Suggestion Of Bankruptcy Filing With A Mortgage

Description

How to fill out Suggestion Of Bankruptcy Filing With A Mortgage?

What is the most dependable service to secure the Suggestion Of Bankruptcy Filing With A Mortgage and other current versions of legal paperwork? US Legal Forms is the answer!

It's the largest compilation of legal documents for any circumstance. Each template is meticulously crafted and validated for adherence to federal and local regulations.

Form compliance verification. Before you obtain any template, you must ensure it aligns with your use case requirements and your state or county regulations. Review the form description and use the Preview if it is provided.

- They are categorized by area and state of application, so locating the one you require is straightforward.

- Experienced users of the website only need to Log In to the system, verify the validity of their subscription, and click the Download button next to the Suggestion Of Bankruptcy Filing With A Mortgage to obtain it.

- Once saved, the template remains accessible for future reference in the My documents section of your profile.

- If you haven't created an account in our library yet, here are the steps you need to follow.

Form popularity

FAQ

When you do begin to apply for a mortgage after bankruptcy, your lender will likely ask you a few questions about your bankruptcy. They may ask you when your case was discharged, what you've done to establish new credit, and how you've been keeping up with your bills.

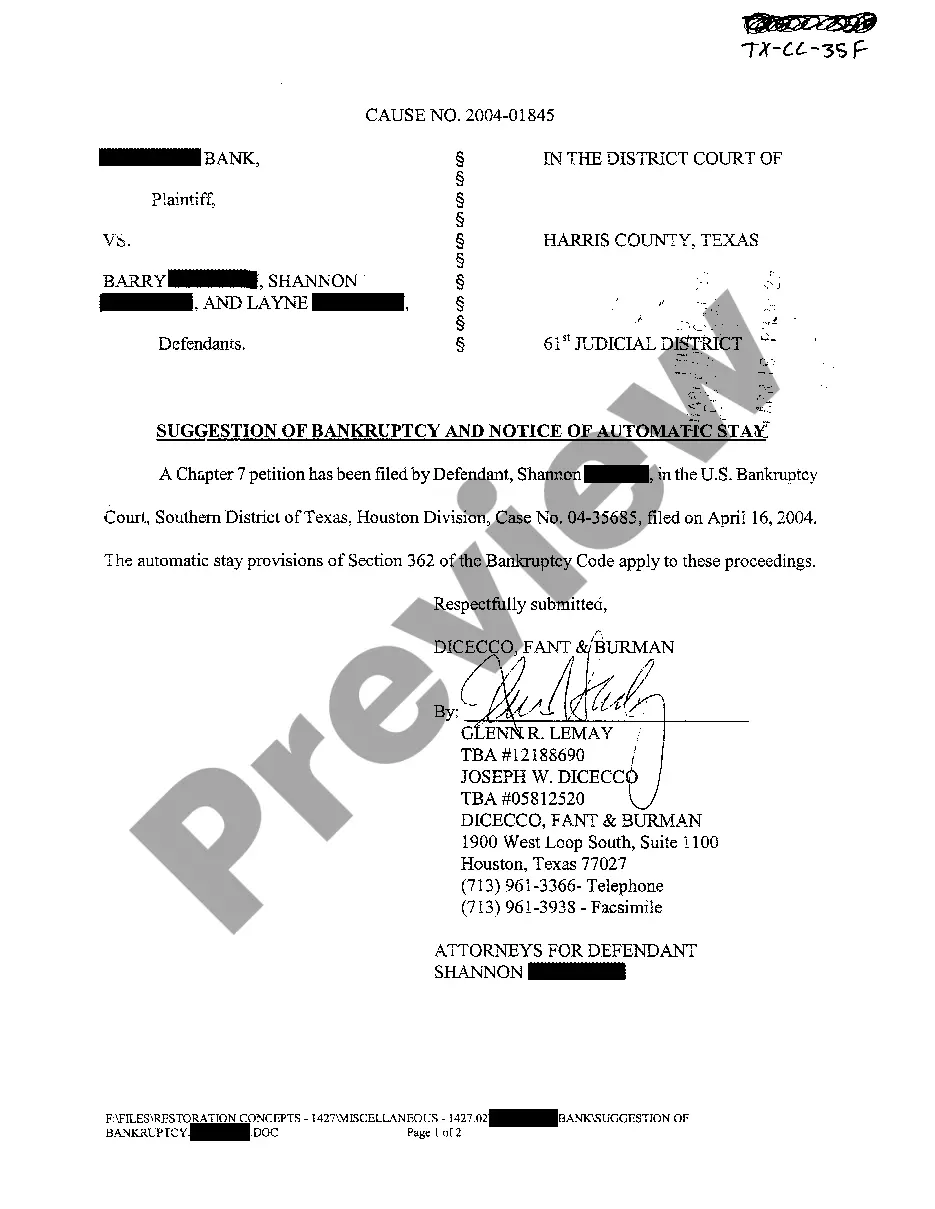

If you are involved in a foreclosure action, a "suggestion of bankruptcy" is filed with the state court letting them know that you have filed bankruptcy. The filing of Bankruptcy stops the foreclosure action from moving forward until the bankruptcy case is resolved.

Here are common mistakes you should avoid before filing for bankruptcy.Lying about Your Assets.Not Consulting an Attorney.Giving Assets (Or Payments) To Family Members.Running Up Credit Card Debt.Taking on New Debt.Raiding The 401(k)Transferring Property to Family or Friends.Not Doing Your Research.

Filing for bankruptcy puts a stop to many evictions, foreclosures, wage garnishments and utility shutoffs. You may be able to discharge your obligation to repay some of your dischargeable debts. Your credit may improve.

If you are involved in a foreclosure action, a "suggestion of bankruptcy" is filed with the state court letting them know that you have filed bankruptcy. The filing of Bankruptcy stops the foreclosure action from moving forward until the bankruptcy case is resolved.