Sec. 34.04 of the Texas Tax Code provides in part as follows:

(a) A person, including a taxing unit, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property. The petition is not required to be filed as an original suit separate from the underlying suit for seizure of the property or foreclosure of a tax lien on the property but may be filed under the cause number of the underlying suit.

(b) A copy of the petition shall be served, in the manner prescribed by Rule 21a, Texas Rules of Civil Procedure, as amended, or that rule's successor, on all parties to the underlying action not later than the 20th day before the date set for a hearing on the petition.

(c) At the hearing the court shall order that the proceeds be paid according to the following priorities to each party that establishes its claim to the proceeds:

(1) to the tax sale purchaser if the tax sale has been adjudged to be void and the purchaser has prevailed in an action against the taxing units under Section 34.07(d) by final judgment;

(2) to a taxing unit for any taxes, penalties, or interest that have become due or delinquent on the subject property subsequent to the date of the judgment or that were omitted from the judgment by accident or mistake;

(3) to any other lienholder, consensual or otherwise, for the amount due under a lien, in accordance with the priorities established by applicable law;

(4) to a taxing unit for any unpaid taxes, penalties, interest, or other amounts adjudged due under the judgment that were not satisfied from the proceeds from the tax sale; and

(5) to each former owner of the property, as the interest of each may appear.

(d) Interest or costs may not be allowed under this section.

(e) An order under this section is appealable.

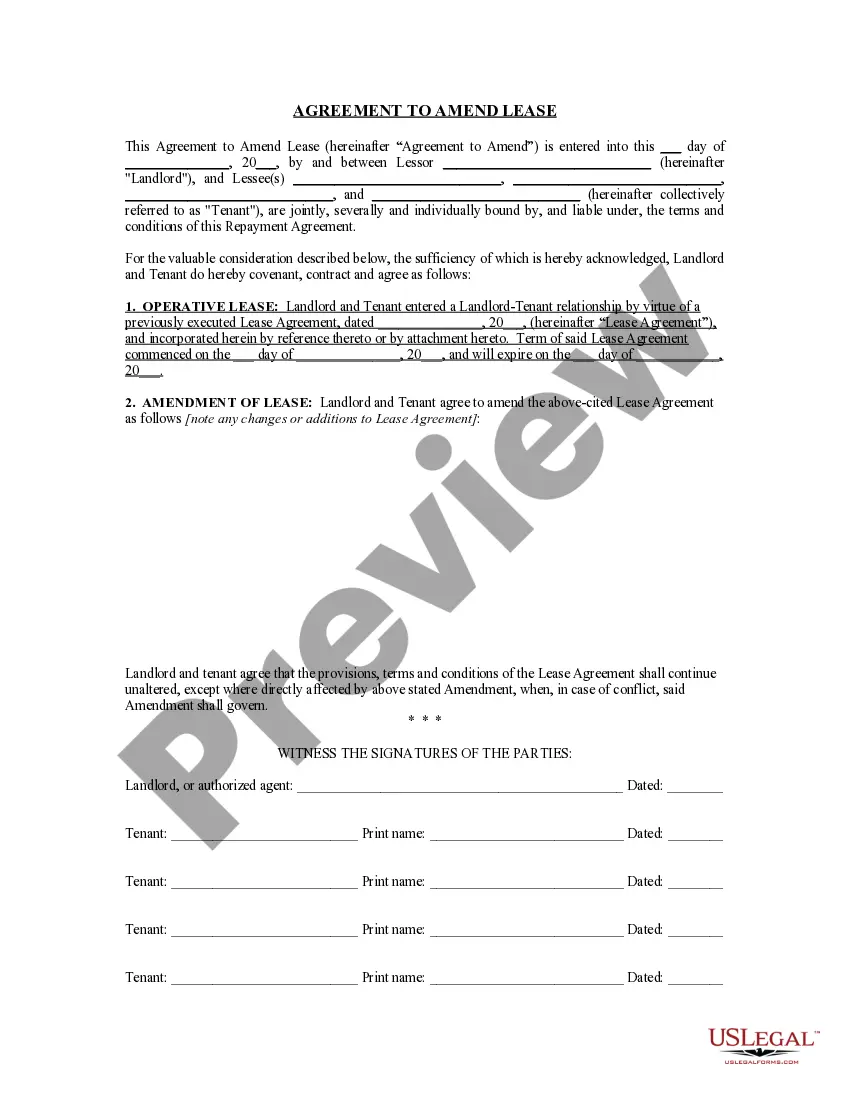

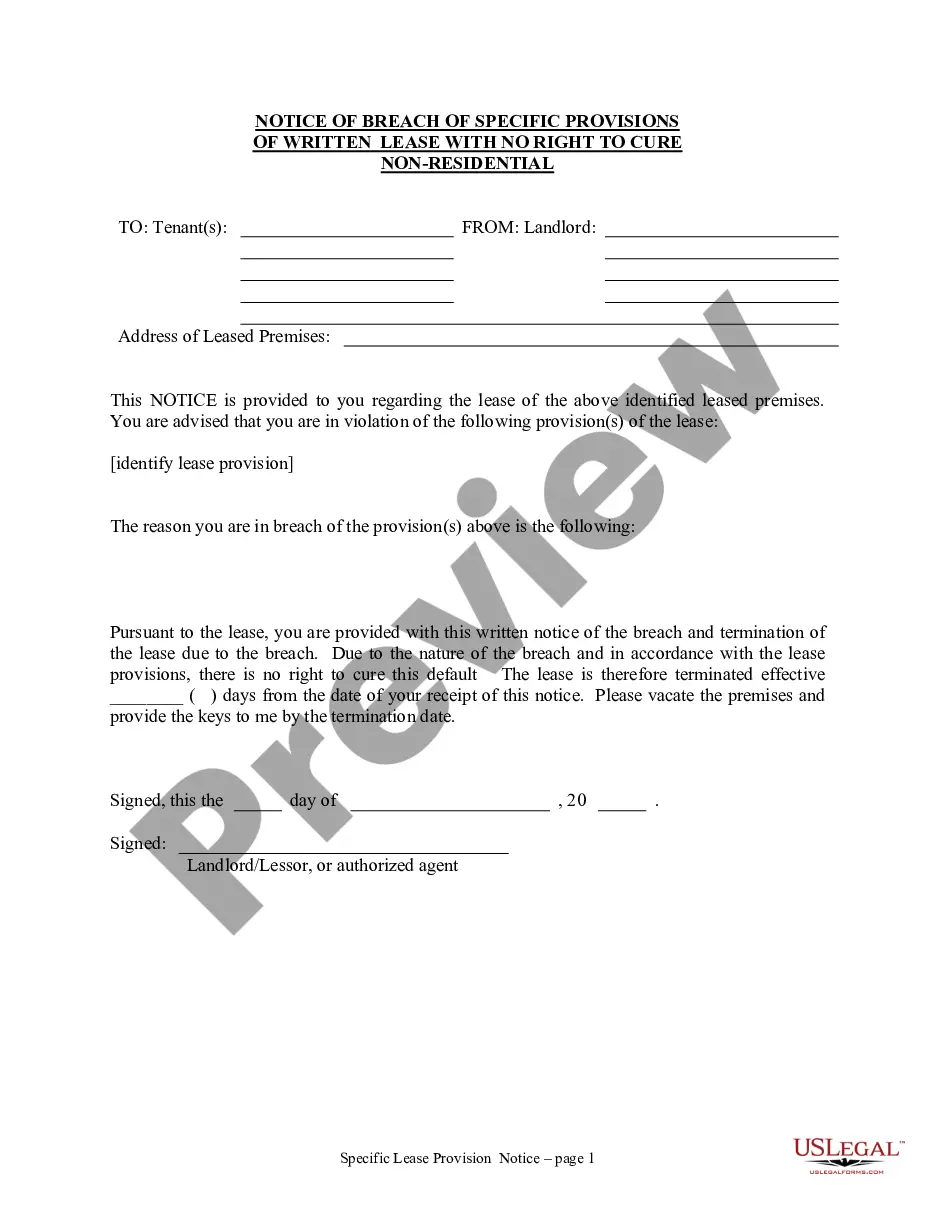

Texas Petition For Release Of Excess Proceeds Formula

Category:

State:

Texas

Control #:

TX-03500BG

Format:

Word;

Rich Text

Instant download

Description Petition Notice Hearing

Free preview Texas Excess Hearing Form Complete

How to fill out Texas Notice Hearing?

Bureaucracy necessitates meticulousness and exactness.

If you do not handle filling out paperwork like the Texas Petition For Release Of Excess Proceeds Formula daily, it may lead to some miscommunications.

Choosing the correct template from the outset will ensure that your document submission proceeds smoothly and avert any troubles of having to resend a file or perform the same task entirely from scratch.

If you are not a subscribed user, finding the needed template would require a few additional steps.

- You can always locate the proper template for your paperwork within US Legal Forms.

- US Legal Forms is the largest online forms repository that maintains over 85,000 templates across various fields.

- You can obtain the latest and the most suitable version of the Texas Petition For Release Of Excess Proceeds Formula by simply searching it on the site.

- Find, keep, and store templates in your account or verify with the description to confirm you have the correct one available.

- With an account at US Legal Forms, you can conveniently acquire, keep in one location, and browse through the templates you save for quick access.

- When on the website, click the Log In button to authenticate.

- Next, proceed to the My documents page, which houses the list of your documents.

- Review the descriptions of the forms and save the ones you need at any time.