Real Estate Lien Note Texas Form

Description

Form popularity

FAQ

To place a lien on property in Texas, you must first identify the proper legal grounds for the lien and gather supporting documentation. Prepare and complete a notice of lien, ensuring you include all required information like property details and the amount owed. Finally, file the notice with the appropriate county office to make it enforceable. Using a Real estate lien note texas form can be an efficient way to ensure you follow all legal requirements correctly.

Filling out a notice of lien requires you to include basic information such as your name, the property owner's name, a description of the property, and the amount owed. Be sure to state the legal basis for the lien and reference applicable Texas laws. It’s crucial to be thorough and accurate to avoid potential disputes. Utilizing a Real estate lien note texas form can provide you with the structure needed to ensure that all necessary fields are completed correctly.

To write a letter for lien removal, start by addressing the lienholder and include essential details like the lien number and property description. Clearly state your request for removal and provide supporting information, such as proof of payment or satisfaction of the debt. Finally, include your signature and some form of contact information. Using a Real estate lien note texas form may simplify this process and ensure all necessary information is included.

In Texas, you typically have four years to file a lien against a property after a debt has become due. This timeframe varies depending on the nature of the obligation, so it's essential to understand the specific rules that apply to your situation. Using a Real estate lien note Texas form can help you initiate this process promptly and protect your interests.

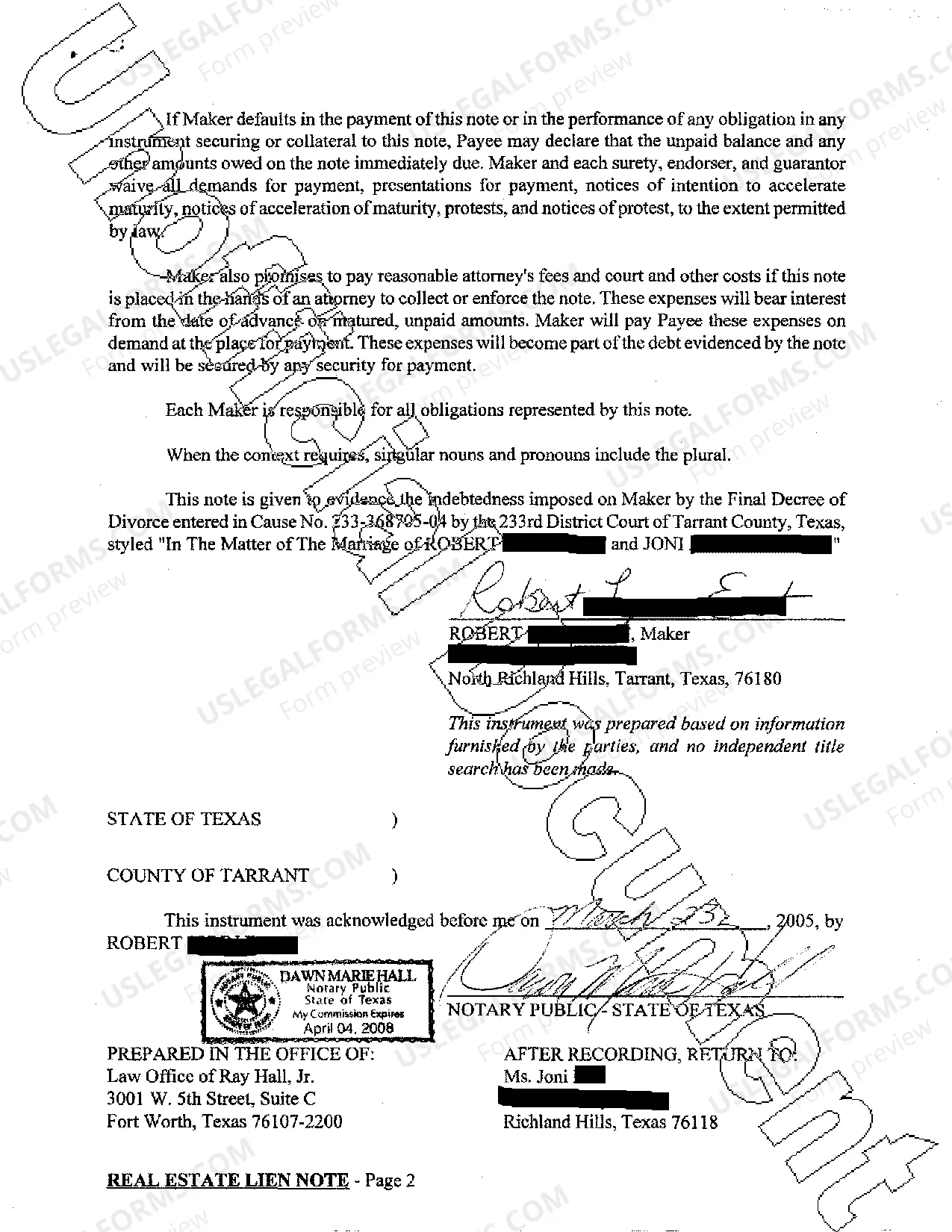

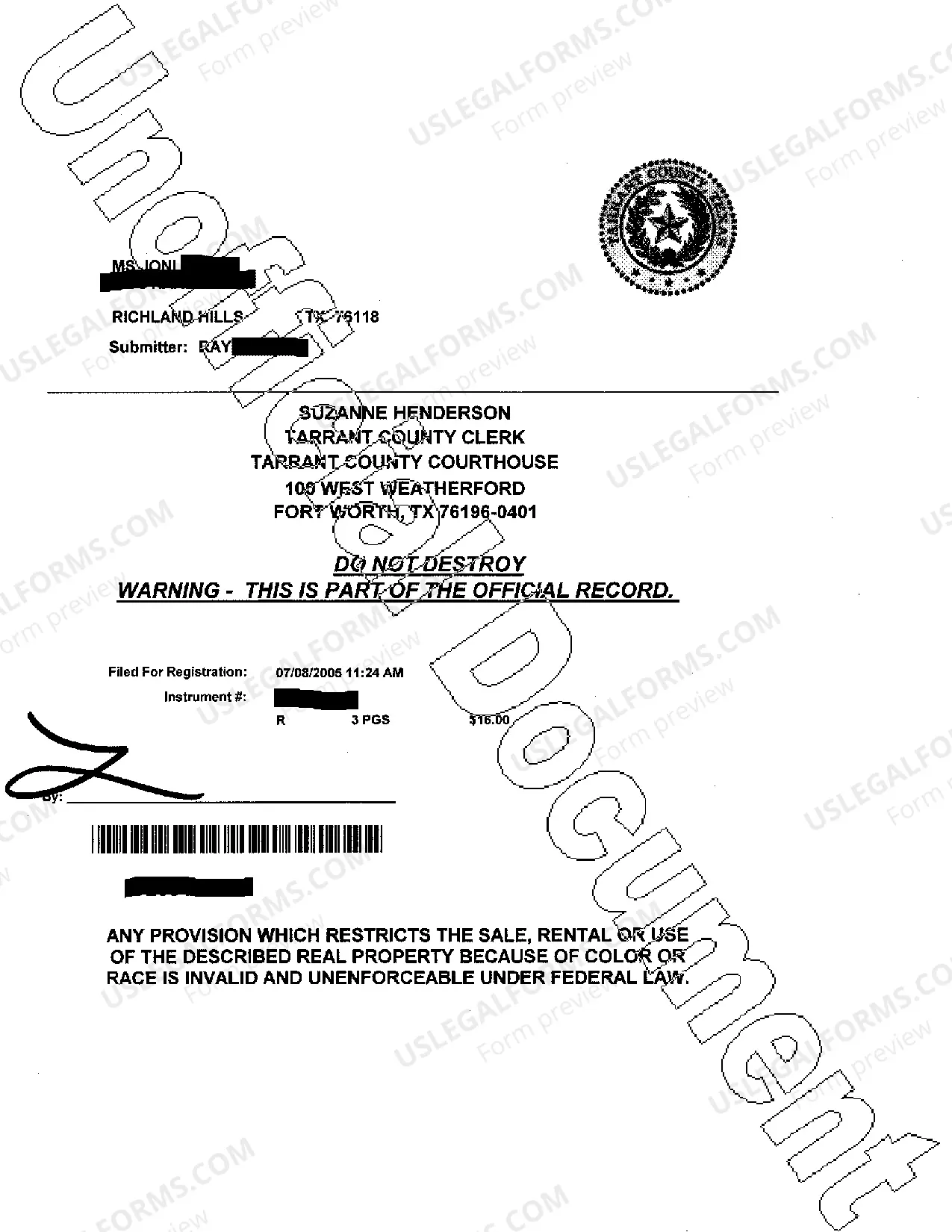

To lien a property in Texas, you must first complete a Real estate lien note Texas form that clearly identifies the debtor and the property in question. After completing the form, you need to file it with the county clerk in the county where the property is located. This process ensures that your lien is officially recorded, providing you legal rights against the property until your debt is satisfied.

Filing a lien on property in Texas involves creating a document that outlines your claim against the property. This document must be filed with the appropriate county clerk where the property is located, and it should detail information like the debtor and the nature of the obligation. For efficiency and clarity, consider using a real estate lien note Texas form to simplify the preparation and filing of your lien.

In Texas, a lien release does not have to be notarized, but it can be beneficial. Notarization helps confirm the identity of the parties involved and adds authenticity to the release. To ensure that your lien release meets all legal requirements, using a real estate lien note Texas form could simplify the process and ensure accuracy.

A real estate lien note does not require notarization to be valid in Texas, but notarization is recommended. Notarizing the document can help prevent disputes about its authenticity and provide additional security for both the lender and borrower. Consider using a real estate lien note Texas form that includes notarization options to enhance your document’s credibility.

To place a lien on a property in Texas, you first need to prepare a legal document stating your claim for unpaid debt. This document should include relevant details about the debtor, the debt amount, and a description of the property. Once done, file it with the county clerk in the appropriate jurisdiction. A real estate lien note Texas form can provide you with a template to simplify this task.

In Texas, a promissory note does not necessarily have to be notarized to be legally binding. However, having it notarized can provide an added layer of protection and clarity, especially in case of disputes. It is wise to consult your legal advisor or use a real estate lien note Texas form that guides you through these requirements for complete peace of mind.