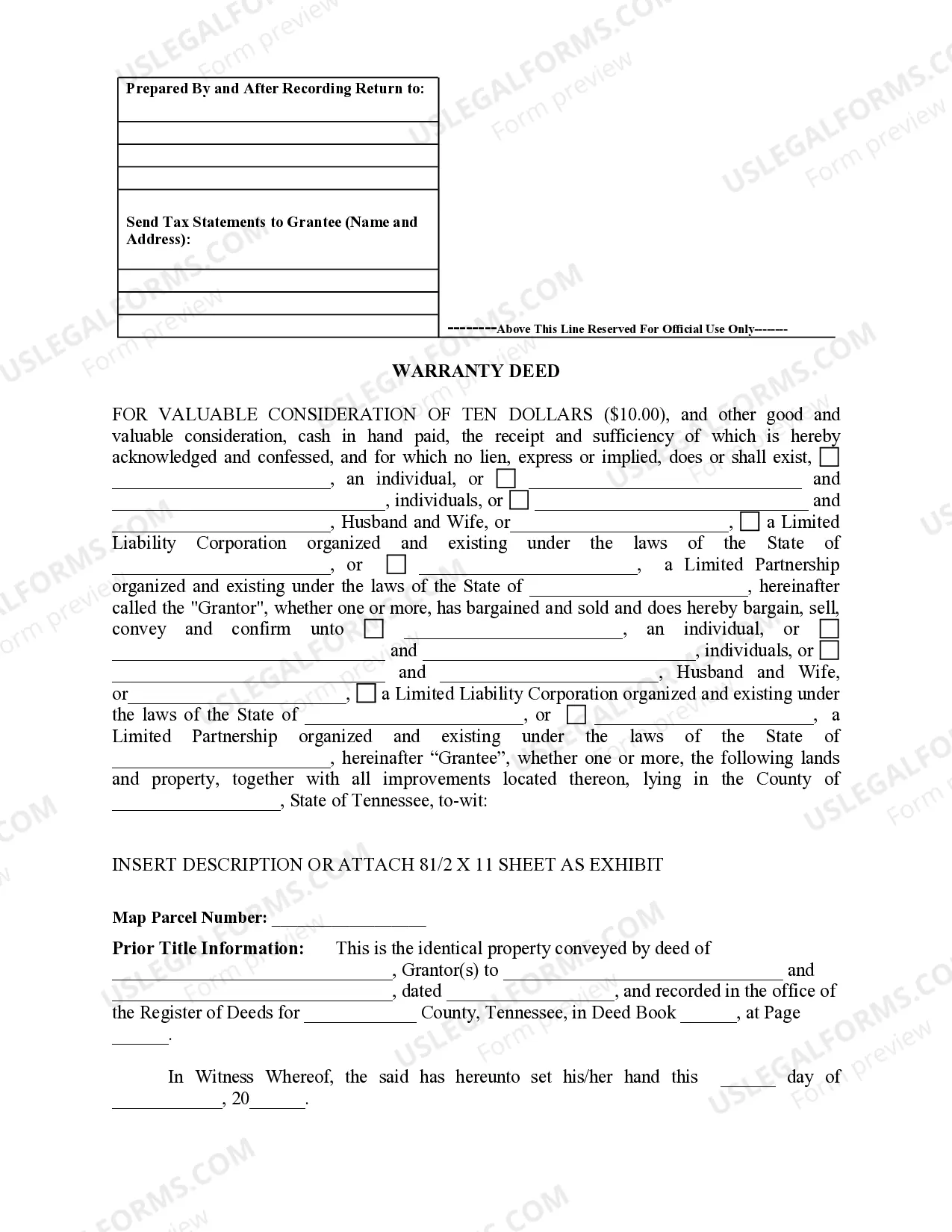

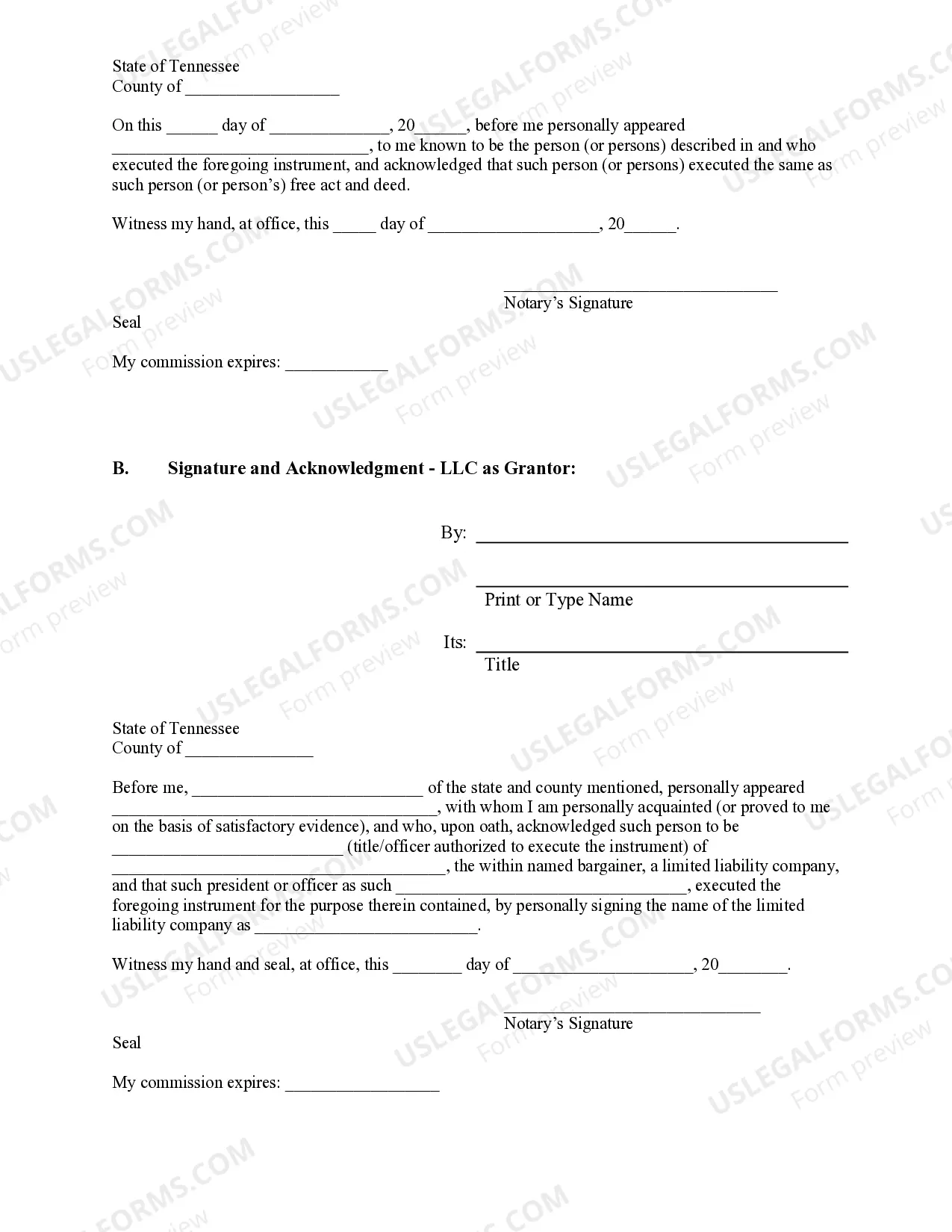

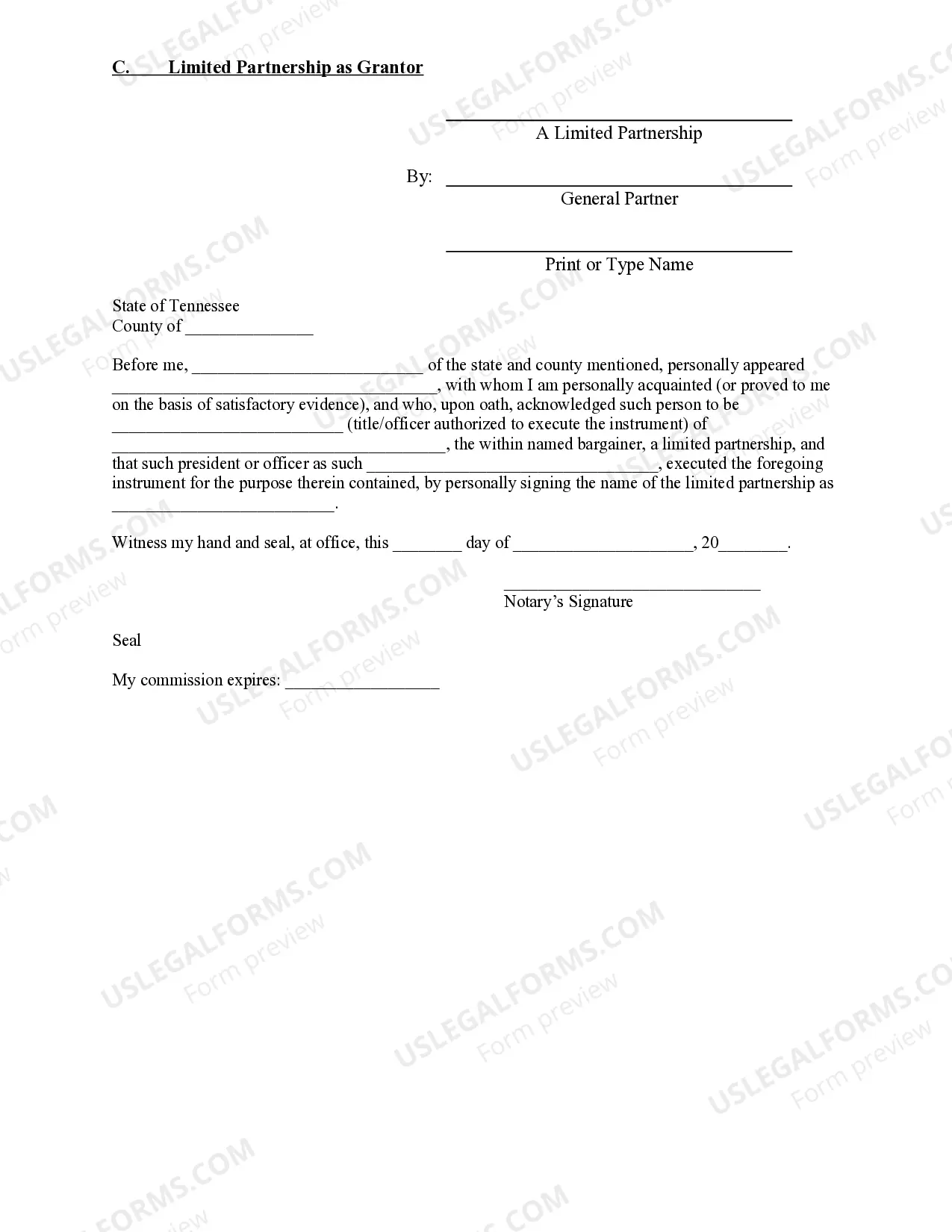

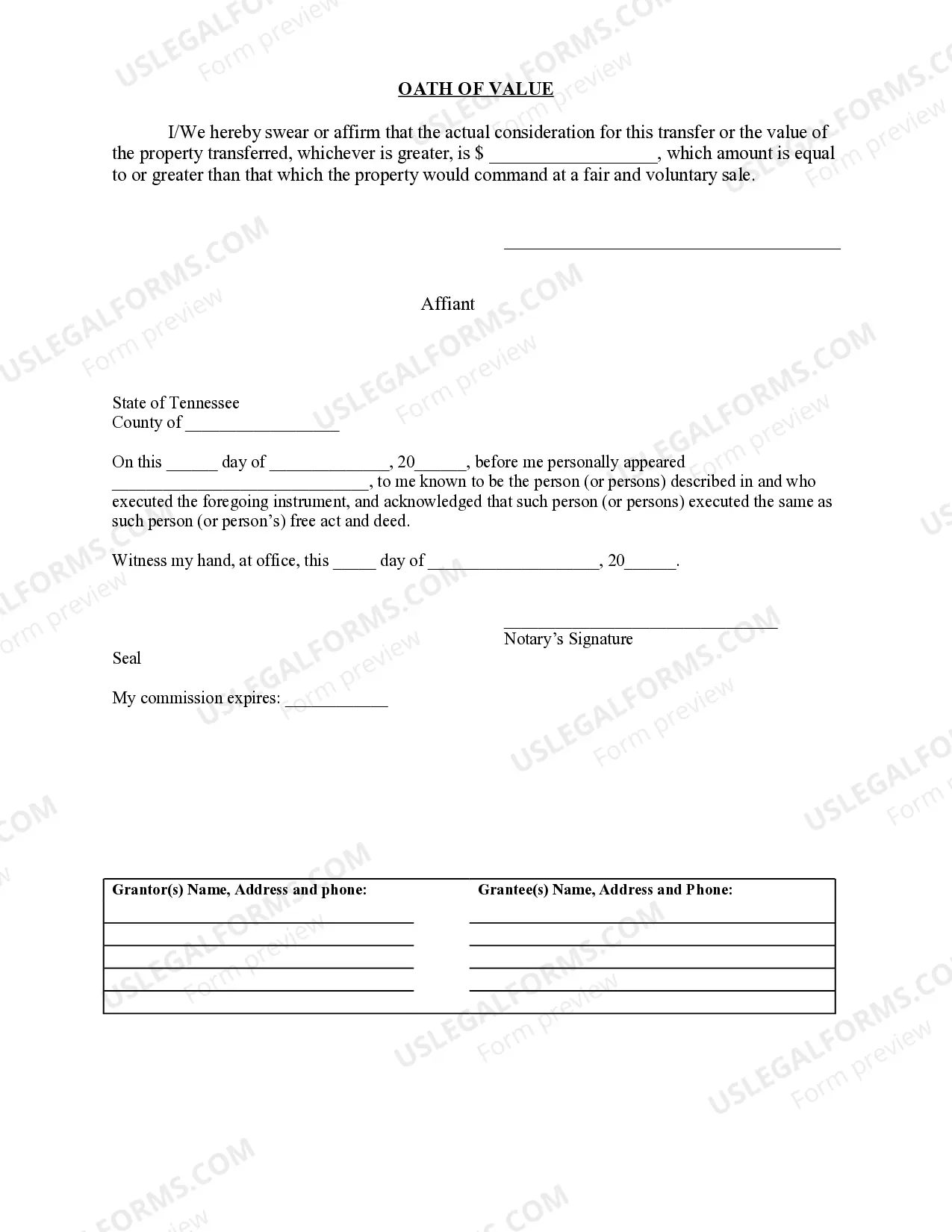

This form is a Warranty Deed where the grantor and/or grantee could be a limited partnership or LLC.

Tennessee Limited Partnership For Real Estate Investments

Category:

State:

Tennessee

Control #:

TN-SDEED-7

Format:

Word;

Rich Text

Instant download

Description

Free preview Tn Warranty Deed