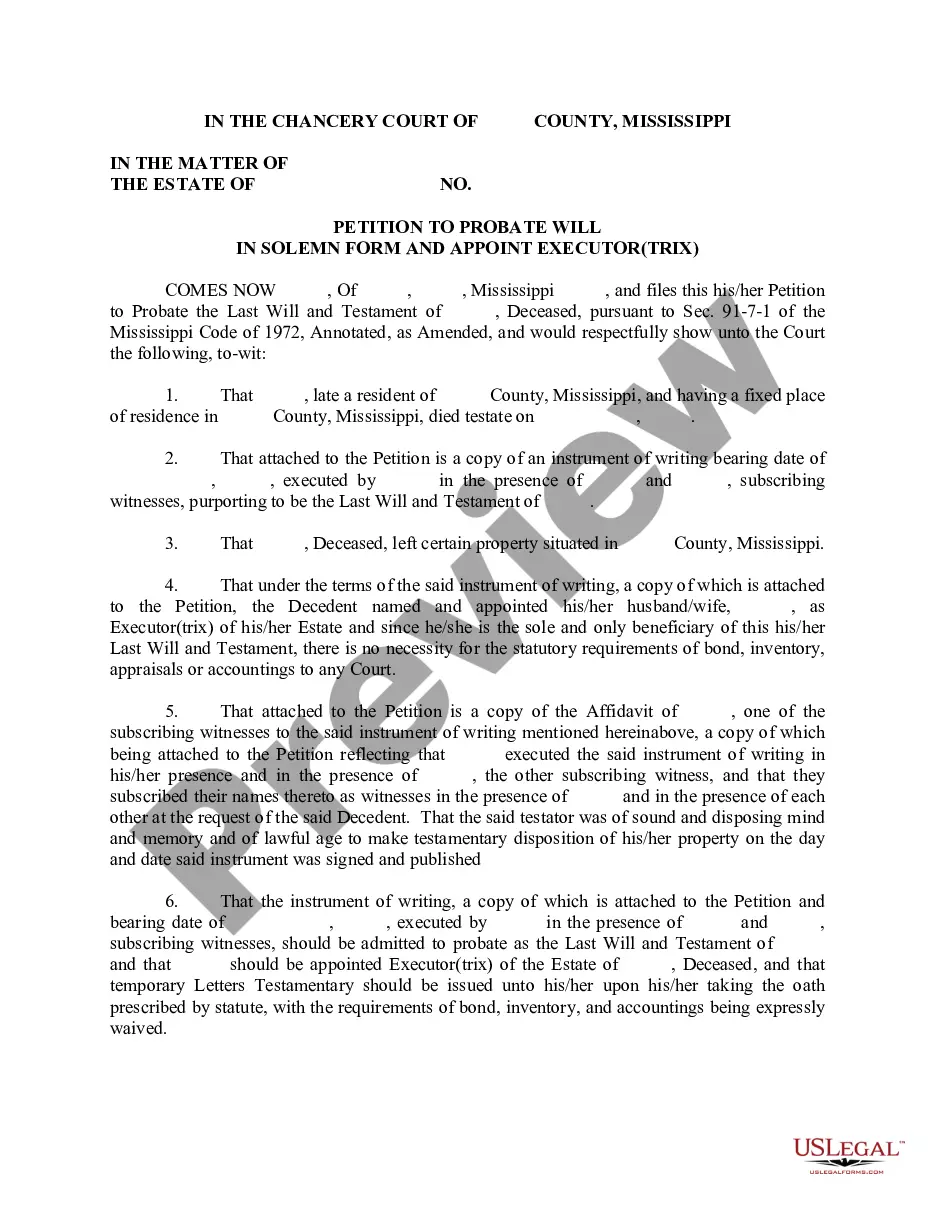

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Deed Of Sale With Assumption Of Mortgage For Car

Description

How to fill out Deed Of Sale With Assumption Of Mortgage For Car?

There's no longer a requirement to squander time searching for legal documents to comply with your local state guidelines.

US Legal Forms has gathered all of them in one location and simplified their access.

Our website offers over 85k templates for any business and personal legal situations categorized by state and area of application.

Utilize the Search field above to look for another template if the current one did not suit your needs.

- All forms are properly drafted and verified for legitimacy, so you can trust in obtaining a current Deed Of Sale With Assumption Of Mortgage For Car.

- If you are acquainted with our platform and already possess an account, ensure your subscription is valid before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time needed by accessing the My documents tab in your profile.

- If you've never interacted with our platform before, the process will require some additional steps to complete.

- Here's how new users can locate the Deed Of Sale With Assumption Of Mortgage For Car in our library.

- Examine the page content thoroughly to ensure it contains the sample you need.

- To do so, use the form description and preview options if available.

Form popularity

FAQ

While a deed of sale can be created without notarization in the Philippines, having it notarized adds a level of legal credibility. Without a notary, it may be harder to prove the validity of the deed in court if disputes arise later. For transactions involving significant assets, like a car or motorcycle and especially when involving a deed of sale with assumption of mortgage for car, it is highly recommended to obtain notarization for protection.

Creating a deed of sale for a car in the Philippines requires specific documents including a valid ID of both the seller and the buyer, a copy of the vehicle registration, and the original certificate of ownership. Additionally, the deed must include details about the car such as the make, model, and Vehicle Identification Number (VIN). Notarization of the document strengthens its legal standing, particularly in transactions that may involve a deed of sale with assumption of mortgage for car.

Processing a deed of sale in the Philippines involves a few critical steps. First, prepare the deed document by including the necessary information about the seller, buyer, and property being transferred, such as the car or motorcycle description. Then, have both parties sign the document in the presence of a notary, as this enhances its legal power. Make sure to secure relevant copies for future reference, especially if you're dealing with the deed of sale with assumption of mortgage for car.

To create a deed of sale for a motorcycle in the Philippines, start by gathering essential documents such as the vehicle registration, proof of ownership, and identification of both the seller and buyer. You will need to draft the deed, clearly stating the transaction terms. Once completed, it is advisable to have it signed by both parties and notarized to ensure it gains legal validity, especially when dealing with the deed of sale with assumption of mortgage for car.

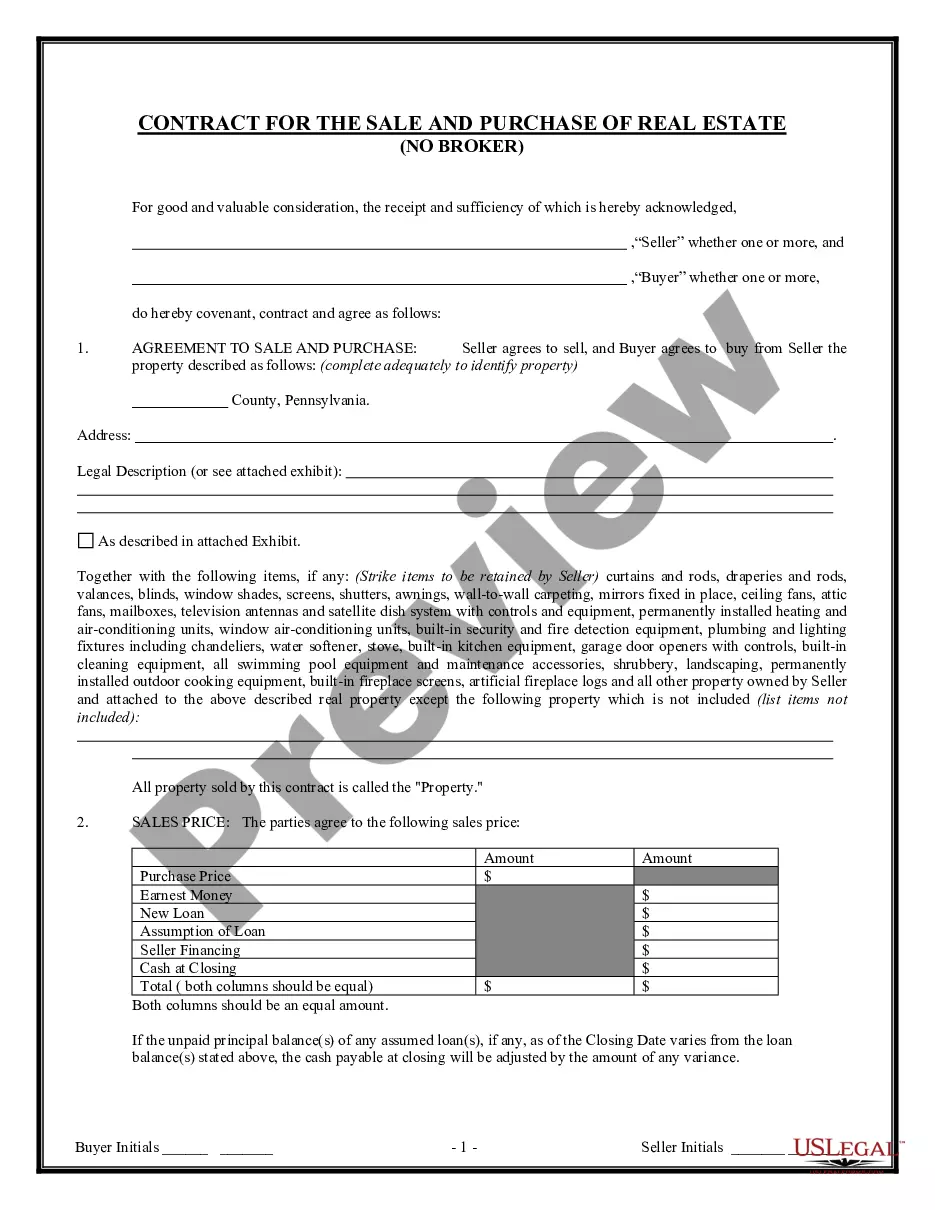

The conditions of a mortgage deed typically outline the obligations of the borrower and lender, including payment terms and interest rates. When dealing with a deed of sale with assumption of mortgage for car, the buyer takes on the responsibility of the remaining balance owed on the vehicle. It’s crucial to fully understand the terms laid out in the mortgage deed to avoid any complications after the sale occurs. For additional guidance, consider using platforms like uslegalforms that provide resources to streamline this process.

To transfer car ownership using an open deed of sale in the Philippines, start by ensuring the deed is properly signed by both parties involved. Next, obtain a photocopy of the original deed, along with the necessary documents, such as the vehicle's Certificate of Registration and the owner's valid ID. Finally, submit these documents to the Land Transportation Office (LTO) to complete the transfer process, ensuring you mention the deed of sale with assumption of mortgage for car during your application.

In the Philippines, the payment for a deed of sale with assumption of mortgage for car is usually shared between the buyer and the seller. Typically, the seller covers notarization fees, while the buyer may be responsible for other costs such as documentary stamp taxes. Understanding these financial obligations can simplify the transaction process, and our uslegalforms platform can provide clarity on who pays what.

You can obtain a copy of the deed of sale with assumption of mortgage for car from various sources. Typically, notaries public can provide copies after notarizing the document. Additionally, if you used our uslegalforms platform, you can access your completed transaction documents anytime, ensuring you have all necessary copies for your records.

To create a deed of sale with assumption of mortgage for car in the Philippines, you need several important documents. First, you must have the car’s original documents, including the Certificate of Registration and the Official Receipt. Additionally, both parties must provide valid identification, and it’s advisable to have a tax identification number (TIN) for tax purposes. Using our platform, you can find templates and guidance to ensure you meet all requirements.

Certain types of mortgages, such as those with due-on-sale clauses, typically cannot be assumed by a new buyer. These clauses enable lenders to call the full amount due if the property changes ownership. When engaging in a deed of sale with assumption of mortgage for car, always check for any restrictions in your mortgage agreement to avoid unexpected pitfalls.