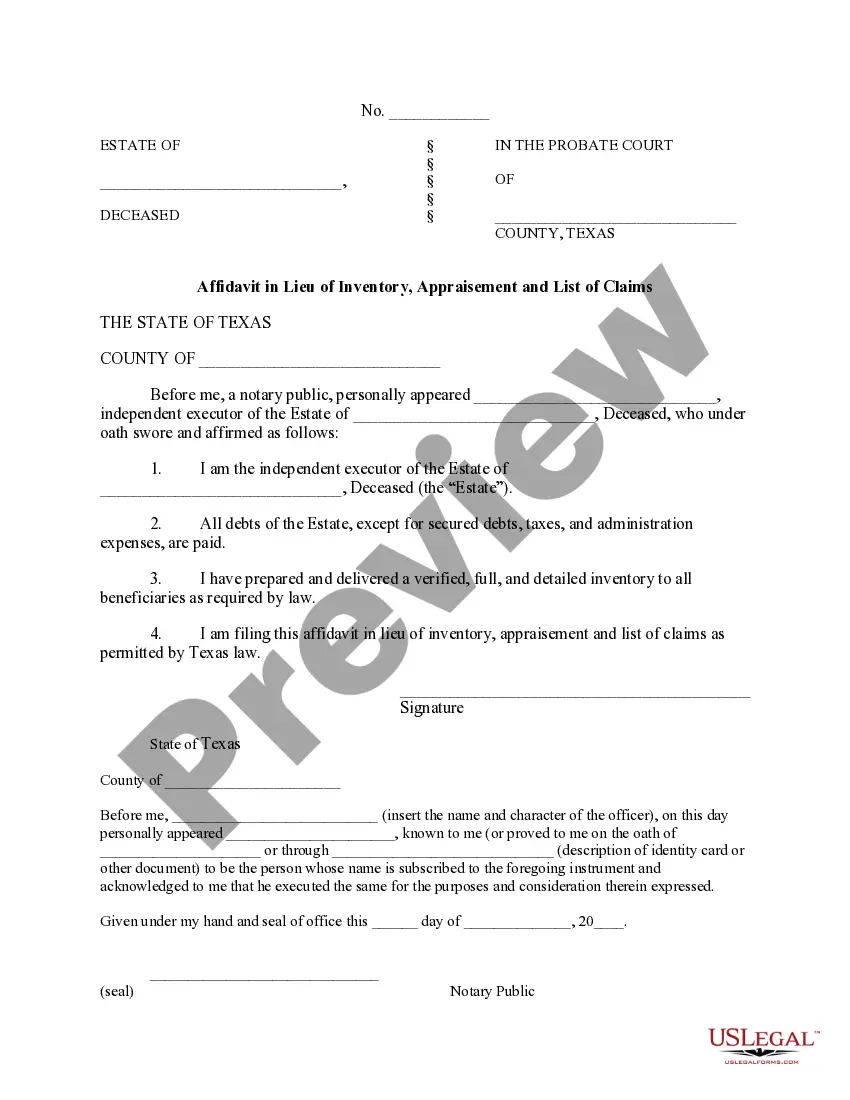

Affidavit In Lieu Of Inventory Form

Description

How to fill out Affidavit In Lieu Of Inventory Form?

What is the most reliable service to acquire the Affidavit In Lieu Of Inventory Form and other up-to-date legal documents? US Legal Forms is the solution! It's the largest compilation of legal papers for any situation.

Every template is skillfully drafted and reviewed for adherence to federal and local laws. They are categorized by area and state of application, making it easy to find the one you require.

US Legal Forms is an ideal option for anyone needing to manage legal documents. Premium users can enjoy additional perks, as they can complete and approve previously saved forms electronically at any time using the built-in PDF editing tool. Try it out today!

- Experienced users of the site simply need to Log In/">Log Into the system, verify their subscription status, and click the Download button next to the Affidavit In Lieu Of Inventory Form to obtain it.

- Once saved, the document is accessible for future reference within the My documents section of your account.

- If you still haven't registered with our library, here are the steps you should follow to create an account.

- Review form compliance. Prior to acquiring any template, you should verify if it meets your usage requirements and complies with your state or county's regulations. Read the form description and use the Preview if accessible.

Form popularity

FAQ

Probate is needed in Texas when someone dies with assets in their single name, whether they have a will or not. Full court probate (court supervised) is required in Texas when the total assets of the estate are greater than $75,000 and or if there is a will.

The duty of loyalty: Every action taken by the executor must be for the benefit of the estate heirs and beneficiaries. They can never disclose information about the estate to unauthorized parties, favor their personal interests over those of the beneficiaries, or realize a profit in business dealings with the estate.

Within 90 days after qualification, the personal representative must file with the Court a sworn inventory, appraisement and list of claims (Inventory) of the estate. The Inventory must include all estate real property located in Texas and all estate personal property regardless of where the property is located.

To summarize, the executor does not automatically have to disclose accounting to beneficiaries. However, if the beneficiaries request this information from the executor, it is the executor's responsibility to provide it. In most cases, the executor will provide informal accounting to the beneficiaries.

The statute of limitations on debt in Texas is four years.