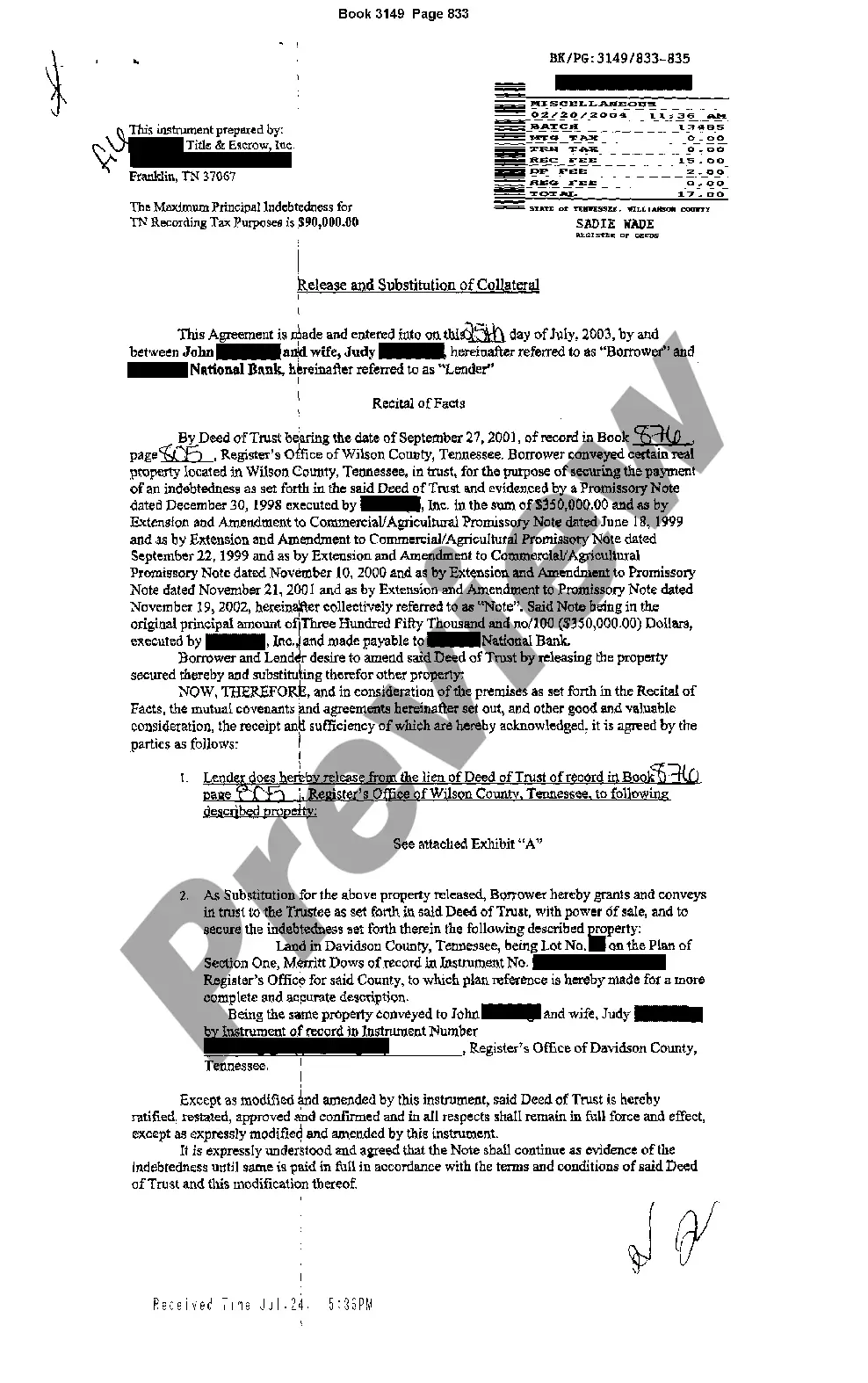

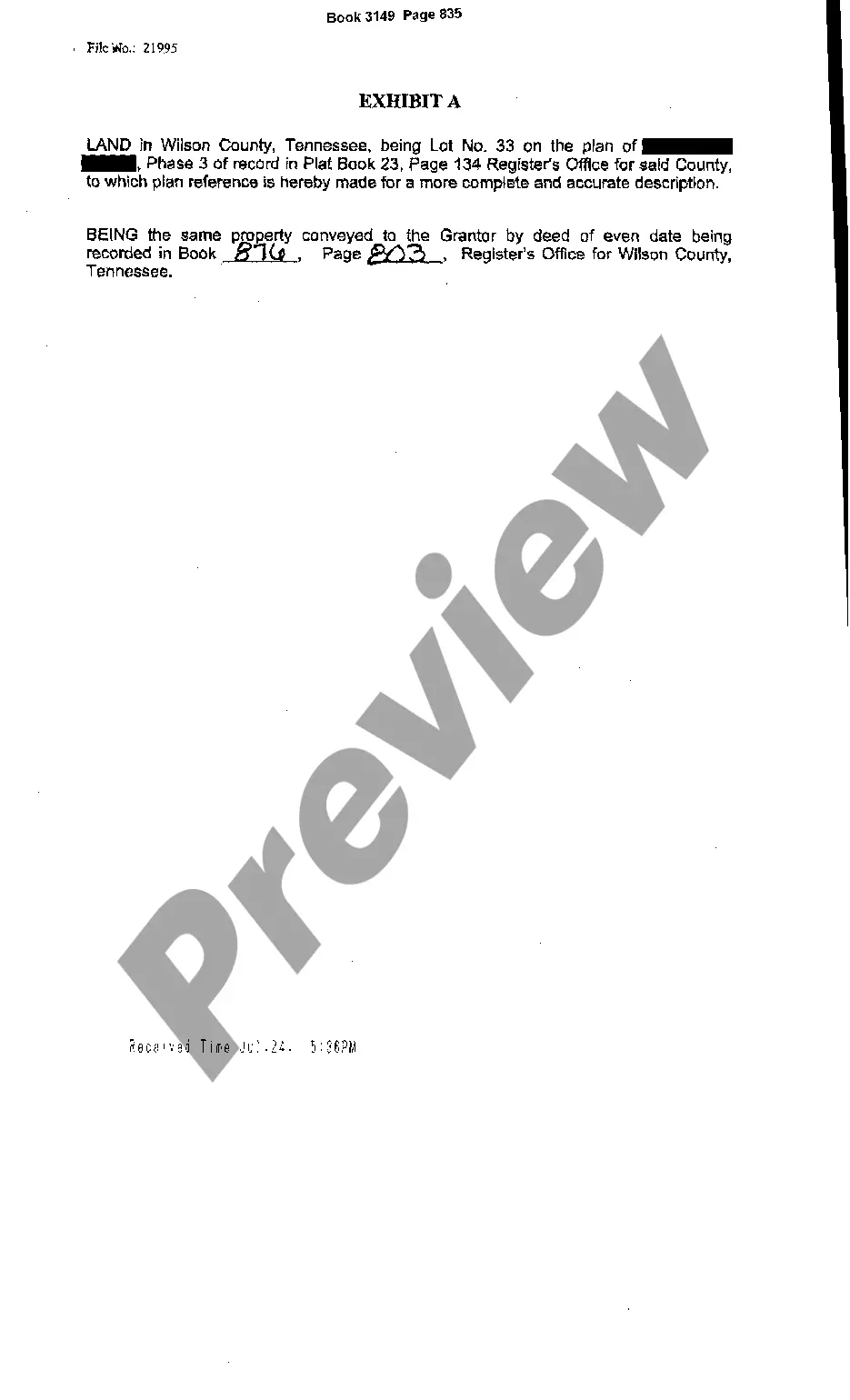

Substitution of Collateral Auto Form with Loan The Substitution of Collateral Auto Form with Loan is a legal document that allows borrowers to replace the original collateral of an auto loan with a new collateral asset. This form is typically used when the original collateral, which was pledged as security for the loan, is no longer feasible or has depreciated significantly. By completing this form, borrowers can offer an alternative collateral asset to secure the loan. Keywords: Substitution of collateral, auto loan, legal document, collateral asset, borrower, security, loan agreement. Types of Substitution of collateral auto forms with a loan: 1. Vehicle Replacement Form: This type of form is used when borrowers wish to substitute the existing vehicle posted as collateral with a new vehicle. It involves providing the details of the original vehicle, such as make, model, year, and vehicle identification number (VIN). The borrower must also provide complete information about the replacement vehicle, including the purchase price and necessary identification details. 2. Property Collateral Substitution Form: Occasionally, borrowers may opt to substitute their original auto collateral with a property such as real estate. This type of form requires extensive documentation and assessment of the property's value. It includes details such as the property type, address, estimated value, and any existing liens or encumbrances. Additionally, borrowers may need to provide supporting documents like property deeds, titles, and valuation reports. 3. Cash Collateral Substitution Form: In some cases, borrowers may prefer to substitute their original vehicle collateral with a cash deposit. This form typically requires the borrower to provide details about the cash collateral, such as the amount, the financial institution holding it, and any associated account or reference numbers. The lender may require appropriate documentation to ensure the legitimacy of the cash deposit, such as bank statements or a letter from the financial institution. 4. Asset Collateral Substitution Form: This form is used when borrowers wish to substitute their original auto collateral with other valuable assets, such as jewelry, artwork, or valuable collectibles. It entails providing comprehensive details about the asset, including a description, estimated value, and supporting documentation like appraisals or certificates of authenticity. Substitution of collateral auto forms with loans provide flexibility to borrowers who wish to replace their original collateral with a more suitable alternative. These forms ensure that the lender's interest remains protected while accommodating changes in borrowers' circumstances or asset availability. Before initiating the substitution process, it is crucial for both parties to review and understand the terms of the loan agreement and any additional requirements specified by the lender.

Substitution Of Collateral Auto Form With Loan

Description

How to fill out Substitution Of Collateral Auto Form With Loan?

It’s obvious that you can’t become a law expert immediately, nor can you figure out how to quickly draft Substitution Of Collateral Auto Form With Loan without the need of a specialized background. Creating legal documents is a time-consuming process requiring a certain training and skills. So why not leave the creation of the Substitution Of Collateral Auto Form With Loan to the pros?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We know how crucial compliance and adherence to federal and local laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our website and obtain the form you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether Substitution Of Collateral Auto Form With Loan is what you’re searching for.

- Start your search again if you need any other form.

- Set up a free account and select a subscription option to buy the form.

- Choose Buy now. As soon as the transaction is complete, you can get the Substitution Of Collateral Auto Form With Loan, fill it out, print it, and send or mail it to the necessary individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

A collateral exchange refers to one vehicle being substituted for another vehicle for a customer. In most states, this agreement does not change any other aspect of the original Retail Installment Contract. Also, any payment history on the previous vehicle remains the same.

Using your car as collateral for a loan can be a double-edged sword, offering both benefits and drawbacks. While it can provide quick access to cash, especially for those with bad credit, it also carries risks, including high-interest rates and the potential loss of your vehicle if you can't repay the loan.

Under paragraph 10.2 of the confirmed Chapter 13 Plan (doc. __), Debtor has the option of substituting collateral by purchasing a replacement vehicle. Debtor states that the Substitute Collateral has a value equal to or greater than the balance currently owed to the Creditor on its allowed secured claim.

This substitution of collateral document is a standard form to replace collateral due to a need by the debtor to sell the collateral.

Auto loans are a type of debt that may involve collateral. In this type of loan, the vehicle generally serves as the collateral. If the borrower fails to repay the loan, the lender may be able to repossess the vehicle to recoup some of the money for the loan.