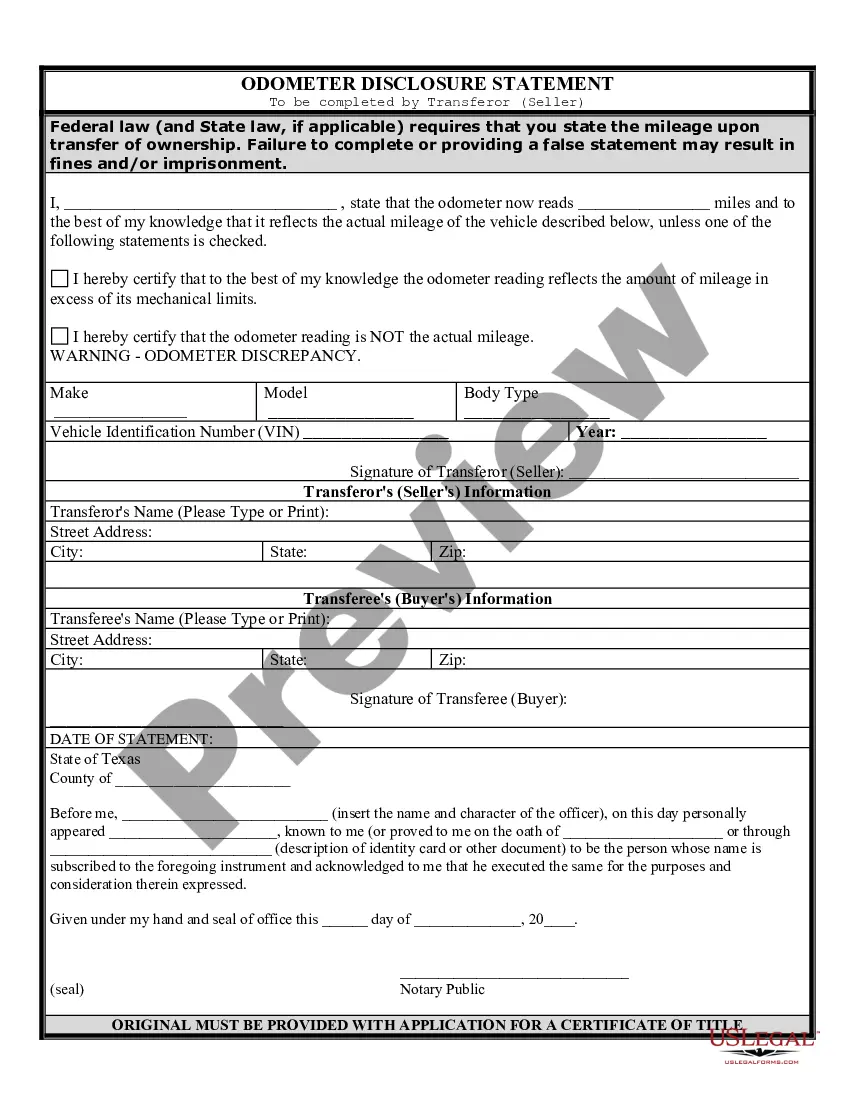

This Bill of Sale of Automobile contains the following information: the make/model of the car, VIN number and other information. Seller guarantees that the property is his/her own and is free of all claims and offsets of any kind. The form also contains the Odometer Disclosure Statement required by Federal Law and State Law, where applicable, which must be signed in the presence of a notary public.

Odometer Disclosure Statement For Texas

Description texas odometer disclosure statement

odometer statement texas Form popularity

FAQ

When an odometer reading is exempt on a Texas title, it indicates that the vehicle does not require disclosure of its mileage due to specific criteria. These criteria may include the age of the vehicle or its classification, such as being a classic car. This exemption protects sellers from discrepancies related to mileage reporting. If you are unsure about your vehicle's status, consulting a legal service can clarify your obligations.

Yes, Texas requires an odometer disclosure when a vehicle is sold or transferred. This requirement aims to prevent fraud and ensure that buyers are aware of the true mileage on the vehicle. As a seller, you must complete and provide an odometer disclosure statement for Texas as part of the sale documentation. Failing to do so could lead to complications and legal issues down the line.

Mileage exempt in Texas refers to certain vehicles that do not require an odometer disclosure statement for Texas due to specific conditions. This is typically applicable to vehicles that are older than 10 years or those that fall into specific categories defined by state regulations. When a vehicle is marked as mileage exempt, it means the seller is not required to disclose the odometer reading. Understanding these exemptions can save you time and paperwork during a vehicle sale.

A mileage affidavit in Texas is a sworn statement that verifies the mileage on a vehicle during a sale. This affidavit serves as a complementary document to the odometer disclosure statement for Texas, adding an extra layer of protection for both parties. It is particularly useful if the odometer reading differs from what is reported. You can find templates for this affidavit through reputable legal services to streamline the process.

You can easily obtain an odometer disclosure statement for Texas through various online platforms or legal services like US Legal Forms. When preparing for a vehicle sale, simply fill out the form, ensuring that all mileage is accurately reported. This document not only helps you comply with Texas law but also builds trust with the buyer. Having this statement ready promotes a smoother sales process.

To get a Texas vehicle inspection waived, you must provide specific documentation demonstrating the vehicle's eligibility for exemption. Certain vehicles, such as those under 10,000 pounds, are exempt from inspection. Additionally, vehicles that are over 25 years old may qualify for an exemption. Always check with the Texas Department of Public Safety for the most accurate information regarding waivers.

The odometer law in Texas requires sellers to provide an odometer disclosure statement for Texas during vehicle sales. This statement ensures that buyers are informed about the vehicle's mileage, protecting them from potential fraud. Sellers must accurately report the mileage to comply with state regulations. Understanding this law is essential for both buyers and sellers engaged in vehicle transactions.

Texas does not specifically require mileage reimbursement for vehicle sales unless stated in the sales agreement. However, if you are using your vehicle for business purposes, you may be entitled to reimbursement from your employer. Always ensure that any agreement regarding mileage is documented to avoid future conflicts. Proper record-keeping, along with the odometer disclosure statement for Texas, can assist in clarifying these matters.

Yes, Texas law requires an odometer statement for most vehicle sales, ensuring that buyers are informed about a car’s mileage. The statement must be signed by both the seller and the buyer, confirming that the mileage is accurate as per the odometer reading. This protects consumers and helps maintain a fair marketplace. Make sure to familiarize yourself with the odometer disclosure statement for Texas to ensure compliance.

An exempt odometer title in Texas applies to certain vehicles that do not require an odometer disclosure statement. This can include vehicles over a specific age or those classified as antiques. Even if the vehicle qualifies for an exemption, it is still good practice to provide a written disclosure regarding the mileage. This ensures clarity and can help avoid future disputes related to the odometer disclosure statement for Texas.