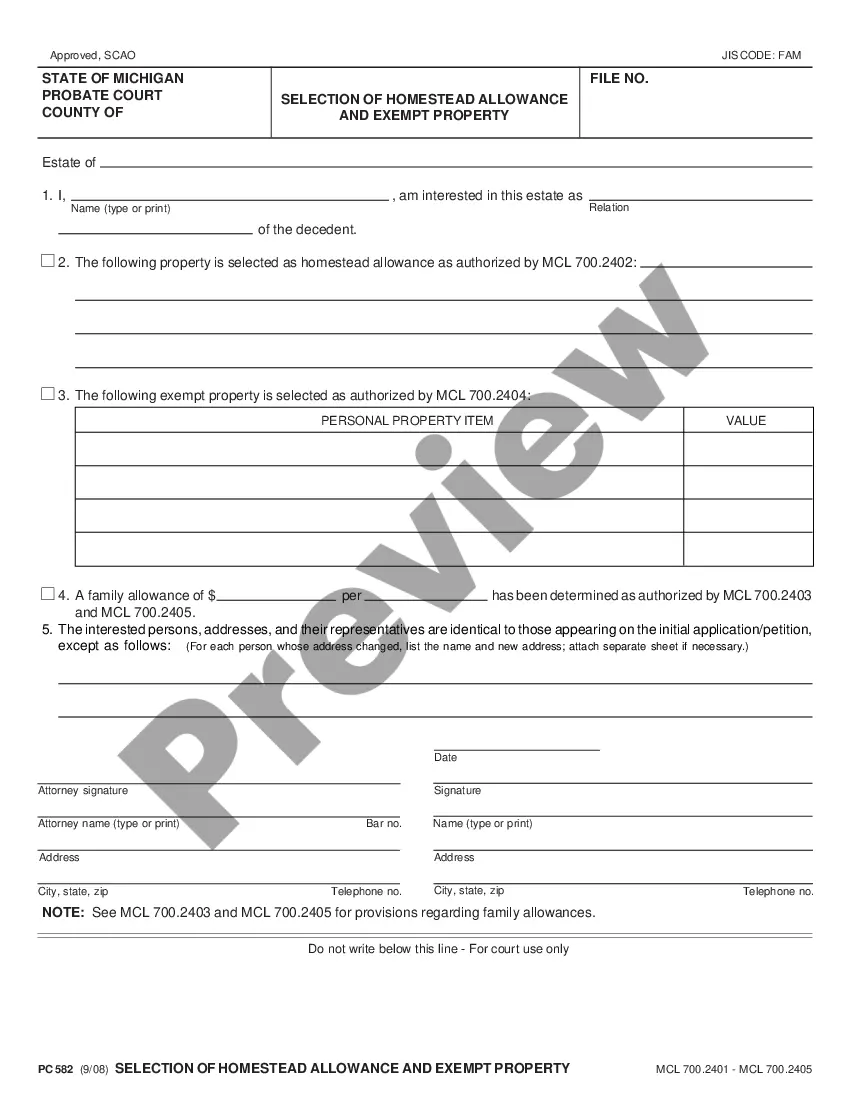

This form is an Executor's Deed where the Grantor is the executor of an estate and the Grantees are the beneficiaries or heirs of the estate. Grantor conveys the described property to the Grantees. This deed complies with all state statutory laws.

Texas Executor Of Estate Form

Description

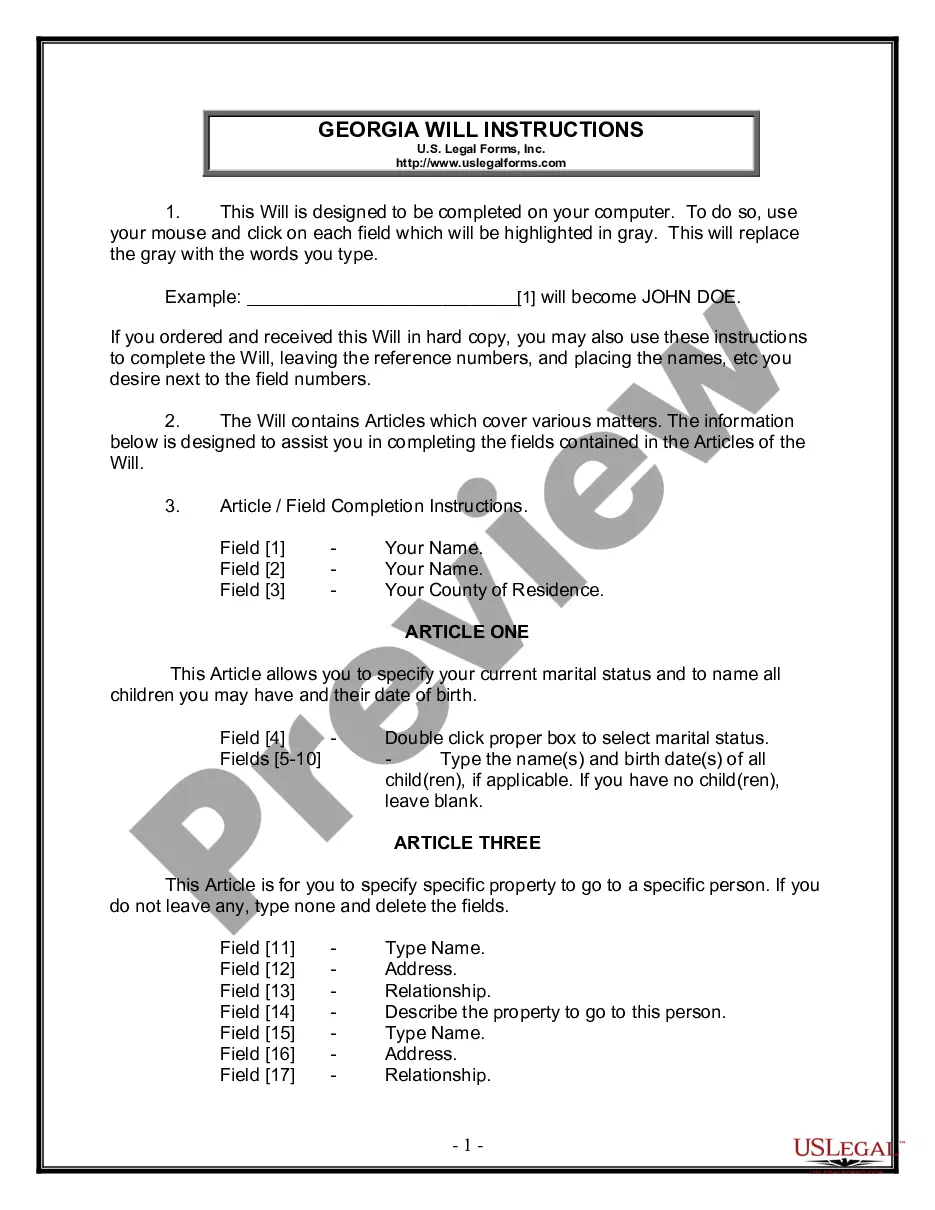

How to fill out Texas Executor Of Estate Form?

Bureaucracy requires meticulousness and exactness.

If you do not handle completing documents like Texas Executor Of Estate Form regularly, it may lead to some misunderstanding.

Choosing the appropriate sample from the beginning will ensure that your document submission proceeds smoothly and avert any troubles of resending a document or repeating the same task from the beginning.

Acquiring the correct and updated samples for your paperwork takes only a few minutes with an account at US Legal Forms. Eliminate your bureaucratic worries and simplify your form management.

- Find the template using the search functionality.

- Confirm the Texas Executor Of Estate Form you have found is applicable for your state or locality.

- Access the preview or review the description containing the details on the application of the template.

- If the result aligns with your search, click the Buy Now button.

- Select the appropriate option among the offered pricing plans.

- Log In to your account or create a new one.

- Finalize the purchase using a credit card or PayPal option.

- Download the form in your preferred format.

Form popularity

FAQ

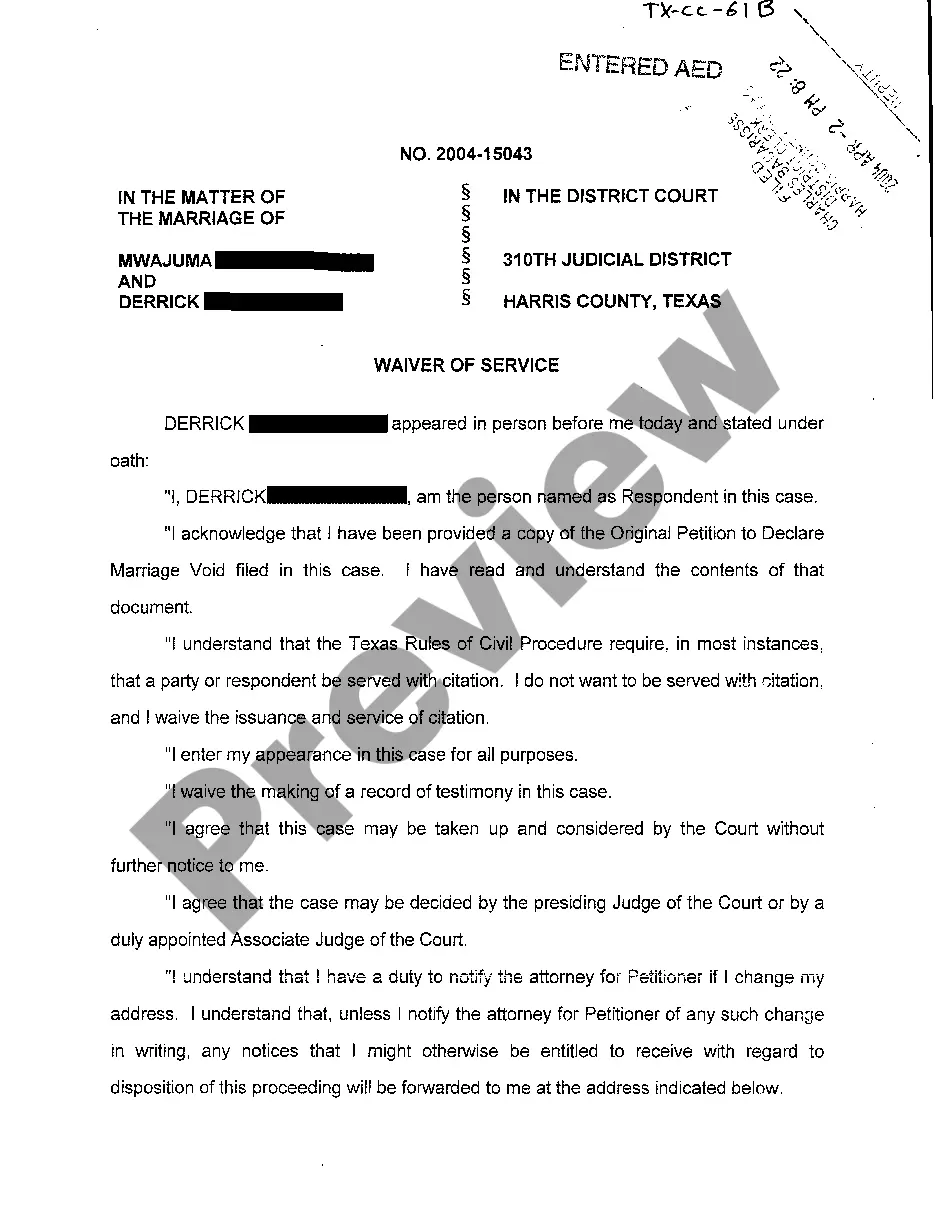

To prove you are the executor of an estate, you need the court-issued letters testamentary or a similar document. This paperwork confirms your authority to act on behalf of the estate. You can obtain these documents by filing the appropriate Texas executor of estate form in probate court. It's essential to present this proof when dealing with banks or other institutions regarding estate assets.

Being an executor of a will can be demanding and time-consuming, which may pose a burden if you hold other responsibilities. You may also encounter conflicts among family members or beneficiaries, leading to emotional strain. Additionally, executors face potential personal liability for any mistakes made during estate administration. Understanding these challenges is important, and utilizing a Texas executor of estate form can help simplify some tasks.

Filing as an executor of an estate starts with gathering the necessary documents, including the Texas executor of estate form and the will. Once you have these, file the documents with the probate court that has jurisdiction over the deceased's estate. You may also need to attend a hearing where the court formally appoints you as the executor. Make sure to understand your responsibilities after this appointment.

The best person to serve as an executor of a will is someone trustworthy, organized, and capable of handling financial matters. This individual should also be familiar with the family dynamics to navigate any potential conflicts. Often, family members or close friends are chosen, but a professional, such as an attorney, can be suitable if there are complexities involved. Consider preparing the Texas executor of estate form with these factors in mind.

In Texas, an executor is generally expected to settle the estate within one year, although this timeline can vary depending on the complexity of the estate and any disputes that arise. Timely management is crucial to keep costs down and satisfy beneficiaries. Utilizing a Texas executor of estate form can help keep the process organized and on track.

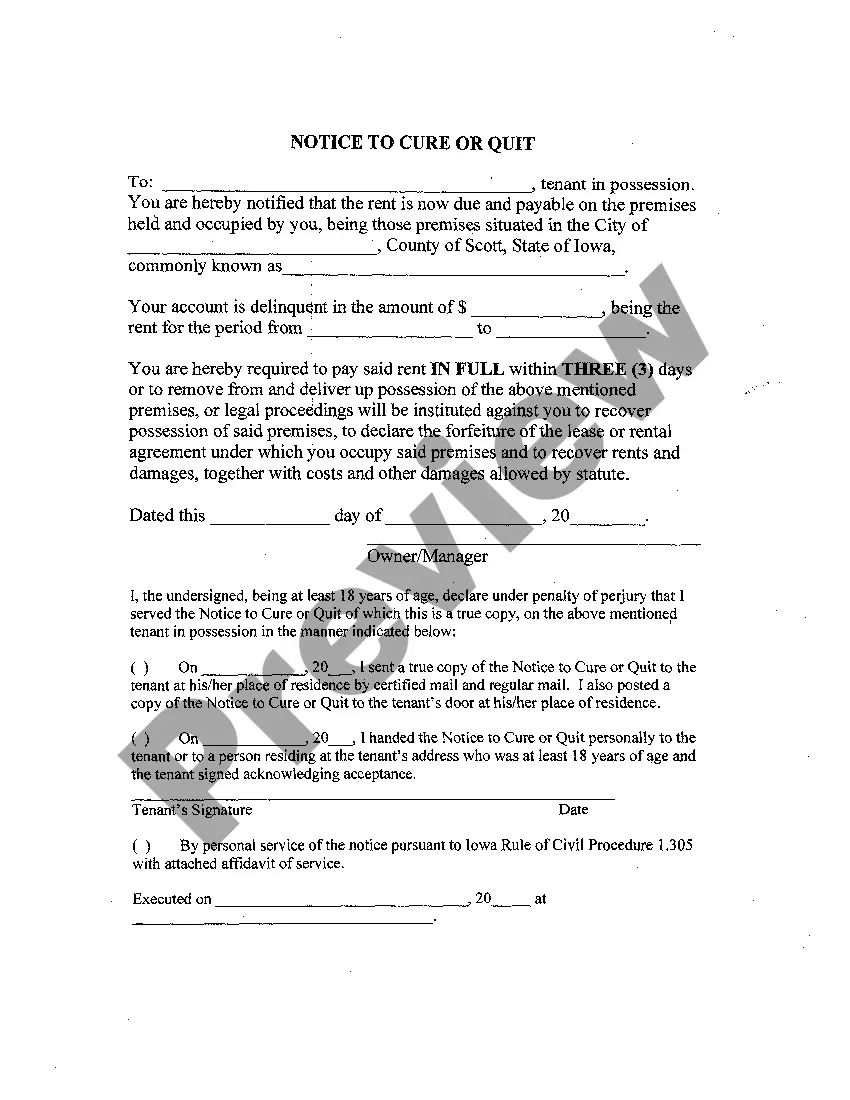

Executor paperwork typically includes a variety of forms and documents, such as the will, inventory of the estate, and accountings of financial transactions. The Texas executor of estate form provides a standardized approach to managing these documents. Organized paperwork can help streamline the probate process and ensure transparency with beneficiaries.

In Texas, an executor has the power to manage the estate, including paying debts, collecting assets, and distributing property according to the will or state law. They also have the authority to hire professionals, such as lawyers or accountants, to assist them. By utilizing a Texas executor of estate form, executors can effectively document their actions and decisions.

An executor cannot distribute assets before debts and taxes are settled. Additionally, they must not make decisions that benefit themselves at the expense of the heirs. To navigate these responsibilities correctly, employing a Texas executor of estate form is highly recommended.

An executor cannot make arbitrary decisions about the estate assets that violate the will's terms or state laws. They must act in the best interest of the beneficiaries and avoid conflicts of interest. It's crucial to follow legal guidelines when managing the estate, and using a Texas executor of estate form can help clarify their duties.

In Texas, an executor has some authority to determine how the estate's assets will be distributed, but they must adhere to the will's instructions. If there is no will, Texas laws of intestate succession will govern the distribution. To fulfill their responsibilities, an executor should utilize a Texas executor of estate form to ensure compliance with state regulations.