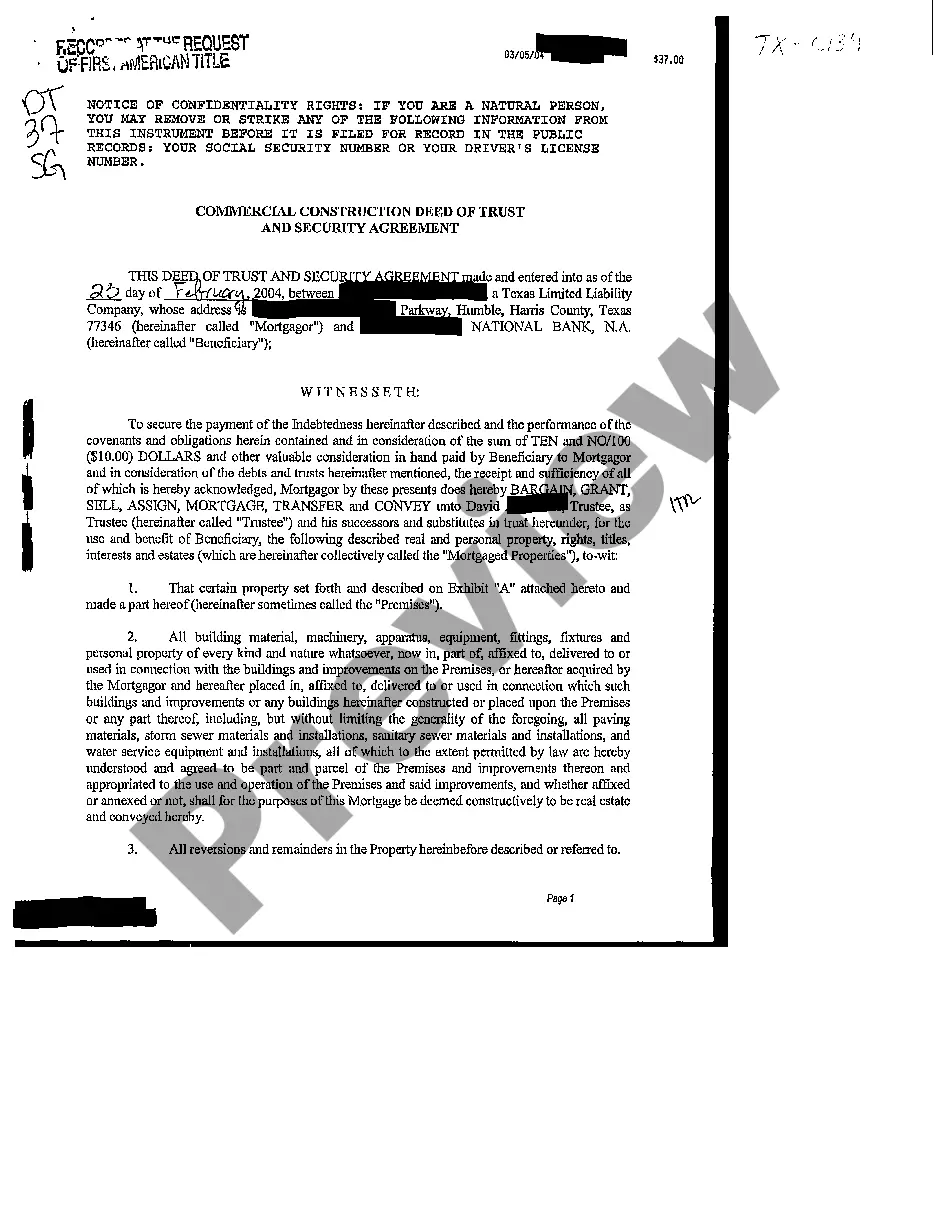

Construction Deed Of Trust

Description

How to fill out Construction Deed Of Trust?

Administrative processes demand exactness and correctness.

If you don't regularly manage documentation like the Construction Deed Of Trust, it might lead to some misunderstanding.

Choosing the appropriate template from the outset will ensure that your form submission proceeds smoothly and avert any hassles of resubmitting a document or starting the entire task anew.

If you do not have a subscription, finding the needed template requires a few extra steps: Locate the template using the search bar. Ensure the Construction Deed Of Trust you found is applicable to your state or county. View the preview or read the description containing the details on the template's usage. When the result corresponds with your search, click the Buy Now button. Choose the appropriate option from the proposed subscription packages. Log Into your account or create a new one. Complete the transaction using a credit card or PayPal. Download the form in your preferred file format. Locating the correct and current templates for your paperwork takes just a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and enhance your efficiency with forms.

- You can always discover the right template for your paperwork in US Legal Forms.

- US Legal Forms is the largest digital repository of templates with more than 85,000 samples across various domains.

- You can easily find the latest and most pertinent iteration of the Construction Deed Of Trust by simply exploring it on the site.

- Locate, save, and download templates in your account or review the description to confirm you possess the correct one at hand.

- With an account at US Legal Forms, you can obtain, save in one location, and browse through the templates you store for quick access.

- When you are on the site, click the Log In button to authenticate your access.

- Then, move to the My documents page, where your document history is kept.

- Review the form descriptions and download the ones you require at any time.

Form popularity

FAQ

A deed of trust addresses three parties: The trustor, or obliger, who is the borrower1. The trustee, who holds "bare or legal" title (usually a title company) The beneficiary, who is the lender2.

How to WriteStep 1 Obtain The California Deed Of Trust Form For Your Use.Step 2 Determine And Present Where This Deed Must Be Returned.Step 3 Report The Assessor's Parcel Number.Step 4 Record The Effective Date Of This Deed.Step 5 Produce The Debtor's Identity As The Trustor.More items...?

Construction Deed of Trust means the deed of trust, encumbering the Partnership's interest in the real property, improvements and personal property constituting the Project, securing payment of the Borrower Loan, and any supplements or amendments thereto made in conformity therewith.

A legal document that creates a trust, giving a person or organization the right to manage money or property for someone else, and says how this should be done: The trust deed stated clearly what they were entitled to do with the property.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.