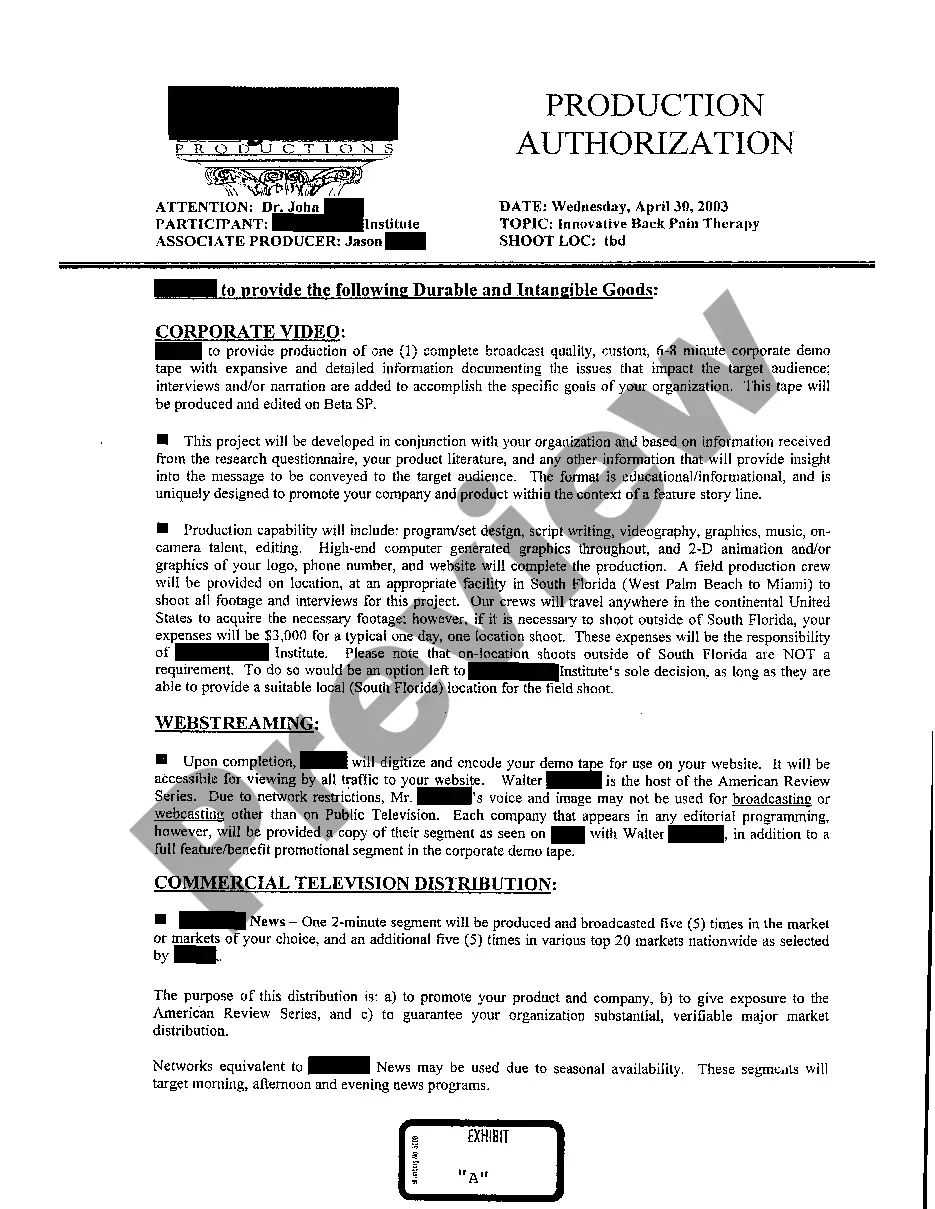

Title: Texas DTPA Demand Letter Example for Insurance Claim: A Comprehensive Guide Keywords: Texas DTPA demand letter, insurance claim, example, types. Introduction: When dealing with an insurance claim in the state of Texas, the Texas Deceptive Trade Practices-Consumer Protection Act (DTPA) can serve as a valuable tool to protect consumers. A Texas DTPA demand letter is one such tool that can help expedite the resolution process. In this article, we will provide a detailed description of what a Texas DTPA demand letter is and provide examples of different types. I. Understanding the Texas DTPA Demand Letter: The Texas DTPA demand letter is a formal written request sent by the claimant (consumer) to their insurance company. It lays out the details of the insurance claim, asserts violations of the Texas DTPA, and demands specific action or remedies. This letter serves as a crucial step before pursuing legal action and aims to settle the dispute through negotiation. II. Elements of Texas DTPA Demand Letter: A. Claimant Identification: 1. Full name, contact information, and policy details. 2. Insurance company details. B. Detailed Explanation: 1. Summary of the incident leading to the claim. 2. Mention of the insurance policy coverage and the specific provisions relevant to the claim. C. Alleged Violations of Texas DTPA: 1. Identify specific subsections of the Texas DTPA violated by the insurance company. 2. Explain how the insurance company's actions or omissions constitute deceptive trade practices. D. Claims and Damages: 1. Enumerate all the claims being made. 2. Provide a comprehensive list of the damages suffered as a result of the insurance company's conduct. E. Demand for Remedies: 1. Specify the desired resolution, such as full payment, coverage extension, or reimbursement for expenses. 2. Set a reasonable deadline for the insurance company to respond. III. Types of Texas DTPA Demand Letters for Insurance Claims: A. Delayed Claim Settlement Letter: — Used when the insurance company unnecessarily delays settling a rightful claim. — Highlights the violation of the DTPA's provisions regarding prompt and fair claim settlement. B. Unfair Claims Handling Letter: — Addressed to insurance companies engaging in deceptive or unfair claim handling practices. — Focuses on violations such as misrepresentations, false statements, or withholding relevant information. C. Denial of Claim Letter: — Sent when an insurance company wrongfully denies a legitimate claim. — Points out the specific DTPA violations committed by the insurer during the claim denial process. D. Unreasonable Delay Letter: — Utilized when an insurance company unreasonably extends the claim investigation process. — States violations of DTPA provisions regarding prompt claims investigations and resolutions. Conclusion: A Texas DTPA demand letter is a vital tool for policyholders to assert their rights in an insurance claims dispute. By understanding its elements and utilizing appropriate examples, claimants can effectively communicate their grievances and demand fair resolution. Whether it's a delayed claim settlement, unfair claims handling, claim denial, or unreasonable delay, the Texas DTPA demand letter can address specific issues, paving the way for a just resolution.

Texas Dtpa Demand Letter Example For Insurance Claim

Description

How to fill out Texas Plaintiff's Original Petition Regarding Deceptive Trade Practices?

Legal administration can be exasperating, even for experienced professionals.

When you are looking for a Texas DTPA Demand Letter Example for an Insurance Claim and lack the time to dedicate to finding the accurate and current version, the process can be stressful.

Access a base of resources including articles, guides, and materials pertinent to your circumstances and needs.

Save effort and time searching for the documents you require, and utilize US Legal Forms' sophisticated search and Preview feature to find the Texas DTPA Demand Letter Example for Insurance Claim and download it.

Take advantage of the US Legal Forms online catalogue, supported by 25 years of experience and reliability. Streamline your routine document management into a seamless and user-friendly process today.

- If you possess a subscription, Log In to your US Legal Forms account, look for the form, and download it.

- Check your My documents section to view the documents you have previously saved and organize your folders as desired.

- If it is your first time utilizing US Legal Forms, create an account to gain unlimited access to the full advantages of the library.

- Here are the steps to consider after you have downloaded the form you need.

- Confirm it is the correct document by previewing it and reviewing its details.

- Make sure that the template is approved in your state or county.

- Click Buy Now once you are ready.

- Choose a monthly subscription plan.

- Select the file format you prefer, and Download, fill out, sign, print, and submit your document.

- Tap into state- or county-specific legal and business templates.

- US Legal Forms addresses every requirement you might have, from personal to corporate documents, all in one place.

- Leverage advanced tools to create and manage your Texas DTPA Demand Letter Example for Insurance Claim.

Form popularity

FAQ

A DTPA demand letter is a formal document used to notify a business or individual of violations under the Texas Deceptive Trade Practices Act. It outlines specific complaints and requests remedies, thereby prompting the recipient to address the issues raised. For those dealing with insurance claims, a well-structured Texas DTPA demand letter example for insurance claim can greatly enhance your chances of a swift response or settlement. Utilizing platforms like USLegalForms can help you create a precise and effective demand letter tailored to your situation.

Filing a medical malpractice lawsuit in Texas requires careful preparation. You should start by obtaining medical records and consulting legal experts who understand the intricacies of such cases. This may also include preparing a Texas DTPA demand letter example for insurance claim, should it be relevant to your situation. Understanding the legal timeline and procedures is crucial, and professional guidance can help you navigate this process effectively.

Under the DTPA, consumers may recover several types of damages. These often include actual damages incurred as a result of deceptive actions, as well as additional damages for any mental anguish suffered. Additionally, if you provide a Texas DTPA demand letter example for insurance claim, you may qualify for attorney fees if your claim is successful. This comprehensive approach to damages ensures consumers receive fair compensation.

Filing a DTPA claim in Texas involves several steps. Begin by collecting any evidence that supports your claim, including a Texas DTPA demand letter example for insurance claim. This letter can serve as a crucial document showing the nature of your complaint. Once your documentation is ready, you should approach a legal professional who can guide you through the filing process and ensure you meet all necessary requirements.

To file a DTPA claim in Texas, you first need to gather all relevant documentation related to your case, including the Texas DTPA demand letter example for insurance claim. Next, you should identify the specific misleading practices or false representations by the company. Afterward, you can send a formal letter to the company outlining your complaint and the damages you seek. If the issue remains unresolved, you may further pursue legal action.

Yes, you can write a demand letter without a lawyer. Many individuals choose to handle their own claims using available resources. Utilizing a Texas DTPA demand letter example for insurance claims can simplify the process and provide a solid framework. However, if your situation is complex, consider consulting a legal professional for additional guidance.

When drafting a demand letter for an insurance claim, begin by outlining the facts of your case. Clearly specify the damages you incurred and the compensation you seek. Referencing a Texas DTPA demand letter example for insurance claims can guide you in structuring your letter effectively. Be direct but polite, making it easier for the insurance company to understand your position.

To write a demand letter in Texas, start by clearly stating the purpose of your letter. Include details about your situation, relevant facts, and the amount you are requesting. Utilize the Texas DTPA demand letter example for insurance claims to ensure you cover all necessary legal aspects. Remember to maintain a professional tone and keep your letter concise.

Writing a demand letter for insurance involves clearly stating your claim, outlining the events that led to the insurance payout request, and the specific amount you’re seeking. It’s essential to attach supporting documents for validation. Consider using a Texas DTPA demand letter example for insurance claim as a reference to strengthen your letter and improve your chances of success.

When crafting an insurance demand letter, detail the incident that prompted the claim and what compensation you seek. Include all relevant documentation to support your request, such as medical records and bills. Following a Texas DTPA demand letter example for insurance claim can help guide your letter structure and ensure you include necessary details.