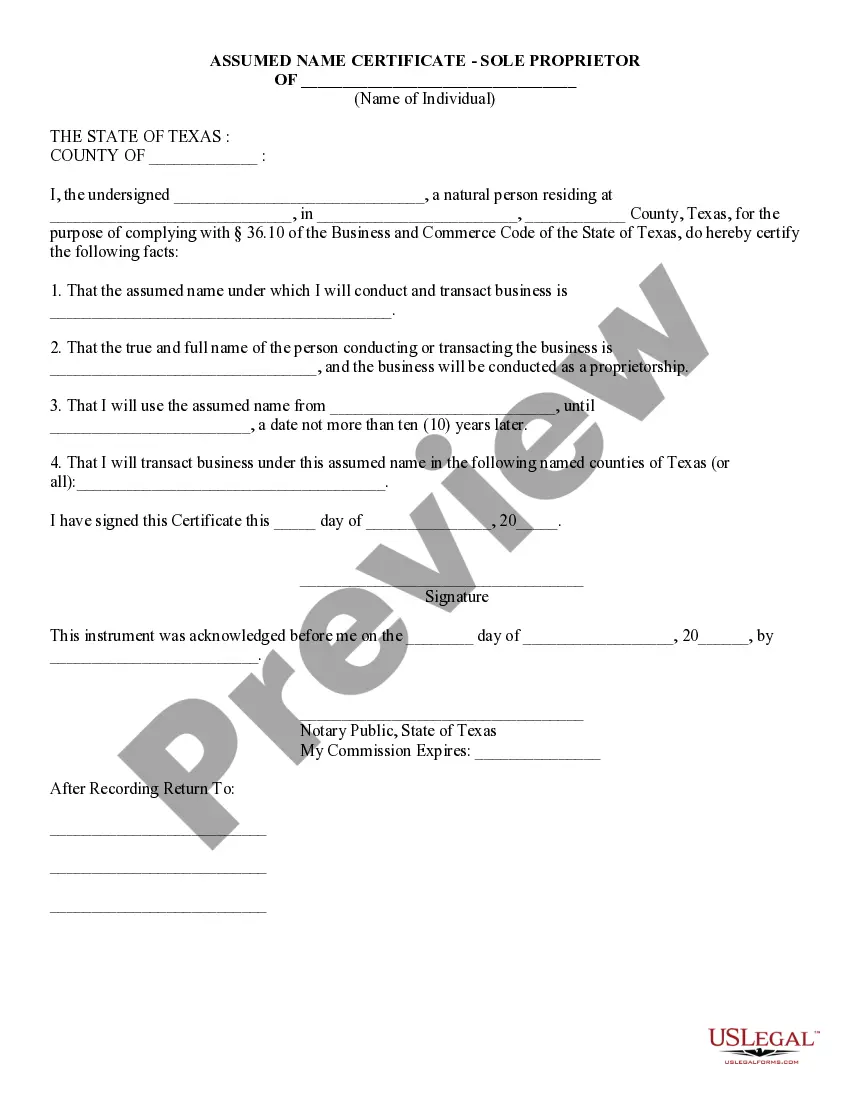

This detailed sample Assumed Name Certificate (Sole Proprietor) complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats. TX-1039

Sole Proprietorship In Texas With Employees

Description

Form popularity

FAQ

Yes, a sole proprietorship in Texas can have employees. As the business owner, you can hire staff to help manage operations and serve customers. However, you must adhere to employment laws and tax requirements specific to employing others. By leveraging resources like US Legal Forms, you can easily access the necessary forms and guidance for hiring employees.

To add an employee to your sole proprietorship in Texas, start by gathering necessary information such as the new hire's Social Security number and tax information. Next, complete the IRS Form W-4 for tax withholding and ensure compliance with any state-specific regulations. It's crucial to report this new employee to the state and obtain all necessary forms to maintain compliance. Utilizing services like US Legal Forms can help guide you through this onboarding process.

Yes, a sole proprietor with employees in Texas must obtain an Employer Identification Number (EIN). This number is necessary for tax reporting purposes and to manage employee payroll effectively. Without an EIN, you cannot legally hire employees or report their earnings to the IRS. Fortunately, obtaining an EIN is a straightforward process that you can complete online.

Yes, a sole proprietor in Texas can certainly have W-2 employees. As the business owner, you can hire individuals to assist in your operations and must follow federal and state guidelines for payroll. You'll need to withhold taxes from your employees' wages and provide them with the necessary tax documentation. For help with this process, consider using resources like uslegalforms, which can provide the necessary forms and guidance.

Many services do not require a specific license in Texas, particularly sole proprietorships. For instance, certain freelance jobs or general consulting may operate without needing permits. However, regulations can vary by city or county, so you should always check local rules. It's wise to clarify your requirements, as uslegalforms can assist in identifying your obligations and ensuring you're compliant.

No, a sole proprietor in Texas must operate a business to hold that status. A sole proprietorship is defined as an unincorporated business owned and run by one individual. However, if you do not have an active business, you cannot claim the title of a sole proprietor. It's essential to establish your business operations and maintain records to fully embrace this status.

In Texas, sole proprietors may need a business license depending on their specific business type and location. While general licensing is not always required, you should check with your city or county for any local permits. If you're operating as a sole proprietorship in Texas with employees, you must also register for an Employer Identification Number (EIN) with the IRS. This ensures you handle taxes correctly for your employees.

To establish a sole proprietorship in Texas with employees, you will need to choose a business name, register for a DBA if applicable, and obtain any necessary local permits or licenses. Additionally, consider applying for an Employer Identification Number (EIN) from the IRS for tax purposes. Utilizing platforms like US Legal Forms can simplify this process, providing forms and guidance tailored to your needs.

Being a sole proprietor in Texas with employees offers several benefits, including complete control over your business decisions and simplicity in tax reporting. You can take advantage of pass-through taxation, where business income is reported on your personal tax return. Moreover, starting a sole proprietorship is typically less expensive and involves fewer regulatory hurdles than forming an LLC.

You do not need a registered agent for a sole proprietorship in Texas, as they are not a separate legal entity. However, if you choose to form an LLC or corporation in the future, a registered agent will be required. For now, focus on ensuring proper business registrations and adherence to local laws while you operate as a sole proprietor.