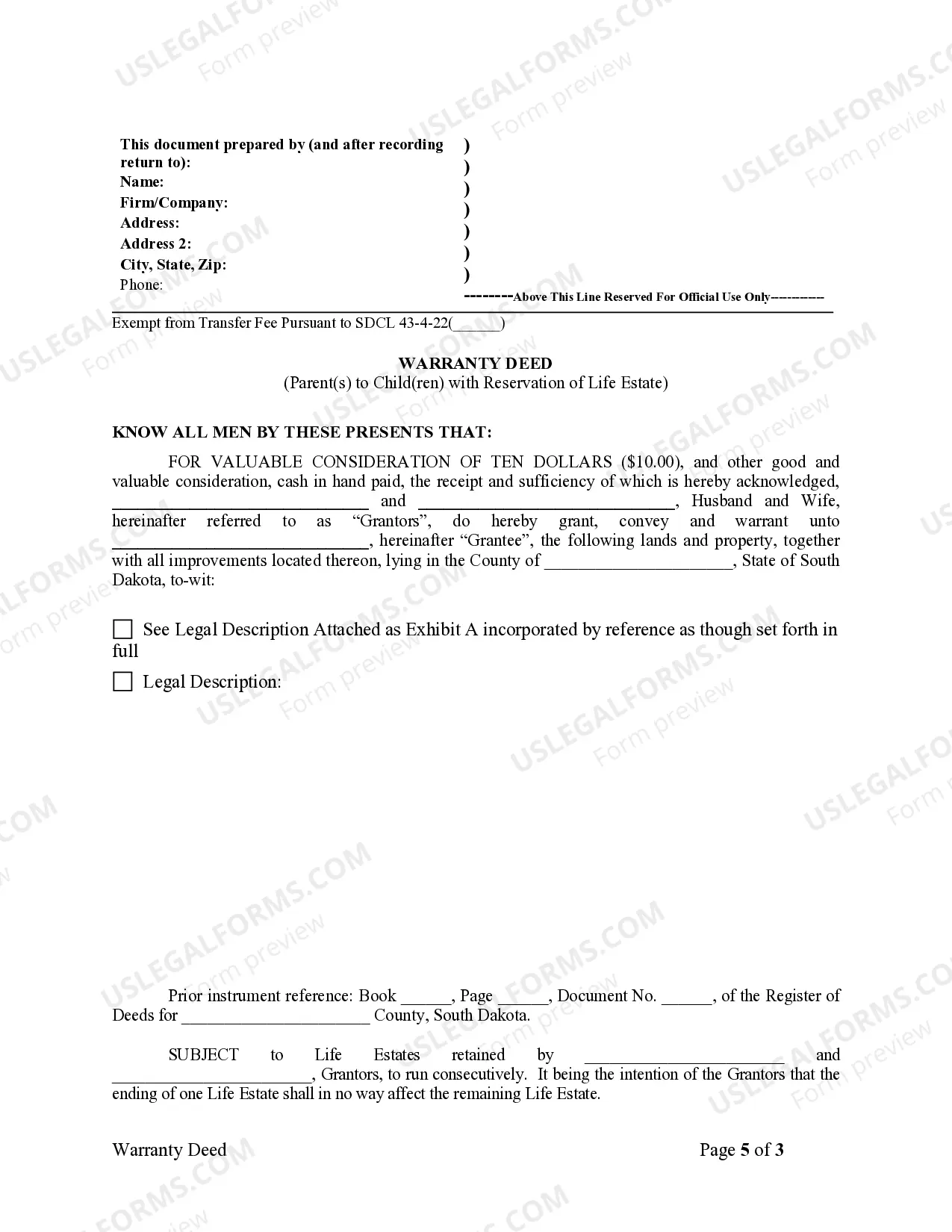

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

South Dakota Life Estate Withholding Form

Description

How to fill out South Dakota Life Estate Withholding Form?

No matter if you deal with documents frequently or only need to send a legal paper occasionally, it is essential to have a reliable source where all the examples are pertinent and current.

One thing you must do with a South Dakota Life Estate Withholding Form is ensure that you are using its latest version, as it determines whether it can be submitted.

If you want to make your search for the most recent document samples easier, look for them on US Legal Forms.

You will not need to spend time searching for the right template or verifying its validity. To acquire a form without creating an account, follow these steps: Use the search menu to locate the form you want. Review the preview and description of the South Dakota Life Estate Withholding Form to confirm it is the one you need. After ensuring the form is correct, simply click Buy Now. Choose a subscription plan that suits you. Sign up for an account or Log In to your current one. Provide your credit card details or PayPal account to finalize the purchase. Select the download file format and confirm it. Say goodbye to confusion when managing legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents featuring nearly any sample document you can imagine.

- Search for the forms you require, immediately check their relevance, and learn more about their applications.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Retrieve the South Dakota Life Estate Withholding Form samples in just a few clicks and save them at any time in your profile.

- A US Legal Forms profile will assist you in accessing all the documents you need with ease and minimal hassle.

- Simply click Log In in the website's header and navigate to the My documents section with all the necessary forms at your disposal.

Form popularity

FAQ

Selling a home with a life estate deed is possible, but it requires cooperation from the remainderman. Since you do not have full ownership, you need to negotiate the terms with the person who will inherit the property after your death. Always consider utilizing the South Dakota life estate withholding form for a clear and effective transfer of rights.

To relinquish a life estate, you generally need to execute a new deed that clearly transfers your interest in the property. This process might involve using the South Dakota life estate withholding form, which can help in formalizing the change of ownership. Consulting a legal professional can simplify this process and ensure all necessary steps are followed.

One downside of a life estate is that it limits your ability to sell or mortgage the property without involving the remainderman, the person who will inherit the property after your death. Additionally, your creditors may have access to the property during your lifetime. It's important to consider these factors, especially when filling out your South Dakota life estate withholding form.

Yes, you can leave a life estate in your will. This means that specific property passes to a person or group of people who will own it after your death, while you retain the right to live in the property until then. Be sure to use the South Dakota life estate withholding form to ensure proper legal documentation and clarity in your intentions.

Yes, South Dakota offers property tax breaks for seniors aged 65 and older under certain conditions. This program helps reduce the tax burden for qualifying seniors. For a detailed understanding of how to apply for these benefits, you can refer to the South Dakota life estate withholding form to ensure you receive any available reductions.

In South Dakota, your paycheck will typically reflect federal income tax, Social Security, and Medicare taxes. Additionally, state withholding tax is also deducted. Understanding these withholdings can be simplified with the help of the South Dakota life estate withholding form to ensure you account for all deductions.

Many states require state tax withholding, and South Dakota is one of them. However, not all states have the same requirements, so it's essential to check each state's rules. If you're looking to set up your taxes correctly, the South Dakota life estate withholding form can assist you in following the local tax laws.

Yes, South Dakota imposes a state withholding tax on income earned by residents. Employers deduct this tax from employee wages before payment is made. For individuals unsure about their tax liabilities, the South Dakota life estate withholding form offers a simple solution to manage their withholding.

In South Dakota, you may qualify for a property tax exemption at age 65. This exemption is available for seniors who meet specific income criteria. To navigate these requirements, consider using the South Dakota life estate withholding form to ensure you apply correctly and receive any breaks available.

Yes, if the life estate generates income, it may be required to file a tax return. The income is typically reported using the grantor's tax identification number. By understanding your responsibilities, including those associated with the South Dakota life estate withholding form, you can better navigate the tax implications.