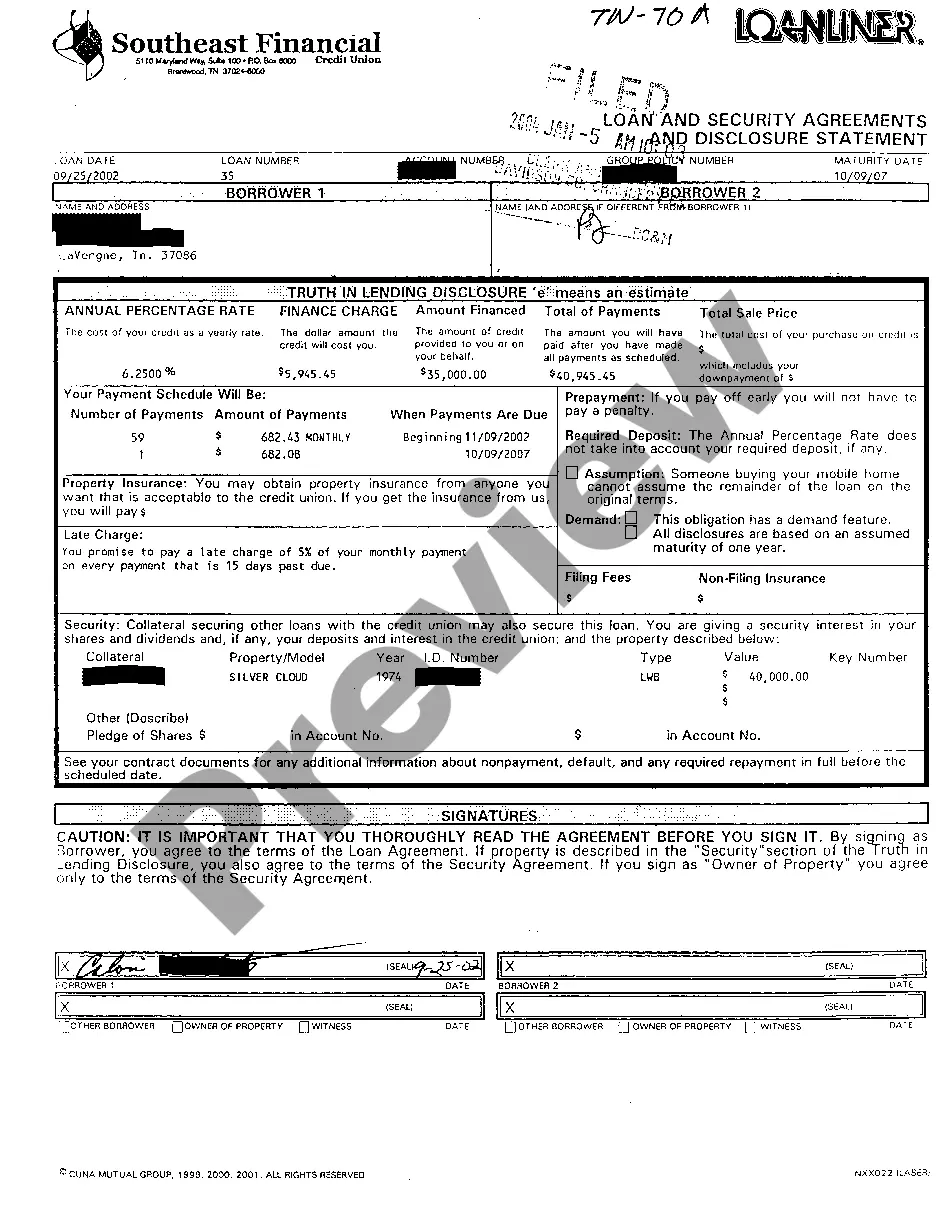

Vehicle Loan Agreement Form

Description loan agreement sample philippines

How to fill out Vehicle Loan Form?

There's no longer any justification to squander time searching for legal documents to meet your local state regulations.

US Legal Forms has compiled all of them in one location and enhanced their availability.

Our website offers over 85k templates for various business and personal legal situations organized by state and area of application.

Utilize the search field above to find another sample if the current one does not suit you.

- All forms are suitably drafted and verified for authenticity, so you can trust in receiving a current Vehicle Loan Agreement Form.

- If you are acquainted with our platform and already possess an account, ensure your subscription is valid before acquiring any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documents whenever required by accessing the My documents tab in your profile.

- If you have not engaged with our platform before, the procedure will require a few more steps to finalize.

- Here's how new users can find the Vehicle Loan Agreement Form in our catalog.

- Review the page content attentively to ensure it contains the sample you require.

- To do so, employ the form description and preview options if available.

guarantee of title auto Form popularity

car loan contract example Other Form Names

courtesy car agreement template FAQ

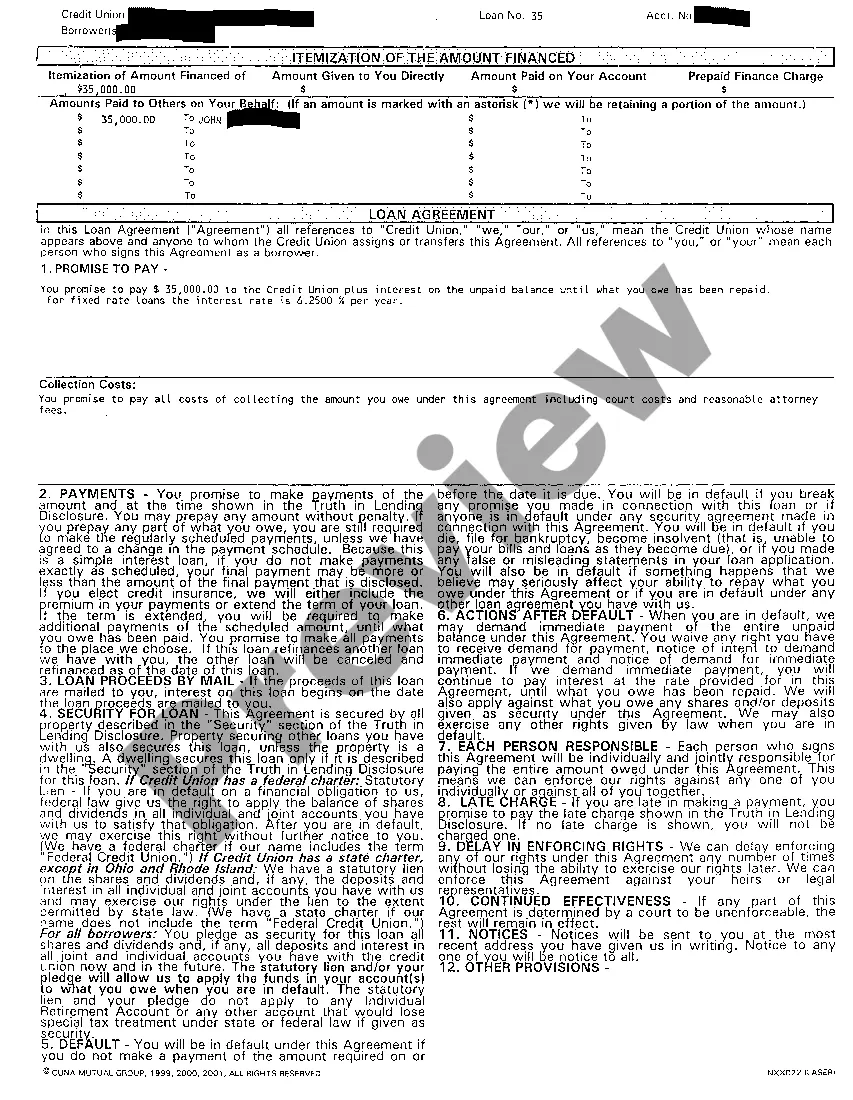

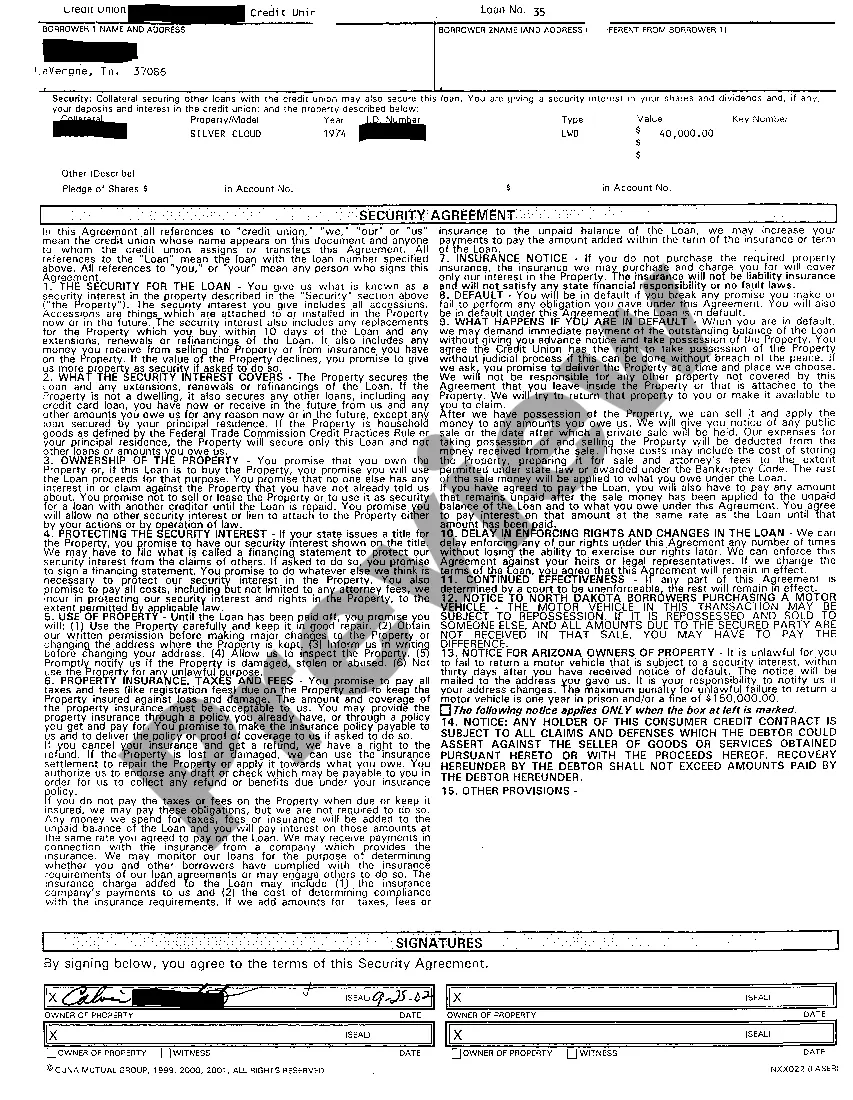

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

Common items in personal loan agreements.The name, address, and contact information of the borrower. The name, address, and contact information of the lender. A plan for loan payment, such as a monthly payment plan with start dates and due dates. The maturity date or the date that the final payment is due on the loan.

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

An Auto Loan Agreement is a contract used to secure the buyer of a motor vehicle to their legally-binding promise to pay back the full amount they borrowed in order to purchase a vehicle.