Well-composed official documentation is one of the crucial assurances for preventing issues and legal disputes, but obtaining it without a lawyer's guidance might require time.

Whether you need to quickly obtain an updated Checklist Tennessee Withholding Form or any other documents for work, family, or business circumstances, US Legal Forms is always ready to assist.

The procedure is even easier for current users of the US Legal Forms library. If your subscription is active, you only need to Log In/">Log In to your account and click the Download button next to the chosen file. Furthermore, you can access the Checklist Tennessee Withholding Form anytime later, as all documents once acquired on the platform remain available under the My documents tab of your profile. Save both time and money on document preparation. Experience US Legal Forms today!

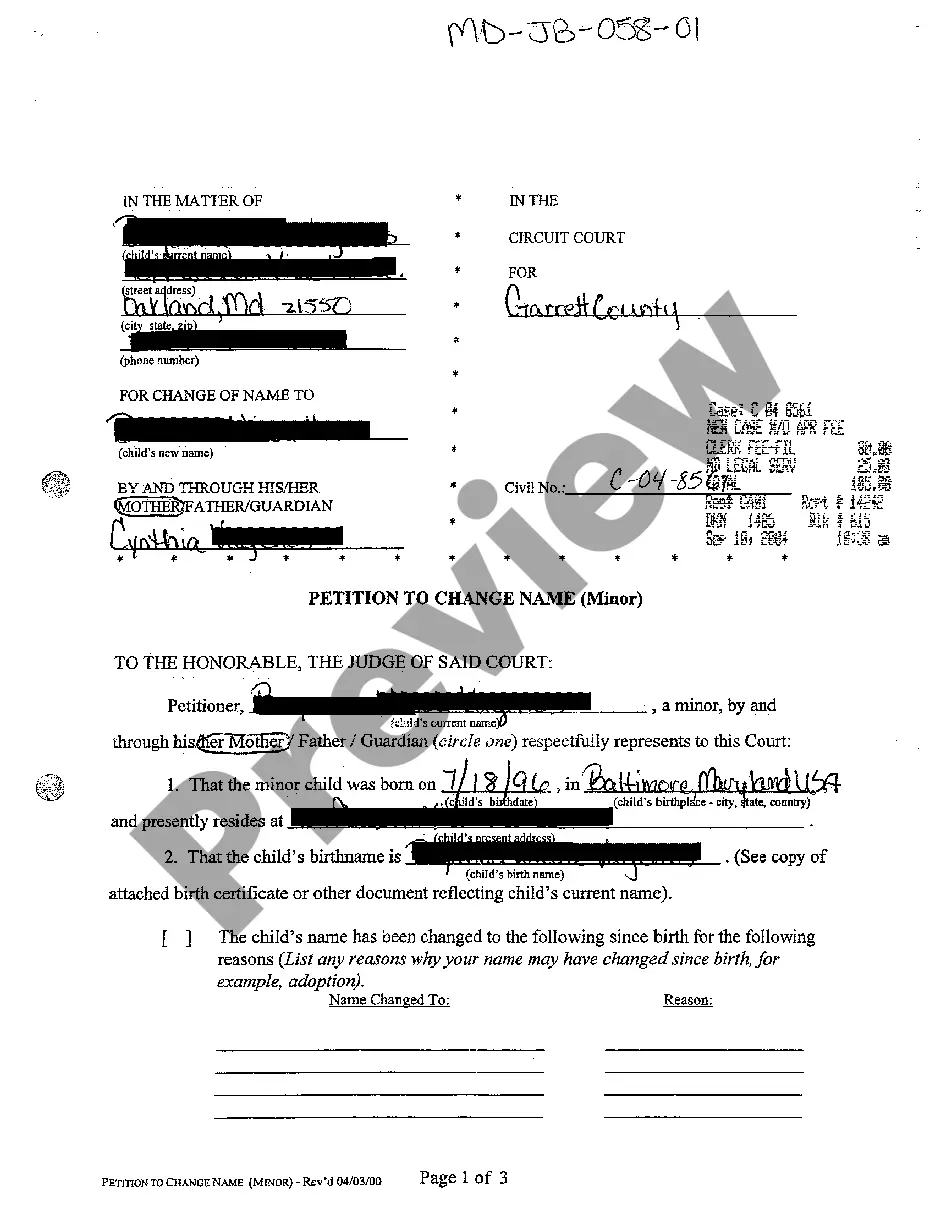

- Ensure that the form is appropriate for your situation and locale by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Press Buy Now once you locate the relevant template.

- Choose the pricing option, Log In/">Log Into your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Checklist Tennessee Withholding Form.

- Click Download, then print the document to complete it or incorporate it into an online editor.

8 million in tax preparation fees. When do I need to use a budget revision form?These are the most frequently requested U.S. Department of Labor forms. You can complete some forms online, while you can download and print all others. APPLICATION FOR EXEMPTION FRANCHISE AND EXCISE TAXES COMPLETE (State of Tennessee). TNTAP Checklist for Motor Carrier (State of Tennessee). All PERS forms are available for print, to download, or to have mailed to you. The kind of income tax you will owe depends on the type of Tennessee business that you own. Learn about tax withholding obligations for employees working in multiple states.