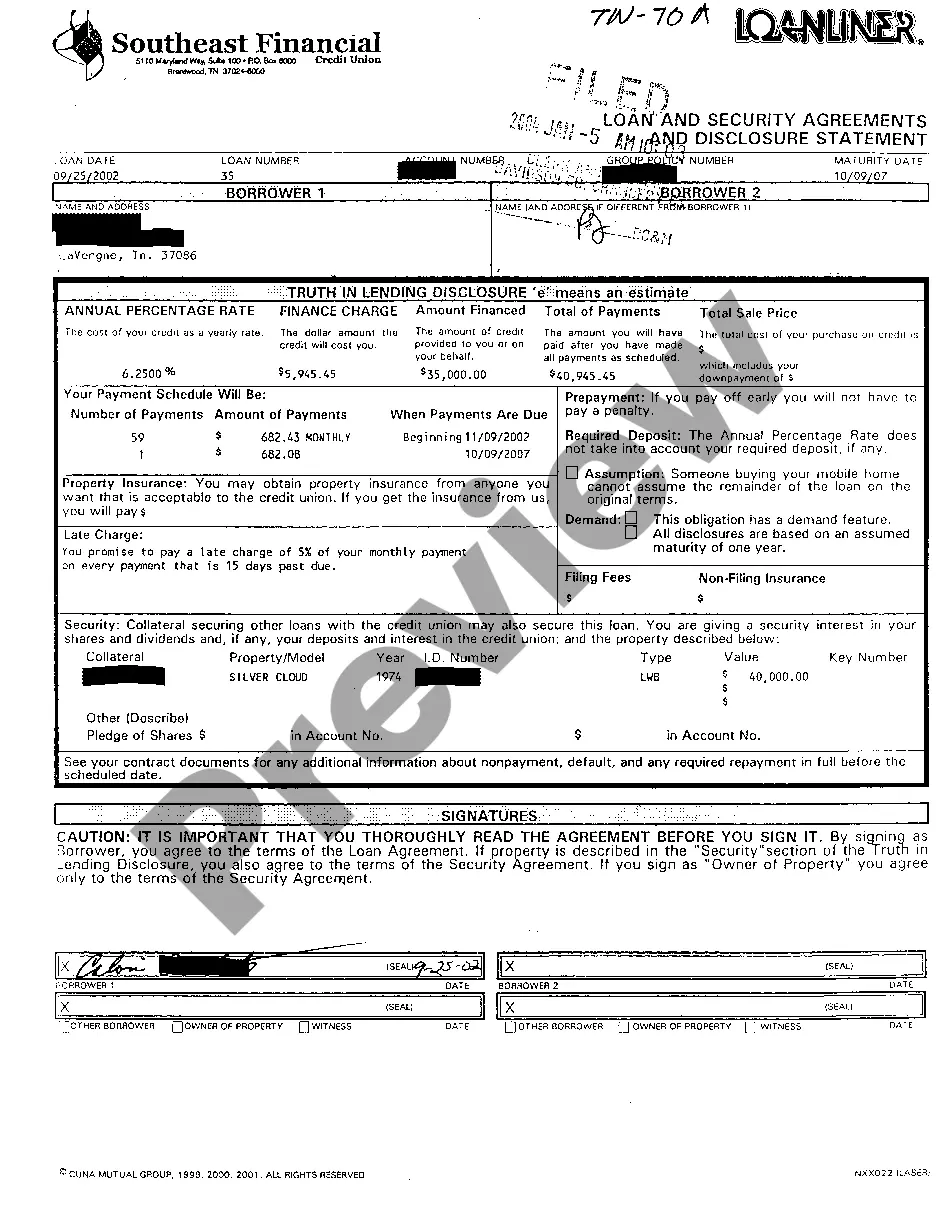

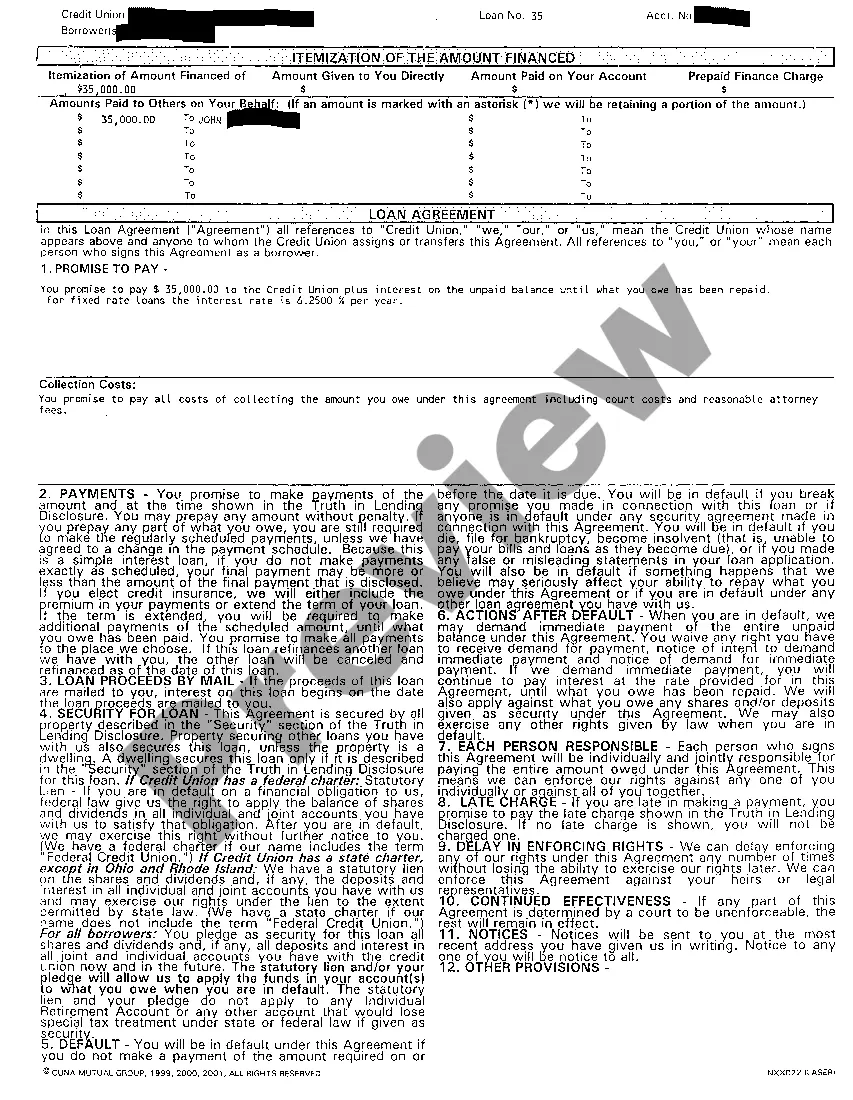

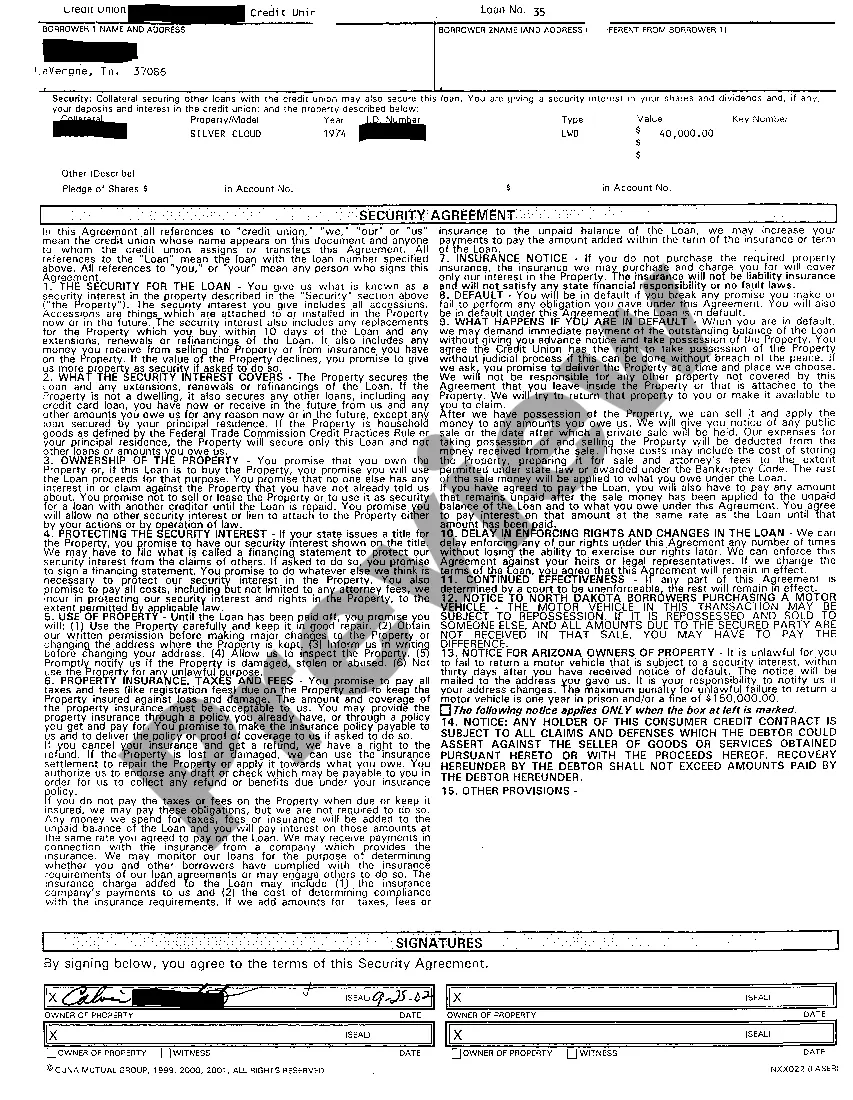

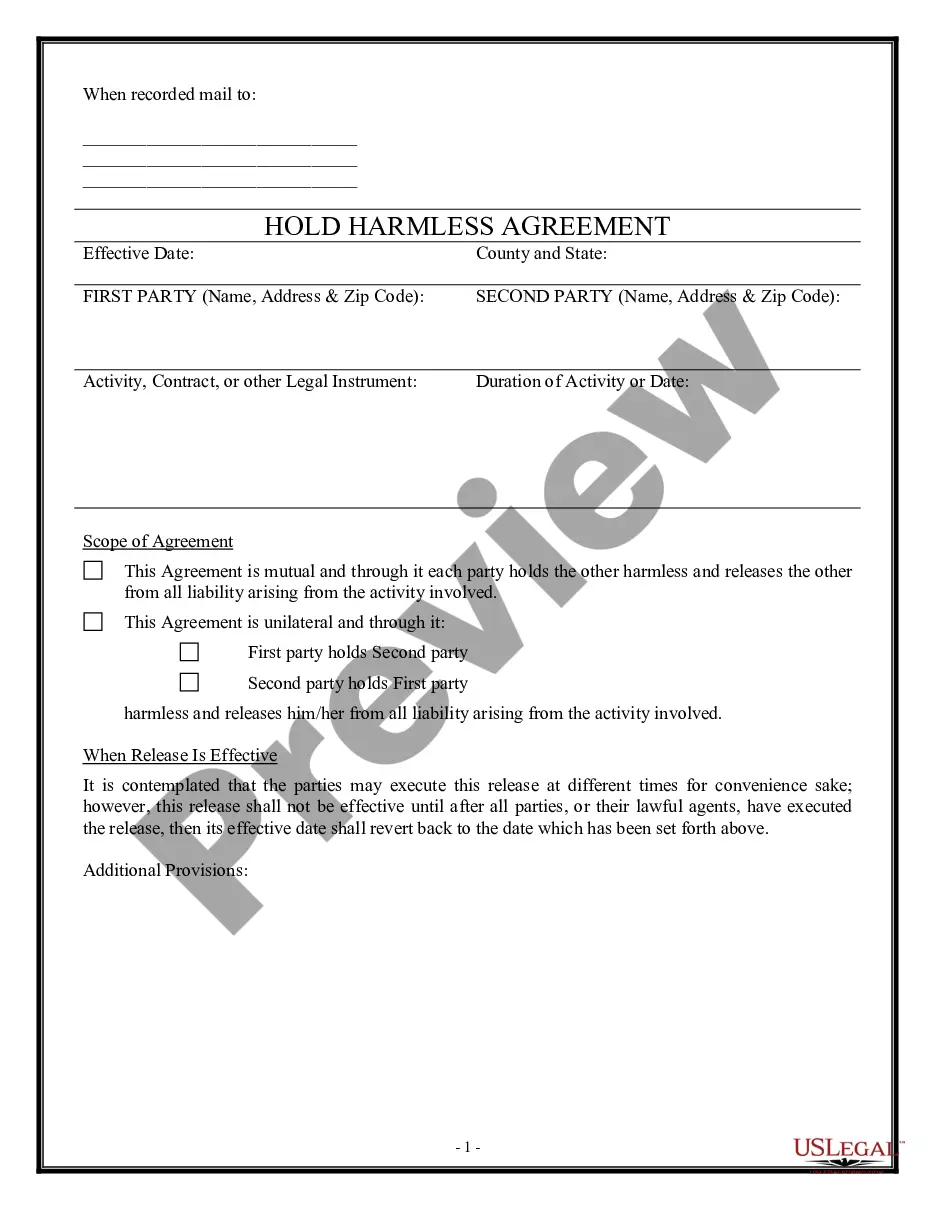

Vehicle Loan Agreement With Collateral

Description

How to fill out Tennessee Loan And Security Agreement?

Regardless of whether you regularly engage with documents or occasionally need to file a legal report, it's crucial to have a resource where all samples are connected and current.

The first step you need to take with a Vehicle Loan Agreement With Collateral is to ensure that you have the latest version, as it determines if it can be submitted.

If you want to streamline your search for the most recent document examples, consider looking for them on US Legal Forms.

Utilize the search feature to locate the form you need. Review the Vehicle Loan Agreement With Collateral preview and description to confirm it’s the specific document you seek. After verifying the form, just click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Enter your credit card information or PayPal account to finalize the purchase. Select the document format for download and confirm your choice. Say goodbye to the confusion of handling legal documents. All your templates will be orderly and authenticated with a US Legal Forms account.

- US Legal Forms is a repository of legal forms that encompasses nearly any document template you could desire.

- Look for the templates you require, assess their applicability instantly, and gather more information regarding their utilization.

- With US Legal Forms, you can access over 85,000 form templates across various sectors.

- Obtain the Vehicle Loan Agreement With Collateral samples in just a few clicks and store them in your profile at any time.

- A profile on US Legal Forms allows you to access all necessary samples with ease and minimal hassle.

- All you need to do is click Log In in the site header and navigate to the My documents section where all your required forms will be at your fingertips, saving you from spending time searching for the correct template or verifying its authenticity.

- To acquire a form without setting up an account, follow these steps.

Form popularity

FAQ

If a loan agreement includes collateral, it means that the borrower has agreed to pledge certain assets as security for the loan. In the event the borrower defaults and does not uphold his or her agreement to repay the loan amount plus interest, the lender gets to keep the pledged collateral.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

However, to use an item you own as collateral on a secured loan, you must have equity in it. Equity is the difference between the value of the collateral and what you still owe on it. For example, if your car's resale value is $6,000 but you still owe $2,500 on your car loan, you have $3,500 of equity in your vehicle.

When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts.

It is possible to use your car as collateral on a loan. This means you offer up the car as security so if you default on the loan, the lender can take the car to help compensate for its financial loss. To use your car as collateral, you must have equity in the vehicle.