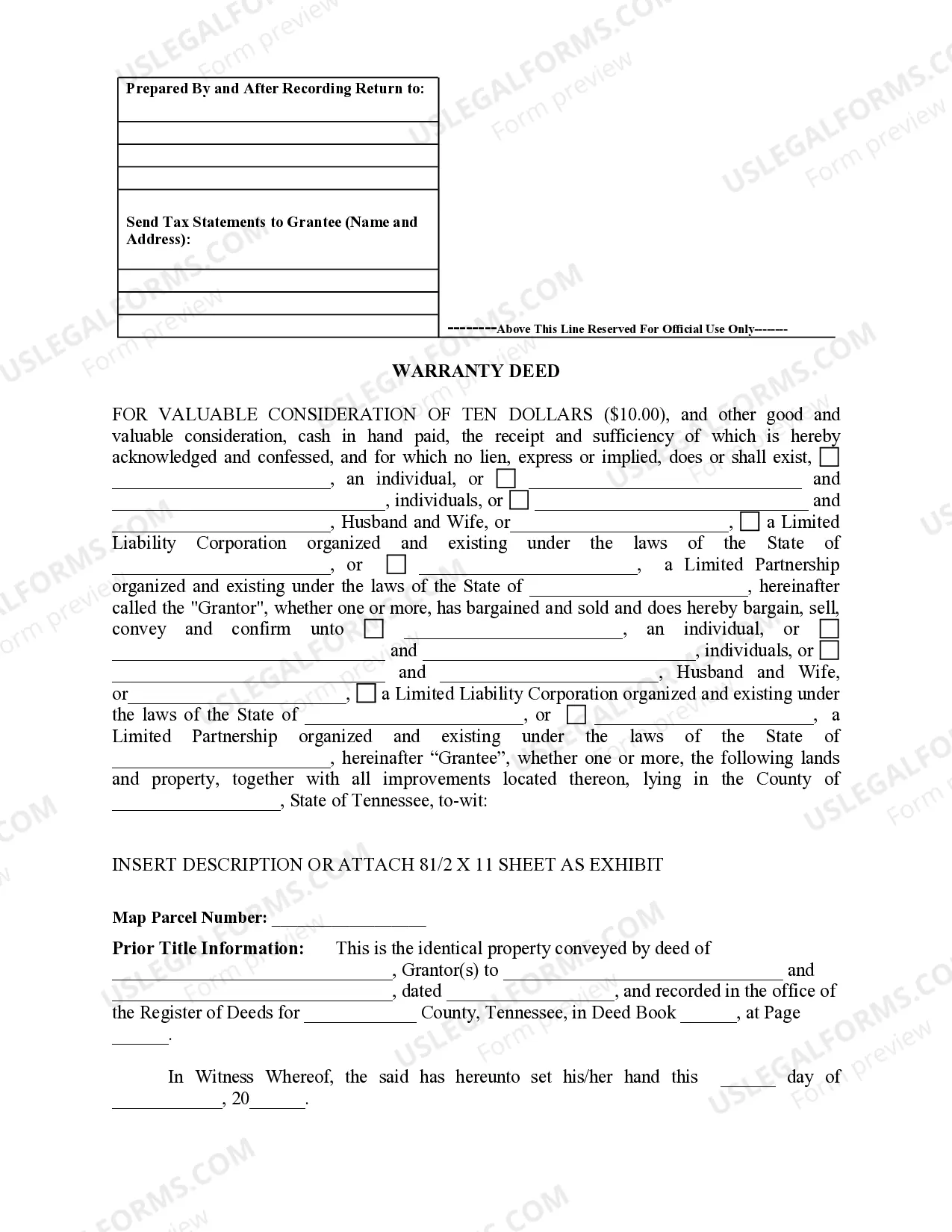

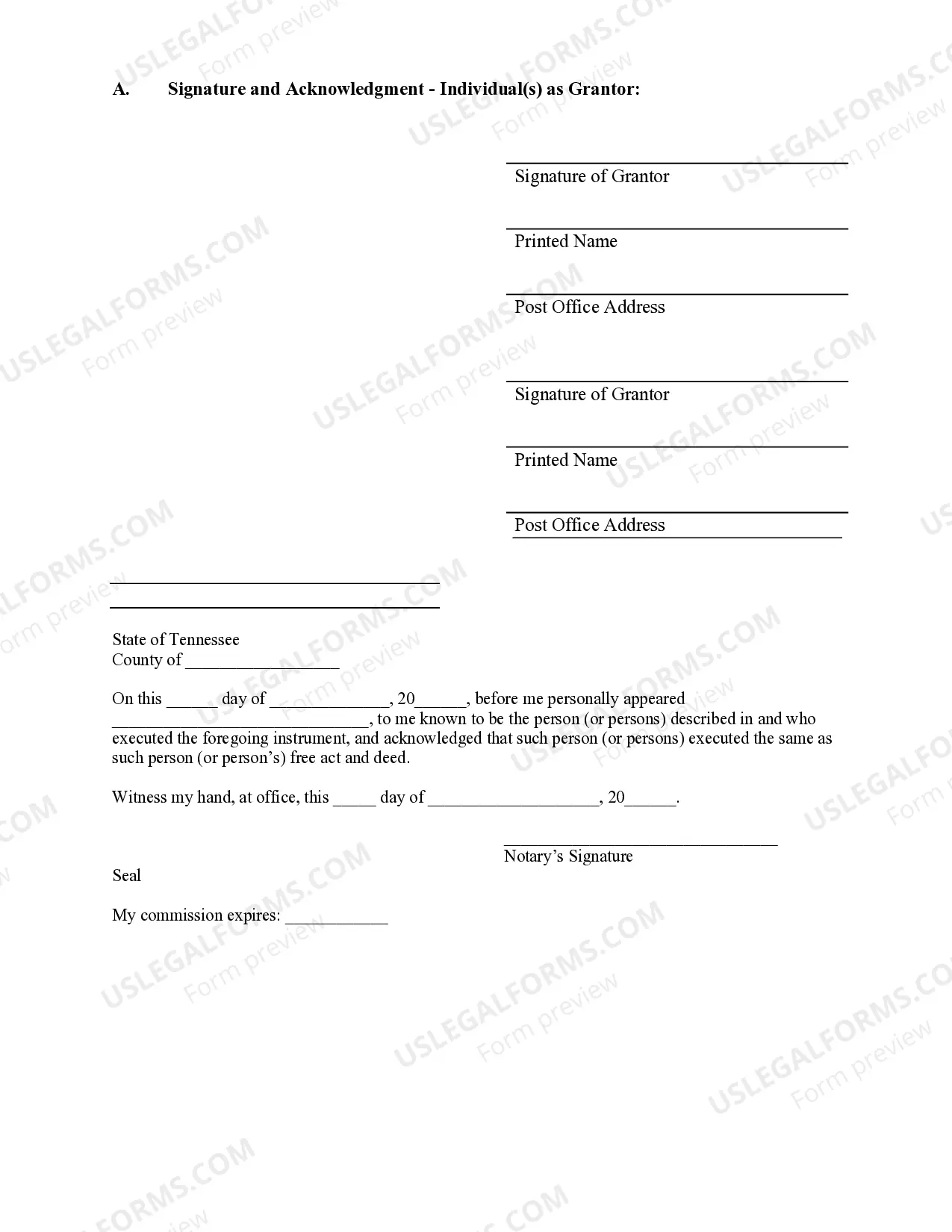

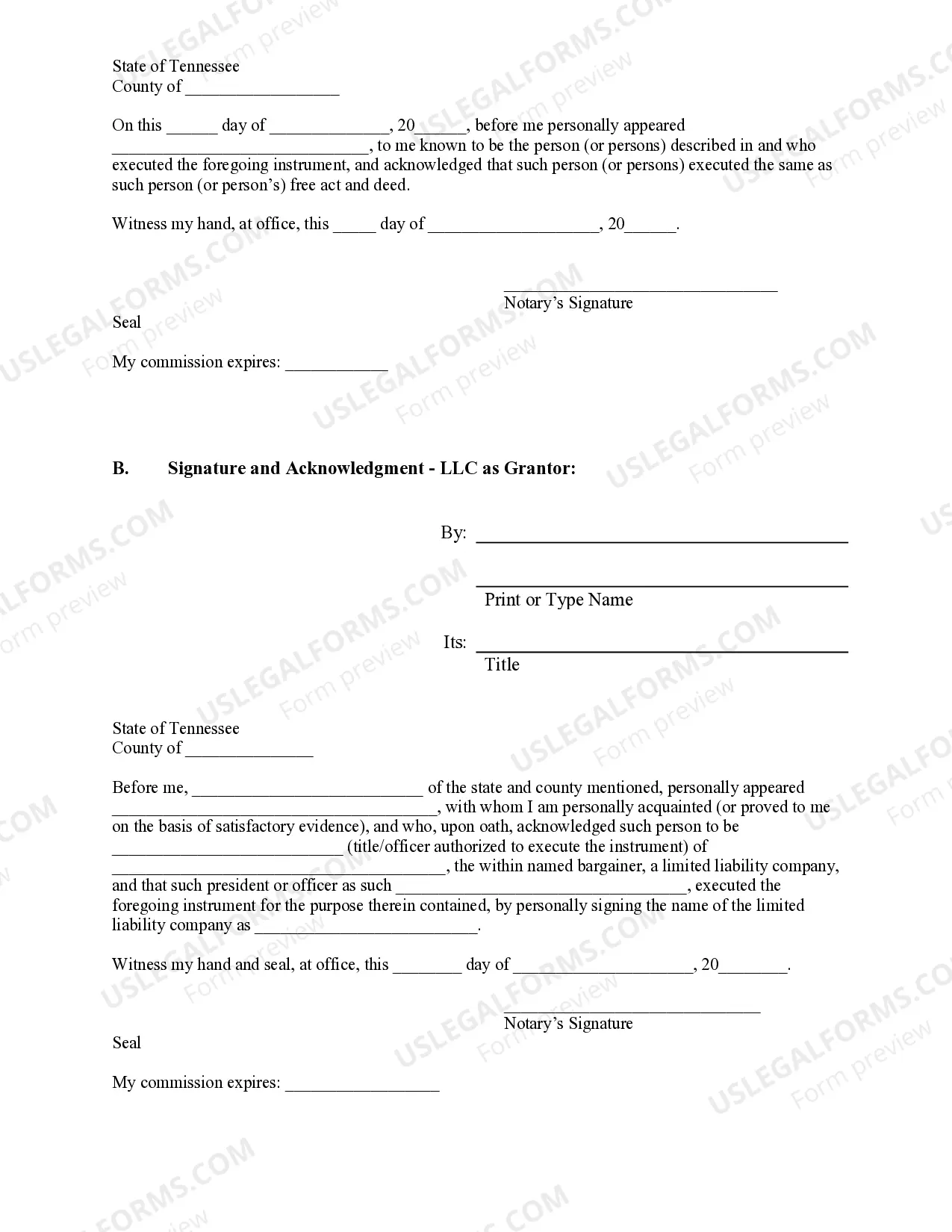

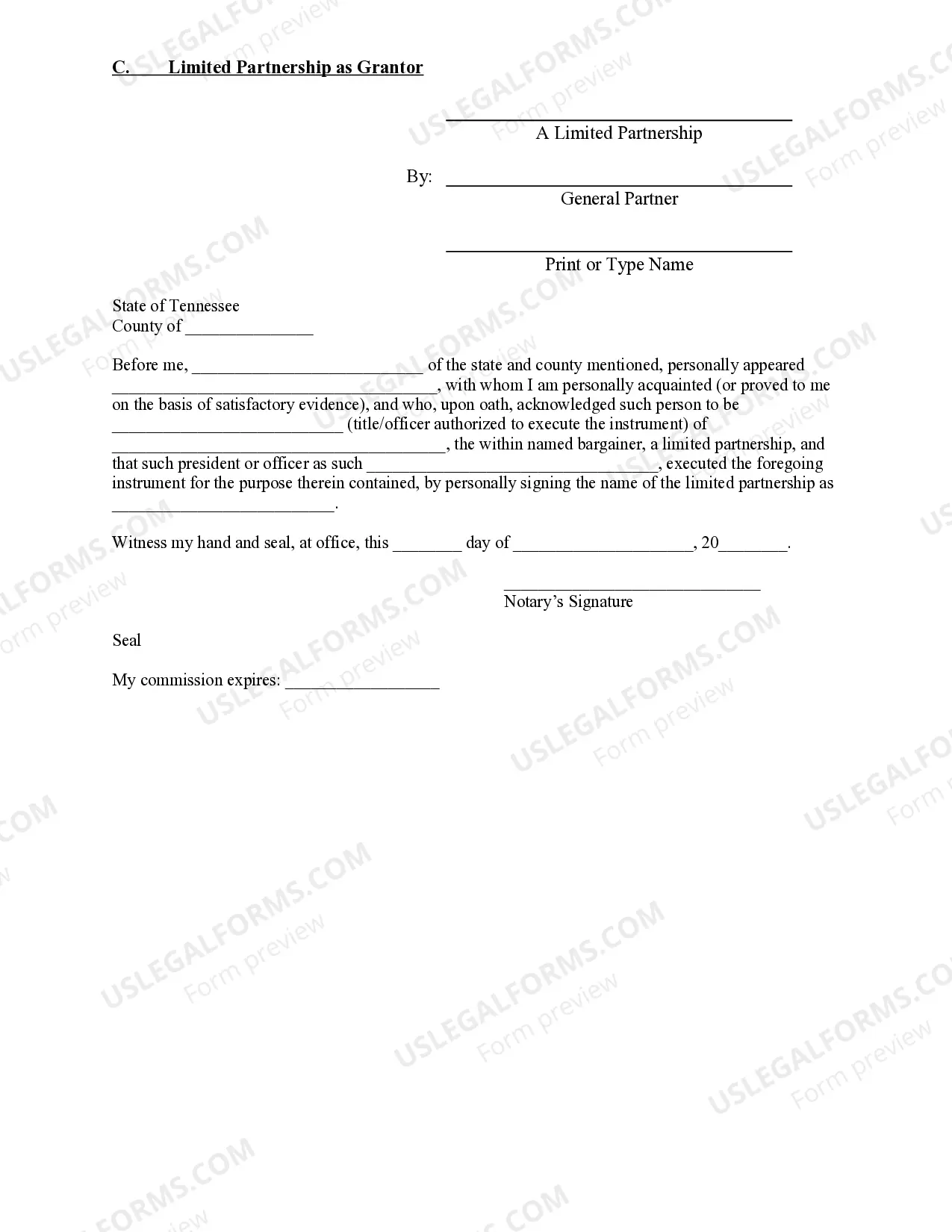

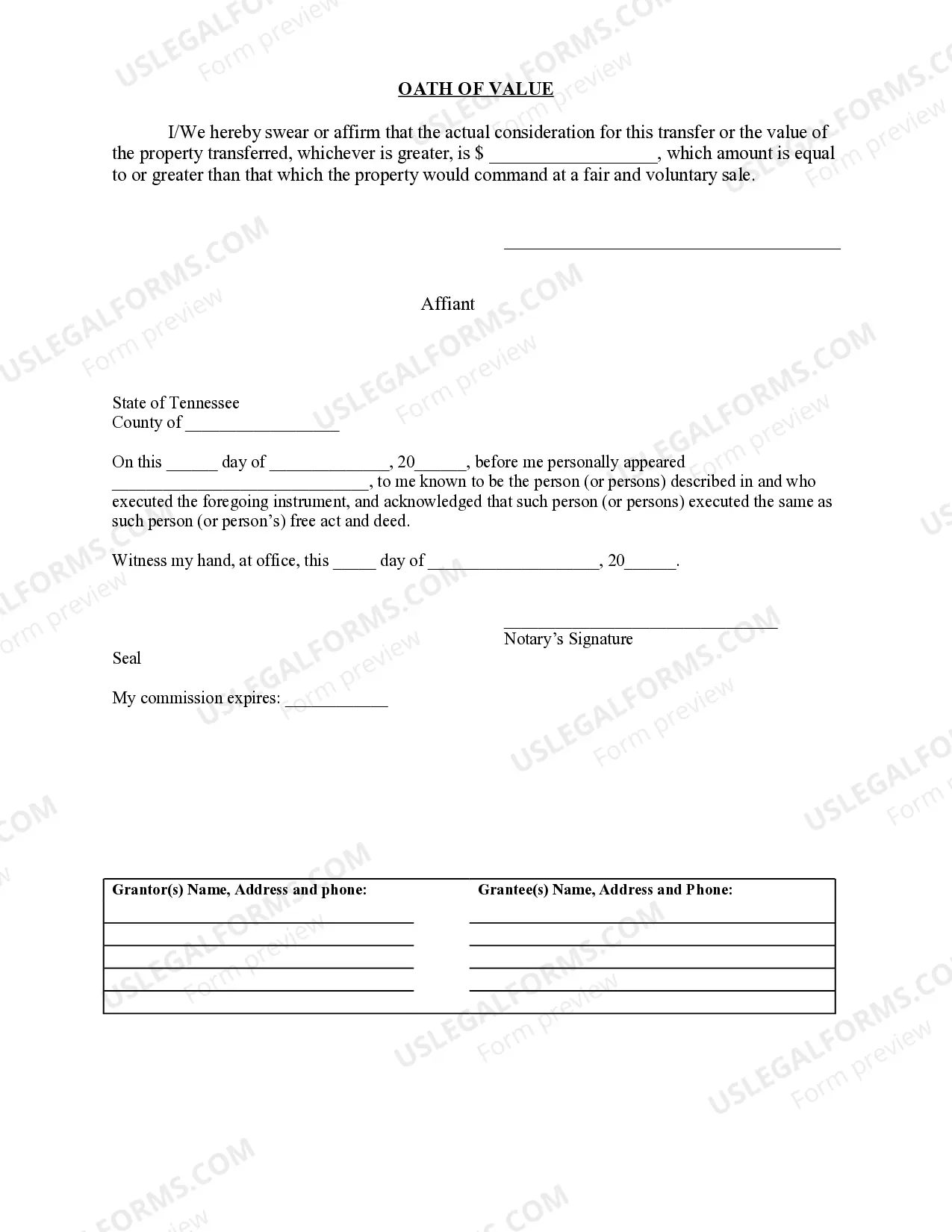

This form is a Warranty Deed where the grantor and/or grantee could be a limited partnership or LLC.

Tennessee Limited Partnership Form

Description

Form popularity

FAQ

To form a partnership, you need a formal agreement that outlines the roles, responsibilities, and profit-sharing arrangements between partners. It is crucial to define each partner’s contribution and expectations. Utilizing a Tennessee limited partnership form from US Legal Forms ensures you cover all necessary legal aspects and helps protect your interests in the partnership.

Filing for domestic partnership in Tennessee typically involves completing a domestic partnership declaration form and submitting it to your local government office. You will need to meet specific criteria, such as sharing a home and being in a committed relationship. Utilizing a Tennessee limited partnership form can help clarify the legal obligations and rights associated with your partnership.

Creating a partnership form requires you to define the partnership structure and outline the roles of each partner. You should detail the terms of the partnership, including profit sharing and duties. Using a Tennessee limited partnership form through US Legal Forms will provide you with a comprehensive template that simplifies this essential step.

To set up an LLC in Tennessee, you must file the Articles of Organization with the Secretary of State. Additionally, creating an operating agreement is a wise step to outline your management structure. It is important to obtain an Employer Identification Number (EIN) from the IRS for tax purposes. Consider using a Tennessee limited partnership form from US Legal Forms to streamline this process.

To become a limited partner, you need to find a partnership that is looking for limited partners and discuss the terms with existing partners. Once you agree on your role and responsibilities, you can formalize your position by including your information in the partnership agreement. It is also essential for the partnership to file the Tennessee limited partnership form if it is a new entity.

Creating a limited partnership (LP) involves deciding on a unique business name and establishing the roles of general and limited partners. After this, you must file the Tennessee limited partnership form with the Secretary of State. This allows your LP to operate legally and protects the interests of all partners.

To form a limited partnership, select a name and draft a partnership agreement outlining each partner's role. You then need to submit the Tennessee limited partnership form to the Secretary of State. This document provides crucial information for legal recognition and protects all partners under Tennessee law.

To form an LLC in Tennessee, you need to choose a unique name for your company and prepare an operating agreement. Next, file the Articles of Organization with the Secretary of State. If you're considering a limited partnership instead, completing the Tennessee limited partnership form would be the necessary step.

A limited partnership is formed by filing the appropriate paperwork with the Secretary of State in Tennessee. You must first choose a unique name and outline the roles of general and limited partners in a partnership agreement. Submitting the Tennessee limited partnership form officially creates your limited partnership, ensuring compliance with state requirements.

A limited partnership in Tennessee requires at least one general partner and one limited partner. Each partner's responsibilities and liabilities differ, with general partners managing the business and assuming full liability. To formalize this structure, you must submit the Tennessee limited partnership form to the Secretary of State, outlining the necessary information about your partners.