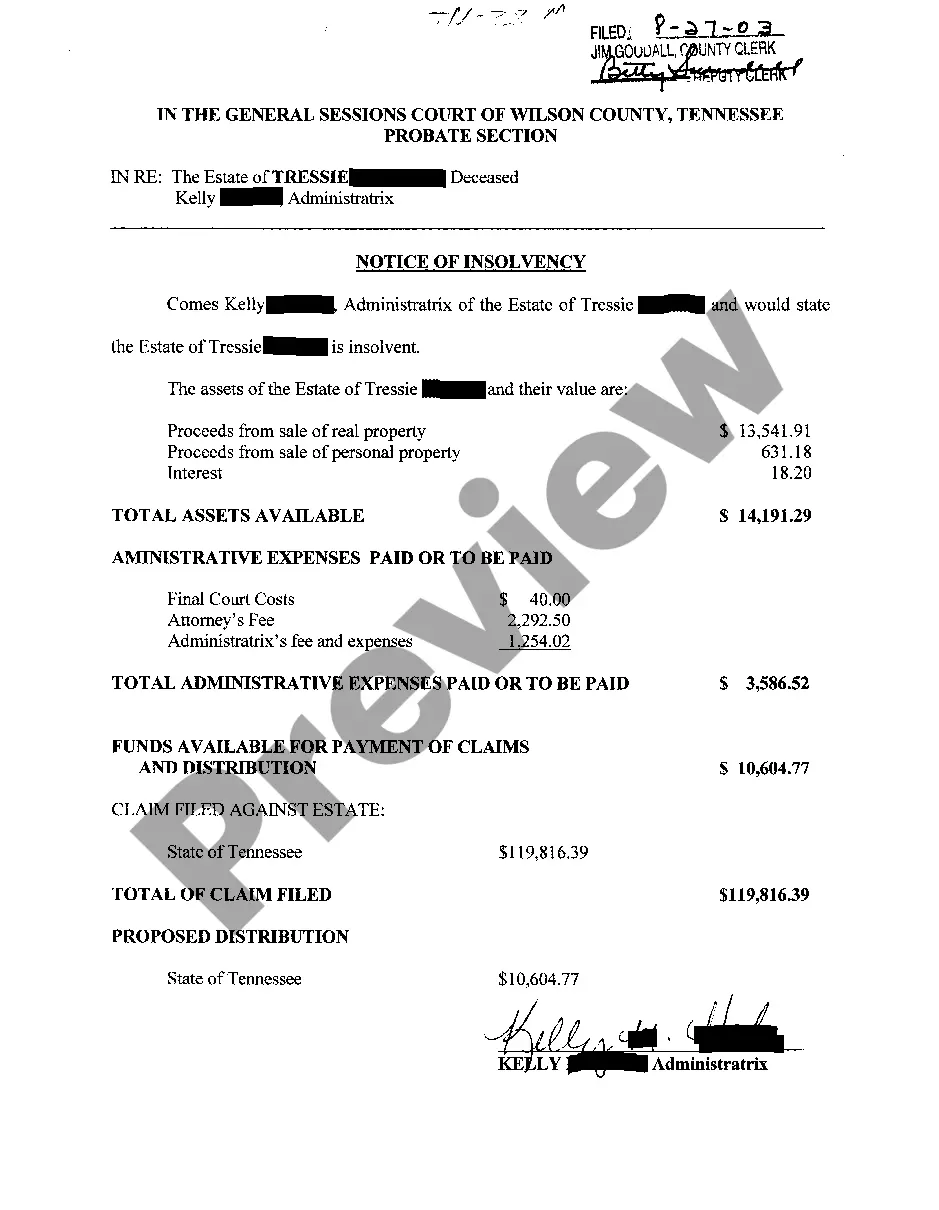

IRS Form 982 is a crucial document for individuals seeking debt relief or experiencing certain financial hardships. In simple terms, Form 982 allows taxpayers to exclude canceled debt from their taxable income. It is important to understand the different types of IRS Form 982 for dummies, as they cater to specific situations. Let's delve into the details! 1. Form 982 for Mortgage Debt Forgiveness: When individuals have their mortgage debt forgiven by lenders, it is typically considered taxable income. However, using IRS Form 982, taxpayers can exclude this canceled debt from their taxable income, avoiding a hefty tax bill. 2. Form 982 for Insolvency: Insolvency occurs when a person's liabilities exceed their assets. In such cases, the canceled debt can be excluded using IRS Form 982. This form serves as a shield against potential tax liabilities that arise from forgiven debts due to insolvency. 3. Form 982 for Bankruptcy: In situations where an individual goes through bankruptcy proceedings and has debts discharged, IRS Form 982 can prove incredibly beneficial. By utilizing this form, taxpayers can exclude canceled debts arising from bankruptcy, ensuring they do not face additional tax burdens. 4. Form 982 for Qualified Farm Indebtedness: Farmers who have their qualified farm debts canceled can exclude the forgiven amount from their taxable income using IRS Form 982. This provision assists struggling farmers, relieving them from potential tax consequences of canceled qualified farm debt. 5. Form 982 for Qualified Real Property Business Indebtedness: For individuals engaged in real property businesses who experience canceled qualified business debt, Form 982 comes to their rescue. This form enables taxpayers to exclude the canceled debt from their taxable income, providing necessary relief during financially challenging times. Understanding these various forms of IRS Form 982 for dummies is crucial for individuals seeking debt forgiveness or facing financial hardship. By utilizing the correct form according to their specific situation, taxpayers can avoid unnecessary tax burdens on canceled debts. It is always advisable to seek professional tax advice or consult IRS guidelines to ensure accurate completion of Form 982 and maximize its benefits.

Irs Form 982 For Dummies

Description

How to fill out Irs Form 982 For Dummies?

Dealing with legal documents and procedures could be a time-consuming addition to the day. Irs Form 982 For Dummies and forms like it typically need you to search for them and navigate the best way to complete them properly. For that reason, regardless if you are taking care of financial, legal, or individual matters, using a thorough and practical online library of forms at your fingertips will greatly assist.

US Legal Forms is the top online platform of legal templates, boasting over 85,000 state-specific forms and numerous tools to assist you complete your documents effortlessly. Check out the library of appropriate papers accessible to you with just one click.

US Legal Forms offers you state- and county-specific forms offered at any time for downloading. Protect your papers management operations using a high quality service that allows you to put together any form within a few minutes with no extra or hidden cost. Just log in in your profile, find Irs Form 982 For Dummies and acquire it right away in the My Forms tab. You can also access formerly downloaded forms.

Could it be your first time utilizing US Legal Forms? Sign up and set up an account in a few minutes and you’ll gain access to the form library and Irs Form 982 For Dummies. Then, follow the steps listed below to complete your form:

- Be sure you have discovered the correct form by using the Preview feature and looking at the form information.

- Select Buy Now once ready, and select the monthly subscription plan that is right for you.

- Select Download then complete, eSign, and print the form.

US Legal Forms has 25 years of experience assisting consumers control their legal documents. Get the form you want today and improve any process without having to break a sweat.

Form popularity

FAQ

Contents of a termination of lease letter Your name and the landlord's name and address. The date you're writing the letter. Informing the landlord you're breaking your lease early. The reason why you're breaking your lease. The building and apartment you're vacating. The date by which you're vacating.

If one co-tenant is leaving in a periodic term, they can end their own tenancy under a periodic agreement by giving a 21- day termination notice to the landlord and each other co-tenant. Once they vacate the premises by the date in the notice, they are no longer a tenant under the agreement.

?I am giving 1 month's notice to end my tenancy, as required by law. I will be leaving the property on (date xx). I would like you to be at the property on the day I move out to check the premises and for me to return the keys. I also need you to return my tenancy deposit of (state amount).?

Provide a written request: Prepare a formal written request to remove a name from the lease. In the letter, explain the reasons for the request and provide any supporting documentation, such as a signed agreement from the remaining tenant or proof of a terminated relationship.

If a co-tenant leaves during the tenancy, they will need to get their share of the bond from the tenant moving in, or those remaining. They must also complete a Change of bond contributors (Form 6), and lodge it with the RTA. If all the tenants move out they need to complete a Refund of rental bond (Form 4).

Termination of lease letter The date of the letter. The name and address of the tenant. A request that the tenant vacate by a specific date. The reason for termination. A reference to the lease clause that permits you to end the lease. The date you want to do a walk-through inspection.

Notice can be hand delivery to the tenant or resident that is at least 18 years old. The tenant or resident must sign and date the notice confirming that they have received it. Notice can be posted on the tenant's door. If posting on the door, landlord must also send out a copy by certified mail and regular mail.

In Iowa, a lease that goes from month to month may be ended by either party. This would be done when one gives the other a thirty day written notice. In Iowa, no specific reason is required to end the lease that runs from month to month.