A land trust with an LLC as the beneficiary is a popular real estate strategy that provides asset protection, privacy, and tax benefits for property owners. This arrangement involves creating a land trust, which is a legal entity that holds the title to the property, while the LLC acts as the beneficiary of the trust. Let's delve into the intricacies and benefits of this arrangement along with its various types. To begin with, a land trust is a flexible and versatile tool used in estate planning to hold and protect real estate assets. In this setup, the trustee holds the legal title to the property in the name of the trust, while the beneficiary retains all ownership rights and responsibilities. This arrangement allows the property to be shielded from potential liabilities and keeps ownership private, as the trust's name is publicly recorded instead of the LLC's or individual's name. The LLC, in turn, serves as the beneficiary of the land trust. By having an LLC as the beneficiary, property owners gain numerous advantages, such as limited liability protection. If any legal claims or liabilities arise, the assets held in the land trust are not directly exposed, as ownership lies with the trust rather than the individual owner or LLC itself. This safeguards the owners' personal assets or other properties held in separate land trusts. Moreover, tax benefits are another advantage of utilizing a land trust with an LLC as beneficiary. The income generated by the property, including rental income or capital gains, can flow through the land trust to the LLC without being subject to additional taxes at the trust level. Instead, taxation occurs at the LLC level, which often provides more favorable tax treatment compared to individual taxpayers. Different types of land trust arrangements with an LLC as the beneficiary include: 1. Revocable Land Trust with LLC as Beneficiary: In this type of land trust, the property owner retains the ability to modify or revoke the trust during their lifetime. This flexibility allows for easy changes to the beneficiaries or terms if circumstances change. 2. Irrevocable Land Trust with LLC as Beneficiary: This type of trust cannot be altered or revoked once established, offering heightened asset protection and estate planning benefits. It ensures long-term management and protection of the property and is often preferred for generational wealth transfer or estate planning purposes. 3. Single Property Land Trust with LLC as Beneficiary: This land trust type is designed for a single property. It allows property owners to segregate each investment and provide a higher level of asset protection and privacy, especially if an LLC is established for each individual property. 4. Multiple Property Land Trust with LLC as Beneficiary: This type of trust is created to hold multiple properties owned by an individual or entity. It streamlines management and administration while delivering asset protection benefits across an entire real estate portfolio. In conclusion, a land trust with an LLC as the beneficiary is a strategic arrangement that combines the asset protection benefits of an LLC with the privacy and flexibility of a land trust. By utilizing various types of land trust arrangements, property owners can safeguard their assets, minimize risks, and take advantage of tax benefits while maintaining anonymity and control over their real estate investments.

Land Trust Form With A Mortgage

Instant download

This form is available by subscription

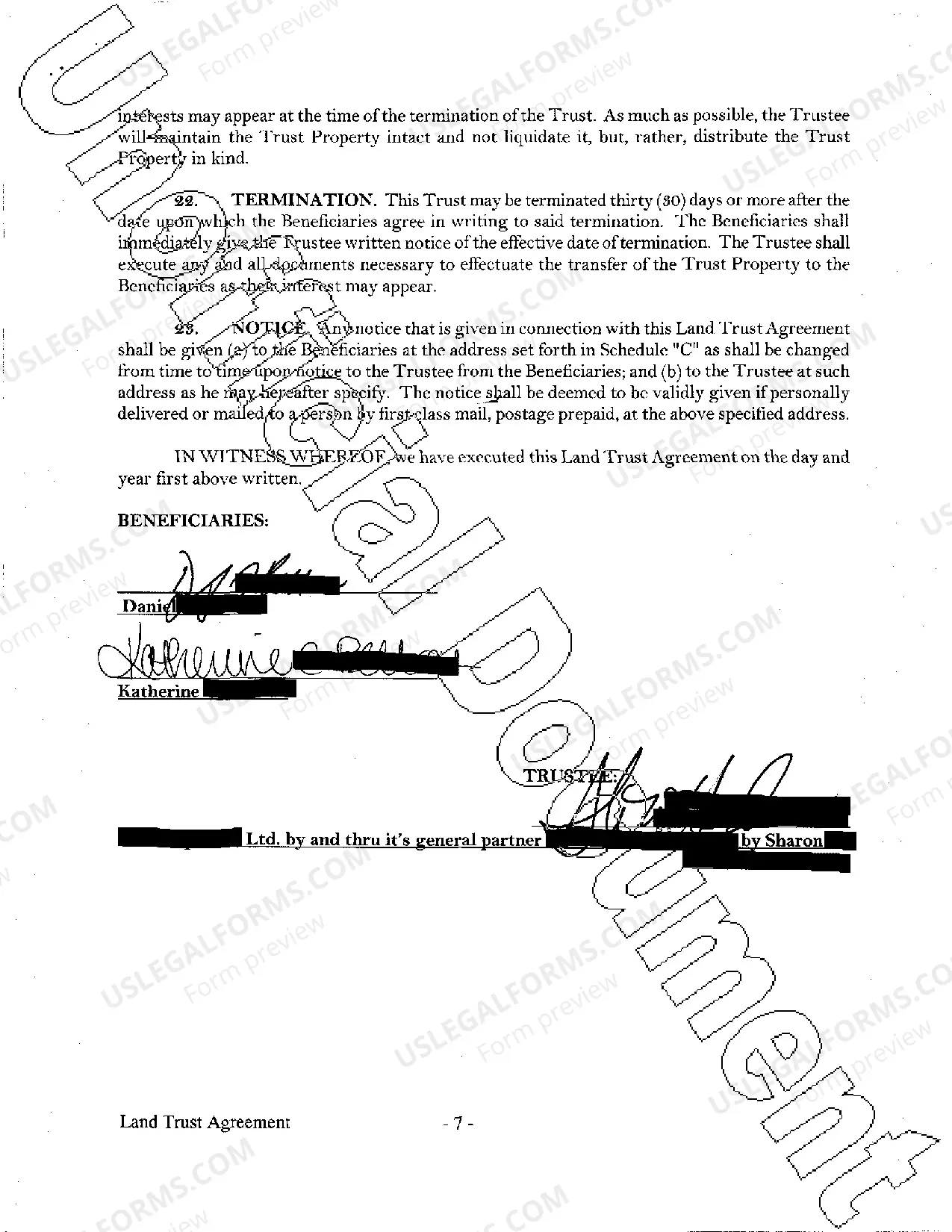

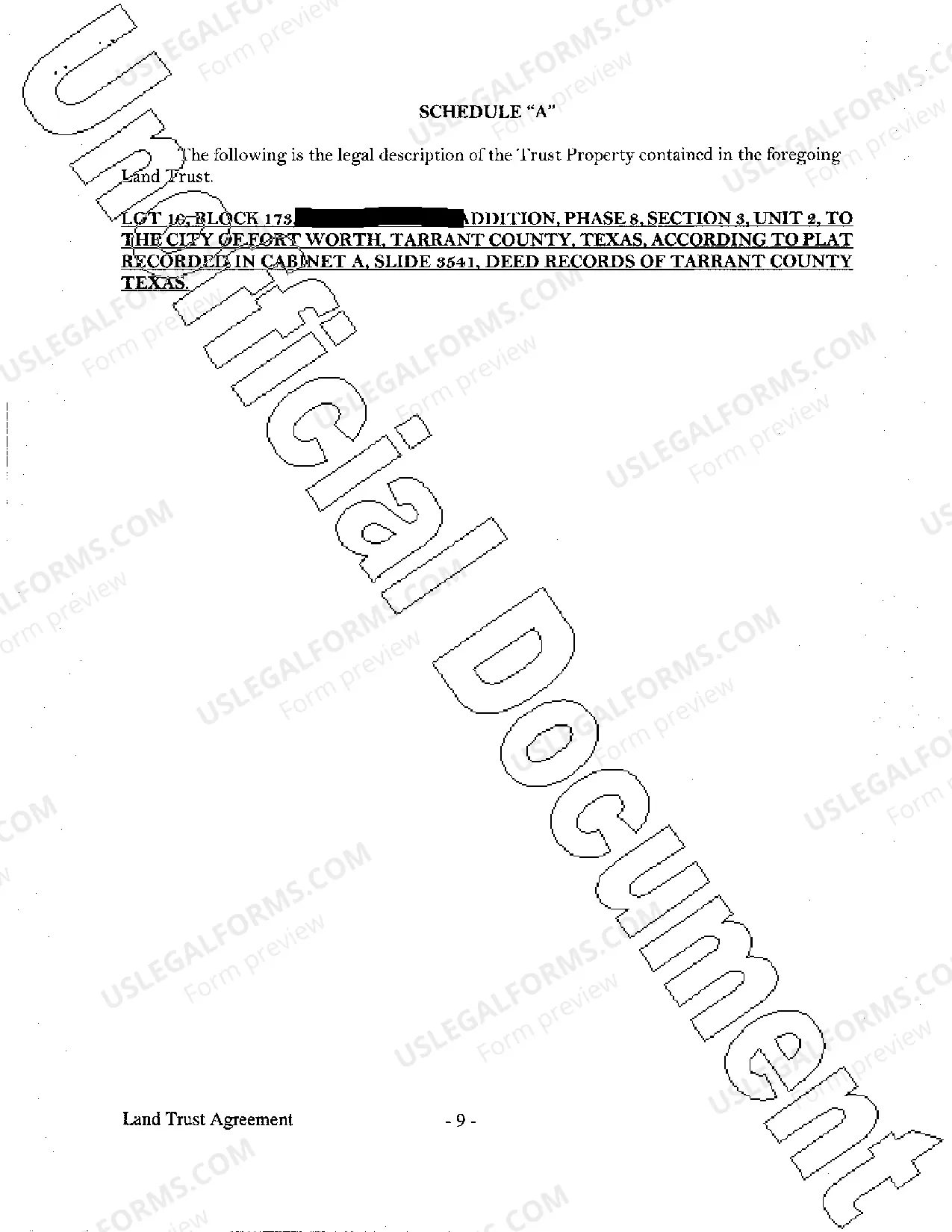

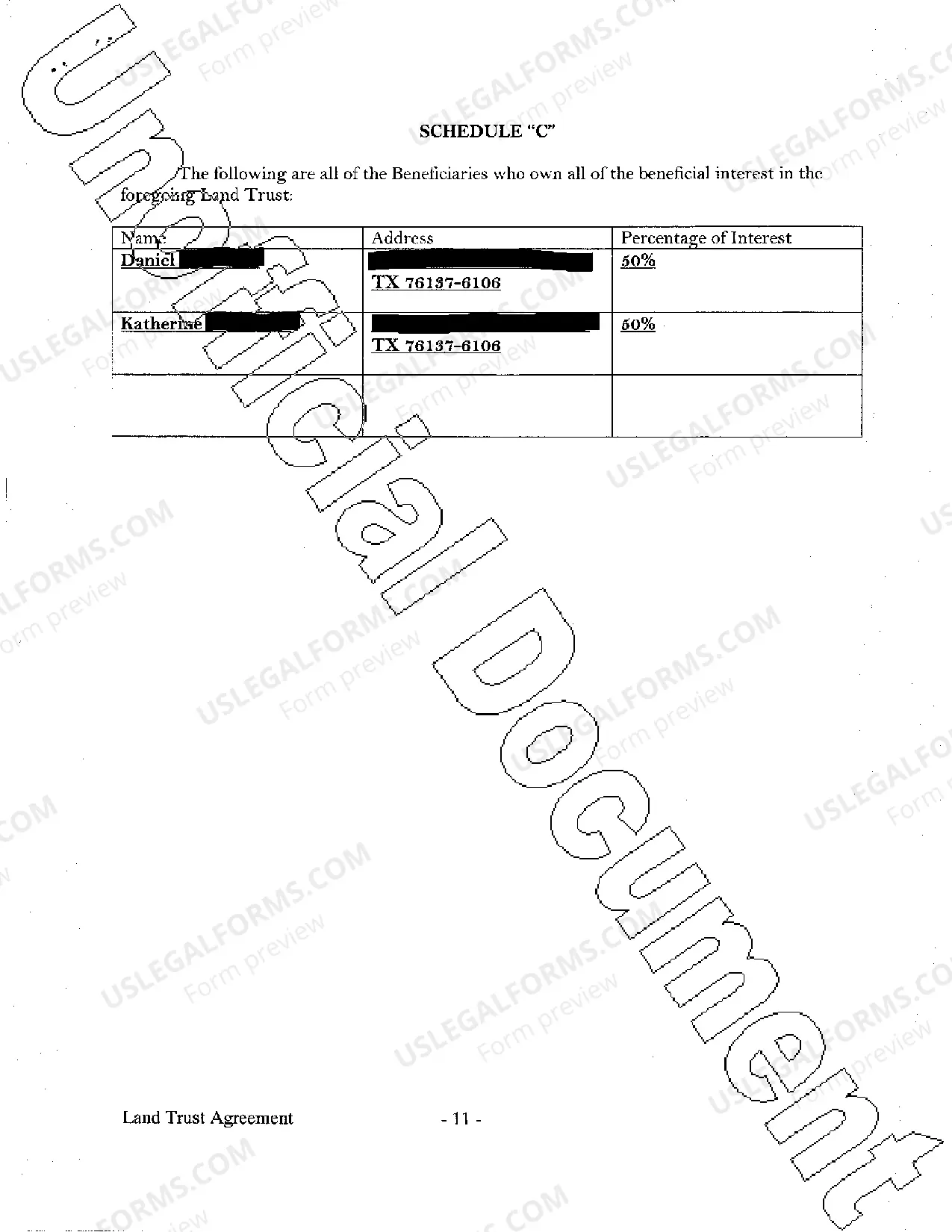

Description Land Trust Agreement

Land Trust Agreement

Free preview Land Trust Documents